Just_Super

Introduction

Potential buyers searching for a diversified proxy to capitalize on shares concerned within the full lithium cycle could also be tempted by the International X Lithium & Battery Tech ETF (NYSEARCA:LIT). This $1.2bn sized product, with a 14-year buying and selling historical past, is taken into account to be one of many extra preeminent choices on this house.

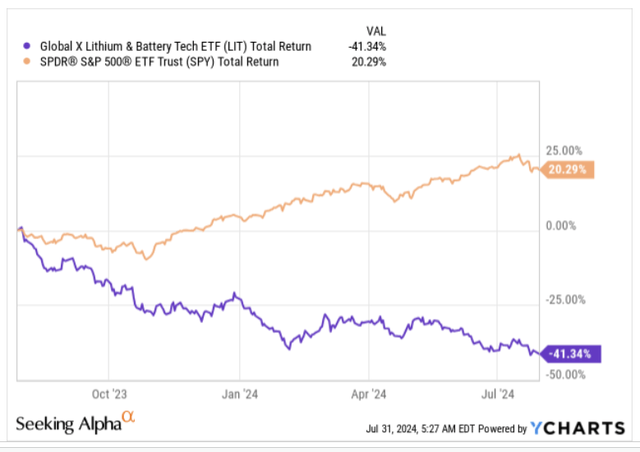

Admittedly, this ETF which covers world shares concerned in lithium mining, exploration, and battery know-how, has skilled a fairly dismal 12 months; while the important thing fairness benchmark has notched up respectable beneficial properties of over 20%, the ETF in focus has contracted by -41% throughout the identical interval.

YCharts

Regardless, when you’re mulling over a place on this product, listed below are just a few necessary issues to notice.

LIT vs. BATT

After LIT, the opposite key various that usually will get bandied round in lithium circles, is the Amplify Lithium & Battery Tech ETF (BATT). Which one would we plump for?

Effectively, regardless of largely fishing in the identical pond, each merchandise have fairly distinct traits, which can enchantment to totally different buyers.

LIT has had an nearly 8-year head begin over BATT which solely received listed in June 2018. But, the differential within the respective AUMs of the 2 merchandise is kind of enormous at over 16x (in favor of LIT)! The promoters of BATT could also be fairly disheartened with this broad disparity, when it seems that their product is extra value aggressive, and has a greater earnings profile. To elaborate, BATT’s expense ratio of 0.59% is 16bps decrease than LIT’s corresponding expense ratio.

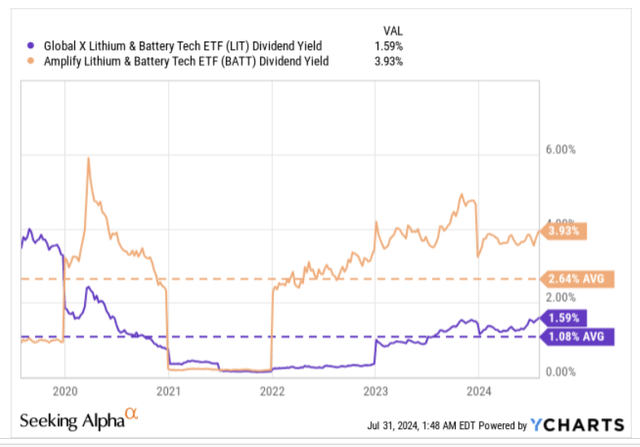

YCharts

Additionally word that since 2022, the variance within the dividend yields of the 2 merchandise has solely continued to develop, with BATT now providing a really aggressive determine of 4%, whereas LIT solely affords lower than 1.6% (though each merchandise supply yields which are higher than their long-tern averages). What’s necessary to notice is that BATT has been extra beneficiant than LIT in increasing its payouts; during the last 3 years, payouts of LIT have solely grown at 70%, whereas BATT’s dividends have grown at a far better tempo of 117%.

