What’s the perfect inventory buying and selling platform to make use of?

Whether or not you’re a newbie or an skilled dealer, it’s good to check your choices and brokerage companies to be sure you’re having access to the belongings you need to commerce and options that can assist you with all the things from selecting investments to rebalancing your portfolio.

Public com has been round since 2019 and in some ways, it revolutionized the world of on-line buying and selling.

Chances are you’ll be questioning about Public.com’s security and asking: Is Public.com legit?

On this Public com assessment, we’ll let you know concerning the firm’s historical past and mission, its security options and the safety measures that maintain customers secure, and the way it compares to different on-line brokerages.

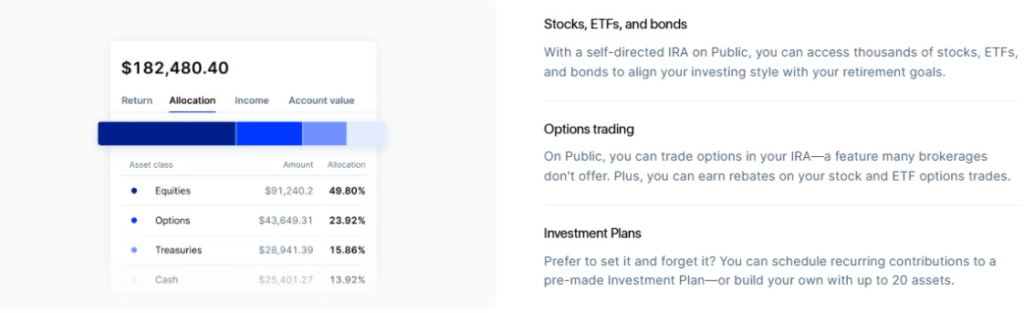

We’ll additionally discuss how Public.com permits customers to commerce shares, bonds, mutual funds, ETFs, futures, choices, crypto and gives a excessive yield money account.

Preserve studying to get all the data you must determine whether or not Public.com is best for you!

Is Public.com Legit? Right here’s What You Ought to Know

Public.com hasn’t been round so long as among the better-known on-line brokerages, however that doesn’t imply it isn’t legit.

Firm Background and Founding

Public.com was first based in 2019 and have become the primary on-line buying and selling platform to supply commission-free, fractional buying and selling. Robinhood and different platforms rapidly adopted swimsuit.

Their mission is to “give folks each alternative to develop their wealth.”

Stated one other approach, Public.com needs to make investing simple and does so by offering a user-friendly interface and reasonably priced charges, in order that anyone who needs to can soar in and begin constructing a portfolio.

For the reason that firm’s inception, it has added options and belongings that enable for portfolio diversification and administration. You should buy and promote shares, bonds, treasury bonds, mutual funds, ETFs, crypto, and different asset courses, along with a excessive yield money account.

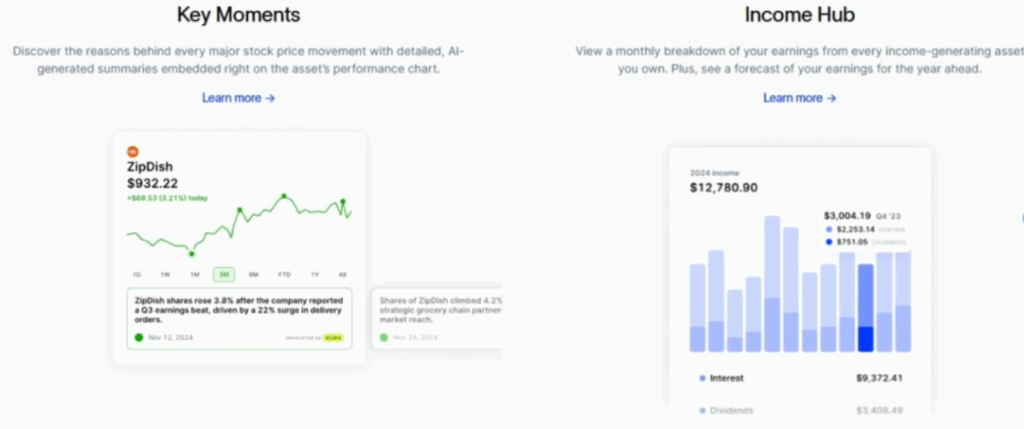

Public.com and public premium customers get entry to helpful instruments, knowledge, and even AI-powered funding insights to assist them handle their investments, make knowledgeable selections, and enhance their wealth.

Professional Tip:

Earn a 4.1% yield in your money as we speak with Public.com!

Possession Construction and Funding

Over time since its founding, Public.com has acquired funding from a wide range of personal buyers. A number of the names which have offered capital embody Lakestar, Tiger World, actress Zoe Saldana, and skateboarding famous person Tony Hawk.

One of many issues we like about Public.com is the corporate’s dedication to transparency. Listed here are just a few highlights.

- Public.com brokerage accounts are held with Open to the Public Investing, Inc, a registered broker-dealer with FINRA.

- Customers’ shares are held in road title at Apex Clearing Company, Public Investing’s clearing and custody agency.

