Fahroni

With a total market capitalization of $5.8 billion and rapid growth in revenue, Lithia Motors is targeting an ambitious five-year plan to become the number one retailer of new automotive vehicles in the United States. Its stock may be undervalued by a fundamental analysis of some of its multiples, but the technical signals are a Strong Sell indicator for LAD at this time.

Revenue

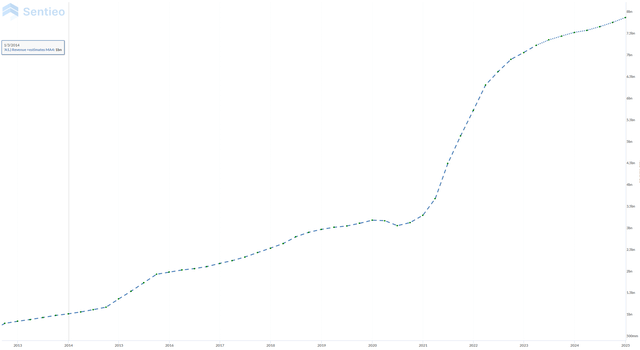

Lithia Motors revenue grew steadily from 2009 until the Covid pandemic but fell short of the 45 degree curve up the chart that I’d like to see for healthy sales growth. Then in the middle of 2020 sales began to climb rapidly from $2.8 billion to $7 billion per quarter in 2022, more than doubling their revenue.

The robust expansion is driven by a combination of Lithia’s rapid pace of dealer acquisition and its push to sell used inventory online through its auto ecommerce portal, Driveway.

Revenue growth is projected to level out to its pre-pandemic pace through 2025. See the following chart with estimates shown in the upper right as a dotted line.

LAD Revenue with estimates (Sentieo)

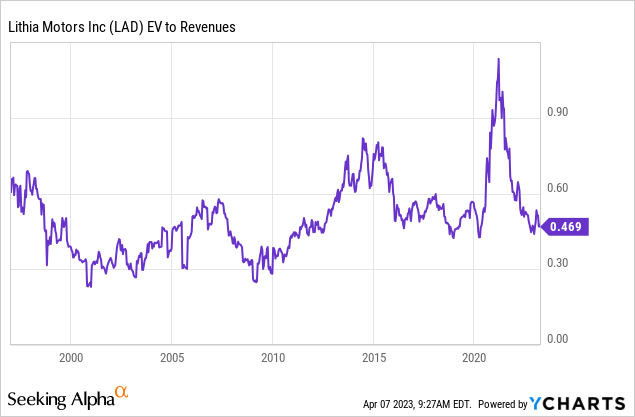

Valuation

The current EV/Sales multiple for LAD is 0.48x. Now typically that’s a nice, low multiple indicating a potentially undervalued stock, although it’s not abnormal for Lithia’s industry and peer group at the moment. Here’s a list of current enterprise value to sales ratios for some of Lithia’s peers:

- Cars.com, NYSE:CARS, 2.58x

- Copart Inc., NASDAQ:CPRT, 9.27x

- Kaixin Auto Holdings, NASDAQ:KXIN, 0.35x

- Sonic Automotive, Inc, NYSE:SAH, 0.36x

- AutoNation, Inc., NYSE:AN, 0.38x

- Asbury Automotive Group, NYSE:ABG, 0.49x

- Carvana Co., NYSE:CVNA, 0.59x

- CarMax, Inc., NYSE:KMX, 0.87x

EV/Sales was much higher (1.1x) two years ago during the most rapid part of Lithia’s expansion, but it has declined by over half since then. It got a lot of hype during that expansion and has cooled off. Overall, its current valuation is definitely at its low end historically speaking but is nothing to get excited over.

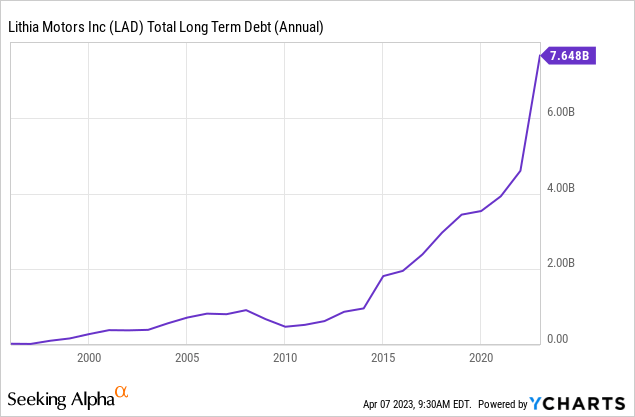

Debt

Lithia Motors ended 2022 carrying nearly $8 billion in corporate debt. That’s up considerably from its 2021 total of $4.96 billion and its 2020 debt burden of $4.17 billion. The year before the pandemic, Lithia’s total debt stood at $3.77 billion.

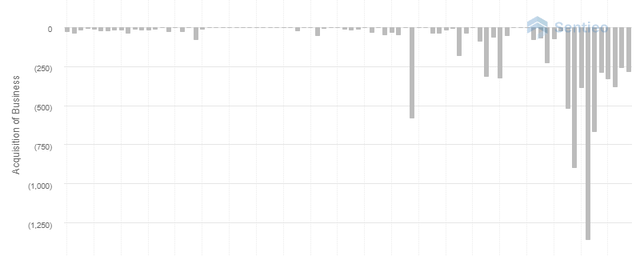

The company has taken on considerably more debt to finance aggressive growth in its operations, both through buying underperforming car dealership to invest in improvements and expanding online sales of Lithia Motors used car inventory through its used car online showroom, Driveway. See the chart below to see how these expenditures spiked recently.