One issue that works in favor of LIT is that it seems to be much less vulnerable to annual churn, although it covers a a lot smaller pool of shares. LIT solely covers 47 shares, and solely round a fifth of its portfolio get churned yearly, which makes it extra tax environment friendly. BATT covers twice the variety of shares as LIT (95 shares in comparison with 47 shares). On condition that LIT focuses on a a lot smaller pool of shares, it’s no shock to find the better focus of its prime holdings (the highest 10 of LIT account for 53% of the whole portfolio, whereas BATT’s prime 10 solely accounts for 40%).

Additionally word that LIT is extra oriented in the direction of shares with sturdy publicity to the Chinese language area (37% publicity) which serves the biggest and fastest-growing EV market on the earth, whereas with BATT, the US takes middle stage (22% publicity).

The opposite key differentiator to notice is that LIT is extra of an upstream play, because it leans extra in the direction of lithium miners, and is open to letting the person weights of those miners attain even 20%, earlier than capping these weights (at the moment its prime holding is the world’s largest Lithium producer – Albemarle). Then again, the downstream battery producers that comprise its portfolio are required to have their weights capped at simply 4%. BATT doesn’t impose any sector-specific caps reminiscent of this, however fairly employs uniform capping of its holdings at 7%.

Buyers may wish to contemplate that BATT dabbles with shares throughout the market-cap spectrum, touching even some speculative micro-cap performs, which contribute 12% of the whole holdings. LIT although refrains from doing so, with microcaps accounting for lower than 1% of the whole portfolio.

So far as valuations go, each merchandise will not be notably low cost, however LIT is priced at a steeper P/E (20.5x) that’s 9% greater than BATT’s corresponding a number of. Some buyers could also be ready to pay that premium, as one can be getting a greater cadence of long-term earnings development of just about 12% (versus simply 10% for BATT)

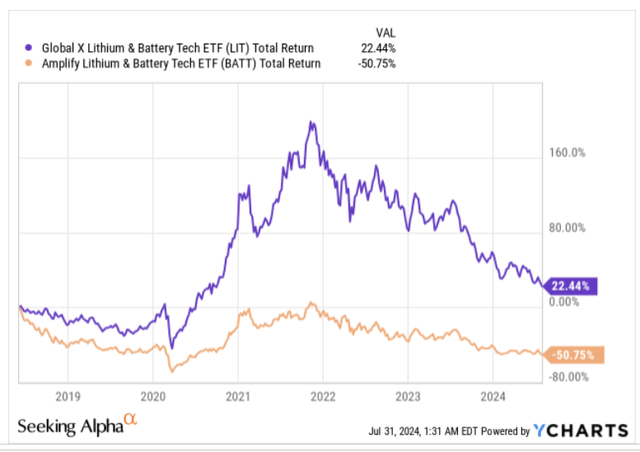

Relating to the historic monitor file of those two merchandise, we now have just one clear winner – LIT. Notice that BATT has confirmed to be a supply of huge wealth destruction because it made its debut in 2018, whereas LIT has nonetheless managed to generate unremarkable, however optimistic beneficial properties of twenty-two% throughout the identical interval.

YCharts

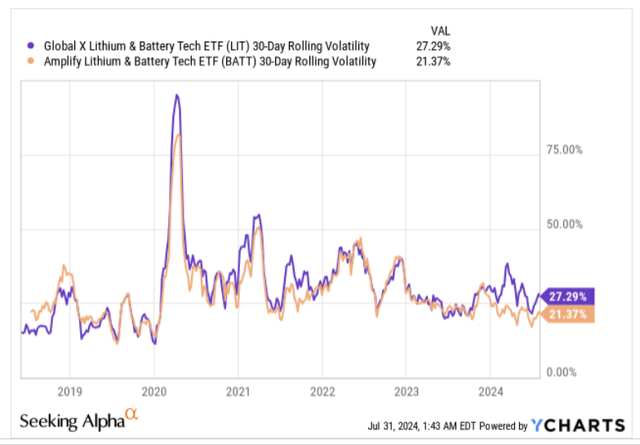

But, LIT additionally seems to have taken on extra threat in its try to generate returns, and that comes by way of within the respective volatility profiles of those two merchandise.

