Because the Federal Reserve aggressively raises rates of interest and bond yields climb, we’re forsaking the period of ultra-low mortgage charges that prevailed from 2020 by way of the top of 2021.

Over the previous a number of years, we’ve change into accustomed to mortgage charges under 4%, with the typical price on a 30-year fixed-rate mortgage (for an proprietor occupant) dipping as little as 2.65% in January of 2021. These are extraordinarily low in a historic context. As of this writing, the typical price on the identical mortgage is about 5.3%.

For no less than the following a number of months and maybe for years to come back, we’ll expertise the next rate of interest surroundings. Nevertheless, the lingering influence of those years of ultra-low rates of interest could possibly be felt for the following a number of years and even a long time to come back because of what has just lately been coined the “Lock-In Impact.”

Within the short-term, rising rates of interest will do what it at all times does to demand—curtail it. During the last a number of months, we’ve seen this occurring as mortgage buy purposes are down about 15% by way of Might 13 from the identical interval in 2021. Rising charges scale back affordability, pricing would-be homebuyers out of the market. So long as rates of interest proceed to extend, they may proceed to place downward stress on demand—nothing new right here.

Nevertheless, what’s probably new is how rising rates of interest might negatively influence stock.

Current information from Redfin reveals that 51% of house owners with a mortgage have an rate of interest under 4%. With so many householders locked into tremendous low charges, there could possibly be a disincentive for owners to promote.

Suppose, in case you have a house with a mortgage price underneath 4%, why would you select to promote that dwelling and enter a brilliant aggressive housing market with excessive costs, solely to pay extra curiosity in your subsequent mortgage? It’s not a really enticing proposition.

To place it in perspective, contemplate a $425k home. In case you had a 3.5% mortgage price, your month-to-month cost can be round $1,910. In case you rebought a house at an analogous worth with an rate of interest of 5.3%, your month-to-month cost can be about $2,360. That comes out to roughly $450 extra per 30 days or $5,400 per yr.

Or contemplate somebody seeking to downsize. Maybe an getting old couple desires to promote the house they raised a household in, get some money to speculate with, and scale back their month-to-month bills.

If this couple downsized from a house price $425,000 to a house price $350,000—they might be saving roughly $0 per 30 days. That’s proper, they might purchase a less expensive, smaller dwelling, and nonetheless be paying the identical quantity. Positive, they’d get some fairness on the commerce, however their month-to-month prices can be the identical, which is tremendous necessary for individuals in retirement. Once more, not a brilliant enticing proposition.

It’s for that reason the time period “Lock-In Impact” has been coined. Many economists and analysts imagine the variety of new listings might stay low for a number of years whereas owners really feel “locked in” to their unusually low mortgage charges.

It’s price mentioning that the variety of owners who could also be “locked in” varies significantly. In accordance with the identical Redfin report, Utah, Colorado, and Washington, D.C. have the best proportion of house owners with low charges. Oklahoma and Mississippi have the fewest.

Whereas we don’t know if this Lock-In Impact will occur, the logic checks out. If it does materialize, it might have profound impacts on the housing marketplace for years, if not a long time to come back.

All of it comes all the way down to stock. If fewer owners put their properties up on the market, it might stop stock from recovering to extra regular, pre-covid ranges when the housing market was extra balanced.

As I wrote just lately, stock wants to extend for costs to average or go down (or no matter you suppose will occur).

There are quite a lot of completely different metrics associated to stock, so let me clarify.

Stock is outlined as the full variety of properties in the marketplace on the finish of a given month. It’s a very helpful metric as a result of it combines each provide and demand. It components in how many individuals put their home in the marketplace (often known as New Listings) in addition to what number of and the way shortly these properties are being offered (demand).

