Not all merchants have the money wished to make a subscription to stock selecting suppliers worth the related charge.

A well-respected service can worth $200 or further yearly. In case you’ve solely obtained just some {{dollars}} to take a place to get started, you might need one factor that’s further cheap.

And if that’s the case, you might want to take note of Stash.

Which leaves the huge question:

Is Stash worth it?

There are a lot of components to consider, along with subscription and shopping for and promoting costs, choices, on the market property, usability, and security.

That may assist you resolve if Stash is the correct investing app for you, we’ll consider all of these things and further.

Maintain finding out to get the details it’s important to make an educated willpower about Stash!

What Is Stash? Historic previous and Mission

Let’s start with Stash’s origins and historic previous, because of there are some issues that basically set it except for completely different digital funding platforms.

The Historic previous of Stash

Stash was primarily based by two Wall Street guys, Brandon Krieg and Ed Robinson. Every Funding professionals, they acknowledged an precise disadvantage.

Frequently of us had been being priced out of the stock market.

Let’s face it: it’s arduous to diversify a portfolio in case you solely have enough money to buy one or two shares of stock at a time.

So, in its place of the usual technique. Krieg and Robinson decided to provide consideration to micro-investing, which solely requires just some {{dollars}} of funding at a time and permits for the acquisition of fractional shares.

They added some cool choices designed to enchantment to new merchants, along with round-up stock purchases and dividend reinvestment… and that’s how Stash was born.

We should additionally discover that Stash is a registered advisor with the SEC.

Stash’s Mission and Values

In defining Stash’s mission, the company acknowledged 4 core values. These things help Stash staff focus their efforts within the exact place and protect the company’s goal clear.

- Prioritize People: A people-first technique has helped to assemble a quite a few agency custom the place everyone learns and grows.

- Obsess Over the Purchaser: An funding platform solely succeeds if its prospects are joyful, so Stash has labored arduous to create an optimum shopper interface and experience to supply prospects what they need to assemble a portfolio and create wealth.

- Take Possession: Members of the Stash group are impressed to share ideas, innovate and create, and to take possession of their work.

- Create Choices: With the patron in ideas, Stash group members use their inventive vitality to resolve widespread points and drawback the established order.

This spirit of innovation and the accompanying give consideration to purchaser satisfaction are points that set Stash except for its rivals and help make clear why it’s a most well-liked funding app for novices.

Current Promotion: Create Your Account Right now & Get a $5 Bonus!

Use THIS net web page to open an account & deposit $5. You’ll then acquire your bonus straight to your account.

How Does Stash Work?

We’ve talked about micro-investing, nonetheless what does that indicate and the way in which does it work?

As you might be succesful to guess from the title, micro-investing is a type of investing that begins small. It’d comprise shopping for fractional shares of shares and ETFs, and even cryptocurrencies.

The time interval ‘micro’ may additionally apply to the overall amount you make investments. People with deep pockets or extreme earnings might be succesful to make investments 1000’s of {{dollars}} each month. Micro-investing democratizes investing by allowing of us to get started with just a few {{dollars}}.

In case you want to get started with Stash, you’ll be able to do it with a deposit of merely $4 in your account.

With that $4, you probably can choose to interact in one among two types of investing.

Self-Directed Investing

In case you’re someone who needs to make your private picks about investing, then self-directed investing with Stash is one of the simplest ways to go.

With self-directed investments, you’ll consider funding decisions. Likelihood is you’ll choose to do a deep dive by viewing earnings title transcripts and financials or by finding out articles from revered analysts. You’ll be able to do some (nonetheless not all) of these things on Stash.

Once you’ve achieved that, you’ll buy the property you’ve chosen and assemble your portfolio accordingly. You’ll even be liable for rebalancing your portfolio to deal with your risk.

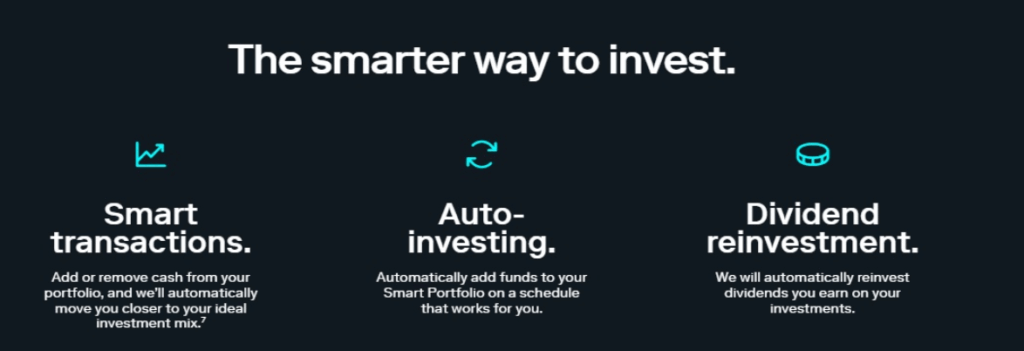

Good Portfolio (Robo-Advisor)

Good Portfolio is Stash’s automated portfolio selection: in numerous phrases, it’s excellent for those who want to use a robo-advisor.

