omersukrugoksu

Sturdy mortgage development will help Lakeland Bancorp’s (NASDAQ:LBAI) earnings via the top of 2023. The mortgage portfolio is about to surge on the again of administration’s efforts and regional financial elements. Alternatively, above-average provisioning will probably drag the underside line. In the meantime, the margin will probably be little modified over the subsequent 12 months and a half. General, I’m anticipating Lakeland Bancorp to report earnings of $1.63 per share in 2022, down 12% year-over-year. For 2023, I am anticipating earnings to develop by 19% to $1.94 per share. The year-end goal value suggests a large upside from the present market value. Due to this fact, I am adopting a purchase ranking on Lakeland Bancorp.

Inside And Exterior Elements To Raise The Mortgage Portfolio

Lakeland Bancorp’s mortgage e-book grew by a outstanding 3.8% within the second quarter of 2022, or 15.2% annualized. Together with the primary quarter’s acquisition of 1st Structure Bancorp, the mortgage portfolio has grown by a large 24% within the first half of the 12 months. The administration is anticipating mortgage development to stay within the high-single-digit vary within the the rest of this 12 months, as talked about within the newest convention name. The administration appeared significantly optimistic in regards to the efficiency of its healthcare lending workforce and the Hudson Valley lending groups through the convention name. Additional, the administration talked about that latest M&A exercise in Lakeland Bancorp’s area helps them develop new relationships. If the corporate is profitable in gaining new accounts then it might enhance mortgage development within the coming quarters.

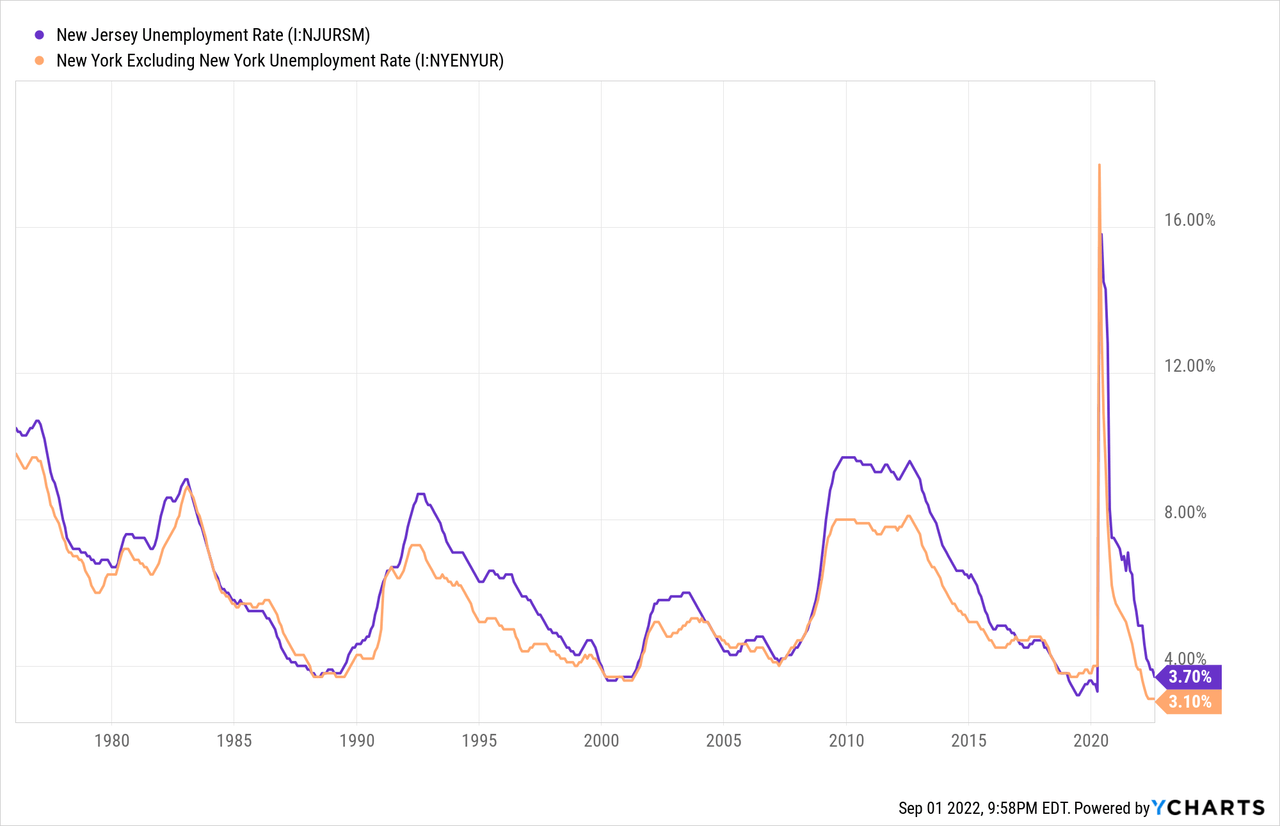

Regional financial elements may drive mortgage development within the coming quarters. Lakeland Bancorp operates in New Jersey and the Hudson Valley of New York. Each New Jersey and New York (excluding New York Metropolis) at present have very low unemployment charges, which bodes effectively for mortgage development, particularly shopper loans.

