Tomas Ragina

You’ve got to give it to Jim Chanos: he was sounding the alarm on the Chinese property markets already in 2017, before reporting on the ghost towns, and certainly before Evergrande. The failure in central planning goes beyond just property with COVID-zero, and combined with a geopolitical risk as relations remain strained between the US and China, reshoring of supply chains and a reduction in the Chinese role seems possible if not probable for us. The iShares MSCI China A ETF (BATS:CNYA) captures lots of Chinese exposures, and while some should be resilient, general issues with China, and demographics can be counted among them, keep us thoroughly uninterested.

Problems With China

China has done quite a lot to signal a more definite end to the restrictive COVID-zero policies they’ve implemented. In our opinion, while domestic consumption will grow incrementally, some of the damage has already been done. These lockdowns have been harassing the supply chains of major wallets in the US and the EU. In our broad coverage of markets, every company that had Chinese manufacturing have been grilled on whether they planned to reshore production. In almost all cases, some hedging by moving production elsewhere was in the works. Even huge companies like Apple (AAPL) are considering India as a more important manufacturing hub.

While this may be in the plans for China to leave middle-income country status, they’re not ready for it yet. Moreover, the demographic situation is actually very dire. China has done in 20 years what Japan needed 50 years of stagnation to accomplish. Their demographic profiles are very similar, and it was again the consequence of central planning and the one-child policy. With Japanese demographics being the source of a massive 30% discount in valuations on Japan-focused companies relative to the rest of the world, we are very worried about China’s prospects for multiple revaluation. Indeed, investment banks are shrinking China teams even now, and major VC investors are writing off swathes of their Chinese portfolios, quietly calling it quits.

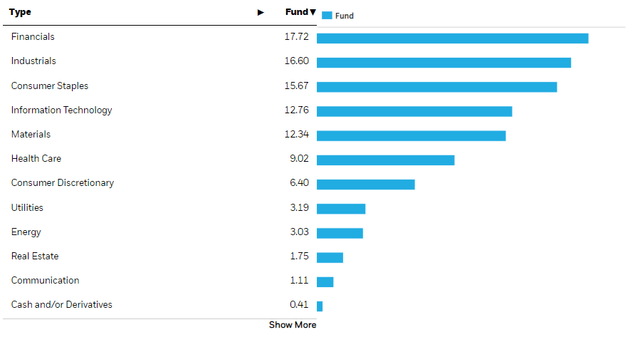

CNYA has quite a lot of financial exposures, and with the housing sector being an important part of the Chinese economic picture, especially construction companies, financials and housing prospects go together.

Sectoral Allocations (iShares.com)

Central planning continues with China in full swing to prevent further economic melt-down. Insurance companies are being asked to create liquidity for Chinese bonds to keep monetary policy transition afloat – not much unlike methods adopted during the early 2010s Eurocrisis. There are a lot of new obligations placed on banks to create amnesty for the property sector and property ‘buyers’. In this case, central planning is probably needed, but it is going to shackle the financial companies with worse performing assets. With demographics playing a key role in property values too, and Chinese demographics are a big and growing problem for the next half-century, we think the financials in China are poorly positioned. Monetary policy will likely have to stay loose to encourage investment and consumption-fueled economic growth, which is part of the Politburo’s explicit plan. This will weigh on the CNYA financial exposure and limit scope for net interest margin growth, on top of problems with establishing better asset quality due to government mandates on housing.

Bottom Line

There are some resilient exposures within CNYA. Liquor companies like Kweichow Moutai feature highly at 5%, and these are typically strong performers. Indeed, the multiple is double-digit in PE for KM at 34x. Other consumer staples companies for a resilient vein in CNYA with a 16% overall allocation. But the rest of it is exposed to greater geopolitical tensions, incentive for foreign companies to reshore, loose monetary policy and a big demographic issue interacting with a worsened economic position. CNYA represents a broad China bet, but it’s too early for that.

There is also the issue that CNYA is all China listed stocks. If tensions worsen a whole lot, imagine if China traps foreign money in their markets like Russia did. Just another thing to consider as a tail risk.