Klaus Vedfelt

Funding abstract

My earlier funding thought for Dwell Nation Leisure (NYSE:LYV) (printed on Might twenty first) was a purchase ranking due to the constructive long-term progress outlook for the business and that LYV is greatest positioned to profit from it given its sturdy aggressive benefit. I keep buy-rated for LYV as the elemental progress outlook stays very constructive, with very sturdy knowledge factors reported within the 2Q24 outcomes that strengthen my bullish view.

2Q24 outcomes replace

Launched on 30 July, LYV whole income grew 7% on a reported foundation from $5.6 billion to $6 billion. On an natural, constant-currency foundation, whole income grew 5.8%. Adjusted working earnings [AOI] grew ~21%, with progress primarily pushed by Concert events phase AOI progress of 61% to $271 million. Notably, the Concert events AOI margin grew to five.4%, a report excessive for LYV. Sponsorship & Promoting [S&A] additionally noticed AOI margin step up considerably from ~67% in 2Q23 to ~71% in 2Q24, driving ~10% of AOI progress. Ticketing income was the one phase that noticed a progress deceleration from 23% natural progress in 2Q23 to three.5% in 2Q24 (1Q24 was 6.6%).

Progress indicators level to sturdy underlying demand

LYV continues to carry out as anticipated, and I consider this sturdy topline and AOI progress momentum can proceed for the foreseeable future. There are a number of underlying traits that help my view.

At the beginning, on a year-to-date [YTD] foundation, LYV has already offered 118 million tickets for exhibits in 2024, and it is a constructive progress vs. 2Q23 with double-digit proportion progress in varied areas reminiscent of arenas, amphitheaters, and theaters and golf equipment exhibits regardless of diminished stadium exhibits this yr. Secondly, LYV has a really sturdy present pipeline for the remainder of the yr. For reference, administration talked about that the variety of confirmed exhibits for giant venues is up by a double-digit proportion, with progress pushed by arenas and amphitheaters. Thirdly, LYV can be increasing the variety of venues it has, with plans to open 14 main venues globally in 2024 and 2025 (FY23 opened 12 main venues). On high of recent venues, LYV can be anticipated to finish main refurbishments of two venues within the US and Mexico in 2024. Primarily based on LYV’s historic observe report, these massive tasks generated a really enticing return-on-investments (>20%). As such, I’m constructive that these new venues might be worth accretive for LYV as properly. Qualitatively, these new venues increase LYV’s distribution capability, permitting it to carry extra exhibits and attain a wider group of followers. Therefore, I don’t see any main impairments to my view that LYV can develop at ~10% CAGR for the approaching years.

For these apprehensive concerning the decrease event-related deferred income ($4.1 billion in 2Q24 vs. $4.3 billion in 2Q23), there shouldn’t be a lot of a priority because the underlying present combine is shifting in the direction of amphitheaters, which generally sees ticket gross sales nearer to the present, so this doesn’t present up within the stability sheet at present. Amphitheater exhibits even have a decrease ticket value, so on an absolute greenback foundation, event-related deferred income is anticipated to be decrease.

As I’ve stated previously, from simply purely a ticketing perspective, narrowly to how they do their numbers, one stadium present is triple the fan rely and triple the common ticket value of an amphitheater present. 2Q24 earnings transcript

On Ticketmaster, the best way it flows by is that it could have had fewer on gross sales within the fourth quarter as a result of the amphitheater exhibits are likely to go on sale nearer in time to the exhibits. 1Q24 earnings transcript

Different minor knowledge factors that time to a constructive underlying demand development embrace:

- Cancellation charges are trending down on a y/y foundation for North American exhibits, now at ranges (4 to five% of whole exhibits) under the historic norm.

- Demand from informal followers is selecting up, together with demand for seasonal live performance ticket promotions and gross sales of garden seats to amphitheater exhibits. This tells me that the demand power is pushed by a broader fan base (greater demand high quality vs. only a concentrated base of followers).

- Spending per fan can be trending upwards, as seen from spending traits in amphitheater exhibits and main festivals (which noticed double-digit progress in spending per fan on a YTD foundation).

One other good indicator that the business is seeing a constructive demand restoration is that advertisers are stepping up their advertising budgets for the stay occasion business. For LYV, it’s virtually totally booked for all the yr, an enormous step up from the 85% booked fee seen in 1Q24. Notably, LYV has expanded its relationships with massive model companions, together with a multi-year partnership with Coca-Cola, an extension with Hulu, and a partnership with BeatBox spanning 40+ festivals. The way in which I assess that is that entrepreneurs will need to have accomplished their very own analysis to consider that demand for stay occasions is again; therefore, they’re keen to step up on advertising bills on this space.

Constructive AOI progress improves stability sheet power

With the enterprise now set to develop (each income and AOI), LYV’s stability sheet ought to get more and more higher. This opens up the chance for administration to conduct share buybacks. Even when administration doesn’t allocate capital to buybacks of dividends, having a stronger stability sheet additionally allows LYV to raised fund its CAPEX plans, which had been indicated to step up from $440 million in 2023 to $650 million in FY24 with out inflicting any main threat.

Valuation

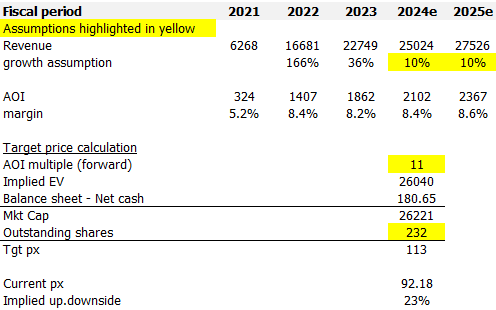

Redfox Capital Concepts

I largely maintained my progress mannequin assumptions for LYV, as I don’t see any main modifications within the 2Q24 outcomes that require me to take action. Actually, with all of the main progress indicators and enhancements in underlying demand, I’ve greater confidence that LYV can develop at a ten% CAGR for the foreseeable future and that the AOI margin ought to increase as progress sustains a ~10% stage. Please notice that the 1H24 AOI margin is ~11% on common, so I’m being conservative in not extrapolating this margin power ahead. Regardless of the constructive progress outlook, the market appears to be overly apprehensive concerning the macro setting (weak discretionary spending setting) because the LYV ahead AOI (EBITDA) a number of received derated to 10x. I consider this sell-down has nothing to do with the basics of LYV and is simply market volatility. As LYV grows as anticipated, valuation ought to revert again to 11x on the naked minimal (previous 1-year common). To offer readers higher consolation, in all the of FY23, the place inflation was so much greater than at present, the inventory has by no means traded under 10x.

Danger

I could possibly be incorrect about how dangerous the discretionary spending setting is, regardless of all of the constructive indicators that LYV has reported. If the macro state of affairs doesn’t get well in due time (i.e., this unsure spending setting will get extended), LYV could not be capable of develop at 10% CAGR within the close to time period. This will likely additionally trigger an overhang on the inventory’s valuation, limiting its skill to get rerated again to 11x.

Conclusion

My view for LYV is a purchase ranking because the sturdy 2Q24 outcomes, coupled with constructive progress indicators, reinforce my bullish view. The growth in venue footprint, rising ticket gross sales, and constructive sponsorship reserving charges paint a really wholesome progress outlook. Whereas the market appears to be apprehensive about discretionary spending impacting demand for stay occasions, LYV’s reported knowledge satisfied me in any other case, and I consider as LYV prints constructive progress as anticipated, valuation a number of will revert upwards.