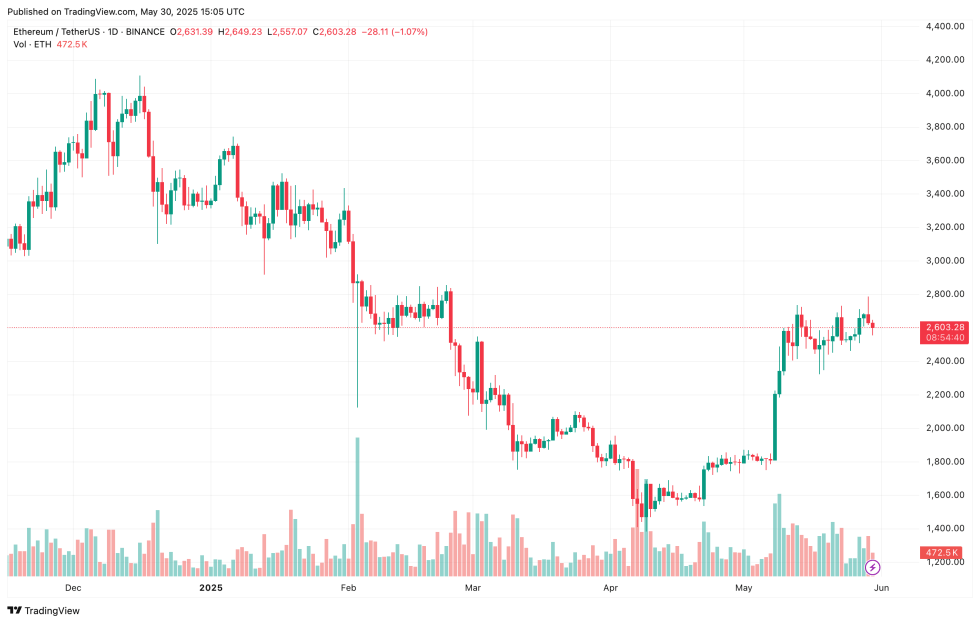

Buying and selling within the mid-$2,000 vary, Ethereum (ETH) has repeatedly teased a transfer towards $3,000, solely to fall quick and retreat again into its present vary. Nevertheless, a number of crypto analysts stay assured that ETH’s ascent to $3,000 and past is simply a matter of time.

Ethereum Exhibiting Indicators Of Renewed Energy

In a current X publish, crypto analyst Titan of Crypto highlighted ETH’s bullish worth motion. The analyst shared the next day by day ETH chart, displaying the cryptocurrency breaking out of a bullish flag following a interval of consolidation – doubtlessly setting its sights on a goal of $3,800.

Fellow crypto analyst Grasp of Crypto shared Titan’s outlook, saying that ETH is “holding up rather well proper now.” In a separate X publish, the analyst added:

It seems like a breakout is coming, and $3K is simply across the nook. The truth that it’s outperforming #BTC this quarter is a robust signal that altcoin season is warming up.

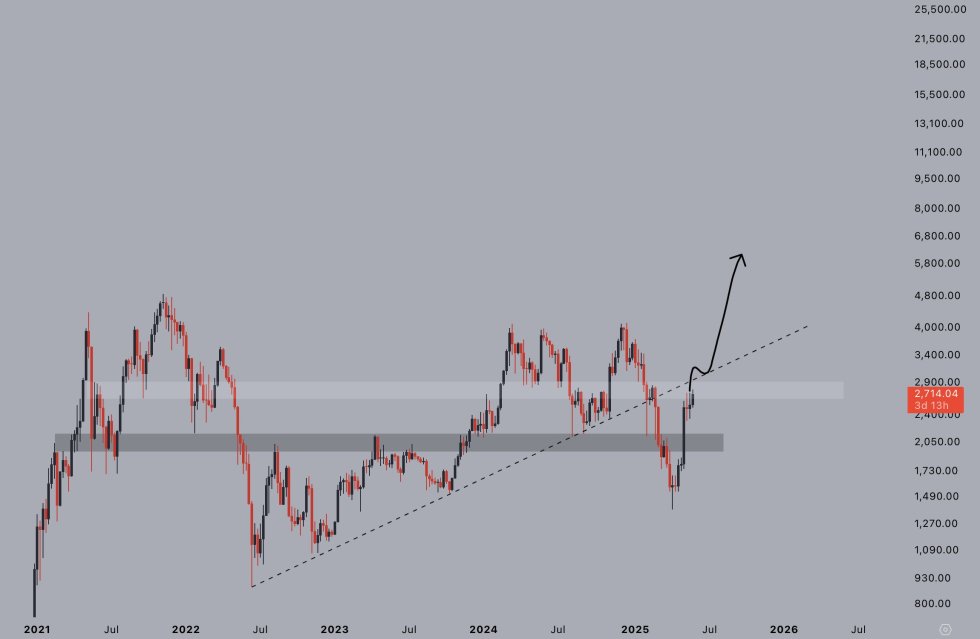

In the meantime, crypto dealer Jelle urged persistence. Sharing the next chart of ETH’s current worth motion, he emphasised that ETH is behaving as anticipated because it continues to problem a key resistance stage. In keeping with Jelle, the “actual enjoyable” will start as soon as ETH hits $3,000.

Notably, ETH continues to draw robust institutional curiosity. Change-traded fund (ETF) inflows for Ethereum topped $91 million yesterday, with BlackRock alone accounting for $50.4 million of that complete – a transparent signal of sustained confidence within the digital asset.

Seasoned analyst Ali Martinez additionally highlighted important whale accumulation. In keeping with Martinez, wallets holding between 100,000 and 1,000,000 ETH acquired over 1 million ETH within the final 48 hours – a robust sign of long-term bullish sentiment.

Massive ETH ETF inflows and whale purchases sign rising institutional confidence and aggressive accumulation – developments that always precede bullish worth motion. By lowering the accessible provide in the marketplace, these strikes may also help gas upward momentum and worth appreciation.

Technical Patterns Sign Bullish Continuation

From a technical standpoint, Ethereum is displaying encouraging indicators. Crypto dealer Merlijn The Dealer identified that ETH seems to be carefully following the Wyckoff Accumulation sample.

On this sample, the spring part includes a false breakdown under assist to shake out weak arms, adopted by a check to substantiate waning promoting stress. This units the stage for the leap – a robust rally above resistance with important quantity, marking the beginning of a brand new uptrend.

In keeping with Merlijn, ETH has already accomplished the spring and check phases and is now poised to enter the leap part – doubtlessly setting the stage for a transfer towards a brand new all-time excessive (ATH).

That stated, all eyes are on the FTX creditor payouts anticipated later as we speak. Specialists warn that the huge $5 billion distribution might briefly dampen ETH’s bullish momentum by rising short-term promoting stress. At press time, ETH trades at $2,603, down 2.4% prior to now 24 hours.

Featured Picture from Unsplash.com, charts from X and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.