A look at the year-to-date charts of the major stock market indexes shows that the bearish trend has been choppy. It’s been marked by short rallies that sputter out until the pattern repeats. This makes a confusing environment for investors.

And we’re not out of the woods yet, says former BlackRock stock chief and Crossmark CIO Bob Doll. In his view, the markets are going to get worse in the short term, perhaps retesting the recent lows near 3,500. Doll notes that the Federal Reserve has “only” raised interest rates to the 3.75% to 4% range, and that this is likely not enough curb inflation.

With this in mind, the task for investors is to find stocks that are going to win going forward, no matter how the market moves, and Doll has a bit of advice there, too.

“I don’t think you have to roll the dice and take on a lot of risk in the portfolio. Good solid companies that are selling at reasonable prices; or they have good cash flow… those are the kinds of things that I’m trying to focus on… Energy companies make a bunch of money… They’re being very disciplined this time, which is great for financial returns and for investors,” Doll opined.

In particular, Doll has recommended two high-quality energy stocks that have proven they can thrive on volatility. We’ve delved into TipRanks’ database to see what Wall Street analysts have to say about whether these stocks make compelling investments. Let’s take a closer look.

Marathon Petroleum Corporation (MPC)

We’ll start with Marathon Petroleum, an old name in the oil industry and currently the largest producer of refined petroleum products in the North American market. The company boasts a $54 billion market cap and stock that has gained 85% year-to-date, far outperforming the broader markets. Marathon strength rests on its operations: 13 active refineries, operating in 12 states, with a combined capacity of 2.9 million barrels of crude oil daily.

A continent-spanning operation, in an essential industry, brought Marathon $47.2 billion in revenues in the recently reported 3Q22, a 45% increase from the same period last year. The company reported an adjusted net income of $3.9 billion, or $7.81 per diluted share. The EPS number was up from just 73 cents in 3Q21.

So the company is profitable, and showing strong share appreciation in a difficult environment. Also of note for investors, Marathon Petroleum also declared a Q4 dividend, to be paid on December 12, of 75 cents per common share. This is a 30% increase quarter-over-quarter, and on an annualized basis, the new dividend comes to $3 per common share. At that rate, it yields 2.6%, a bit over the average for companies listed in the S&P 500. Marathon has been keeping reliable dividend payments for the past 11 years.

All of this has impressed Raymond James’ 5-star analyst Justin Jenkins, who writes of MPC: “We believe the relative momentum will roll on as the refining macro is still supportive of well above midcycle margins (and record October cracks too). While MPC has executed on its capital allocation and shareholder return goals, excellent operations, a supportive refining macro, and continued emphasis on returns by managements forces MPC to be our top refining pick even after dramatic outperformance over roughly the past two years…”

To this end, Jenkins rates MPC stock a Strong Buy, and his price target of $150 suggests it has a 29% upside potential for the coming year. (To watch Jenkins’ track record, click here)

Wall Street is definitely down with the bulls on these shares. The stock has 13 recent analyst reviews, and they break down to 10 Buys over 3 Holds for a Strong Buy consensus rating. (See MPC stock forecast on TipRanks)

ExxonMobil Corporation (XOM)

The second energy stock pick on Doll’s list is ExxonMobil, one of the world’s largest crude oil and natural gas exploration and production companies. ExxonMobil has its fingers in many pots, from hydrocarbon exploration on the global scene to the US refined product market to the development of new energy sources and more efficient fuels to power a low-carbon or net-zero future.

It takes a big company and a deep purse to manage all of that. ExxonMobil, with its $448 billion market cap, fits the bill. The company keeps up its size with outsized quarterly results – it showed a top line exceeding $112 billion in the recently reported 3Q22, up 52% year-over-year. For the first nine months of this year, ExxonMobil has generated $318 billion in revenues, compared to $200 billion for the same period in 2021.

On earnings, the company realized $19.7 billion in the recent third quarter. This came to $4.68 per diluted share, compared to $1.58 EPS in the year-ago quarter. The company’s cash flow expanded in Q3, by $11.6 billion, and the free cash flow, which helps to support the dividend payment, came in at $22 billion.

The dividend is worth mentioning. ExxonMobil declared a 91-cent per commons share payment for Q4, up 3 cents from the previous quarter, and payable on December 9. With the annualized rate coming to $3.64 per common share, the dividend yields a 3.2%, well above average. XOM has been keeping reliable payments for 14 years.

Along with increasing top and bottom lines, ExxonMobil’s shares have been gaining all year. The stock is up an impressive 84% year-to-date, outperforming the broader markets by a wide margin.

Covering the stock for Jefferies, 5-star analyst Lloyd Byrne thinks this name could see even more gains ahead.

“We believe Exxon has created a compelling investment case… XOM is ‘on the front foot’ and we see attractive risk/reward, particularly for generalists needing energy exposure… We see Exxon’s financial position as solid, as the company rationalized cost structure, and used the higher oil & gas environment to repair its balance sheet. At the same time, XOM continued to reinvest in longer term projects across the energy chain,” Byrne opined.

“With strong financials and an industry leading upstream and downstream portfolio, we believe Exxonis positioned to outperform over the medium-term,” the analyst summed up.

All of this, in Byrne’s view, justifies a Buy rating, along with a $133 price target. Should the target be met, a twelve-month gain of ~22% could be in store. (To watch Byrne’s track record, click here)

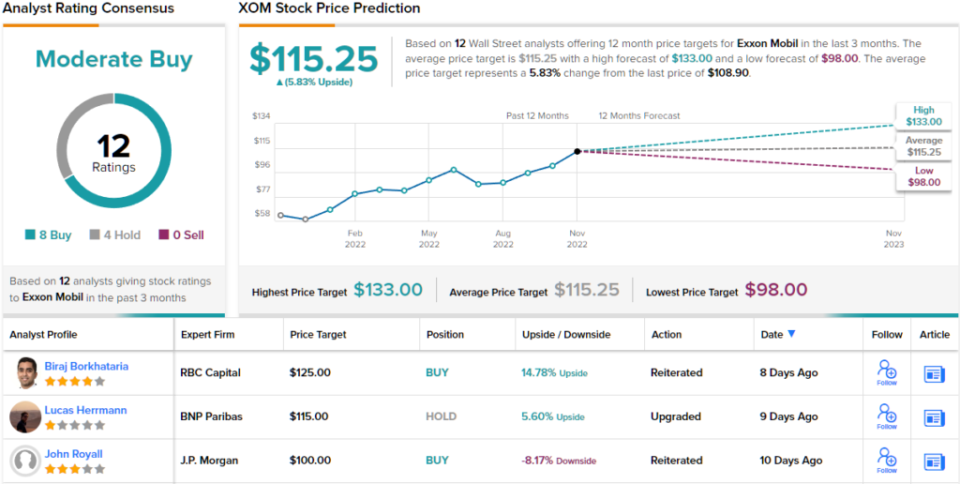

All in all, XOM shares have gotten the nod from 12 analysts, who collectively give the stock an 8 to 4 advantage in Buys over Holds for a Moderate Buy consensus rating. (See XOM stock forecast on TipRanks)

To find good ideas for energy stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.