Leonid Ikan

By Alex Rosen

Summary

Invesco DB Oil ETF (NYSEARCA:DBO) tracks an index of crude oil futures contracts. Year to date the fund is up 3.64%, and since inception in 2007, it is down 37%. DBO’s model is very simple. It holds oil futures traded on the West Texas Intermediate. Any assets not tied up in futures contracts are put in cash and cash equivalents such as T-bills. We rate DBO a Hold, as we are waiting for the next global shock to the system that will affect the supply and demand curves for oil.

Strategy

According to the prospectus, “DBO seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Crude Oil Index Excess Return™ (DBIQ Opt Yield Crude Oil Index ER or Index) plus the interest income from the Fund’s holdings of primarily US Treasury securities and money market income less the Fund’s expenses.” While the fund seeks to provide access to commodity futures, it requires a certain level of sophistication due to its speculative realm.

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Commodities

- Sub-Segment: Energy

- Correlation (vs. S&P 500): Low

- Expected Volatility (vs. S&P 500): Moderate

Holding Analysis

DBO, like any oil futures ETF will hold only two things: Oil futures contracts, in this case WTI oil, and cash or cash equivalents to buy those contracts. With DBO, the split is 78% WTI, 22% T-bills.

Strengths

Any single commodity ETF lives and dies by that investment. DBO is not a fund for those looking to diversify the portfolio or to get a little exposure to the sector. This is a hardcore oil futures ETF. Oil futures go up, the fund goes up. Oil futures go down, the fund goes down. For those who understand the oil futures market and believe they can accurately forecast it, this can be an excellent fund.

Weaknesses

Oil is a commodity that is highly susceptible to global shocks and capable of wild swings in price. When Russia invaded the Ukraine, and the West imposed sanctions, the futures prices shot through the roof. When the world took a giant pause to appreciate a global pandemic, the market collapsed to the point where oil went negative.

DBO’s singularity of investment swings both ways. If you get stuck in a down cycle, be prepared to jump ship as soon as possible.

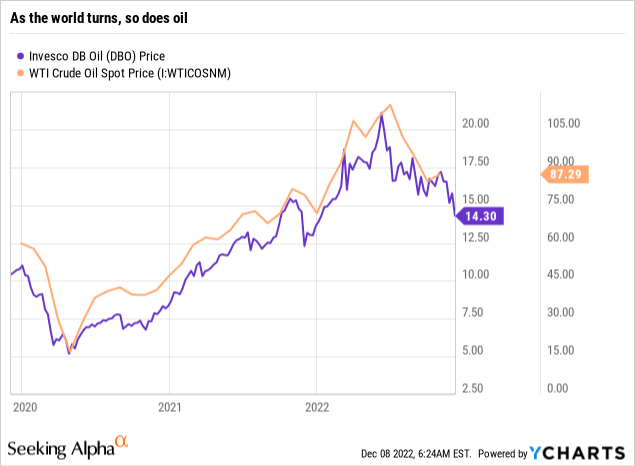

DBO and the WTI index rise and fall along with global events (Ycharts)

If you notice in the above chart, the high and low points directly correlate to major global events. Bottomed out in early 2020, COVID onset led to high supply, low demand. Peaked in mid-2022, Russian invasion of Ukraine, led to consistent demand, decreased supply.

Opportunities

Figure out when the next global shock leads to diminished supply, and capture the upswing. Recognize the downturn leading to oversupply, and get out. It is not much more difficult than that. The trouble lies in reading the tea leaves. Who saw in February of 2020 that within a month the entire world would shut down? What we do know, though, is that global pandemic turned in to a real opportunity for anyone making personal protective equipment, vaccines, or home brewing kits. It was not a good time for oil, aviation, or energy in general.

Oil is very subjective to the supply and demand functions of the market. Stability in Venezuela is bad for the oil market (but good for Venezuelans). War in the Ukraine is good for the oil market (but very bad overall).

Threats

The biggest threat is misreading the tea leaves. Sometimes you zig when you should have zagged, and boom, you smack right into oncoming traffic. The very speculative nature of oil or futures in general really exposes tremendous downside risk.

In February of 2022, when Russian troops were amassing on the Ukrainian border, the talk was that Putin was bluffing. He would never be so foolish as to actually invade. Then, as soon as the Russians crossed the border, the expectation was that Ukraine would fall in a week, and then what would be Putin’s next target? Ten months later, the war is going very badly for Russia, but has still managed to virtually destroy the Ukraine’s infrastructure.

What does this portend? It is hard to know.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Hold

- Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

DBO does not play any games. It doesn’t have a proprietary methodology that takes into account 76 metrics upon which it values assets. It invests in WTI futures good or bad and that is it. We like funds that are transparent and can be understood without a PhD in anthropology. For that reason we like the model behind DBO.

ETF Investment Opinion

Seeking Alpha’s quantitative analysis rates DBO as a strong sell. We definitely see the argument for that rating and wouldn’t blame investors for wanting to jump ship, but we are not as bearish as Seeking Alpha. We think the global shocks have not fully played out, and demand may yet increase. Therefore, we are rating DBO a Hold, with the caveat that it is critical to keep a keen awareness of the global landscape and what may cause shifts one way or another in the supply and demand curves.