Joe Terranova

Scott Mlyn | CNBC

Joe Terranova plans to stay by the successful quantitative strategy that is allowed his Virtus Terranova U.S. High quality Momentum ETF (JOET) to establish shares like Palantir early earlier than the remainder of the market has piled in over the past 5 years.

The ETF — created by Terranova, chief market strategist for Virtus Funding Companions — has risen 10.9% this yr, beating the 6.8% acquire within the Invesco S&P 500 Equal Weight ETF (RSP) in that point.

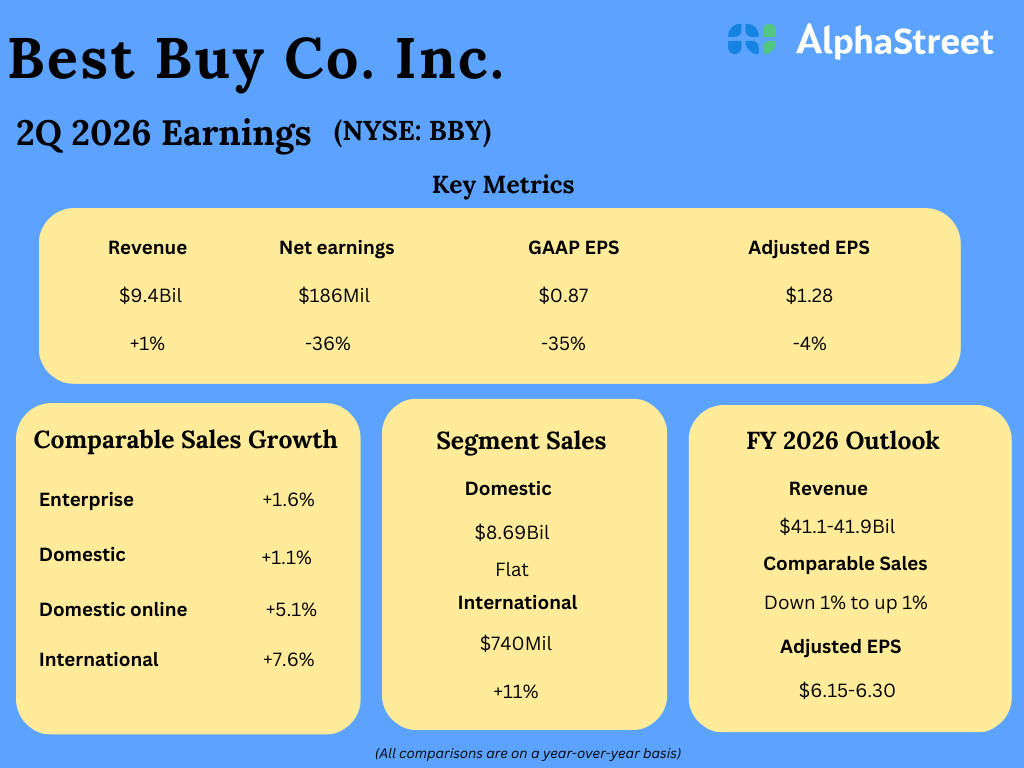

JOET, RSP YTD chart

To pick the ETF’s holdings, Terranova follows a strict set of rules-based rules. First, he and his workforce display screen the five hundred largest U.S. corporations for shares with the best constructive momentum, calculated utilizing their complete returns over 12 months. The highest 250 shares are then included within the choice checklist.

The securities are then graded on three high quality components — return on fairness, debt-to-equity ratio and annualized gross sales development charge over the previous three years. The highest 125 shares with the best composite scores make up the equal-weighted ETF’s holdings.

Though the fund is not actively managed in a standard sense, it’s rebalanced each quarter. Terranova stated he does not miss the feelings of actively managing a fund, since his rules-based technique has helped him seize alpha that he in any other case may need missed.

“In January of ’24, Palantir certified. Wasn’t within the S&P at this level, as a result of we’re not scanning the S&P,” Terranova stated within the “High quality within the Streets, Momentum within the Sheets” episode of The Compound and Mates podcast with fellow CNBC contributor Josh Brown. “I’m telling you 100% I might have offered the inventory if I had discretion six occasions over. I might have discovered six totally different occasions to promote that inventory, the technique, the self-discipline.”

Terranova estimated that he purchased into Palantir whereas it was buying and selling round $16.76. Shares of the analytics instruments builder traded round $173 on Monday and have soared 129% in 2025.

The investor additionally thanked his strategy for capturing the market’s “persona” and serving to him get in early on different themes, like the present healthcare rally. On the flip aspect, Terranova’s technique has additionally helped him promote out of positions that he in any other case may need grown hooked up to.

“I’ve extra affection in direction of the holdings which were there for a number of quarters,” he instructed CNBC on the sidelines of the podcast episode recording. “Tesla’s an excellent instance. Tesla’s income development flattened out, and I might see what was coming — that we had been going to promote Tesla. And on Halloween, the technique liquidated Tesla, which appears like a reasonably good transfer.”

Going ahead, Terranova intends to construct a collection of ETF merchandise that applies his investing guidelines to different belongings outdoors of U.S. large-cap shares, similar to small-caps and European equities. He believes his technique will proceed to achieve permitting him to create a core fairness holding and shock absorber for buyers’ portfolios.

“Momentum is a mirrored image of technical confidence. High quality is a mirrored image of basic confidence. And also you wish to make investments across the confidence,” Terranova stated to CNBC. “To me, that is the place you get the long-term success.”

The JOET fund has an expense ratio of 0.29% and has round $240 million in belongings beneath administration.