YCharts

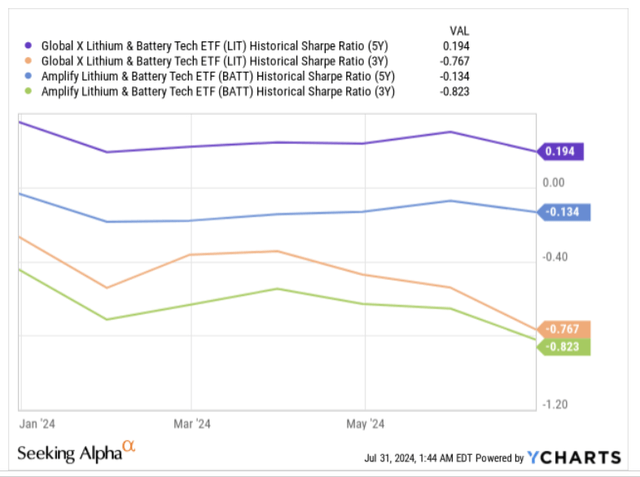

A whole lot of ETF merchandise fail to generate extra returns (over the risk-free charge) that commensurate with the whole threat taken throughout a interval (basically implying a Sharpe ratio of 1x or extra) and LIT is not any exception, but it surely nonetheless throws up significantly better figures over a 5-year time interval, and although it too delivers a unfavorable Sharpe ratio like BATT over the three-year time-frame, as soon as once more it beats its smaller peer.

YCharts

Lithium Market Commentary

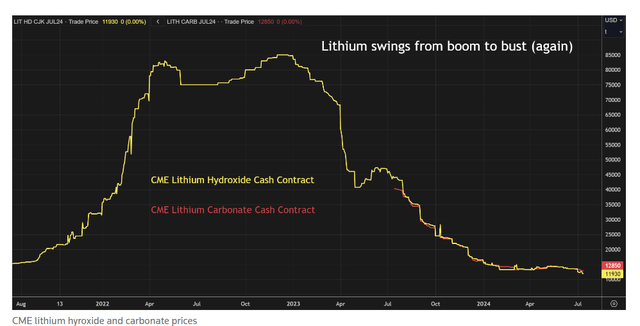

The lithium market is in a nasty means (Chinese language-based lithium carbonate is now at its lowest level since Aug 2021) as it’s being battered by many headwinds, though one can nonetheless spot just a few inexperienced shoots.

Reuters

Firstly, elevated coverage rate of interest thresholds in latest durations have knocked the stuffing out of potential automobile house owners, and with EVs (which account for the lion’s share of lithium demand) the affordability scenario is much more urgent, given their comparatively larger ticket value. For context, within the US, over half of gasoline powered or hybrid autos will be picked up at a value of lower than $37,000, however solely 3% of all EVs are priced at under that mark, making them extra of an elitist play.

Beforehand, there have additionally been query marks over EV charging infrastructure, and their capability to assist longer vary EV fashions (restricted vary has been one other deterrent for EV possession), however latest studies counsel that the financial situation with charging stations is bettering, and it might additionally obtain some fillip from the Nationwide Electrical Automobile Infrastructure Deployment Program (NEVI), which might see $5bn of federal funds being devoted in the direction of establishing a minimum of one public quick charging station each 50 miles of the US’s main transportation routes. With extra charging stations on the anvil, and probably decrease rates of interest in 2025, might the demand-side stage a comeback?

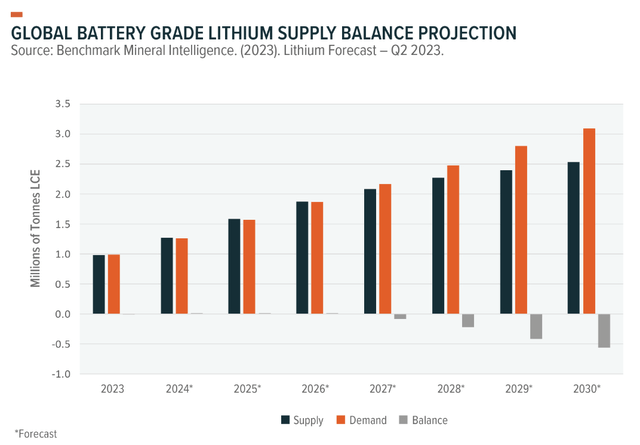

In the meantime, the availability aspect has ramped up significantly in latest durations, with the lithium market largely anticipated to be in a balanced state by way of 2026.

