hapabapa

J.Jill, Inc. (NYSE:JILL), the women’s apparel retailer with operations within the US, reported the company’s fiscal Q2 outcomes, ending August third, on the 4th of September in pre-market hours exhibiting a safe effectivity throughout the quarter no matter weak spot all through the commerce amid a weak shopper sentiment. Whereas Q2 financials bought right here in above the anticipated stage, the market reacted very negatively with a -17% stock decline ensuing from JILL’s lowered FY2024 guidance.

In my earlier article on the stock, “J.Jill: Improved Profitability With Fewer Outlets“, I initiated JILL at a Buy rating as the company’s retailer group optimization had resulted in clearly larger earnings, creating a beautiful valuation. After the article was printed on the seventh of December, JILL has now solely returned 3% compared with S&P 500’s larger return of 20% as a earlier equity enhance and the lowered guidance have pushed JILL’s stock down considerably.

My Rating Historic previous on JILL (Trying to find Alpha)

JILL’s Q2 Report: Secure Revenues, Weak Margins In Troublesome Enterprise Backdrop

JILL’s Q2 revenues bought right here in at pretty an excellent stage. Whereas the revenues of $155.2 million declined -0.9% year-on-year, adjusting for retailer rely changes and a 53rd week throughout the prior fiscal 2023 12 months, comparable product sales grew at a optimistic 1.7% tempo, beating Wall Highway’s expectations by a small $1.0 million margin.

The comparable revenues have been, in my opinion, comparatively good as apparel retailers have normal expert weak spot related to a weak Q2 shopper sentiment. As an illustration, Metropolis Outfitters (URBN) confirmed a similar 2.0% comparable improvement within the an identical fiscal Q2 interval, The Buckle (BKE) has confirmed immense comparable improvement weak spot as I’ve beforehand written along with a -6.8% decline in July, and the already beforehand weak Cato Firm (CATO) confirmed a -2% comparable decline. American Eagle Outfitters (AEO) did outpace JILL considerably, with a 4% improvement, though.

Apparel inflation throughout the US has moreover been extraordinarily gradual all by way of JILL’s Q2, ranging from 0.8% in Would possibly to easily 0.2% in July, extra showcasing JILL’s comparable product sales’ pretty good effectivity.

Alternatively, JILL’s profitability took a considerable hit in Q2. The gross margin contracted 1.2 proportion components to 70.5%, and as SG&A moreover elevated fairly, adjusted working income declined by $4.2 million into $24.9 million. The adjusted EPS bought right here in at $1.05, declining $0.10 year-on-year nonetheless beating Wall Highway’s estimates by $0.14 as a result of the Q2 adjusted EBITDA decline was already guided for with the Q1 report.

Altogether, the Q2 financials bought right here in at a efficient stage. Whereas revenues have been pretty sturdy considering the commerce backdrop, JILL’s already guided-for weaker profitability was a unfavorable difficulty. The weaker profitability included non-recurring costs resembling a communicated $0.5 million SG&A enhance related to OMS (Order Administration System) problem implementation, the fiscal 12 months’s shift, and higher freight costs due to the situation throughout the Crimson Sea, nonetheless the income decline was nonetheless pretty sharp compared with JILL’s safe revenues.

The Lowered FY2024 Steering Disenchanted The Market

Whereas the Q2 outcomes themselves have been above Wall Highway’s expectations, the lowered guidance dissatisfied the market – after elevating the FY2024 guidance with the Q1 report, JILL now reconsidered the outlook with a reducing in Q2 due to the not sure commerce backdrop.

JILL now expects FY2024 product sales to develop merely 0-1% compared with a 1-3% improvement differ beforehand. Adjusted EBITDA is now anticipated to fall -4% to -9%, down from JILL’s earlier -1% to -3% decline expectation. Excluding the 53rd week in fiscal 2023 and the OMS problem’s non everlasting SG&A, the model new differ shows healthful product sales improvement of 2-3% and a small AEBITDA hiccup of -1% to -6%.

For Q3, product sales are anticipated to be down -1% to up 2%, and for AEBITDA to be $23.0-27.0 million compared with $28.3 million in Q3/FY2023, anticipating pretty a similar year-on-year effectivity as JILL reported in Q2 with barely larger mid-point earnings improvement. The company has seen notably weakening guests developments from July forward, as instructed throughout the Q2 earnings title, inflicting the lowered guidance ranges and weaker-than-expected Q3.