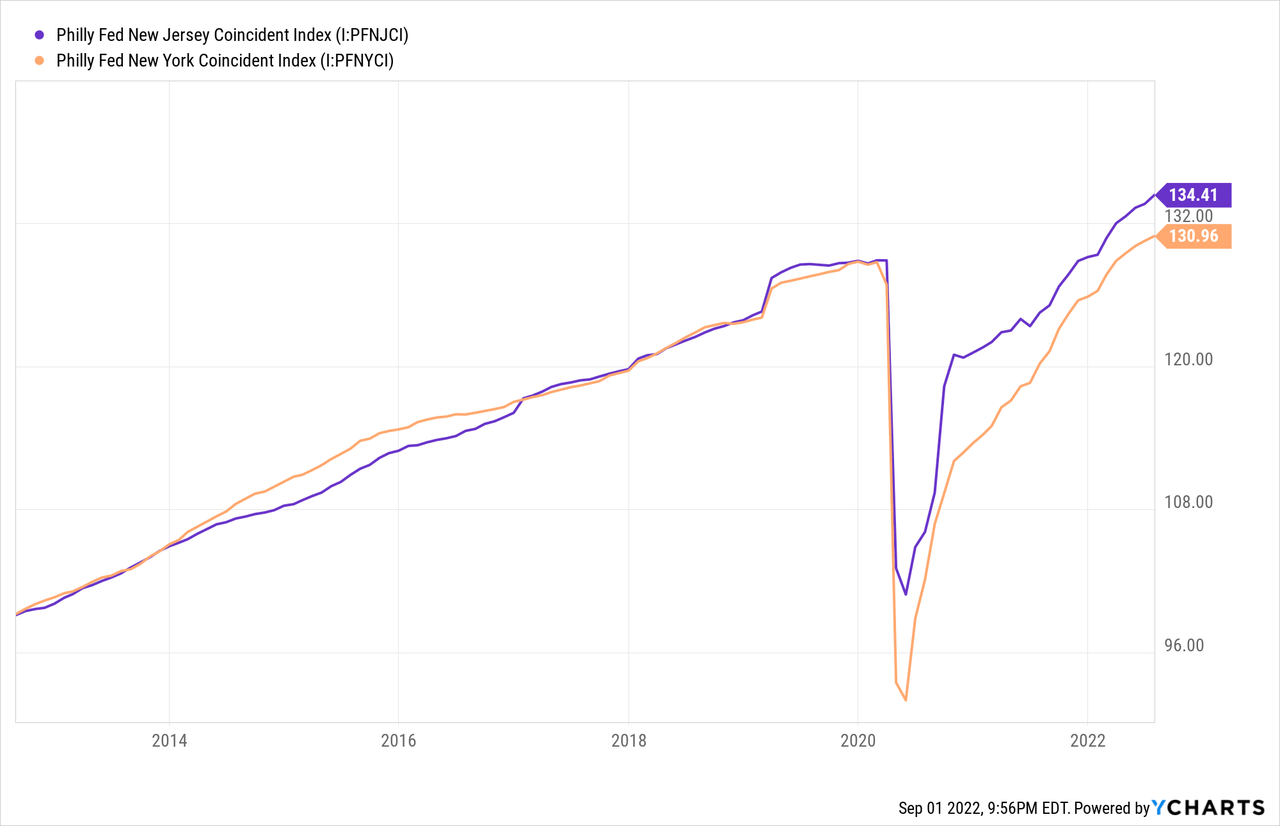

Additional, the coincident indices for each states present that financial exercise has recovered effectively and is at present at a passable stage.

Contemplating these elements, I am anticipating mortgage development to stay within the high-single-digit vary via the top of 2023, on an annualized foundation. I am anticipating the mortgage portfolio to develop by 8% annualized each quarter until the top of subsequent 12 months.

