SDI Productions/E+ via Getty Images

As the economy grows larger, companies will inevitably grow larger as well. This opens the door to a very interesting opportunity for businesses to develop for the sole purpose of providing non-core services to their customers. By ‘non-core’, I am referring to services, such as finance and accounting talent solutions, that are necessary for pretty much every company but that the company would prefer not to do on its own in favor of focusing on its own core operations. One business dedicated to providing these types of services is Kforce (NASDAQ:KFRC). Fundamentally speaking, the overall trajectory the company has experienced has been positive. That performance continued into the 2022 fiscal year. Unfortunately, shares of the company look more or less fairly valued compared to similar firms. But on an absolute basis, the stock does look cheap. Because of this, I’ve decided to rate the enterprise a soft ‘buy’ at this time, a rating that reflects my belief that shares should likely outperform the broader market, even if marginally, for the foreseeable future.

A business for your business

According to the management team at Kforce, the enterprise operates as a leading domestic provider of technology and finance and accounting talent solutions for its customers. To best understand the company, we should dig into the specific operations that it engages in. The first of the company’s two segments is referred to as its Technology business. Through this, the firm provides talent solutions for its customers by matching its customers up with qualified candidates in highly skilled areas. Examples include those with experience in systems and applications architecture, mobile and web development, data management and analytics, business and artificial intelligence, machine learning, security, and more. This unit provides not only the aforementioned qualified individuals, but also teams of consultants on a temporary basis. Although a fairly small portion of the company, accounting for only 2% of sales overall in 2021, the firm does provide direct hire solutions as well whereby certain placement can be established permanently. This is the largest portion of the company’s business, accounting for 80.6% of its revenue in 2021.

The other segment is referred to as its FA business. This particular unit specializes around providing consultants in traditional finance and accounting roles to its customers. Examples of particular activities include financial, planning and analysis, business intelligence analysis, accounting, and other related activities. Lower-skilled areas like loan servicing, customer and call center support, data entry, and more, are also included under this umbrella. However, management has made clear that in prior years they have been shifting their focus toward the highly skilled assignments and away from the lower-skilled ones. This segment is substantially smaller than the Technology business is, accounting for only 19.4% of sales.

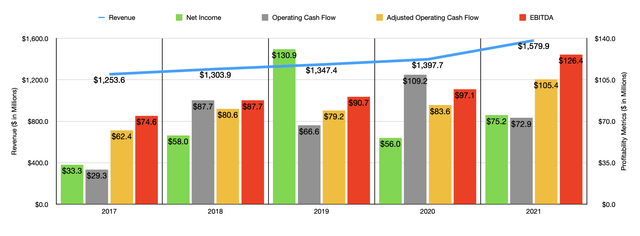

Author – SEC EDGAR Data

In each of at least the past five years, sales achieved by Kforce have risen. Revenue went from $1.25 billion in 2017 to $1.58 billion in 2021. The increase from 2020 to 2021 was an impressive 13%. This was driven largely by a 22.3% rise in revenue per billing day for the Technology business and was offset to some degree by an 11.4% decline in the FA business. Although the decline in FA may look bad, it’s important to note that the company had significant temporary contracts with government entities related to COVID-19 initiatives. Excluding these from the equation, sales for the aforementioned segment would have decreased a more modest 1.5%. The company also benefited from a 48.1% surge in sales associated with direct hire activities. This makes a great deal of sense when you consider how tight the job market is and the desire of businesses to lock down permanent work.

While it’s great to see revenue increase consistently, the same cannot necessarily be said of profitability. From 2017 through 2019, net income for the business rose from $33.3 million to $130.9 million. Profits then plunged to $56 million in 2020 before staging a partial recovery to $75.2 million in 2021. Operating cash flow has been even more volatile, bouncing around between a low of $29.3 million and a high of $109.2 million, with no clear trend. But if we adjust for changes in working capital, the metric would have risen in four of the past five years, ultimately climbing from $62.4 million to $105.4 million. An even better trend can be seen when looking at EBITDA. Over the past five years, it rose consistently year after year, climbing from $74.6 million to $126.4 million.