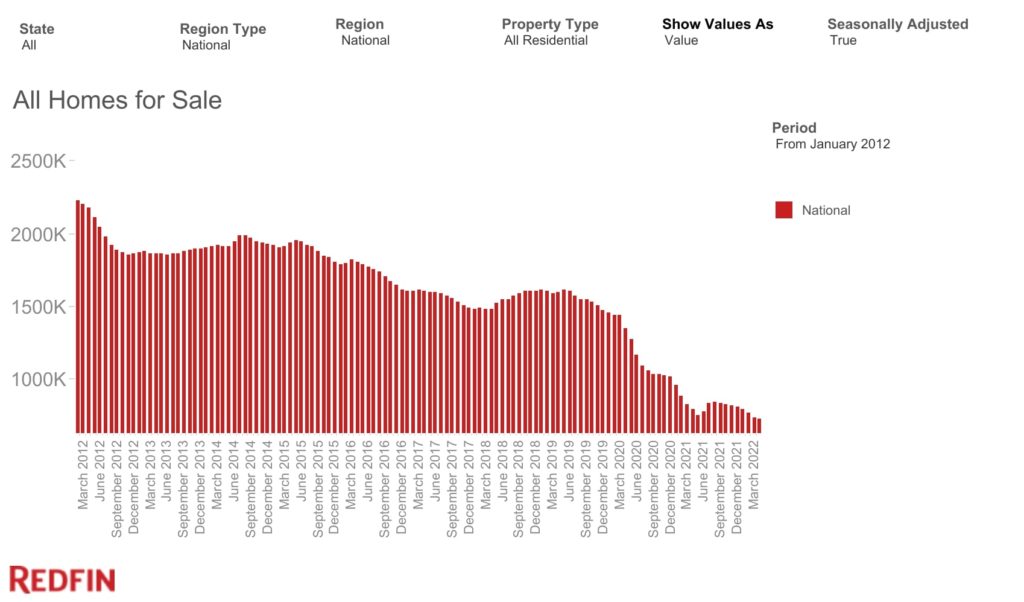

That is the place stock is as of March 2022.

There’s a fairly dramatic story depicted on this chart. Pre-pandemic, we anticipated about 1.8M items of stock over the busy summer season months. Now, we’re at 600k.

As different housing market analysts and I imagine, this quantity wants to extend for the housing market to return to a more healthy and extra regular degree (or to crash). Costs have been nonetheless appreciating when stock was at 1.8M, so you may wager they’ll go up with dramatically decrease provide.

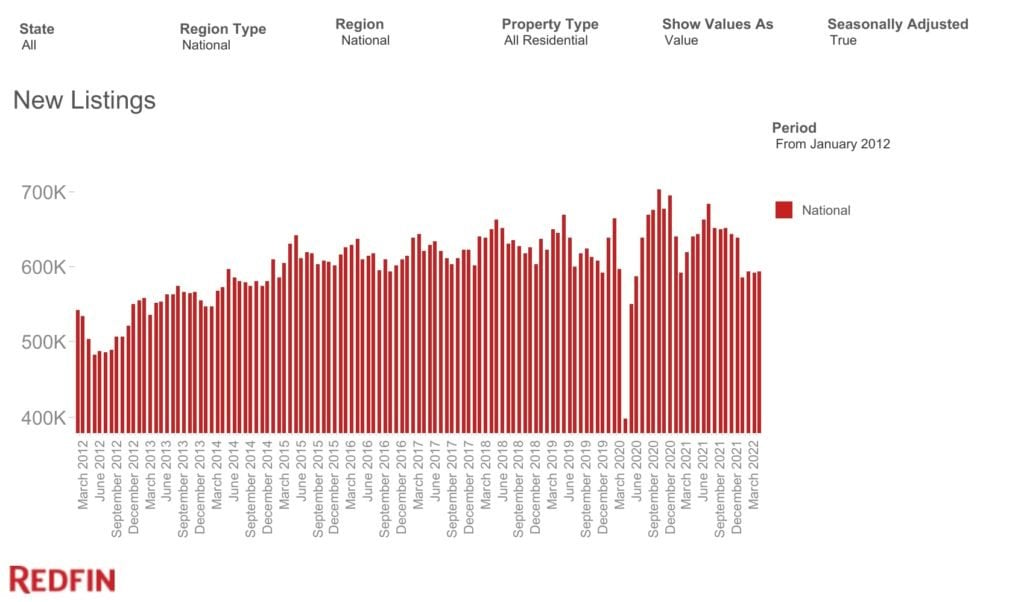

As demand moderates, stock might begin to decide up, however we’ll doubtless have to see extra new listings. As of now, that’s not occurring, as New Listings are down on a seasonally-adjusted foundation.

