Buena Vista Photos

Introduction

Investments in a mushroom grower, an enormous Tokyo Skyscraper, a non-public debt deal, and a Japanese multi-billion personal fairness deal are simply 4 examples of operations the personal fairness big KKR & Co. Inc. (KKR) is engaged in — simply final month!

I discovered these 4 examples in a search on Bloomberg that took me lower than 30 seconds. I may have listed many extra offers, as personal fairness and credit score are booming once more, making KKR and a few of its friends high-performers on the inventory market.

Bloomberg

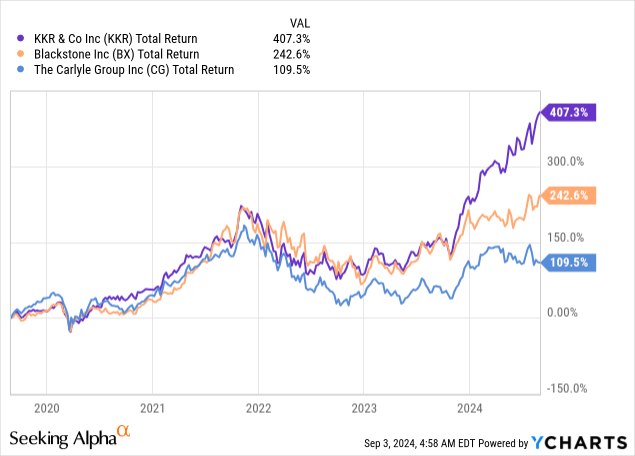

After struggling in 2022 because of elevated rates of interest, the personal fairness business has come again roaring, led by KKR. This big, with a $110 billion market cap, has returned greater than 400% over the previous 5 years, leaving high-performers like Blackstone (BX) within the mud.

On July 22, I lined Blackstone, utilizing the title “Enjoying Actual-Life Monopoly With Blackstone.” In that article, I defined how the enormous had constructed a enterprise mannequin that allowed it to make use of scale and experience to create an unmatched portfolio of high-quality belongings and lending operations.

KKR is smaller — but not much less spectacular.

Therefore, on this article, I am going to focus on what makes KKR so particular and what to make of the chance/reward after its spectacular inventory worth efficiency lately.

So, as now we have rather a lot to debate, let’s get to it!

KKR’s A Large

KKR was based in 1976 by Henry Kravis, George Roberts, and their mentor Jerome Kohlberg. With simply $120,000, they began a non-public fairness agency centered on U.S. belongings.

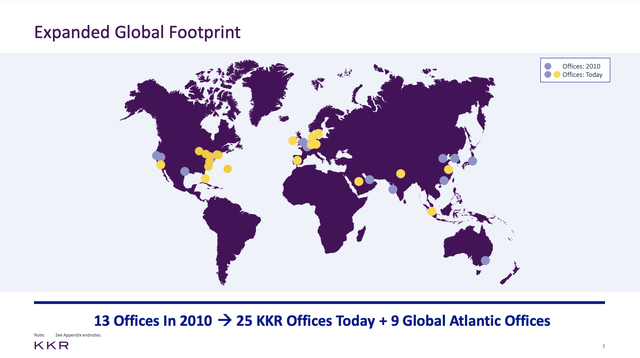

These days, the corporate is a world big with greater than 25 KKR workplaces and 9 World Atlantic workplaces, which handle KKR’s insurance coverage enterprise. In the beginning of this 12 months, KKR purchased the remaining fairness curiosity on this insurance coverage big, making it a completely owned a part of the corporate. Since June of this 12 months, the corporate has been an S&P 500 (SP500) member.

KKR & Co.