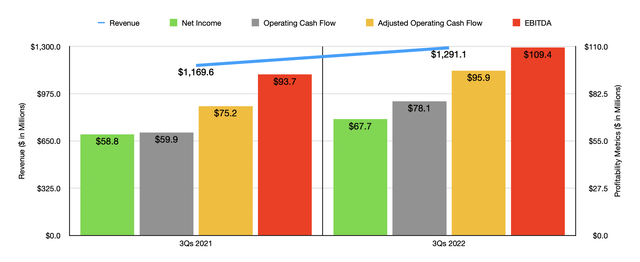

Author – SEC EDGAR Data

For the first nine months of 2022, the company’s sales momentum continued. Revenue of $1.29 billion came in higher than the $1.17 billion reported only one year earlier. Net income continued to rise, climbing from $58.8 million to $67.7 million. Also on the rise was operating cash flow, a metric that jumped from $59.9 million to $78.1 million. On an adjusted basis, meanwhile, it rose from $75.2 million to $95.9 million. And finally, EBITDA for the business also improved, rising from $93.7 million to $109.4 million.

On February 6th, after the market closes, the management team at Kforce is expected to announce financial results covering the final quarter of the company’s 2022 fiscal year. Investors would be wise to pay attention to what’s reported. After all, we have recently seen some tremendous jobs numbers, but there is also broader concern about the economy. In its third quarter earnings release, management said that revenue for the final quarter should be between $414 million and $422 million. This would be up from the $410.4 million reported the same time one year earlier. For context, analysts are anticipating sales of $418.5 million, roughly $0.5 million greater than the midpoint that management forecasted.

In terms of profitability, analysts anticipate earnings per share of $0.92. This would translate to $18.4 million and would match the midpoint expectations provided by management of between $0.88 per share and $0.96 per share. To put this in perspective, in the final quarter of 2021, the firm generated earnings per share of $0.98, translating to net income of almost $20.6 million. Naturally, investors should also pay attention to other profitability metrics. Analysts have not offered any guidance on these. But for perspective, in the final quarter of 2021, Kforce generated operating cash flow of $13 million, adjusted operating cash flow of $30.2 million, and EBITDA of $31.8 million.

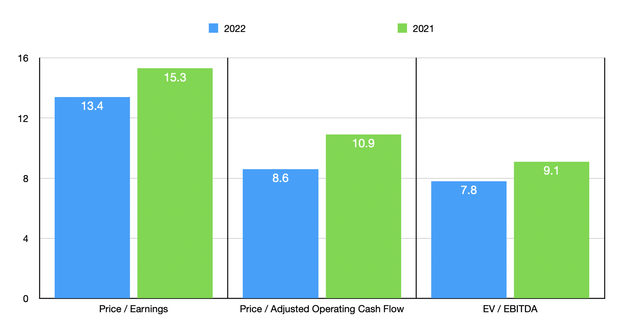

Author – SEC EDGAR Data

If management can hit the midpoint of expectations, then the company should have generated $86.1 million for 2022. Approximate estimates for adjusted operating cash flow and EBITDA should be $134.4 million and $147.6 million, respectively. Based on these figures, the company is trading at a price-to-earnings multiple of 13.4. The price to adjusted operating cash flow multiple should be 8.6, while the EV to EBITDA multiple would be 7.8. By comparison, using the data from 2021, these multiples would be 15.3, 10.9, and 9.1, respectively. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 9.4 to a high of 29. Two of the five were cheaper than our target. Using the price to operating cash flow approach, the range was from 6.8 to 33. In this scenario, only one of the five firms was cheaper than our prospect. And finally, using the EV to EBITDA approach, the range was from 5.2 to 15.7. In this scenario, three of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Kforce | 13.4 | 8.6 | 7.8 |

| Insperity (NSP) | 29.0 | 13.4 | 15.7 |

| ManpowerGroup (MAN) | 12.9 | 11.3 | 7.2 |

| TriNet (TNET) | 13.5 | 16.3 | 7.4 |

| ASGN Inc. (ASGN) | 17.8 | 12.8 | 10.1 |

| Korn Ferry (KFY) | 9.4 | 6.8 | 9.1 |

Takeaway

Fundamentally, Kforce seems to be doing quite well. The company continues to grow its top line, and bottom line results are showing continued improvement. Given the recent strong jobs data that has come out, it would be interesting to see how Kforce fared near the end of last year. And naturally, there is always some concern about what the future holds. But for now, shares in the business look cheap on an absolute basis, even though they might be fairly valued compared to similar firms. Add onto this its track record for growth, and I feel as though a soft ‘buy’ rating is appropriate at this time.