The robo-advisor will choose investments in your portfolio primarily based totally on the information you current, along with particulars about your risk tolerance and funding preferences.

One issue we like regarding the Good Portfolio selection is that it’s going to routinely rebalance your portfolio every three months. You acquired’t wish to fret about taking pointless risks on account of overinvestment in a single asset, commerce, or sector.

Current Promotion: Create Your Account Right now & Get a $5 Bonus!

Use THIS net web page to open an account & deposit $5. You’ll then acquire your bonus straight to your account.

What Choices Does Stash Have?

A lot of the digital funding platforms and apps available on the market have a ton of educational and stock analysis choices.

On account of Stash has a simplified interface that’s excellent for novices, it’s not as jam-packed with choices as just a few of its rivals.

That talked about, it’s nonetheless obtained some elements that every beginner and superior merchants would possibly respect.

Portfolios

We’ve already talked concerning the Good Portfolio, nonetheless subscribers to all plans moreover access Personal (self-directed) and Retirement Portfolios.

There’s no devoted Environmental, Social, and Governance (ESG) portfolio, so in case you care about sustainable investing, you’ll wish to determine in your private investments accordingly.

Accessible Property

Not like just a few of its rivals, Stash presents solely two fundamental asset courses for funding: shares and ETFs.

Which suggests you probably can’t buy bonds, commodities, or cryptocurrencies. Chances are you’ll get some publicity to the bond market by shopping for bond ETFs.

Let’s discuss what that means in your common funding approach.

A well-balanced portfolio must comprise a combination of property, along with shares, bonds, and cash. It’d moreover embrace precise property, commodities, and cryptocurrencies.

Because you probably can’t buy most of these asset programs on Stash.com, you might wish to make use of a number of software program to create a really balanced portfolio that aligns alongside together with your financial targets and risk tolerance.

Accounts

Together with portfolio decisions, Stash moreover permits prospects to open numerous account varieties, along with retirement accounts.

- Cash account: Deposits are FDIC-insured by means of the Apex Sweep Program as a lot as $250,000

- Typical IRA (pre-tax contributions)

- Roth IRA (post-tax contributions)

One limitation is that there are usually not any small enterprise or custodial IRAs on the market.

Banking Choices

We already talked about that Stash has some banking choices, along with an FDIC insurance coverage protection selection because of its relationship with Apex Clearing Firm.

- Stock-Once more® Automotived: Affords 1% to a few% stock rewards with every purchase

- No overdraft fees

- Fee-free entry to better than 55,000 ATMs

- Early paycheck entry with direct deposit

- Mobile take a look at deposit

- Immediate transfers between your checking account and Stash

You’ll get a free Stock-Once more® Card with any Stash subscription.

Current Promotion: Create Your Account Right now & Get a $5 Bonus!

Use THIS net web page to open an account & deposit $5. You’ll then acquire your bonus straight to your account.

Automated Investing Selections

Together with what we’ve already talked about, there are only a few completely different automated choices that we anticipate are the true “specific sauce” of Stash.

- Stock Spherical-Up: Every stock purchase you make is rounded as a lot because the closest dollar and the remaining is added to your portfolio.

- Dividend Reinvestment: When you earn dividends, the proceeds are reinvested in your portfolio to help it develop.

- Stock-Once more Rewards: Every subscriber will get a Stock-Once more® Card and would possibly earn between 1% and three% of stock rewards for each purchase.

These choices are all designed to help merchants assemble a portfolio and develop their investments and wealth as quickly as attainable.

How Lots Does a Stash Subscription Value?

There are two subscription tiers for Stash.

Given that agency has devoted itself to creating investing cheap for everybody, it shouldn’t come as a shock that every subscription ranges are terribly cheap.

The Stash Progress plan costs merely $3 month-to-month. It comes with some good choices, along with:

- Tutorial property designed to help novices examine investing, plus primary financial suggestion.