However, New Listings might enhance from three locations: owners promoting, new building, or foreclosures.

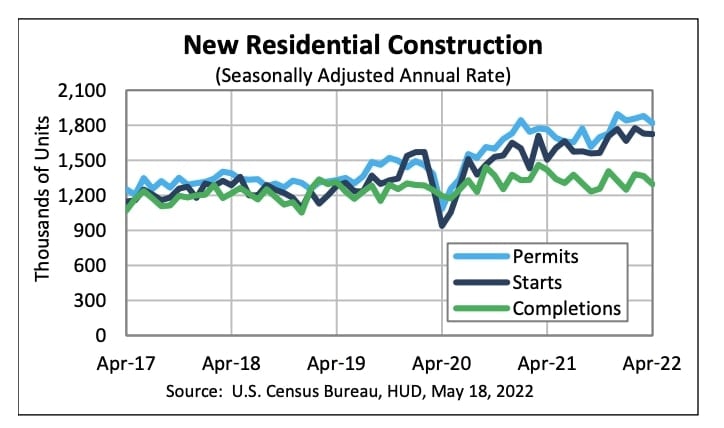

New building might add to new stock, however provide chain points have suppressed completions, and new permits began to drop as of April 2022.

Many individuals imagine a wave of foreclosures is coming and can add stock, however that’s not going to occur. You may watch my different interviews and movies about that, however to place it shortly, mortgage delinquencies have dropped for seven straight quarters. Owners will not be defaulting. Might a recession change this? Positive, however the stock from a possible enhance in foreclosures can be gradual and take years to play out.

The final and an important supply of New Listings are owners. Usually, as COVID-19 turns into a receding a part of our lives, I might suppose that New Listings from present owners would enhance. However that is the place the Lock-In Impact might come into play. If over 50% of house owners with a mortgage have ultra-low mortgage charges, we could not see many householders listing their properties on the market.

If fewer owners put their properties up on the market, that may put upward stress on housing costs. After all, some, or perhaps all of that upward stress, could possibly be offset by the downward pressure of rising rates of interest, however the influence of years of ultra-low charges can be a brilliant necessary issue within the housing market, doubtless for a few years.

I may even see a situation the place this Lock-In Impact impacts the marketplace for a long time. Once more, rates of interest through the pandemic have been the bottom they’ve ever been, and it’s not clear if charges will ever get as little as they only have been. Ever. And even when it does occur, it could possibly be a very long time earlier than it does.

Personally, I feel charges will rise for an additional yr or so, however then we’ll see a gradual easing of rates of interest. In spite of everything, the Fed has pursued straightforward cash insurance policies for about 15 years underneath 4 completely different administrations. Whereas the Fed is briefly elevating charges, I don’t at the moment suppose we’re going again to an period of double-digit mortgage charges. On the identical time, I additionally don’t know if we’ll see a 2.7% fixed-rate mortgage once more in our lifetimes. It’s solely occurred as soon as and took a really distinctive set of circumstances to get there.

After all, nobody is aware of what occurs subsequent. However for those who’re like me and wish to get a way of the place the housing market is heading, control the Lock-In Impact. It will likely be very fascinating to see if the predictions of decrease stock come true. To maintain monitor, simply take a look at new itemizing and stock numbers every month.

If you’d like extra data-driven details about the housing market, investing, and the financial system, try On The Market, BiggerPockets’ latest podcast, the place I’m the host. Each Monday, yow will discover new episodes on Apple, Spotify, or YouTube.

On The Market is offered by Fundrise

Fundrise is revolutionizing the way you put money into actual property.

With direct-access to high-quality actual property investments, Fundrise means that you can construct, handle, and develop a portfolio on the contact of a button. Combining innovation with experience, Fundrise maximizes your long-term return potential and has shortly change into America’s largest direct-to-investor actual property investing platform.

Study extra about Fundrise

:max_bytes(150000):strip_icc()/Health-GettyImages-2148115727-320342eaa3ce4fb6bda09bf3994791ea.jpg)