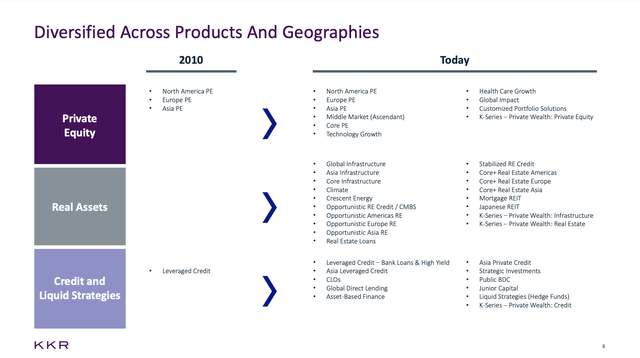

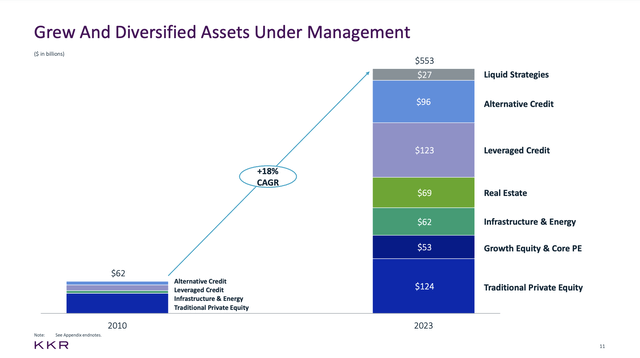

In 2010, the corporate had 13 workplaces and operations in North America, Europe, and Asia. As we are able to see under, these operations have been primarily in personal fairness and credit score. Since then, it has added numerous different operations, together with a variety of personal fairness segments, rather more credit score capabilities, and actual property, which has turn out to be the go-to place for personal fairness lately.

KKR & Co.

The chart under captures the corporate’s transformation even higher. In 2010, it had $62 billion in belongings underneath administration (“AUM”). In 2023, that quantity had grown to greater than $550 billion.

Presently, conventional personal fairness is larger than the corporate’s whole asset base of 2010. Furthermore, it has seen robust development in leveraged credit score, various credit score, actual property, and infrastructure.

KKR & Co.

This is not simply spectacular but additionally nice information for its fee-related revenue. Between 2010 and 2023, the corporate has grown its fee-related earnings by 7x to $2.4 billion. Internet revenue has risen by 5x to $3.0 billion.

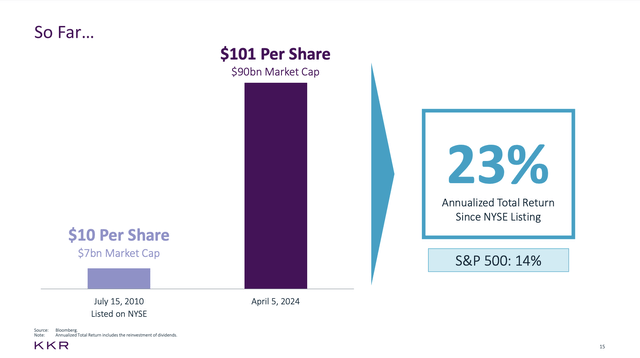

Even higher, shareholders who’ve been with the corporate since its July 2010 IPO have loved a 23% annualized whole return, beating the spectacular 14% annual return of the S&P 500 by a substantial margin.

KKR & Co.

To this point, so good.

As nice as a unbelievable previous efficiency could also be, it is all in regards to the future.

KKR’s Simply Getting Began

On this case, I am utilizing the corporate’s personal phrases. In its 2024 Investor Day presentation, it famous: “We’re simply getting began.”

This was backed by the next chart, displaying it expects to lift over $300 billion in new capital by way of 2026.

That is anticipated to lead to annual compounding EPS development of roughly 20%!

KKR & Co.

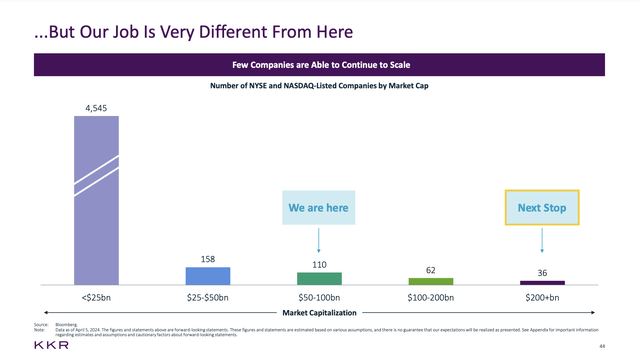

All of that is a part of its plan to turn out to be a >$200 billion market cap big to make use of its scale even higher. Notice that as of April 5, 2024, solely 36 corporations on the NYSE and NASDAQ have been a part of that class.

KKR & Co.

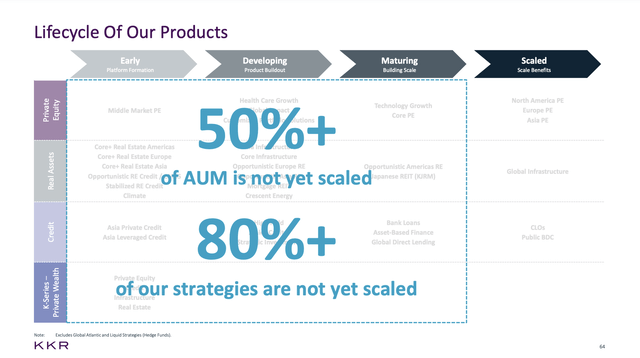

A giant a part of its anticipated development is utilizing present belongings. For instance, in response to the corporate, greater than half of its AUM shouldn’t be absolutely scaled, whereas greater than 80% of its methods are usually not but scaled, both.

