Mongkol Onnuan

This is the next article of my little series about value exchange-traded funds, or ETFs. After introducing systematic value investing in quite some detail here, I will now examine the iShares Core S&P U.S. Value ETF (NASDAQ:IUSV) in this article.

For a deeper introduction to (systematic) value investing, I kindly refer you to the “Value Investing – Idea and Evidence” section of my first article, or to this post on my website. To get everyone on the same page, however, here is a brief summary. The general idea behind value investing is that fundamentally cheap securities tend to outperform expensive ones. In practice, this means that buying/overweight cheap stocks and shorting/underweight expensive ones should lead to better returns over the long term. Needless to say, such strategies are nowadays well-known as the “value factor.”

IUSV’s Implementation of Value

Looking at its website, we find that IUSV has tracked the S&P 900 Value Index since January 23, 2017. Prior to that, it tracked the Russell 3000 Value Index. I have already written about the potential problems of the Russell-value process here and here, so at this point, I will focus on the methodology of the S&P 900 Value Index and see how it differs.

On the index’s website, S&P already provides a first introduction about the underlying methodology (emphasis added):

We measure value stocks using three factors: the ratios of book value, earnings, and sales to price. S&P Style Indices divide the complete market capitalization of each parent index into growth and value indices. Constituents are drawn from the S&P 900, which combines the S&P 500® and S&P MidCap 400®.

Source: S&P 900 Value Index, Website.

From my perspective, this is already quite good. S&P uses multiple well-researched value signals and applies them to a universe of large and small caps. Building on this composite value score, S&P next uses a bunch of quantitative algorithms to determine the final weights of each stock. The details are (in my opinion) a bit tedious, and if you are interested, you can read them in the index methodology starting at page 8. The end result is a float-adjusted market-cap weighted index that overweights cheap value stocks with respect to the parent S&P 900 Index. So, it is essentially a large-cap value strategy.

Compared to the “low sales growth = value” methodology from Russell, I believe this process from S&P is much better. To the best of my knowledge, the literature about systematic value investing finds that the factor is best implemented by multiple value signals. There is no theory that says “Price/Book is the only right valuation ratio to measure the value factor,” so it is best practice to use a composite of plausible measures. S&P does that, and I think this is a sensible way to construct such an index. The icing on the cake would be if they rank stocks within their respective industries to avoid unintended tilts (MSCI does that with VLUE), but I don’t want to complain about something that is already quite good.

In the following chart, I show the cumulative return of IUSV and IWD since IUSV switched to the S&P 900 Value Index on January 23, 2017. So this is more or less a direct comparison of the two different approaches (S&P 900 and Russell 1000 should be fairly comparable universes). Both value indices lag the overall Russell 1000 which is not too surprising as these were tough years for the value factor in general. Within value, however, the S&P methodology outperformed the Russell methodology by about 15%-points over this roughly 6-year period. This is of course not robust scientific evidence, and the difference is probably not statistically significant. But I still think it is nice that the history of the two ETFs supports the arguments I just made. And to be clear, even if the Russell Value process would have performed better, I would still go with the S&P Index. A worse process will occasionally work better than a better one, that is just the random character of financial markets.

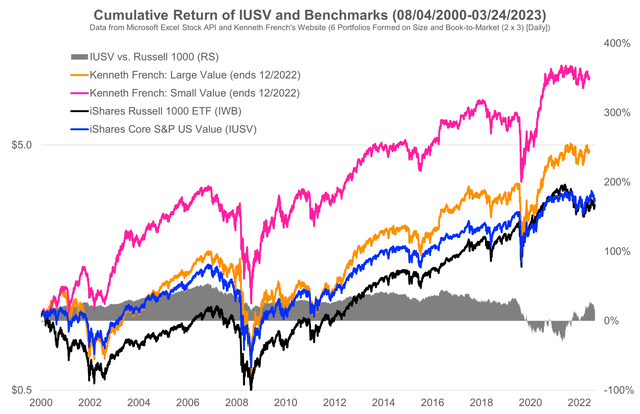

The next chart shows the cumulative performance of IUSV and some benchmarks since its inception in August 2000. The first point that is really special for a value ETF these days: the fund is currently slightly ahead of the overall Russell 1000 since inception. It also suffered less during the deep value drawdown between 2018 and 2020 than other ETFs of my peer group. On the other hand, IUSV is still considerably behind the simple academic “Large Value” benchmark from Kenneth French’s website (note the log scale). As I mentioned throughout my previous articles, some of this has certainly to do with practical constraints of real-world investment products. On top of that, the academic portfolios ignore any trading costs and management fees. So the real underperformance is not as large as the chart suggests. Having said that, it is in my opinion still quite interesting that most value ETFs couldn’t keep up with the simple and well-known academic benchmark.

Own illustration of data from Kenneth French’s website and market data. (Own illustration of data from Kenneth French’s website and market data.)

IUSV and Value-Peers

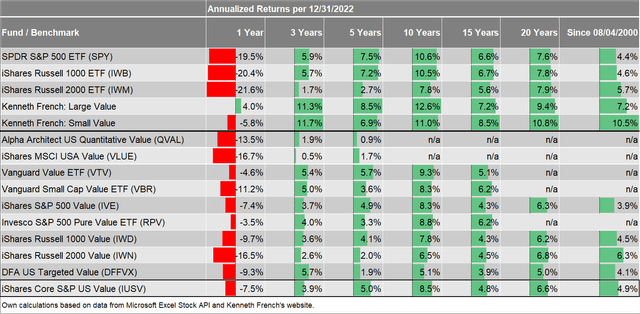

As regular readers know, the next step of my analysis is a simple comparison of IUSV and a (admittedly somewhat arbitrary) value peer group. The following table summarizes performance data over different time periods.

Tuck School of Business and Microsoft Excel Stock API

For most periods, IUSV is somewhere between the middle and top of the peer group. Especially over 5, 10, and 20 years, the fund is in my opinion well-positioned. Having said that, the differences to peers are mostly minor, and please don’t think of IUSV as a super differentiated value strategy. However, if a strategy achieves comparable or even slightly better results with a much more plausible and logical process, this is in my opinion a clear plus.

Conclusion

Similar to the iShares Russell 1000 Value ETF, the iShares Core S&P US Value ETF is designed to be a simple value barometer for the U.S. market. It is also a transparent smart beta strategy for investors who want to get some large-cap value exposure. By construction, this doesn’t make it a super-differentiated value fund, but I think S&P does a lot of things right here. Most importantly, they follow the literature and rank stocks by three well-researched value signals and therefore have (in my opinion) a much better value process than Russell.

For investors who want to have exposure to the value factor at modest active risk (IUSV currently holds 705 positions and is thus invested in most of the 900 names from the universe), I believe iShares Core S&P U.S. Value ETF is, therefore, a reasonable instrument. Consequently, I assign a long-term “Buy,” as iShares Core S&P U.S. Value ETF should benefit from the value premium over longer investment horizons.