International X

Nonetheless, fairly a big chunk of the extra provide in latest durations has additionally come from casual artisanal miners based mostly in Africa, and it’s questionable if they’ve the endurance within the present value atmosphere. As an example, final yr, these small-scale miners contributed near 67% of complete African provide, with volumes nearly accounting for final yr’s world market surplus.

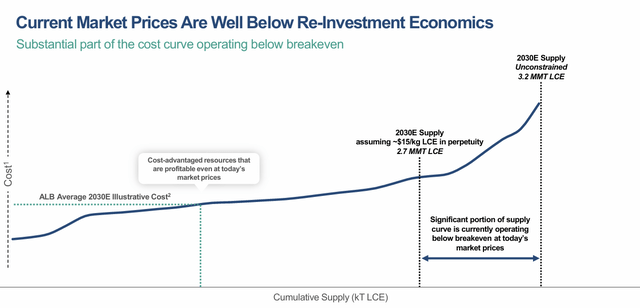

ALB June 2024 Presentation

Massive vertically-integrated gamers reminiscent of Albermarle (ALB) which LIT is well-exposed to, are higher ready to climate the storm below present market costs, whereas many of the high-cost small-scale producers who will not be even breaking-even can be compelled to exit, making the availability scenario extra palatable.

In the meantime, lithium carbonate inventories in China, which have been overwhelmed down, seem like slowing, inching up since April, and studies popping out of China counsel that enquiries for battery-grade lithium carbonate have picked up, as shoppers look to benefit from comparatively decrease costs.

One shouldn’t be essentially suggesting that issues are solely trying up from now, however we additionally really feel that the hunch has been happening for too lengthy, and because the market adjusts to the underlying realities, a number of the well-established built-in entities that LIT covers can be higher positioned to bounce again.

Closing Ideas – Is LIT ETF A Good Purchase Now?

Lithium shares will not be having their day within the solar, however the charts counsel that there could also be some gentle on the finish of the tunnel.

On the month-to-month charts of LIT, weak spot within the value motion remains to be fairly evident, with a collection of lower-lows (LLs) and lower-highs (LHs), even because it fails to interrupt previous a descending trendline. But, buyers could wish to word that the product has now dropped to ranges which have traditionally served as helpful pivot factors.

Investing

In 2011, we noticed the present value zone function an space of resistance, and as soon as once more, the situation was repeated in 2015. With the value now revisiting these ranges, there’s an excellent likelihood it bottoms out right here earlier than pivoting within the different course.

In the meantime, additionally word that the RSI indicator has now dropped to some extent final seen in 2015, from the place we noticed the value backside out earlier than resuming a transfer larger.

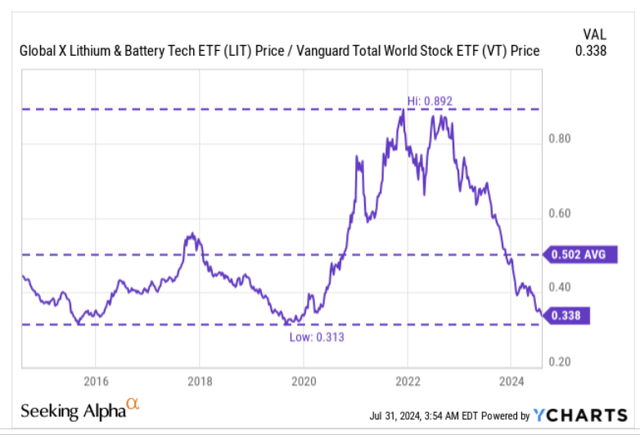

Lastly, additionally word that the relative power (RS) of LIT’s portfolio versus different world shares shouldn’t be too far-off from hitting the lows final seen in 2019 and 2015. On condition that the present RS remains to be solely a 3rd of its long-term common (0.502), we see first rate scope for mean-reversion.

YCharts

All these components make us flip cautiously optimistic on LIT, and thus we wouldn’t be averse to taking a nibble at present ranges.