Investor fears spiked once more after Moody’s downgraded the U.S. authorities’s debt score, however CNBC’s Jim Cramer suggested a special response. He urged traders to handle their feelings reasonably than panic, suggesting that digital belongings like Bitcoin might function a protecting choice in unsure occasions.

Jim Cramer Warns In opposition to Concern-Pushed Promoting

Jim Cramer, host of CNBC’s Mad Cash, addressed traders on Monday following Moody’s determination to downgrade the U.S. debt score. The announcement, made after market shut on Friday, triggered a unstable begin to the week. Markets opened decrease, with the Dow Jones falling by 300 factors and the S&P 500 slipping by 1% in early buying and selling.

Regardless of the preliminary drop, markets recovered through the session. The Dow closed up 0.32%, the Nasdaq rose 0.02%, and the S&P 500 gained 0.09%. Jim Cramer urged traders to withstand worry, calling it a repeated sample following earlier downgrades, equivalent to these by S&P in 2011 and Fitch in 2023.

“You might be being given an early warning to speculate extra—no more aggressively—however extra of what it can save you,” Jim Cramer mentioned. He added that promoting after a downgrade has not been a dependable technique up to now.

Bitcoin and Gold Urged as Security Nets

Jim Cramer suggested these involved about rising nationwide debt to think about belongings outdoors of conventional markets. He particularly talked about gold and Bitcoin as alternate options throughout occasions of fiscal uncertainty. “Concern is what should be tamed if you wish to be an excellent investor,” he defined, emphasizing that panic usually results in poor choices.

Bitcoin, specifically, has proven resilience in current days. Following the downgrade information, Bitcoin’s worth confirmed volatility however continued to carry above key help ranges. Cramer famous that digital belongings like Bitcoin may provide a buffer for these cautious of extreme authorities borrowing.

He additionally steered that some worry narratives are pushed by people or entities with their very own monetary pursuits.

“The individuals who write these are both fools who know nothing or extremely shrewd brief sellers who actually need to unfold worry due to their enterprise mannequin,” Jim Cramer mentioned.

Bitcoin Open Curiosity Soars Value Hits $107k

Bitcoin’s open curiosity within the futures market reached $74 billion, based on knowledge from Coinglass. This marks one of many highest ranges seen in current weeks and suggests rising dealer exercise.

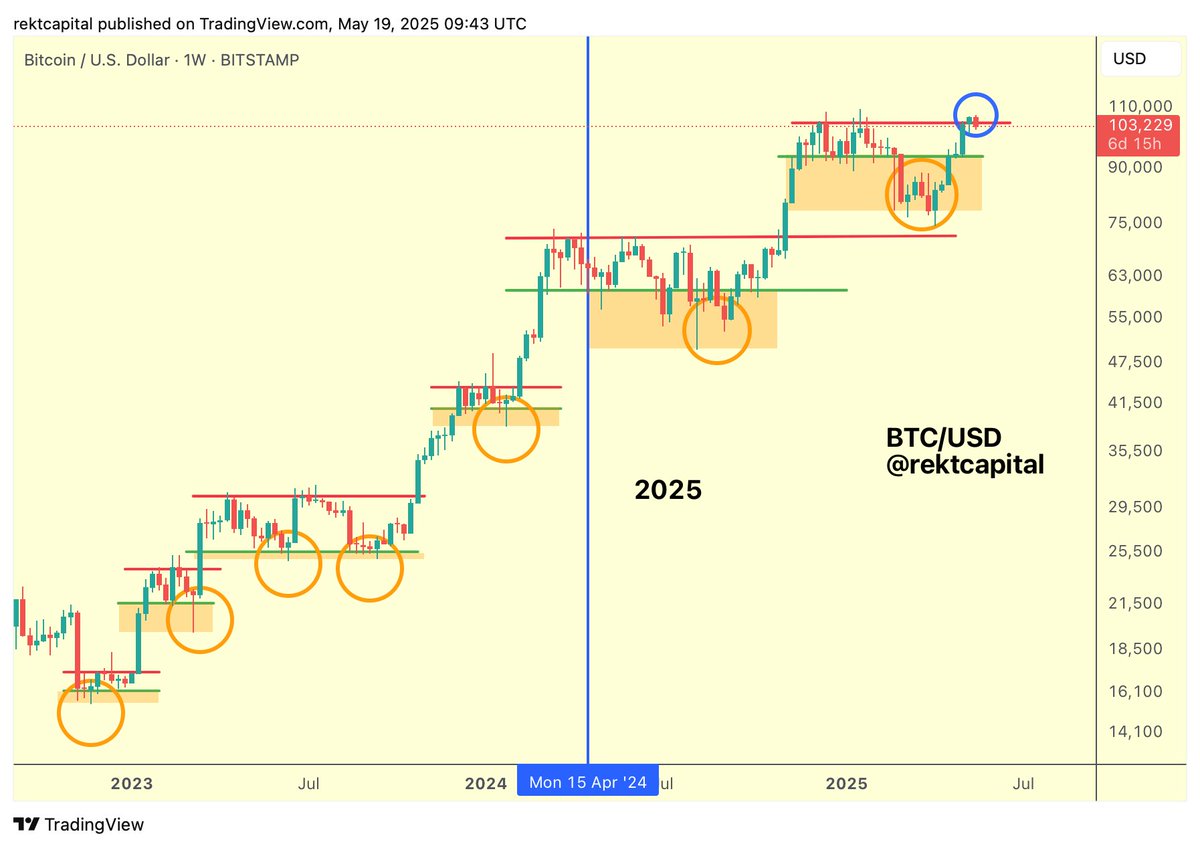

Bitcoin worth is at present buying and selling round $105,000 after a quick transfer to $107,000. It has rejected that stage twice in current periods, indicating resistance. Regardless of the fluctuations, Crypto skilled Rekt Capital mentioned that the asset closed the earlier weekly candle above $103,000, which had been a key resistance level.

Analysts are attributing the exercise to sentiment that rates of interest will come down and inflation will average, each of that are favorable for issues like Bitcoin. This rising variety of monetary corporations ramping up their crypto publicity like Michael Saylor-led Technique, can also be pointed at by some as one of many causes behind Bitcoin’s stability.

Disclaimer: The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.