yullz/iStock Editorial by way of Getty Photos

The timing was not enjoying in our favor, however we’re believers within the building companies for the time forward. Right here on the Mare Proof Lab Towers, we reiterate our constructive view and our purchase scores for each LafargeHolcim (HCMLF, OTCPK:HCMLY) and for HeidelbergCement (HLBZF, OTCPK:HDELY).

As a short recap, our key takeaways for Holcim have been:

- Greater authorities spending on infrastructure plans to revitalise enterprise after the pandemic;

- We see Holcim as a frontrunner within the ESG surroundings;

- Supportive M&A;

- And robust monetary efficiency.

Wanting on the firm’s efficiency and the inventory worth appreciation, we couldn’t be extra glad. We bought it proper for all of the above factors and we verify our thesis.

Q1 Outcomes

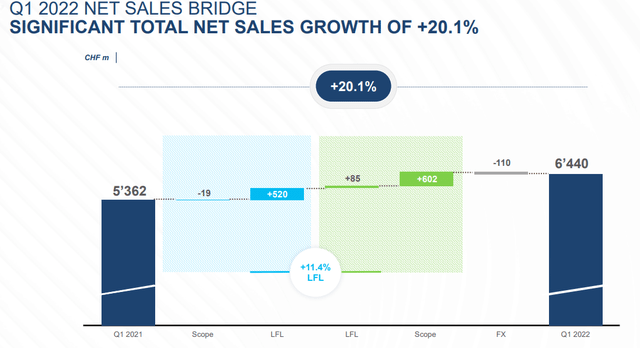

Beginning with level 4, Holcim reported report top-line income at CHF 6,440m, posting a plus +20.1%. This was pushed by robust demand, supportive acquisitions (level three), and pricing energy. Happening on the P&L, the corporate posted one other report efficiency on the working revenue degree with a Q1 that posted CHF 614m with a complete development of +16.3% at CET. As soon as once more, a robust contribution was as a result of newest acquisition, in our newest article on Holcim, we emphasised the a number of arbitrage alternative due to Firestone. Certainly, the roofing enterprise contribution was at a 17% working revenue margin.

Holcim gross sales pattern (Q1 Outcomes)

Our Factors Two and Three

An image paints a thousand phrases and we are able to use some to see what Holcim is doing. Jan Jenisch Holcim’s CEO stated: “With sustainability on the core of our technique, we printed our first Local weather Report, sharing our net-zero journey with 2030 and 2050 targets validated by the Science-Primarily based Targets initiative. A primary in our trade, it critiques our decarbonisation actions, from inexperienced constructing options, all the best way to round building and next-generation applied sciences.”

ECOPact inexperienced concrete reached 10% of ready-mix gross sales in March 2022. Holcim will not be solely working on the ESG degree on net-zero emission, nevertheless it additionally making the most of the beneficial EU laws within the inexperienced bond space (with extraordinarily low-interest charges).

Holcim ESG (Q1 Outcomes)

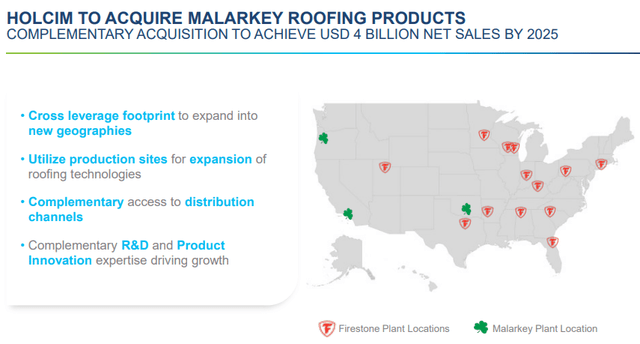

Concerning the acquisition, we see Holcim as a real worth participant. Malarkey is a confirmed development driver and could be very complementary to the Firestone acquisition. Accretive EPS ranging from this yr, synergies of $40 million by yr three, and a greater gross sales diversification.

Malarkey M&A particulars (acquisition presentation)

Conclusion and Valuation

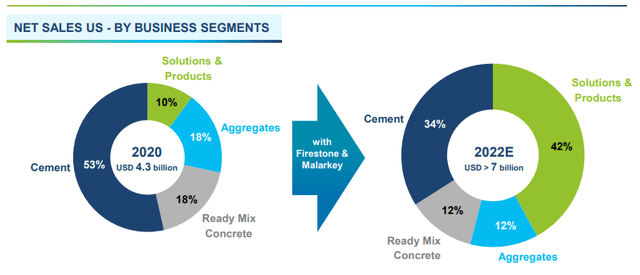

Regardless of the current macro improvement, Holcim as soon as once more raised the bar on 2022 steering and we’re assured that they’ll meet their inside outlook. Our inside staff is forecasting an EBITDA of seven billion CHF due to a greater product combine, the newest acquisition, and robust pricing energy. We actually like companies that are adaptive and Holcim is definitely considered one of them. From a pure participant in cement, aggregates, and concrete, they’ve determined to shift to extra value-added merchandise (picture beneath). We worth the corporate based mostly on our forecast EBITDA of 6.5x and we arrive at a valuation of 67 CHF per share, implying a present upside of greater than 42%. Except for the same old dangers within the building enterprise sector, we would like our readers to think about the Syria litigation.

Holcim enterprise transformation (Malarkey acquisition presentation)

Earlier protection within the building/cement sector:

- LafargeHolcim: A number of Arbitrage Thanks To Firestone Acquisition

- HeidelbergCement: The Greatest Is But To Come

- Wanting At HeidelbergCement’s Russian Publicity