KKR & Co.

As personal fairness, actual property, credit score, and personal wealth operations are nonetheless seeing a massively fragmented market with the advantages of recent methods, KKR sees a number of paths to develop its AUM to greater than $1 trillion within the subsequent 5 years!

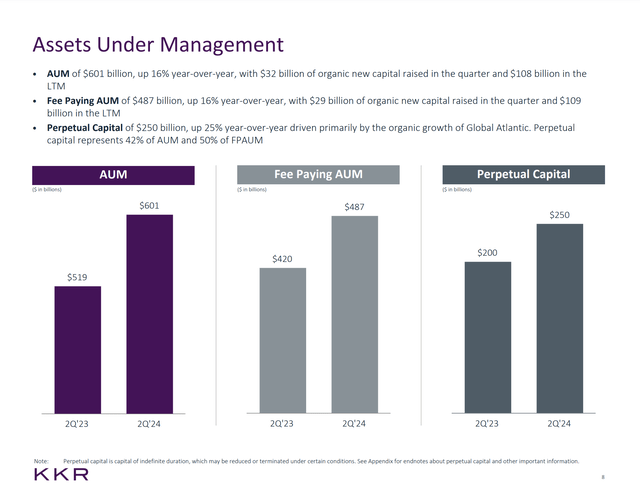

Within the second quarter of this 12 months, the corporate raised $32 billion. This made it the second most lively fundraising quarter in its historical past. We’re seeing this momentum in the whole personal fairness business, as decrease inflation and expectations of decrease charges have introduced again optimism amongst buyers.

This contains the profitable launch of its World Infrastructure V fund, which raised roughly $10 billion by July 2024. Furthermore, its Capital Markets enterprise has been thriving, with 2Q24 being one of the vital profitable quarters lately.

It now has greater than $600 million in AUM, 16% extra in comparison with the prior-year quarter.

KKR & Co.

Greater than 90% of its AUM is perpetual capital or capital with a period of a minimum of eight years at inception. That is capital that has an indefinite time period with no predetermined requirement to return invested capital to shareholders.

Going again to fundraising, with anticipated document Capital Market charges within the third quarter, the corporate believes it’s in an important spot to capitalize on favorable market situations. Primarily based on the present atmosphere, it is vitally troublesome to disagree with that.

In accordance with the corporate, the worldwide atmosphere is seeing a major upswing in leveraged credit score issuance, IPOs, and M&A exercise, with leveraged credit score issuance development of greater than 100%, development in IPOs of fifty%, and introduced M&A quantity development of 25% year-to-date.

[…] given it sometimes takes a few quarters for the market to show again on, these numbers understate the run fee exercise we’re feeling immediately. If this momentum continues, we imagine you will note much more exercise and introduced offers and exits within the second half of the 12 months. – KKR 2Q24 Earnings Name.

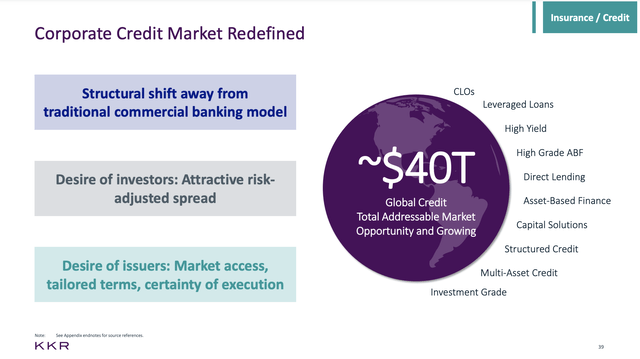

Even higher, the corporate has lots of dry powder and sees important alternatives within the international $40 trillion credit score market and extra capital demand than provide in markets like international infrastructure and actual property.

KKR & Co.

With ongoing rate of interest challenges and banks being on the sidelines for threat causes, personal fairness is in a unbelievable place to choose up the slack and increase in these fast-growing markets.

