LaylaBird

Thesis

Levi Strauss & Co. (NYSE:LEVI) is a stock that we believe can provide good shareholder returns for investors. The company is a market leader in the jeanswear industry and recent financial performance has shown that management has been executing on its strategic goals. We believe the current valuation is attractive given the strong fundamentals, and as such, we are recommending a “BUY” on this stock.

Company Overview

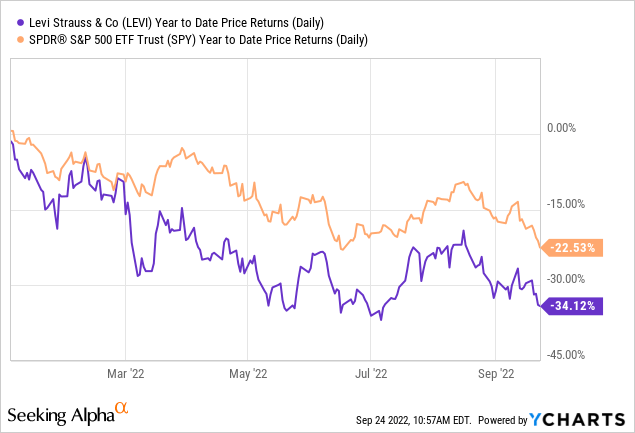

Levi Strauss & Co. is a global leader in jeanswear and designs and markets jeans, casual wear and related accessories for men, women, and children under numerous brands. Brands include the Levi’s, Dockers, Signature by Levi Strauss & Co.™, Denizen and Beyond Yoga. Products are sold internationally in more than 110 countries worldwide through a combination of chain retailers, department stores, online sites, and 3,000+ retail stores. Year-to-date, Levi Strauss & Co.’s stock price performance has considerably underperformed the overall markets. The company’s stock price declined -34.12% compared to S&P 500’s decline of -22.53%.

Recent Earnings

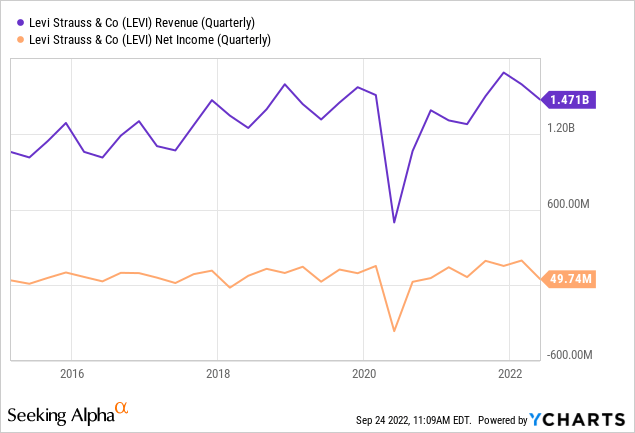

Levi Strauss & Co. reported its Q2 earnings in July and results were all-around strong. Year-over-year revenue increased 15% in Q2 2022 compared to Q2 2021, and when adjusted for constant-currency, the year-over-year revenue growth was 20%. Notably, a larger percentage of its net revenues were made up of digital channels, which demonstrate the company’s increasing digital penetration. Bottom-line showed solid results on an adjusted basis, as the company reported an adjusted diluted EPS was $0.29 in Q2 2022, up from $0.23 in Q2 2021. Without adjustments, the company’s net income actually declined on a YoY basis, from $65 million in Q2 2021 compared to $50 million in Q2 2022. Overall, the company continues to follow a steady growth trajectory in line with its historical performance.

