I rate the Invesco Exchange-Traded Fund Trust II – Invesco KBW Property & Casualty Insurance ETF (NASDAQ:KBWP) a hold. However, I plan to follow this ETF during the coming periods as the high-strung emotions surrounding the financial sector begin to die down. I have before addressed how insurance ETFs may have a silver lining amid unfavorable economic conditions. KBWP is high-quality in many respects and could offer a lot to investors, but I don’t believe now is this to make any transactions.

The insurance industry has been quite profitable historically and could be attractive to investors seeking exposure to financials without dealing with the possible drawbacks of significant procyclicality. This might give insurance a unique edge over banking. However, the insurance industry is by no means invincible to macroeconomic headwinds created by speculative crises like bank runs. In specific respects to property and casualty (P&C) insurance, profits are somewhat dependent on the performance of certain industries like real estate, which are also quite procyclical. The effects on the real estate industry tend to be amplified proportional to market changes. This could alter both the demand for homeowners insurance by residents and the demand for other types of P&C coverage by construction companies.

In the long term, insurance ETFs like KBWP could offer investors quality returns while possibly sparing them of larger fluctuations associated with excessive procyclicality. However, this ETF still saw a sharp drop similar to that of banks after the recent collapse of several regional banks. I don’t believe the financial sector is quite yet in the clear, and investors might want to just play it safe for now.

Khanchit Khirisutchalual

Strategy

KBWP tracks the KBW Nasdaq Property & Casualty Index and uses a full replication technique. With this method, investors can remain confident that this fund effectively mirrors the trajectory of its designated benchmark. This ETF also invests in both growth and value stocks of different market capitalizations.

Holdings Analysis

KBWP’s holdings are primarily centered on financial institutions that provide P&C insurance services. These same companies reside solely in the United States. Investors should therefore recognize that though this ETF is capable of delivering quality returns, it might not be an effective source of sector and geographical diversification.

KBWP allocates 59% to the top 10 holdings in a fund of just 27 holdings, making this ETF somewhat top heavy, but lesser than many other ETFs I’ve covered. Therefore, concentration risk is unlikely to be a meaningful drawback in owning this ETF.

Strengths

The property and casualty insurance industry has decently strong growth forecasts. This industry is currently worth $873B in 2023, could grow to over $1.3T by 2030 at a CAGR of 6%. Strong growth forecasts could attract investors and eventually manifest in profits within companies held in KBWP.

