The IRS has unveiled new federal revenue tax brackets to account for inflation – with the hope of offering aid for some Individuals once they file their taxes for subsequent 12 months.

Regardless of its partial closure because of the authorities shutdown, the company shared particulars Thursday of the brand new federal revenue tax brackets and normal deductions, which apply to tax 12 months 2026 for returns filed in 2027.

The IRS lets most filers decrease their taxable revenue by taking the usual deduction, which is a flat quantity based mostly on submitting standing and age, in accordance with NerdWallet.

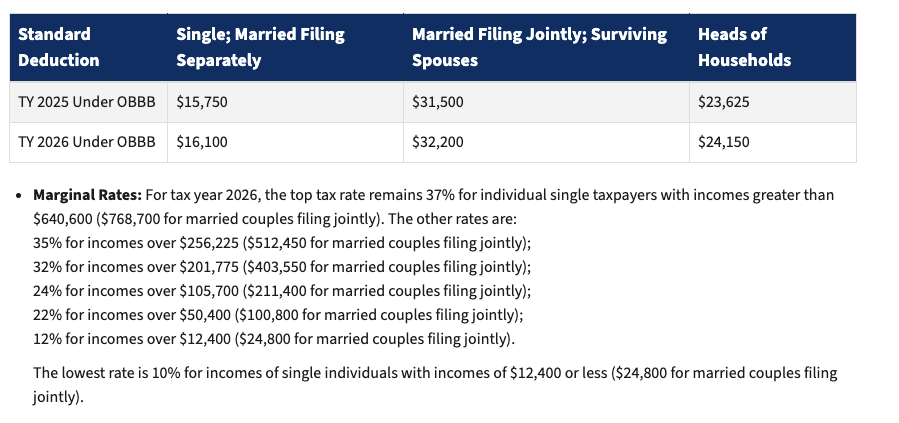

For 2026, the usual deduction shall be raised from $31,500 to $32,200 for married {couples} submitting collectively. For single taxpayers and married folks submitting individually, the usual deduction will enhance from $15,750 to $16,100.

The IRS additionally shared adjustments to particular person revenue tax brackets. Whereas tax price percentages will keep the identical, due to Trump’s One Large Stunning Invoice that handed in July, the incomes threshold to enter a brand new tax bracket has been adjusted for inflation.

For 2026, the highest price of 37 % applies to people with taxable revenue above $640,600 and married {couples} submitting collectively incomes $768,700 or extra.

Elevating the incomes threshold might doubtlessly create financial savings for some Individuals who haven’t acquired a pay increase to counteract the rising value of meals, housing, gasoline and different requirements.

The IRS makes changes every year, usually in October or November, to keep away from what is called “bracket creep,” which happens when inflation pushes folks into increased tax brackets, forcing them to pay extra come Tax Day.

A number of different adjustments past the federal tax brackets have been shared Thursday, together with adjustments to HSAs and FSAs.

Beginning subsequent 12 months, individuals who contribute to a well being versatile spending account (FSA) can contribute as much as $3,400 and, if their plan permits it, carry over as much as $680 into the following tax 12 months.

The 2026 contributions for well being financial savings accounts will enhance to $4,400 for self protection and $8,750 for household protection.

The annual exclusion for presents, which restricts how a lot taxpayers may give another person with out submitting a present tax return, shall be $19,000 per individual for 2026, which is similar because it was in 2025.

Different adjustments embrace a rise within the property tax credit score, which establishes a threshold for the taxation of estates upon a rich individual’s loss of life. In 2026, estates valued at or under $15 million is not going to be topic to property tax, which is up from $13.9 million in 2025.

In the meantime, the earned revenue tax credit score, which was created to present a break to qualifying taxpayers with kids, may also enhance from $8,046 to $8,321.

The IRS bulletins come a day after the company mentioned it could furlough practically half of its workforce because of the authorities shutdown, which has now entered its ninth day.