- Entry to Personal, Good, and Retirement Portfolios (along with typical and Roth IRAs)

- Choice between self-directed or robo-advisor portfolios

- Capability to place cash into every shares and ETFs

- Earn 1% stock once more alongside together with your Stock-Once more® Card

- Banking choices, along with FDIC insurance coverage protection, early payday, no overdraft fees, and further

- A $1,000 life insurance coverage protection protection from Avibra

The Stash+ Plan presents some useful further choices and rewards which is able to make the extra $6 month-to-month a worthwhile funding.

- Stash+ Market Insights for merchants who want entry to analysis and evaluation

- Children’ portfolios, good for educating youngsters about investing and compounding curiosity

- Earn as a lot as 3% in stock on purchases alongside together with your Stock-Once more® Card

- A $10,000 life insurance coverage protection protection from Avibra

Proper right here’s a chart evaluating key variations between the two plans.

| Stash Progress | Stash+ | |

| Stock-Once more® Card | 1% stock once more with every purchase | 3% stock once more with every purchase |

| Children Portfolios | No | Positive |

| Stash+ Market Insights | No | Positive |

| Avibra Life Insurance coverage protection | $1,000 | $10,000 |

How Does Stash Defend Clients?

As we’ve already talked about, Stash is registered with the SEC. The company may also be a FINRA member, as is Apex Clearing Firm.

Cash deposits are protected by FDIC insurance coverage protection. Since Apex Clearing is a member of the Securities Investor Security Firm (SIPC), prospects’ investments are insured as a lot as $500,000.

That takes care of regulatory security and insurance coverage protection, nonetheless what about defending your accounts?

Like all revered funding platforms, Stash takes security very critically. Listed below are among the many measures they make use of to confirm your money, investments, and personal info are safe.

- 256-bit, bank-level encryption

- Transport Layer (TL) security

- Two-factor authentication (2FA)

- Biometric recognition (fingerprint or facial scan)

In case you resolve to turn into a Stash subscriber, perceive that 2FA is impressed nonetheless not required. You’ll should log into your account and permit 2FA to protect your self.

What Do Clients Say About Stash?

We on a regular basis favor to take a look at shopper critiques to see what people are saying regarding the funding apps and platforms we consider.

Clients on the Google Play Retailer and Apple Retailer reward Stash’s user-friendly interface, reinvesting choices, and low subscription costs.

A lot of the most common complaints should do with glitches throughout the app. It looks like Stash used to have a free account selection, and some subscribers had been routinely switched to a paid plan and took drawback with that. Whole, Stash is very conscious of every constructive and damaging solutions and even encourages prospects to email correspondence them at [email protected] to supply ideas to improve the app or resolve factors as they arrive up.

Our Conclusion: Is Stash Worth It?

Is Stash worth it?

The short reply is bound, notably in case you’re a beginning investor who needs an affordable resolution to create a portfolio and useful devices to develop your investments and assemble wealth.

We’d say the reply for superior merchants isn’t as clear. Whereas Stash presents just some analysis devices, it’s not the place for expert merchants who need an answer to dive deep into a company’s financials.

In case you’re a beginner, then being able to get started with merely $4 is a clear revenue. You can purchase fractional shares and profit from reinvestment decisions in order so as to add to your portfolio generally.

To be taught further about Stash, check out our full, in depth, Stash Analysis.

FAQ

Establishing a Stash account is quick and easy, and it consists of the an identical steps as opening any funding account. You’ll have to be 18 or older and have a United States checking account, a Social Security Amount, and U.S. citizenship, a inexperienced card, or certain visas.

Positive, the minimal is $4, which contains $3 for the first charge of your Stash Progress subscription plus $1 to start out investing. In case you choose the Stash+ account, you’ll need a minimal $10 deposit.

In case you go for a Good Portfolio, the robo-advisor will choose shares and ETFs all through various industries and market caps that align alongside together with your risk tolerance and preferences. It could routinely rebalance your portfolio every 3 months. Self-directed investing means you’ll be chargeable for choosing your private investments and rebalancing as wished. Stash has educational property to help with that.

Positive, there’s a library of useful articles on all types of funding issues, along with asset allocation, stock market terminology, utilizing out market volatility, and far more.

rn

rn

Source link ","creator":{"@sort":"Particular person","title":"Index Investing Information","url":"https://indexinvestingnews.com/creator/projects666/","sameAs":["https://indexinvestingnews.com"]},"articleSection":["Stocks"],"picture":{"@sort":"ImageObject","url":"https://www.wallstreetsurvivor.com/wp-content/uploads/Stash-is-it-Value-It-featured-image.png","width":0,"top":0},"writer":{"@sort":"Group","title":"","url":"https://indexinvestingnews.com","emblem":{"@sort":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link