I don’t take into account that the lowered guidance is a sign of structural deterioration in JILL’s enterprise; the commerce has very apparently suffered from a weak shopper sentiment. As I’ve beforehand written, Metropolis Outfitters has moreover seen weakening retail developments from late July forward, most important the competitor to anticipate improvement deceleration in Q3 compared with JILL’s remaining expectation of slight sequential acceleration. As such, the stock’s very large fall appears as if an overreaction.

June Share Offering Deleverages Steadiness Sheet

In June, JILL launched a 1 million share equity enhance and an additional 1 million share offering from JILL’s largest shareholder as a public offering, priced at $31.00 per share. The stock moreover reacted very strongly to the proposed offering, falling -19% on the thirteenth of July.

The proceeds have been primarily used to pay down JILL’s interest-bearing debt, and after Q2, roughly $73.2 million of interest-bearing debt stays on JILL’s steadiness sheet. I take into account that the equity enhance was pretty pointless, as the company’s leverage wasn’t too extreme even sooner than the most recent paydowns. The transactions did nonetheless stabilize JILL’s financing in an effective way, although I take into account the equity enhance to have been nonessential.

JILL’s Valuation Stays Low price

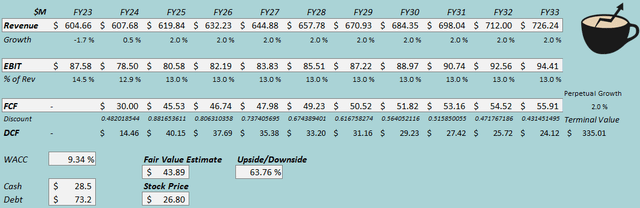

As JILL’s curiosity payments have blended lease-related curiosity payments, I take into account that estimating levered cash flows is further guide of JILL than my prior methodology of along with leases as debt. As such, I updated my discounted cash transfer [DCF] model to not subtract debt from the truthful price estimate, nonetheless for the model to now subtract curiosity payments from the cash transfer estimates. With $3.7 million in Q2 curiosity payments, I estimate $14.9 million in annualized curiosity cash flows.

In some other case, I’ve saved the model pretty safe normal. I now estimate low 0.5% earnings improvement for FY2024 due to the weak guidance, nonetheless nonetheless mounted 2% improvement after the 12 months. I’ve adjusted the EBIT margin estimate barely downwards proper right into a sustained 13.0% stage compared with a 13.4% estimate beforehand due to the weaker guided FY2024 profitability.

Excluding the changes to my model regarding curiosity payments, JILL’s cash transfer conversion should nonetheless stand good over the long term.

DCF Model (Author’s Calculation)

The estimates put JILL’s truthful price estimate at $43.89, 64% above the stock worth on the time of writing – I take into account that the stock stays a beautiful funding as a result of the stock gives a safe and good cash transfer yield. With the FY2025 cash transfer estimate and the share worth of $26.80 the cash transfer yield stands at nearly 11% for the 12 months combined with safe anticipated 2% improvement going forward.

CAPM

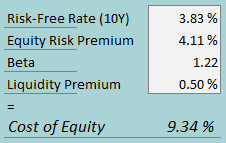

A weighted frequent worth of capital of 9.34% is used throughout the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

As I now estimate levered cash flows for JILL, I solely estimate the worth of equity for the worth of capital. To estimate the worth of equity, I make the most of the 10-year bond yield of three.83% as a result of the risk-free cost. The equity hazard premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. For the beta, I now use Aswath Damodaran’s estimates – with the everyday of the ultimate retail beta of 1.25 and the apparel commerce beta of 1.19, the model new beta estimate stands at 1.22. With a liquidity premium of 0.5%, the worth of equity stands 9.34%.

Takeaway

JILL’s Q2 financials bought right here in only above expectations as revenues stayed resilient amid weak shopper spending and margins declined decrease than the market anticipated. Whereas the Q2 financials have been efficient, the market in my opinion overreacted to a barely lowered FY2024 outlook as shopper spending throughout the commerce has remained weak. In my opinion, the stock stays undervalued, and as such, I stick with a Buy rating for J.Jill.