Justin Sullivan/Getty Images News

Today, we are revisiting our previous thesis on McDonald’s (NYSE:MCD) and we are going to provide an estimate, what the fair value of MCD’s stock could be, based on its dividends in the current market.

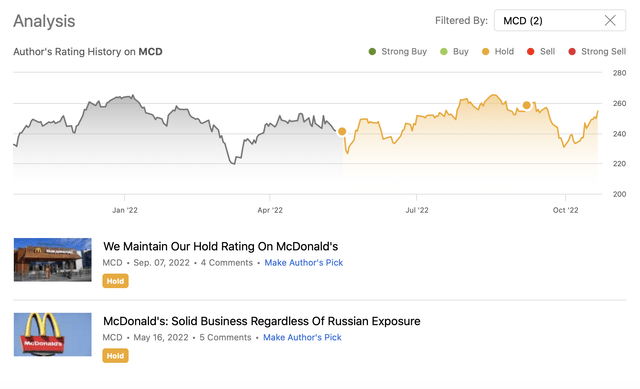

This year, we have already published two articles about McDonald’s on Seeking Alpha, titled:

McDonald’s: Solid Business Regardless Of Russian Exposure – May, 2022

We Maintain Our Hold Rating On McDonald’s – Sept, 2022

In both of these articles we have rated MCD’s stock as “hold”. On one hand, we liked the firm’s high quality business model, the superb brand recognition and customer loyalty, the long history of safe and sustainable dividends and share buybacks. On the other hand, we have raised our concerns regarding the uncertainty surrounding the firm’s operations in Russia and Ukraine, and we have pointed out the relatively high valuation of the stock compared to the firm’s peers.

Since our first writing, the stock price has slightly increased, outperforming the broader market by about 10%.

Ratings history (Author)

So now, the question is, at what valuation would we find MCD’s stock attractive enough to justify an upgrade to a “buy” rating? As MCD can be found in many dividend and dividend growth portfolios, we will be using the Gordon Growth Model (GGM) to answer this question.

But first, we will take a look at some of the recent developments in the sector and industry, to try to gauge MCD’s Q3 performance.

Recent developments

September restaurant surveys

September restaurant surveys show that the demand for quick-service products was especially high.

According to Baird Real-Time Restaurants Survey reports, for week ended September 25, same-store sales up 7% compared to last year. Averaged +7% for the month of September vs. +5% in August, +4% in July, and +6% in Q2 overall. The sample size included chains representing ~$11B.

Segment-wise: casual dining +2% (August +1%, July flat); fast-casual +26% (August +21%, July +21%), quick-service +23% (August +20%, July +18%).

In our opinion, this is a positive sign for MCD and its shareholders. We interpret this as a sign that indeed MCD’s business can fare well in times of low consumer confidence and the demand for their products can indeed remain high, even during times of downturns.

FX headwinds

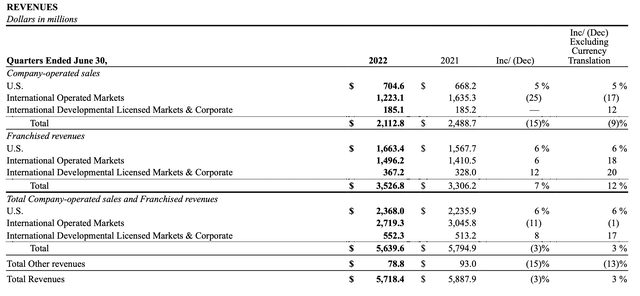

McDonald’s has been generating a substantial amount of its revenue outside of the United States in the last quarter.

Revenues by region (MCD)

While the firm has a hedging strategy in place, the relative strength of the USD, compared to other currencies, may cause headwinds in the near term.

Citi also appreciated this risk and issued a warning.

So keeping these recent news in mind, let us take a look at what valuation would we find MCD’s stock attractive.

Fair Value

What is the Gordon Growth Model?

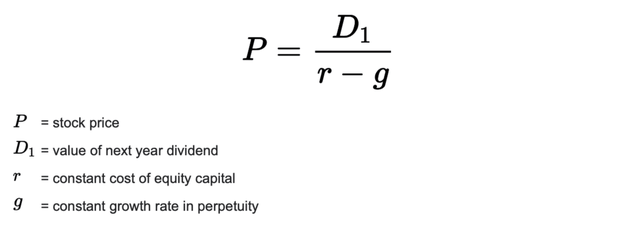

The Gordon growth model (‘GGM’) is a fairly simple and widely recognized dividend discount model, used to value the equity of dividend paying firms.

The math behind the model is described by the following equation:

GGM (Wall Street Prep)

The main assumption of this model is that the dividend grows indefinitely at a constant rate. Due to this criterion, the growth model is particularly appropriate for firms that are:

1.) Paying dividends

2.) In the mature growth phase

3.) Relatively insensitive to the business cycle

A strong track record of steadily increasing dividend payments at a stable growth rate could also serve as a practical criterion if the trend is expected to continue in the future.

