Torsten Asmus

The Nuveen Floating Rate Income Fund (NYSE:JFR) is a closed-end fund which focuses on investing in high-yielding fixed income securities to deliver attractive income streams. As is usually the case, achieving capital appreciation is a secondary objective.

More specifically, JRF allocates capital mostly into floating rate loans that are rated below the investment grade level. This way, the current yield potential is significantly enhanced, which we can observe by looking at the current distribution income, i.e. 11.5%.

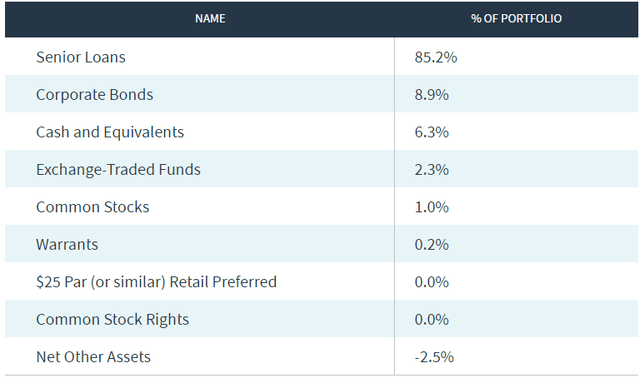

In the table below, we can see how exposed JFR is to senior loan instruments, where the remaining ~ 15% of the asset base is distributed among, primarily, corporate bonds and cash equivalents (in the form of T-bills).

Nuveen, LLC.

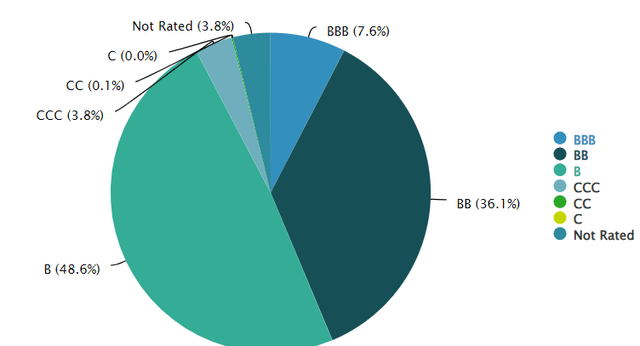

However, the more important aspect is the underlying distribution of JFR’s assets across different credit rating categories. The first point to underscore in this context is that only 7.6% of JFR’s assets are located in the investment grade territory. The remaining chunk is by and large split between two non-investment grade notches – BB (36% of the asset) and B (48% of the assets).

Nuveen, LLC.

Otherwise, all of JFR’s investments are nicely diversified both at the sector and individual security level. For example, the single largest security accounts for 2% of total JFR’s exposure, and the total number of securities, currently, stands at 414.

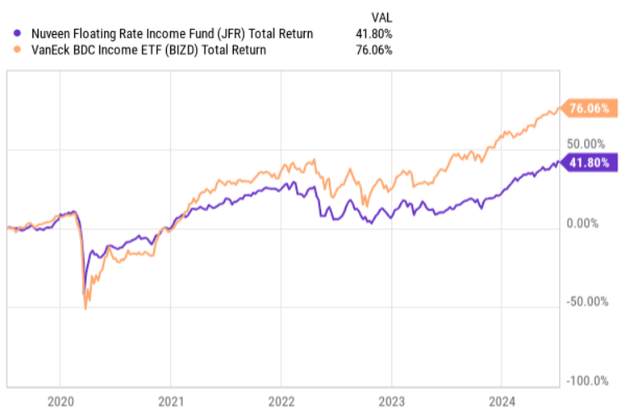

Now, if we take a look at JFR’s total return performance over the past 3-year period, we will observe that the CEF has indeed registered decent double digit returns.

Ycharts

The key driver of this performance has been the increase in interest rates that have rendered the floating rate investments more attractive, stimulating higher yields.

However, in this chart I have also added an index, which reflects the BDC sector performance. At its core, BDC segment exhibits rather similar characteristics as JFR – e.g., returns are driven by floating senior loans, where most of these loans are not ranked at investment grade level. So, compared to the BDC space, JFR has quite consistently lagged behind during this period.

Let me now elaborate on why I think that JFR is a rather suboptimal investment.

Thesis

There are three fundamental reasons why I do not think that JFR is the right place to deploy capital.

The first one is related to the level of risk that we have to automatically assume. As indicated above, almost 85% of JFR’s assets are invested in below investment grade securities, which inherently introduces an elevated risk.

For the context, here are official definitions of what BB and B securities mean:

- ‘BB’ ratings indicate an elevated vulnerability to default risk, particularly in the event of adverse changes in business or economic conditions over time; however, business or financial flexibility exists that supports the servicing of financial commitments.

- ‘B’ ratings indicate that material default risk is present, but a limited margin of safety remains. Financial commitments are currently being met; however, capacity for continued payment is vulnerable to deterioration in the business and economic environment. CCC.

Theoretically, one might argue that part of the risk is mitigated through a massive diversification across ~420 securities, and the fact that most of these investments are structured as senior loans, which imply greater protection or higher probability of recovering invested principle in case things go south.

However, it is also clear that in case of an economic distress, the financial difficulties could become relevant in a systematic fashion, increasing the default rates in the below IG space across the board (especially for the speculative B segment).

The second reason is associated with a quite likely scenario in which the interest rates start to gradually come down. While we should definitely take the interest rate projections with a grain of salt, I think it would be fair to assume that a base case is that SOFR starts to tick lower from either this year or 2025. The FOMC dot plot below illustrates the prevailing consensus.

FOMC; St. Louis Fed

For JFR, this would mean the following: decreased current income streams from the floating rate senior loans, which will drive the distribution yield lower accordingly.

The third reason is a bit broader, as it relates to the potential opportunity cost of going long JFR. Besides the outlined risks above, in my opinion, there are greater risk / reward alternatives out there that can offer similar yield levels.

Most of these alternatives lie in the BDC space, where the underlying risk and return factors are rather similar to those of JFR. Unfortunately, we do not have the luxury to assess the leverage and coverage metrics of those companies, which have issued loans and in which JFR has deployed its capital. Yet, from the high concentration in BB and B investments, we can imply that the embedded risk level is quite high for JFR.

Instead, there are several BDCs that focus on already established, cash-flowing and relatively defensive businesses by investing in their senior first lien structures, while keeping the underwriting standards strict and transparent (based on which we can assess the financial risks). For example, such names as Fidus Investment (NASDAQ:FDUS), Blue Owl Capital Corporation (NYSE:OBDC), and Morgan Stanley Direct Lending Fund (NYSE:MSDL) offer attractive yields, while preserving the necessary defensive characteristics.

The bottom line

All in all, in my view, JFR is not a great investment choice. First and foremost, the risk that comes with investing in JFR is very high as we can infer it from the huge exposure towards below IG securities. The issue is also that we cannot assess the risk profile further than this as opposed to what is possible for BDC names that inherently embody quite similar risk and return factors. On top of this, the future interest rate curve does not bode well for JFR’s yield levels.

In my humble opinion, there are better investment alternatives out there (with similar yields but more balanced risk profile) than the Nuveen Floating Rate Income Fund – especially in the BDC segment (e.g., FDUS, OBDC and MSDL).