- Each Public Investing and Apex are members of SIPC and FINRA.

- SIPC insurance coverage protection protects person belongings as much as $500,000.

This clear strategy is one thing that ought to set buyers’ minds comfy. If you happen to use Public.com, you received’t want to fret about an organization failure placing your belongings or your excessive yield money account in danger.

Security Options That Shield Your Investments

Security needs to be a serious concern everytime you’re contemplating an funding platform. No one needs to take pointless dangers with their cash, in any case.

THe excellent news is that Public.com takes person security extraordinarily severely. Listed here are among the security options that reply the query: Is Public.com secure?

256-bit encryption

Like many different digital brokerages, Public.com makes use of 256-bit bank-level encryption to guard customers’ accounts and investments.

Encryption protects your saved belongings and likewise gives end-to-end safety throughout transactions.

Two-factor authentication

Two-factor authentication, or 2FA, is a safety measure that you could allow that requires you to make use of a secondary log-in technique to entry your account.

It’s one thing we all the time advocate on any web site or app the place you’re sharing monetary data or have a funded account.

Why? As a result of it ought to by no means be simple for somebody unauthorized to entry your accounts, investments, or money deposits.

Public.com doesn’t require 2FA, which implies you’ll want to enter the menu, select Account Settings, after which allow it.

Biometric login choices

Public.com refers to 2FA as Biometric Authentication, and there are 3 ways you should utilize it.

- Fingerprint scan

- Facial recognition

- PIN

A PIN isn’t biometric, so we’d say it’s the least safe of those three choices. If somebody has your telephone, they may probably see the authentication code, particularly you probably have it set as much as preview texts when your telephone is locked.

Professional Tip:

Earn as much as a $10,000 money bonus if you switch your current account to Public.com as we speak!

How Public.com Makes Cash Whereas Retaining You Secure

No Public app investing assessment could be full with out an evidence of how Public.com makes cash whereas nonetheless maintaining you secure.

We’ve already instructed you that they don’t cost fee on normal trades, however they generate income in different methods.

The no-PFOF (elective tipping) mannequin for shares and ETFs

Public.com (and loads of different buying and selling platforms) used to cost a fee for order stream (PFOF) which often amounted to just a few pennies per commerce.

The quantity charged various based mostly on the kind of commerce, with higher-risk trades garnering the best charges.

In 2021, Public.com removed the PFOF mannequin and changed it with a no-PFOF mannequin that permits for elective tipping.

One crucial notice about tipping: the Public.com interface DEFAULTS to tipping, so that you’ll must uncheck the field for those who don’t need to go away a tip (this could make a giant distinction you probably have excessive month-to-month buying and selling quantity).

Premium subscription assessment

Signing up for a fundamental Public.com self directed brokerage account is free, which makes it an reasonably priced possibility for newbie buyers who need to begin constructing a portfolio.

There’s additionally a premium possibility, and Public.com earns a few of its cash by way of subscriptions, which price $8 monthly for public premium members.

One cool factor about Public Premium is that even the $8 monthly cost goes away you probably have a complete portfolio steadiness of $50,000 or extra.

Premium subscribers get entry to enhanced data, together with earnings name transcripts, customized value alerts, and VIP buyer assist.

Choices rebate program transparency

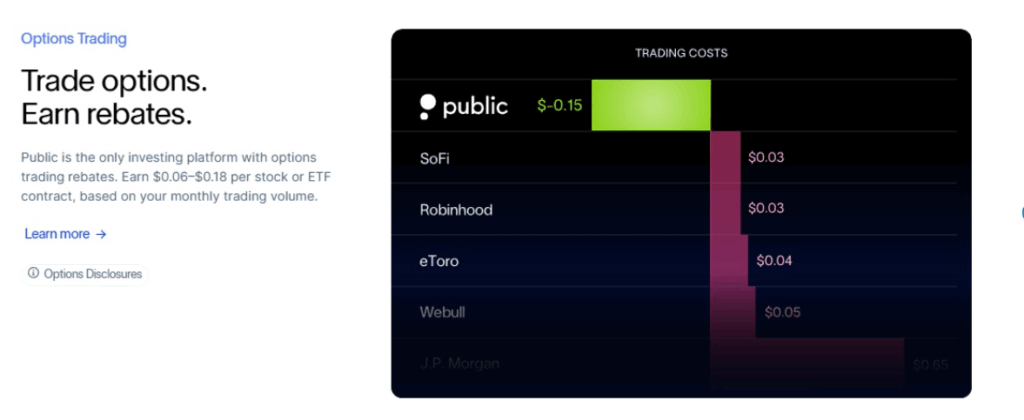

Choices buying and selling all the time comes with a charge. On Public.com the charges vary from $0.35 to $0.50 per contract, costs that align with trade requirements.

Public.com encourages choices buying and selling by together with a clear rebate program. It provides merchants a rebate between $0.06 and $0.18 per choices commerce based mostly on commerce quantity.

In fact, extra choices trades imply extra money for Public.com, however the rebate interprets to lower-than-average costs, thus encouraging merchants to take part.

