Juan Jose Napuri

Just over two months ago, I wrote on Jaguar Mining (OTCQX:JAGGF), noting that while Jaguar may have been an alluring name for investors after suffering a 70%+ share price decline, it continued to be an inferior way to play the sector. This is because it’s a marginal producer in a Tier-2 ranked jurisdiction, and with its mines not benefiting from economies of scale, it could have a harder time clawing back lost margins. Since then, Jaguar was one of the only gold miners that posted a negative return on a trailing-two-month basis, down 3% since late November vs. a 13% rally in the Gold Miners Index (GDX).

Unfortunately, the company’s Q4 and FY2022 results didn’t provide much help from a share-price performance standpoint, with Jaguar missing guidance by a mile for the second consecutive year. Worse, although the FY2023 outlook is an improvement, with Jaguar calling for higher production at lower costs, the FY2023 guidance range is below that of FY2022, and I think the cost guidance mid-point of $1,325/oz looks a little ambitious. So, with Jaguar being a marginal producer that’s still a few years away from showing meaningful growth, I continue to see more attractive bets elsewhere in the sector.

Jaguar Mining Operations (Company Presentation)

Q4 & FY2022 Production Results

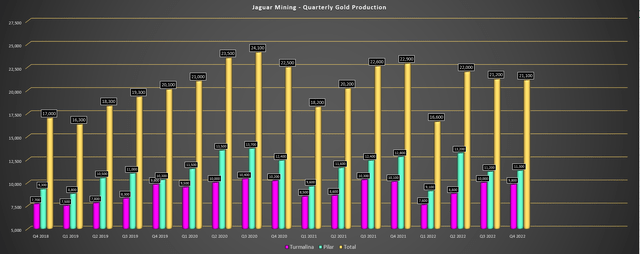

Jaguar Mining released its Q4 and FY2022 production results last month, reporting quarterly production of ~21,100 ounces of gold, an 8% decline over the year-ago period. Lower grades drove this decline at both assets and lower recovery rates at Turmalina, and the relatively soft quarter wasn’t nearly enough to help overcome the significant shortfall relative to FY2022 guidance that was present heading into Q4. The result was that Jaguar missed guidance by a mile for a second consecutive year, with its FY2022 production of ~81,000 ounces of gold coming in 5,000 ounces shy of the low end of guidance and 10% below its guidance mid-point (FY2022 guidance: 86,000 to 94,000 ounces).

Jaguar Mining – Quarterly Production by Mine (Company Filings, Author’s Chart)

At Jaguar’s smaller Turmalina Mine, Q4 production was impacted by lower grades, with ~101,000 tonnes processed at 3.50 grams per tonne of gold in Q4, down from similar throughput at nearly 2% higher grades in the year-ago period. On a full-year basis, grades were up slightly to 3.28 grams per tonne of gold, which was offset by lower throughput and slightly lower recovery rates. As the chart above shows, this was certainly an improvement from H1 2023, but behind H2 2021, performance and annual production declined more than 3% year-over-year to ~36,200 ounces. That said, H1 performance was impacted by intense flooding in Q1, leading to a temporary shutdown, with additional headwinds from COVID-19-related absenteeism.

Looking at the company’s larger Pilar Mine, production came in at just ~11,300 ounces in Q4, a sharp decline from ~12,800 ounces in the year-ago period. This was related to much lower head grades, with grades dipping to just 3.71 grams per tonne of gold vs. 4.04 grams per tonne in the year-ago period. On a full-year basis, production fell 2% due to lower grades (3.57 grams per tonne vs. 3.69 grams per tonne), but if not for the flooding that impacted both operations, production may have been down only marginally year-over-year vs. the 3%+ decline (FY2022: ~44,800 ounces).