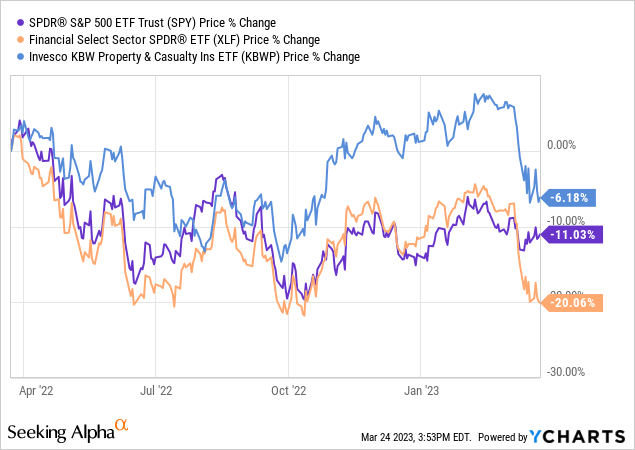

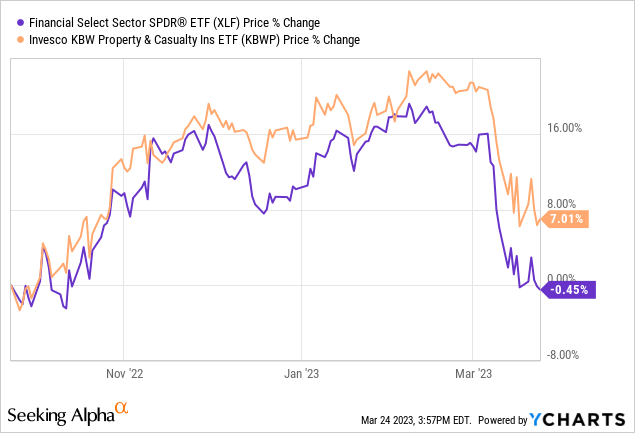

This ETF has also outperformed the financial sector and the broader market within the past year. This could indicate a performative edge and ability to hedge against high inflation compared to other financial ETFs like those focused on banking.

The outperformance gap seemingly began widening during last October, and has grown since. Interest rate hikes happened to become especially aggressive in October 2022. Therefore, KBWP might have a greater ability to hedge against inflation and transcend its peers when economic conditions worsen.

Reduced economic activity in the past year could have reduced risky activities whose consequences might require one to file an insurance claim. Continuation of this trend could result in fewer losses and accidents like those typically covered by P&C insurance, reducing claims costs for P&C insurance companies.

Weaknesses

Insurance ETFs like KBWP are somewhat able to hedge against high inflation, however the insurance industry has caveats of its own. Insurance fraud has risen in recent years, which creates a potentially threatening pitfall for this ETF. Insurance fraud becoming more prevalent could cut into certain companies’ profits and reputation alike. Ultimately, this puts many holdings in KBWP at risk.

This ETF is currently trading higher than other financial ETFs like XLF, however, KBWP is by no means immune to financial crises. As seen in the chart below, KBWP experienced a decline after recent bank runs despite coming out higher than the rest of the financial sector. Therefore investors should still be attentive to this ETF’s procyclicality even if it’s generally lesser than that of banking ETFs.

Opportunities

Construction and infrastructure spending could increase in the coming years, potentially driving profits in P&C insurance companies like the ones held in this ETF. Some have forecasted a decline in construction costs in 2023. Cheaper construction could catalyze the emergence of new construction companies. Construction is one of the most accident-prone industries, meaning construction companies are required to have P&C insurance.

P&C insurance providers could also profit from the increasing prevalence and future growth of companies like Uber (UBER) and Airbnb (ABNB). Companies like those held in KBWP could provide specialized coverage to drivers and hosts alike as both services gain popularity. This could result in increased buying volume of insurance services by said companies as they seek to enhance employee and consumer confidence as well as profits.

Threats

Climate change and the natural disasters it elicits are likely to only become more threatening to property and human lives in the future. For example, United Property & Casualty Insurance Co. was placed into receivership recently as many in Florida bore heavy losses from Hurricane Ian in September of last year. Many Florida homeowners were left without property insurance as claims expenses became overbearing and reinsurance coverage levels were also inadequate. Debacles like these could escalate in the long-term as climate change-related natural disasters increase in both frequency and severity. This could cut into the profits of companies held in this ETF and eventually chip away at investors’ returns.

The housing market is also bearing a significant brunt of the current market downturn. Mortgage rates have receded recently and overall the sentiment for the housing market may be getting better. However, I do not believe the housing market to be in the clear just yet. Furthermore, the recent bank runs and rate hikes could have further implications for the housing market. Until the housing market recovers significantly, the demand for homeowners insurance could be in danger, which could hurt the sales of companies in KBWP.

Conclusions

ETF Quality Opinion

It will be interesting to see how this ETF performs against intensifying macroeconomic conditions and other events that could place industries like banking in hot water. KBWP is definitely a notable fund that I plan to follow in the long-term.

ETF Investment Opinion

I give KBWP a hold. I am balancing my expectations for this ETF in considering both a price rebound as well as any further decline in the near future. I believe KBWP’s short-term returns could be somewhat erratic as investors recuperate from recent shocks and also re-evaluate their long term expectations. That being said, investors might want to consider playing it safe for now and waiting for the financial sector to cool down.