Lithia’s expenditures to acquire new businesses – Quarterly (Sentieo)

The growth in revenues from these expansions has kept pace with Lithia’s debt financing, so its debt remains serviceable. Lithia is currently boasting an 11.4x interest coverage ratio with most of its debt is sub-5% (save a few notes due in 2025), so debt servicing isn’t an issue even with rapidly piling it on.

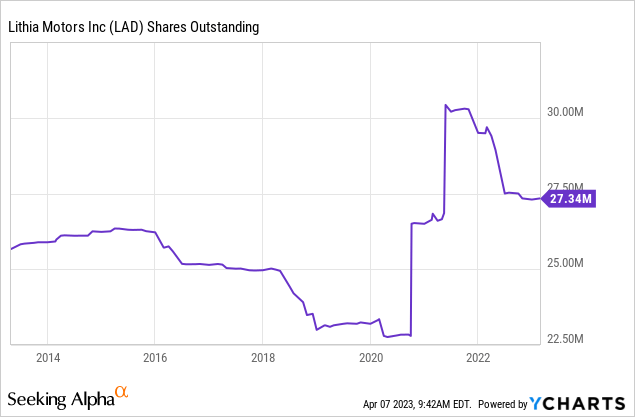

Shares Outstanding

Lithia Motors currently has 27 million shares outstanding. That figure has decreased by 2.41% from the 29 million shares outstanding the company had in 2021.

Prior to this most recent regime of share buybacks, the company issued a large amount of shares for capital financing of its rapid expansions in addition to leveraging up its corporate debt financing since the start of the pandemic. Some of this issuance was likely also used to fund operations during the worst parts of the pandemic before governments started opening things back up again.

In 2020 Lithia Motors had 24 million shares outstanding, so the issuance of 5 million more shares over 2021 was a 20% increase over the company’s shares outstanding pre-pandemic.

The buybacks show financial strength in equity consolidation and corporate responsibility as projected revenue growth flattens. I really want to see this continue, and they should buy those shares back down to where they were pre-COVID.

Mergers and Acquisitions

Since the start of the pandemic, Lithia has gone on an aggressive buying spree of low-performing dealerships at bargain prices, then rehabilitating them to improved profitability. Lithia itself is not a current target for a buyout in my opinion, and their current strategy likely doesn’t have them purchasing another publicly traded company.

The mega dealership’s acquisitions growth has coincided with a boom in U.S. automobile sales post-pandemic, as pent-up demand for consumer goods, historically low interest rates, and record employment of the labor force converged to boost auto sales. They’re likely to continue on this course since it’s been quite effective for them, but perhaps at a slower pace.

Regulatory Risk

There are no major new regulatory threats on the horizon for Lithia’s business and industry, however the company remains subject to the same ongoing set of stringent legal and regulatory requirements that govern the retail and used automobile sales and non-bank financing activities that comprise all of Lithia’s business.

All the additional regulatory compliance burdens that companies like Lithia successfully specialize in meeting while scaling their business, do give stocks like LAD a “moat” of protection from competition with new entrants for their market share. That significant barrier to entry gives LAD a wide berth to continue its expansion free from new competition.

Leadership

Corporate leadership at Lithia is evidently committed to scaling the company aggressively, with targets to become a $50 billion-a-year, nationwide automotive retailer by the year 2025. If it reaches its goals, Lithia will double its store count, quadruple revenue, and become the largest new car dealer in the United States.

On balance, employees with the company generally like Lithia, but many have complaints. The company has a Glassdoor rating of 3.3 on par with peers Carvana and Carmax, which have a 3.0 and 3.8 Glassdoor rating, respectively. Topping the charts in complaints about the company are poor management and long hours. With this lower rating from employees, and complaints so rampant, I have to conclude that the leadership of Lithia does not have a proper command structure in place.

Technical Analysis

The moving averages and technical indicators for LAD stock are currently a Strong Sell readout. Exponential and simple moving averages at the 10-day, 20-day, 30-day, 50-day, 100-day, and 200-day window are all sell signals. The relative strength index, stochastic oscillators, and ADX oscillator are all sells as well.

Conclusion

Now may be a time for investors who bought LAD stock before the pandemic to take profits depending on how they’re rebalancing their portfolios to hedge this year’s astonishing mix of macro factors. After a number of insiders sold off a sizable chunk over the last year, and with technical indicators pointing downhill, I can’t recommend purchasing this company.

The debt, although serviceable right now, will have to continue climbing in order for them to expand. With interest rates so high at the moment they’ll have a tough time with new issues. This will slow down their growth dramatically.

Furthermore, it seems they’ve neglected a few things during their aggressive expansion. The biggest concern among those is their employees, as reviews have strongly trended down over the course of 2022. Their expansion hasn’t allowed them time to properly vet and train new management, and instead they’re likely just “making do” with warm bodies. In the end this will be detrimental, and I’m concerned about the company even making its revenue estimates moving forward due to this factor. I’ve seen so many times where employee morale can make or break a company.

They’ve put themselves into a precarious position where shareholders expect them to continue rapid growth, even at these reduced share price levels. And if they can’t deliver it, then shareholders won’t be happy and price levels will decline further. My near-term price target on this is $175, and if you really want this company that’s where you want to set your buy limit order.

So in conclusion if you already own this stock then it’s a sell at this point. Otherwise just avoid it.