How Does Public.com Stack Up In opposition to Conventional Brokers?

It’s not unusual for digital brokerages to be in comparison with conventional brokerages. Right here’s our tackle how Public.com stacks up.

Public.com vs. established brokerages

Public.com established itself as a digital brokerage, which implies it was all the time designed to be a cell app and/or on-line platform.

That differentiates it from conventional brokerages, a lot of which began as analog companies the place brokerage purchasers met in particular person or talked to their brokers on the telephone.

These conventional brokerages needed to adapt to create on-line platforms. Some have created platforms that prioritize the person expertise, whereas others have struggled to take action.

Public.com had a user-friendly interface and excessive ranges of digital safety from the outset. As a mobile-first platform, security precautions similar to 2FA, biometrics, and encryption had been in-built and have all the time been there to guard customers.

Professional Tip:

Lock in a 7.3% bond yield with Public.com as we speak!

Cellular-first safety issues

As a result of Public.com began out as a cell buying and selling app, mobile-first safety on their app is thorough and spectacular. Just a few examples embody:

- Machine lock for telephones and tablets

- Biometric authentication

- OS-level encryption

THese issues have additionally turn into normal on apps created by conventional brokerages.

Regulatory compliance comparability

Public.com is regulated by the SEC, a member of FINRA, and customers’ deposits are insured in a checking account by the SIPC.

Any licensed broker-dealer should register with the SEC and be a part of FINRA, so that is an space the place Public.com comes out even with conventional brokers, who provide the identical protections.

Widespread Safety Issues—and How Public.com Handles Them

Public.com is totally ready to deal with any safety considerations as they come up.

Platform reliability throughout market volatility

One of many instances when buyers are at their most susceptible is throughout market volatility.

When the market is experiencing turbulence, buying and selling platforms similar to Public.com expertise higher-than-normal site visitors and which will imply that there are safety dangers, together with the chance of the platform crashing.

There aren’t any information studies of Public.com experiencing any outages when there’s excessive site visitors, in order that’s a very good signal for customers.

WIthdrawal course of safety

Withdrawals out of your Public.com account are simple to make throughout the app or net interface.

As we talked about earlier than, all transactions, together with withdrawals, are protected by end-to-end, 256-bit encryption, which is identical stage of encryption that banks use for account safety.

Customer support response to safety points

Public.com makes it simple to contact customer support and report safety points.

Routine customer support requests ought to be submitted by way of dwell chat within the app or by way of e-mail.

There’s a devoted e-mail ([email protected]) for reporting safety points. You must restrict such points to those who:

- Might lead to a monetary loss for Public.com or its members

- Might affect the confidentiality or integrity of members data or Public.com programs

- Have the potential to affect a lot of folks

Account restoration procedures

If you must get better your account, you possibly can contact Public.com at [email protected] for help or use the dwell chat characteristic.

You possibly can scale back the chance of shedding entry to your account by enabling 2FA, utilizing gadget lock, and never sharing your account data or financial institution particulars with anybody.

Is Public.com Proper for You?

Is Public.com secure? Is it best for you? Right here’s how we see it.

Rookies, mobile-first customers, and people concerned about ESG (environmental, social, and governance) investing are prone to love Public.com. (Public.com gives ESG scores for all shares.)

It’s much less prone to enchantment to energetic buyers who need instruments to handle their very own portfolios, superior analysts, and individuals who need a big collection of cryptocurrencies or multi asset investing..

Right here’s our tackle the professionals and cons.

| Execs of Public.com | Cons of Public.com |

| Cellular-first platform | Restricted evaluation options |

| Provides bonds for buying and selling | Has solely 18 crypto cash accessible |

| Provides choices rebates | General charges could also be greater than different platforms |

| Inexpensive premium possibility | Should pay for premium to get value alerts |

Conclusion

Now that you simply’ve learn our Public.com assessment, you might be on the lookout for an outline. Right here’s our tackle Public free, their excessive yield money account, and their premium membership.

Is Public.com top-of-the-line funding apps?

Public.com gives customers full transparency about charges, state-of-the-art financial institution grade safety, and a easy, user-friendly interface that’s supreme for novices, seeking to construct a diversified portfolio with excessive curiosity on money balances (uninvested money) and excessive yield bonds.

The corporate is professional and controlled, and there’s insurance coverage in place to guard customers’ accounts and holdings.

All in all, Public.com compares favorably to different digital platforms and conventional brokerages for newbie buyers (particularly with public premium account options and a excessive yield money account), though it lacks in depth asset courses, various investments, and funding evaluation.

In case you are curious to how a Public investing brokerage account compares to Robinhood particularly, take a look at our Public.com vs Robinhood full assessment!

FAQ

Sure, Public.com has a user-friendly, mobile-first interface that makes it simple for novices to start out their investing journey with state-of-the-art safety.

Sure, Public makes use of the identical 256-bit encryption utilized by banks and credit score unions.

If you happen to go for the premium possibility, which supplies you entry to customized alerts and extra knowledge than the free model, you’ll pay simply $8 monthly. In case your total steadiness is greater than $50,000, the premium service is free.