Margin To Be Barely Affected By The Surge In Curiosity Charges

Lakeland Bancorp’s deposit e-book is sort of rate-sensitive due to the abundance of interest-bearing, non-maturing deposits. These deposits re-price continuously, therefore they are going to allow the rising-rate atmosphere to shortly elevate the common deposit price. These deposits, particularly interest-bearing checking, cash market, and financial savings accounts, altogether made up 63.6% of complete deposits.

The administration’s interest-rate sensitivity evaluation additionally exhibits that legal responsibility re-pricing is prone to outweigh asset re-pricing within the twelve months following a price hike. Based on the outcomes of the evaluation given within the 10-Q submitting, a 200-basis factors hike in rate of interest might DECREASE the web curiosity earnings by 1% over twelve months.

Contemplating the legal responsibility sensitivity and the anticipated mortgage development mentioned above, I am anticipating the margin to stay virtually secure via the top of 2023 from the second quarter’s stage.

Increased Provisioning To Drag Earnings This Yr

Lakeland Bancorp’s allowances had been 310.62% of nonaccrual loans on the finish of June 2022, down from 341.83% on the finish of December 2021. The present allowance protection doesn’t seem massive sufficient for the high-inflation atmosphere and the resultant monetary stress for debtors. Consequently, I am anticipating provisioning to stay elevated within the subsequent few quarters. The threats of a recession can even encourage Lakeland Bancorp’s administration to construct up its reserves.

General, I am anticipating provisioning to proceed on the second quarter’s above-average stage via the top of 2023. I am anticipating the web provision expense to make up 0.17% (annualized) of complete loans in each quarter until the top of 2023. As compared, the web provision expense averaged 0.10% from 2017 to 2019.

The above-average provisioning will probably be one of many largest contributors to an earnings decline this 12 months. Alternatively, anticipated mortgage development will probably help earnings until the top of 2023. In the meantime, the margin will probably stay secure and have little impact on the underside line.

General, I am anticipating Lakeland Bancorp to report earnings of $1.63 per share for 2022, down 12% year-over-year. My earnings estimate contains the one-time merger-related bills attributed to the acquisition of 1st Structure Bancorp. For 2023, I am anticipating earnings to leap by 19% to $1.94 per share. The next desk exhibits my earnings assertion estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Revenue Assertion | ||||||||||

| Web curiosity earnings | 174 | 196 | 208 | 235 | 317 | 350 | ||||

| Provision for mortgage losses | 4 | 2 | 27 | (11) | 17 | 14 | ||||

| Non-interest earnings | 22 | 27 | 27 | 22 | 28 | 30 | ||||

| Non-interest expense | 111 | 127 | 133 | 141 | 186 | 196 | ||||

| Web earnings – Frequent Sh. | 63 | 71 | 57 | 94 | 106 | 126 | ||||

| EPS – Diluted ($) | 1.32 | 1.38 | 1.13 | 1.85 | 1.63 | 1.94 | ||||

Supply: SEC Filings, Earnings Releases, Creator’s Estimates (In USD million until in any other case specified) | ||||||||||

Precise earnings could differ materially from estimates due to the dangers and uncertainties associated to inflation, and consequently the timing and magnitude of rate of interest hikes. Additional, a stronger or longer-than-anticipated recession can enhance the provisioning for anticipated mortgage losses past my estimates.

Rising Charge Atmosphere Has Eroded Fairness Guide Worth

Lakeland Bancorp’s tangible e-book worth per share dropped from $13.21 on the finish of December 2021 to $12.47 on the finish of June 2022. A part of the decline was attributable to the acquisition of 1st Structure Bancorp. A buildup of unrealized losses on the massive available-for-sale securities portfolio was additionally chargeable for the dip in tangible fairness e-book worth. As rates of interest elevated available in the market, the market worth of the available-for-sale securities declined. These mark-to-market losses skipped the earnings assertion and flowed instantly into the fairness account.

Additional stress on the fairness e-book worth is probably going within the second half of 2022 due to the 75 foundation factors Fed Funds price hike in July. I am additionally anticipating an extra 75 foundation level price hike within the the rest of the 12 months. The next desk exhibits my steadiness sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Monetary Place | ||||||

| Web Loans | 4,419 | 5,098 | 5,950 | 5,918 | 7,636 | 8,266 |

| Progress of Web Loans | 7.3% | 15.4% | 16.7% | (0.5)% | 29.0% | 8.2% |

| Different Incomes Property | 825 | 905 | 982 | 1,653 | 2,219 | 2,309 |

| Deposits | 4,621 | 5,294 | 6,456 | 6,966 | 8,845 | 9,574 |

| Borrowings and Sub-Debt | 520 | 613 | 331 | 327 | 686 | 699 |

| Frequent fairness | 624 | 725 | 764 | 827 | 1,133 | 1,219 |

| Guide Worth Per Share ($) | 13.0 | 14.3 | 15.1 | 16.3 | 17.4 | 18.8 |

| Tangible BVPS ($) | 10.1 | 11.2 | 11.9 | 13.1 | 13.1 | 14.4 |

Supply: SEC Filings, Creator’s Estimates (In USD million until in any other case specified) |

