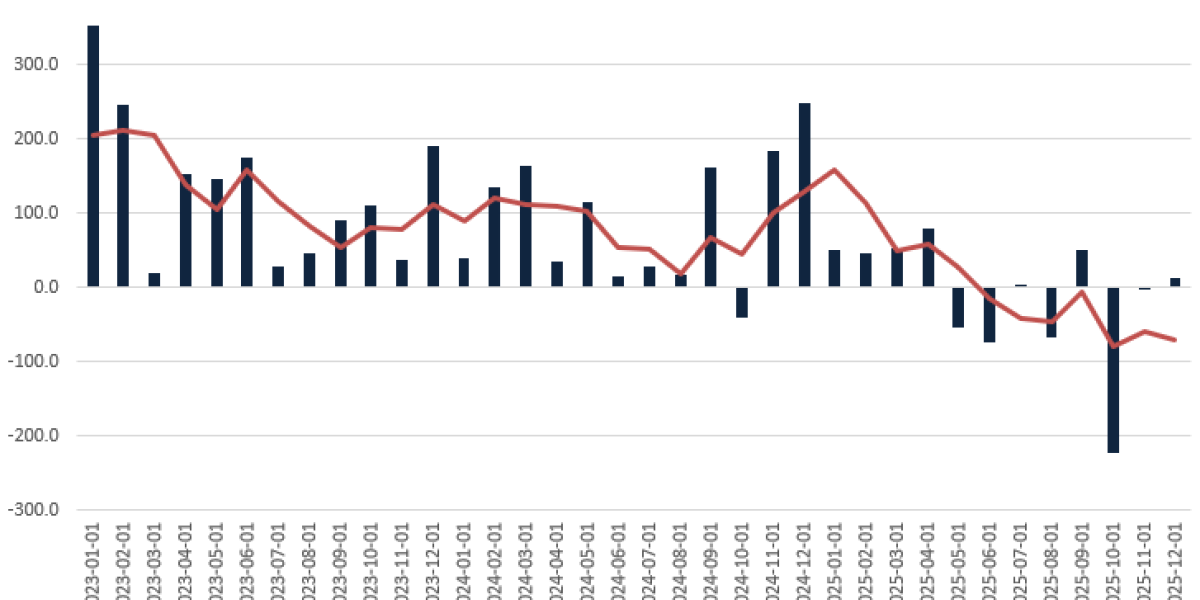

“In case you have not noticed, central banks the world over have been increasing their interest rates. In India, yields on 3-month treasury bills have increased from a low of about 2.7% in May 2020 to about 6.5% now,” Rajeev Thakkar, CIO & Director of PPFAS, said in a letter to unitholders.

“There was a time when it seemed futile to bother to move money out of the savings account to a liquid fund. In some cases, savings bank account interest rates were higher than the prevailing interest rates for treasury bills and commercial paper,” Thakkar said.

“It may no longer be profitable to be lethargic and let money lie idle in the savings bank account. You may consider shifting your idle funds in the savings and current account to a liquid fund,” he added.

India’s largest public sector lender SBI or State Bank of India offers a 2.70% interest rate on savings account deposits while small finance banks like Fincare Small Finance Bank and Jana Small Finance Bank offer the highest savings account deposit interest rate of 4.50%.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)

Source link