The one silver lining worth noting is that despite the challenging year, Jaguar did see a meaningful improvement with 11,600 meters of development completed in 2022, a more than 20% increase year-over-year. Meanwhile, the company is heading into 2023 with a new fleet of haul trucks at both operations and $25 million in cash to support continued reserve and resource growth. And while we did see a significant guidance miss, this was largely out of the company’s control with flooding and COVID-19-related absenteeism. That said, the company had the opportunity to reel in guidance and take a more conservative approach post-flooding after already missing by a mile in FY2021, but instead dug its heels in and still missed by more than 6%.

Jaguar Mining’s management stated in the Q1 results: “We still expect to produce within our guidance of 86,000 to 94,000 ounces, although on the lower side”.

FY2023 Outlook & Costs

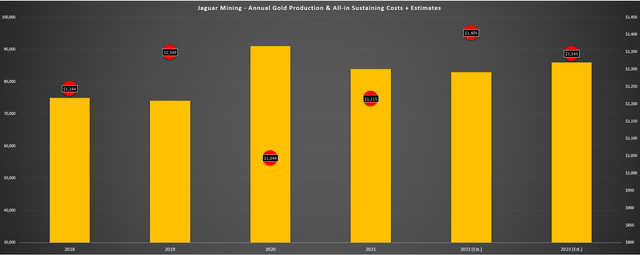

While 2022 is now in the rear-view mirror, and the damage has been done to the share price with another year of underperformance, the FY2023 outlook was slightly disappointing. This is because the company is guiding for even an even lower production range than FY2022 (84,000 to 88,000 ounces vs. 86,000 to 94,000 ounces) and a significant increase in costs vs. FY2020 levels assuming the company manages to meet guidance. This is based on guided all-in-sustaining costs [AISC] of $1,275/oz to $1,325/oz, which, even at the mid-point, would translate to 27% higher costs than FY2020 levels.

While this isn’t surprising given Brazil’s elevated inflation rates and inflationary pressures affecting the industry as a whole, Jaguar is in a less enviable position than some of its larger peers. This is because it operates two relatively small operations that don’t benefit from economies of scale, meaning it could be tougher for the company to claw back lost margins. Meanwhile, larger companies sector-wide have the balance sheets to invest in optimizing their assets by looking at opportunities such as trolley assist, throughput expansions, and technology/automation to help improve costs, as well as aggressive exploration budgets ($30+ million at some assets) to uncover new higher-grade resources near-mine (Fosterville, Detour Lake, Hope Bay).

Jaguar Mining – Annual Production & Costs (Company Filings, Author’s Chart)

Looking at the chart above, we can see that Jaguar’s all-in-sustaining costs are likely to come in near $1,400/oz in FY2022, well above its guidance mid-point of $1,200/oz. Some investors might be elated that costs are expected to improve next year, but it’s worth noting that this cost improvement (FY2022 estimates: $1,345/oz) is the minimum we would expect after costs have soared nearly 30% on a two-year basis. Meanwhile, these costs are still well above the industry average (FY2023 estimates: $1,280/oz). So, with an insignificant production profile and no guaranteed returns with the dividend suspension, it’s hard to make an investment case for Jaguar, especially relative to some of its peers generously returning capital to shareholders each quarter.