Excessive Whole Anticipated Return Justifies A Purchase Ranking

Since 2015, Lakeland Bancorp has elevated its dividend within the second quarter of yearly. Given the earnings outlook, I imagine the corporate will keep this pattern subsequent 12 months and lift its quarterly dividend to $0.155 within the second quarter of 2023. My earnings and dividend estimates recommend a payout attain of 31% for 2023, which is near the five-year common of 36%.

Regardless of the stress on fairness e-book worth, Lakeland Bancorp’s capital continues to be principally at a snug stage. Lakeland reported a complete capital to risk-weighted asset ratio of 13.74% on the finish of June 2022, versus the minimal regulatory requirement of 10.50%. Due to this fact, I imagine there isn’t any risk to the dividend payout from capital adequacy necessities. My dividend estimate implies a ahead dividend yield of three.7%.

I’m utilizing the historic price-to-tangible e-book (“P/TB”) and price-to-earnings (“P/E”) multiples to worth Lakeland Bancorp. The inventory has traded at a median P/TB ratio of 1.40 prior to now, as proven beneath.

| FY18 | FY19 | FY20 | FY21 | Common | ||

| T. Guide Worth per Share ($) | 10.1 | 11.2 | 11.9 | 13.1 | ||

| Common Market Value ($) | 18.9 | 15.9 | 12.0 | 17.2 | ||

| Historic P/TB | 1.87x | 1.43x | 1.00x | 1.31x | 1.40x | |

| Supply: Firm Financials, Yahoo Finance, Creator’s Estimates | ||||||

Multiplying the common P/TB a number of with the forecast tangible e-book worth per share of $13.1 provides a goal value of $18.4 for the top of 2022. This value goal implies a 12.3% upside from the September 1 closing value. The next desk exhibits the sensitivity of the goal value to the P/TB ratio.

| P/TB A number of | 1.20x | 1.30x | 1.40x | 1.50x | 1.60x |

| TBVPS – Dec 2022 ($) | 13.1 | 13.1 | 13.1 | 13.1 | 13.1 |

| Goal Value ($) | 15.7 | 17.1 | 18.4 | 19.7 | 21.0 |

| Market Value ($) | 16.4 | 16.4 | 16.4 | 16.4 | 16.4 |

| Upside/(Draw back) | (3.7)% | 4.3% | 12.3% | 20.3% | 28.3% |

| Supply: Creator’s Estimates |

The inventory has traded at a median P/E ratio of round 11.5x prior to now, as proven beneath.

| FY18 | FY19 | FY20 | FY21 | Common | ||

| Earnings per Share ($) | 1.32 | 1.38 | 1.13 | 1.85 | ||

| Common Market Value ($) | 18.9 | 15.9 | 12.0 | 17.2 | ||

| Historic P/E | 14.3x | 11.6x | 10.6x | 9.3x | 11.5x | |

| Supply: Firm Financials, Yahoo Finance, Creator’s Estimates | ||||||

Multiplying the common P/E a number of with the forecast earnings per share of $1.63 provides a goal value of $18.7 for the top of 2022. This value goal implies a 14.1% upside from the September 1 closing value. The next desk exhibits the sensitivity of the goal value to the P/E ratio.

| P/E A number of | 9.5x | 10.5x | 11.5x | 12.5x | 13.5x |

| EPS 2022 ($) | 1.63 | 1.63 | 1.63 | 1.63 | 1.63 |

| Goal Value ($) | 15.4 | 17.0 | 18.7 | 20.3 | 21.9 |

| Market Value ($) | 16.4 | 16.4 | 16.4 | 16.4 | 16.4 |

| Upside/(Draw back) | (5.8)% | 4.1% | 14.1% | 24.1% | 34.0% |

| Supply: Creator’s Estimates |

Equally weighting the goal costs from the 2 valuation strategies provides a mixed goal value of $18.5, which suggests a 13.2% upside from the present market value. Including the ahead dividend yield provides a complete anticipated return of 16.9%. Therefore, I’m adopting a purchase ranking on Lakeland Bancorp.