by confoundedinterest17

Like the disastrous Bernie Madoff debacle where investors lost millions of dollars, Sam Bankman-Fried has apparently cost investors like Steph Curry, Shaq and Tom Brady considerable sums as well.

What do Bernie Madoff and Sam Bankman-Fried have in common? Greedy investors who apparently didn’t bother to monitor what was going on.

Yes, had they monitored FTX, Bankman-Fried’s company, they would have noticed that FTX held less than $1bn in liquid assets against $9bn in liabilities.

Generally, with buyer beware, the onus falls on investors to monitor what is going on. But The Fed’s completely dropped the ball on Bernie Madoff where investors didn’t seem at all curious about earning supercharged returns. The same is the case for FTX.

FTX had partnered with Ukraine to process donations to their war efforts within days of Joe Biden pledging billions of American taxpayer dollars to the country. Ukraine invested into FTX as the Biden administration funneled funds to the invaded nation, and FTX then made massive donations to Democrats in the US.

The SEC’s Gary Gensler blew it again. After his agency failed to warn investors about Terra and Celsius—whose collapses this spring sparked a trillion-dollar investor wipeout—the Securities and Exchange Commission chair allowed an even bigger debacle to unfold right under his nose. I’m talking, of course, about the revelation this week that the $30 billion FTX empire was a house of cards and that its golden boy founder, Sam Bankman-Fried, is the crypto equivalent of Theranos’s Elizabeth Holmes (Stanford University is where Holmes was an MBA student and Stanford Law School is where both SBF’s parents are professor).

To be fair, Gensler was not the only one suckered by SBF. Nearly everyone else fell for the narrative that SBF, with his cute afro and aw-shucks demeanor, was exactly the savior crypto needed to shake off its dodgy reputation and emerge as part of the mainstream financial system. The problem is that cop-on-the-beat Gensler not only failed to spot the crime—he appeared set to go along with a legislative strategy that would have given SBF a regulatory moat and made him king of the U.S. crypto market.

While it is easy to blame Gensler, the onus still falls on investors (and their managers) to MONITOR. Buyer beware.

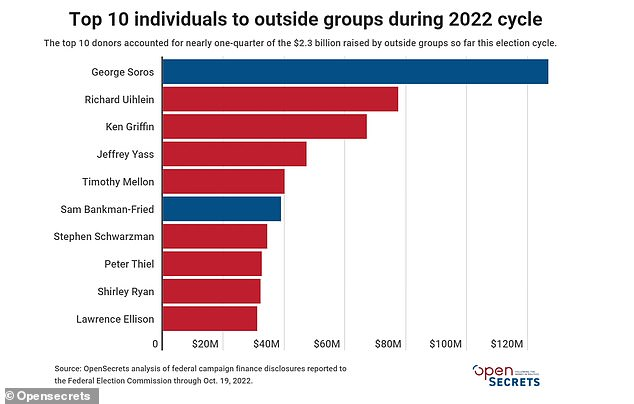

What will happen to Sam? Likely nothing. He is a golden child of Democrats and was the second biggest donor to Biden and the Democrats after America-hating George Soros. Just like Biden’s son Hunter will never pay for his many inappropriate antics, I doubt that Merrick “Double Standard” Garland will do much to Sam.

Steph Curry, Shaq and Tom Brady should fire their investment advisors and possibly sue then for failure to monitor. No one noticed $1bn in assets against $9bn in liabilities??

Gary Genslar is more like Inspector Clouseau than a serious regulator.

Here is the SEC’s Gary Genslar interviewing Sam Bankman-Fried about FTX.

Maybe Sam’s Stanford law school professor parents didn’t tell him that it is against the law.