Recent Developments

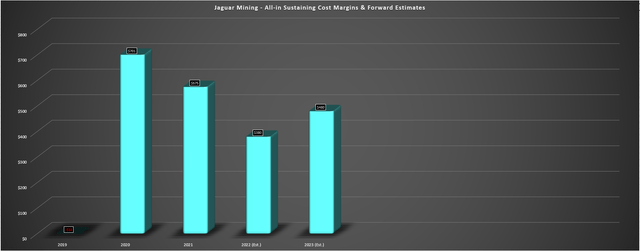

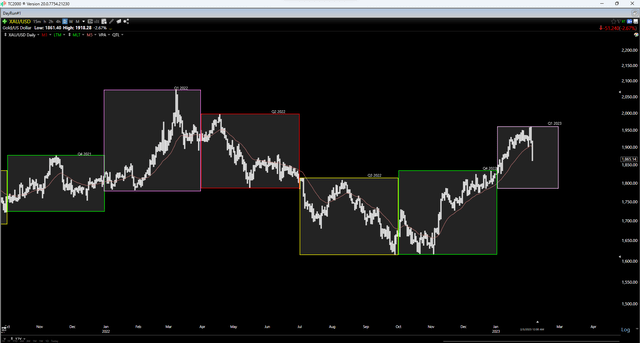

While Jaguar was set up for further margin compression in 2023 if the gold price didn’t recover from its brief visit to the $1,600/oz level, the company is getting saved by the gold price currently and should see meaningful margin expansion in FY2023. This view is based on estimated AISC margins below $400/oz in FY2022 and the potential for $480/oz+ AISC margins in FY2023, assuming an average realized gold price of $1,825/oz and FY2023 AISC of $1,345/oz. In addition, Jaguar should have a solid Q1 on deck when it reports its results in April, with the gold price averaging $1,900/oz quarter-to-date.

Jaguar Mining – Annual AISC Margins & Forward Estimates (Company Filings, Author’s Chart & Estimates) Gold Futures Price (TC2000.com)

Although the strength in the gold price is certainly a positive development, this isn’t a company-specific benefit, and all producers (except those overly hedged) will see the same boost to their Q1 results. For this reason, I don’t see the gold price strength as a catalyst that would justify buying Jaguar Mining, as one can get the same benefit elsewhere. Plus, while Jaguar Mining has production growth planned post-2025, I expect production to remain below 96,000 ounces for 2023 and 2024.

So, with more or less flat production and on a 4-year basis (FY2024 vs. FY2020) in a period where some junior producers are aggressively ramping up production, I don’t see any differentiator for Jaguar vs. peers that would justify owning the stock. In fact, if one were less confident in where the gold price was going and wanted to remove this from the equation, the best trade would be to own those producers with significant growth on deck that will see rising cash flow and earnings per share despite where the gold price trades as their sales volumes will increase considerably. This is not the setup for Jaguar just yet, as the company is still investing to deliver growth post-2025, while other names should see 20% plus production growth in 2023.

Valuation

Based on 75 million fully-diluted shares and a share price of US$2.05, Jaguar trades at a market cap of $154 million. There is no disputing that this is a very reasonable valuation for a junior miner working towards growing output by more than 30% over the next four years, especially when some developers like New Found Gold (NFGC) have valuations quadruple that of Jaguar and will be lucky to pour their first gold pour before 2029. That said, valuations can remain at depressed levels longer than some expect unless there’s a clear catalyst to drive a re-rating, and I don’t see any real catalysts on deck unless we see a major new discovery this year, with the only real news being PEA work ongoing at Faina and another year of relatively flat production.

If we assume a conservative figure of $50.0 million in operating cash flow in FY2023 and a cash flow multiple of 3.5 to reflect Jaguar’s position as a small-scale producer with industry-lagging margins in a Tier-2 jurisdiction, I see a fair value for the stock of $175 million. After adding $20 million in net cash and dividing by 75 million fully-diluted shares, I see a fair value for Jaguar of US$2.60 per share. In my view, this isn’t nearly enough upside to justify owning a micro-cap name, and I prefer a minimum 40% discount to fair value to justify starting new positions in micro-cap stocks. So, while Jaguar is finally becoming more reasonably valued, I would need a pullback below US$1.60 to consider going long.

Summary

Jaguar Mining had another disappointing year in 2022 (second consecutive guidance miss), but FY2023 should be a better year. In fact, we should see a significant increase in free cash flow generation if the gold price cooperates. That said, it’s hard to justify owning a small-scale producer with no production growth when several seniors are growing production and returning 4% per year to shareholders through dividends/buybacks with better margin profiles. For this reason, I continue to see Jaguar Mining as an Avoid, given that there are far safer bets elsewhere in the sector, and this is especially true if the gold price weakens given that Jaguar’s all-in costs remain above $1,650/oz.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.