Strong Brand Performance

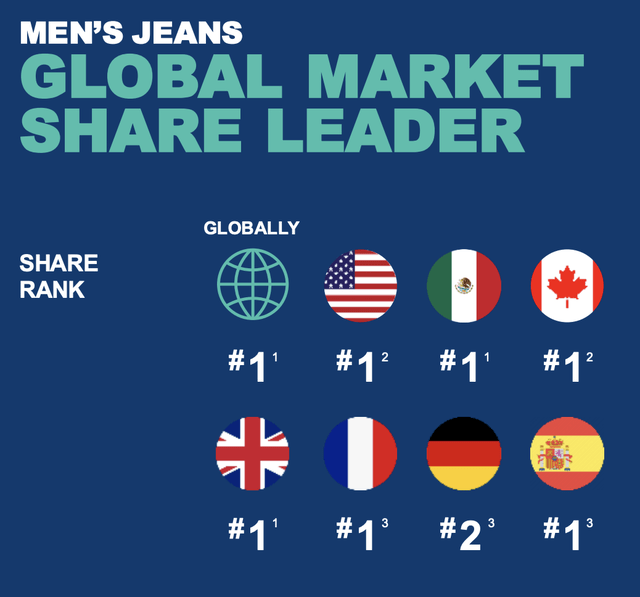

Levi Strauss & Co.’s brands continue to be market leaders in major segments. The company’s main line of products in Men’s Jeans is a market share leader globally, and is a market share leader in major markets, such as the U.S., U.K., France, Spain, and more. The company has also grown at the fastest pace in 2021, as the company was the biggest market share gainer in 2021. We believe that the long history of the Levi’s brand, and the company’s continued execution of trendy and timeless designs provide substantial brand moats for the business moving forward.

Q2 2022 Earnings Presentation

Focus on Shareholder Returns

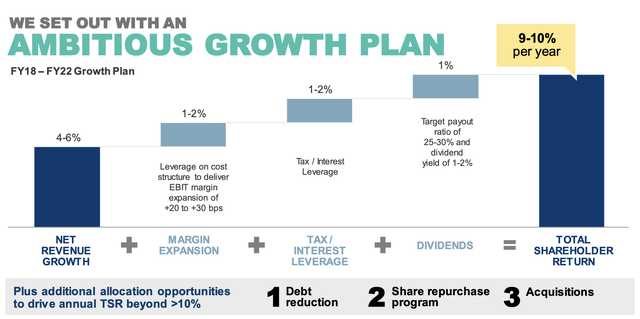

The company has embarked on a growth plan that is led by revenue growth, margin expansion, and shareholder friendly policies to provide a shareholder return of 9-10% per year. Such plans to increase shareholder value should be good news for investors. The company paid out a quarterly dividend of $0.12 which represents a dividend yield of 2.81% on an annualized level. Such dividend yield is 66% higher than the S&P 500 dividend yield of 1.69%. In addition to a decent dividend yield, the company also has recently initiated a $750 million buyback program. We believe such shareholder friendly policies will help support the stock price and provide reasonable shareholder returns during economic uncertainties.

Q2 2022 Earnings Presentation

Valuation

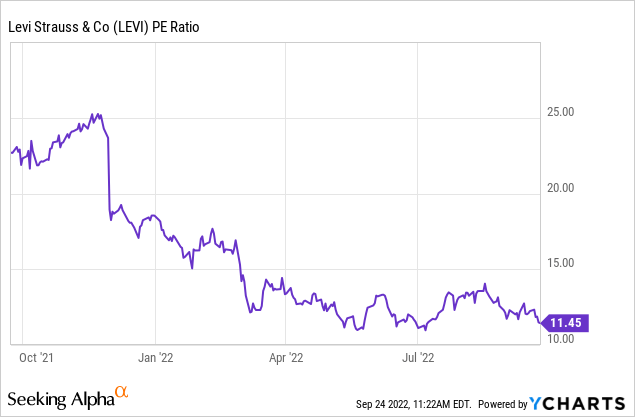

We believe that Levi Strauss & Co. is attractively valued based on historical levels as its PE ratio now stands at around 11.45x. We believe that valuation is attractive for a business with strong history of growth and a company that has continued to remain strong in its market position and improve financial metrics. As the company navigates through any economic challenges, we believe that the current valuation leaves ample room for a multiple expansion in line with its historical P/E average of 15x which translates to roughly ~40% upside from current levels.

Risks

Recession risks are considerable given that the company operates in the consumer discretionary industry. The recent CPI print has significantly raised expectations for continued rate hikes, and such monetary policy could significantly affect consumption in the U.S. and abroad. Already, U.S. consumption is slowing down, and the impact of further rate hikes could potentially depress consumer sentiment even further. However, the company’s fundamentals are strong and we believe that the company is well poised to weather through a recession. First and foremost, the company has a cash balance of $602 million, which represents roughly 10% of its market capitalization. In addition, the company’s current dividend payout ratio is around ~24.27% which is very low. We believe such a low payout ratio improves the company’s financial flexibility, and we believe even in an earnings recession, the company will be able to continue to sustain its dividend levels.

Conclusion

We believe that Levi Strauss & Co. is an attractively valued stock that can provide solid shareholder returns during an uncertain economic environment. The company has strong brand positions, and its financial fundamentals are strong. Though there remain macroeconomic risks – ones faced by many companies in the industry, we believe that Levi Strauss & Co. has the capacity to weather a recession and come out of the recession as a stronger company.