Dividend & Valuation

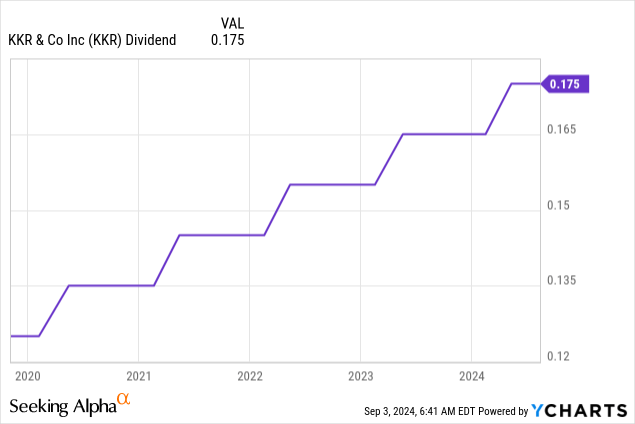

After climbing its dividend by 6.1% on July 31, the corporate presently pays a dividend of $0.175 per share per quarter. This interprets to a yield of 0.6%.

Over the previous 5 years, the dividend has grown by 6.3% per 12 months. It enjoys a really low payout ratio of 17%.

Though this dividend is nothing to write down residence about, the corporate, which enjoys an A-rated stability sheet, has one thing else: elevated earnings development.

As we mentioned within the first a part of this text, the corporate may be very formidable on the subject of rising its earnings.

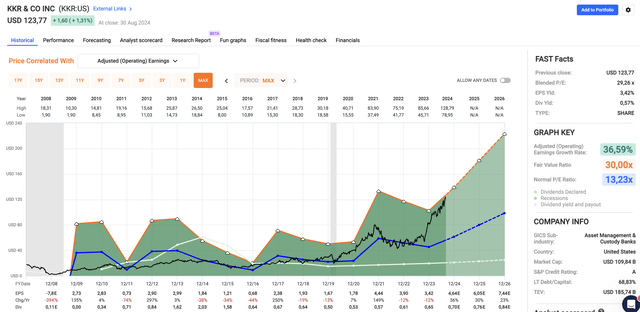

Utilizing the FactSet knowledge within the chart under, analysts anticipate KKR to develop its earnings per share by 36% this 12 months, probably adopted by 30% and 23% development in 2025 and 2026. These are really “tech-like” earnings, fueled by a powerful enterprise mannequin and more and more favorable market situations.

FAST Graphs

Furthermore, though the corporate trades at a blended P/E ratio of virtually 30x, the market stays bullish, with a consensus worth goal of $139, 12% above the present worth.

Probably the most bullish goal on my radar comes from Redburn Atlantic, which places a good price ticket of $153 on the inventory, 24% above the present worth.

Though KKR shouldn’t be very low-cost, the market is solely not promoting at these ranges, as an more and more favorable working atmosphere offers room for what may very well be a chronic development streak with above-average development charges.

As such, I give the corporate a Purchase ranking. Nevertheless, I might not purchase a full place at present costs. Have been I out there for KKR, I might be a gradual purchaser. If the inventory worth corrects a bit, I can common it down. If the inventory worth continues to rally, I’ve a foot within the door.

On a longer-term foundation, I imagine KKR is in an important spot to beat the market.

Takeaway

KKR & Co. Inc. is on a formidable development trajectory, increasing its affect throughout personal fairness, credit score, actual property, and infrastructure with a transparent path to changing into a $200 billion market cap big.

Regardless of a powerful five-year efficiency and bold development targets, together with a purpose to greater than double its AUM to over $1 trillion within the subsequent 5 years, KKR’s present valuation suggests it is priced for continued success.

Whereas it isn’t the most affordable inventory, the corporate’s sturdy enterprise mannequin, favorable market situations, and spectacular development outlook make it a strong purchase on pullbacks.

Execs & Cons

Execs:

- Robust Development Trajectory: KKR has been on a roll, with a 400% return over the previous 5 years and bold targets to double its AUM to over $1 trillion within the subsequent 5 years. The corporate’s sturdy growth in personal fairness, credit score, and actual property places it in a first-rate spot for continued development.

- Favorable Market Circumstances: With the personal fairness market rebounding and KKR’s strategic positioning, I imagine the corporate is in an important spot to capitalize on a good working atmosphere, particularly with banks standing on the sidelines.

- Tech-Like Earnings Development: Anticipated EPS development charges of greater than 20% yearly by way of 2026 make KKR’s earnings trajectory one of many strongest among the many largest-cap corporations.

Cons:

- Valuation Considerations: Buying and selling at practically 30x earnings, KKR is not low-cost. The inventory displays lots of optimism, and any declines in execution or market situations may result in a pullback. Nevertheless, I imagine all of this could create shopping for alternatives.

- Dividend Yield is Modest: With a yield of simply 0.6%, the inventory is not a standout for income-focused buyers. A lot of the enchantment lies in capital appreciation as an alternative of dividends.

- Financial Development: As a result of the corporate is cyclical, a recession may harm its AUM and revenue development.