In our opinion, MCD is an appropriate candidate to be valued, using the GGM.

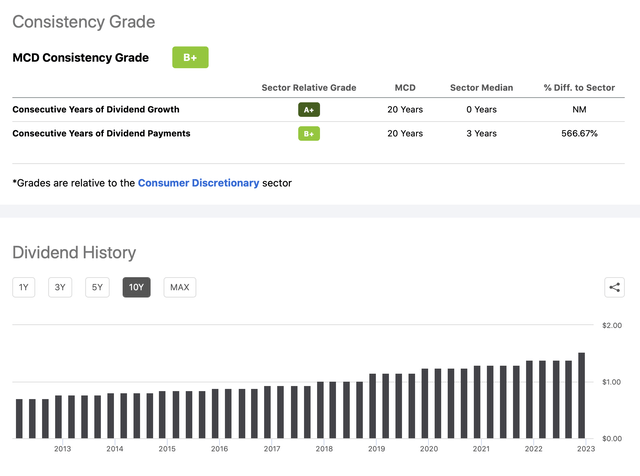

The firm has a strong track record of returning value to its shareholders in form of dividend payments. They have been paying dividends in each year in the last two decades and they have even managed to increase these payments every year.

Dividend history (Seeking Alpha)

Further, we believe that the company is relatively insensitive to business cycles and can fare well in various economic environments in different stages of the business cycle.

So, to start using the GGM, we have to make a number of assumptions:

1.) What is our required rate of return?

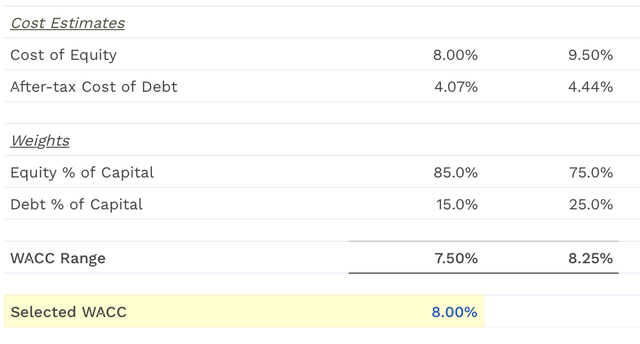

We often prefer to use the company’s weighted-average cost of capital (‘WACC’) for our required rate of return. The current WACC of the firm is estimated to be 8%.

WACC (FinBox)

2.) What could be a reasonable constant dividend growth rate in perpetuity?

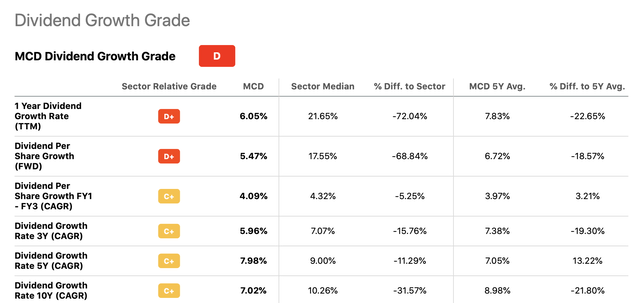

To answer this question, we have to look at MCD’s dividend history and try to define a reasonable long-term trend. Important to note here that the growth rate has a substantial impact on the calculated intrinsic value. Overestimation of the growth rates can lead to a substantial overestimation of the fair value. For this reason, we like to use relatively conservative assumptions.

Dividend growth (Seeking Alpha)

In our view, a range of 4% to 6% could be a suitable range to assume for estimating the firm’s intrinsic value. While the firm has recently raised its dividend by as much as 10%, we believe that such hikes are not likely to be sustainable in the long term.

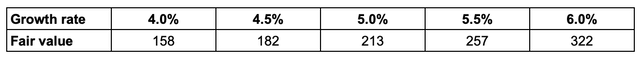

The following table shows the results of our fair value calculation (in USD) using an 8% required rate of return and the above defined range of constant sustainable dividend growth rate.

Fair value in USD per share (Author)

The stock is currently trading around $255 per share, which is at the higher end of our estimated fair value range. While we believe that the firm may outperform the broader market in the near term, we would like to see the stock price come down by about 20%, or see the macroeconomic environment improve substantially, before we would consider upgrading our rating to “buy” based on valuation.

Conclusion

We believe that MCD’s high quality business model, brand recognition and customer loyalty allow the firm to perform well in various economic environments in different stages of the business cycles. In the challenging near term, these factors may even enable MCD to outperform the broader market.

The demand for products quick-service restaurants have increased in September significantly, potentially signalling high demand for MCD’s products, while the challenging FX environment has started to raise concerns and Citi even issued a warning.

With regards to valuation, in our view, MCD’s stock is somewhat overvalued. Based on the GGM, the stock is currently trading at the higher end of our estimated intrinsic value range. For this reason, we would like to see the stock price come down by about 20%, before we would consider upgrading the stock, based on its valuation.

For now, we maintain our “hold” rating.