deepblue4you

The iShares U.S. Oil Equipment & Services ETF (NYSEARCA:IEZ) contains major oil service providers. There is a lot of exposure to fracking service companies but also to general oil production assets like rigs. We think secular tailwinds, primarily from the supply side, remain for oil. The market is great, but a 38x PE is unconscionable. It doesn’t even respect the likely horizon for oil as a major source of energy, and certainly not for higher risk-free rates. This ETF is totally overextended in our opinion. We’re no longer interesting.

IEZ Breakdown

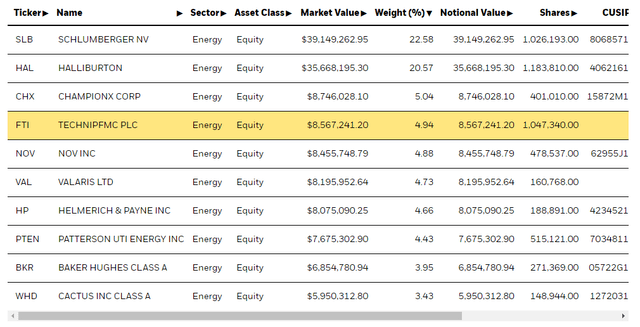

Let’s quickly review the top holdings.

Holdings (iShares.com)

Schlumberger (SLB) and Halliburton (HAL) are the main exposures and provide a pretty good view on the companies in this ETF. Together they account for 40%+ of the allocation, and are exposed to asset building in the fracking and oil rig-based oil production. They are required particularly in the initial steps, including geological and seismic work to locate reserves.

The expense ratio is not very low at 0.39%, and the PE is 38.73x which is where the problems start with this ETF.

Bottom Line

Firstly, there are low multiple exposures to the oil services market that have as good if not better economics and the same market scope and opportunities as these companies in IEZ. We take Subsea 7 (OTCPK:SUBCY) as an example, which we’ve covered before on SA. They trade at half the EV/EBITDA of SLB.

Moreover, the high ETF PE is also likely a sign of very high leverage in the oil industry. They took on a lot during the depths of COVID-19, and this has substantially remained to compress their bottom lines. Mixed with the rate hiking cycle, this is a bad thing for an ETF like IEZ.

The almost 40x PE represents a minute earnings yield that pales even to the US Treasury rate. While earnings growth is likely, all these companies still have to deal with inflation as well, and have less operating leverage than E&P companies who are directly commodity exposed would.

While engagements could rise, these are big capital commitments. Some investment in oil is happening, but especially among US companies, focus has been on capital return and not on reinvestment. Business can still dry up for these companies, and the backlog isn’t as reliable as one would think.

While peak oil is a bit of a lame point now since we’ve been shown we rely so heavily on oil still, at some point the secular declines in oil will show themselves. We believe that renewable will never replace oil, but it is likely to continue to penetrate as it becomes such a massive sink for investment. A 40x PE is not fitting for an industry that is both in secular decline, and has questionable scope even in an era where E&P companies are super profitable thanks to the high oil price, which should stay high since geopolitical dislocations are not going to change for a while.

A recovery in the economy over the next couple of years will likely reverse the speculation against oil that had happened from the demand side. Supply factors should keep it expensive, and more so as demand recovers. There is going to be some investment in oil, and backlogs have grown for companies across the oil services space. However, there are still stranded asset risks, and the benefit from higher oil prices doesn’t fully pass through to companies in the oil services industry. At a nearly 40x PE, they shouldn’t be bought. It’s a joke relative to a 3.6% long-term treasury rate, which dwarfs the earnings yield which barely surpasses 2%. With higher long-term rates, refinancing won’t look pretty either for these companies’ bottom line. In some cases, earnings growth isn’t really there, like with HAL. In others, leverage is a problem for the bottom line. There are parts within the oil supply chain to be more excited about.