MediaProduction

Author’s Note: This is an abbreviated version of an article originally published in advance inside Integrated BioSci Investing for our members.

Intra-Cellular

The intelligent investor is a realist who sells to optimists and buys from pessimists. – Ben Graham (Warren Buffett’s mentor)

In biotech investing, you should not expect growth to occur linearly. Instead, growth typically manifests itself in spurts. While this is true for most biotech companies, it is most applicable to small to mid-sized companies. That is to say, sales tend to ramp up after the approval and label expansion of a “crown jewel” therapeutic. When such a regulatory event occurs, you can expect rapid sales growth in the subsequent quarters.

Intra-Cellular Therapies (NASDAQ:ITCI) epitomize the aforesaid phenomenon. After the recent label expansion of Caplyta for bipolar depression, product revenues have been increasing rapidly. On top of the recent growth spurt, the company is pushing for additional label expansions while brewing other early-stage molecules. In this research, I’ll feature a fundamental analysis of Intra-Cellular while focusing on upcoming clinical and growth development.

StockCharts

Figure 1: Intra-Cellular chart

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the subsequent section. I noted in the prior research,

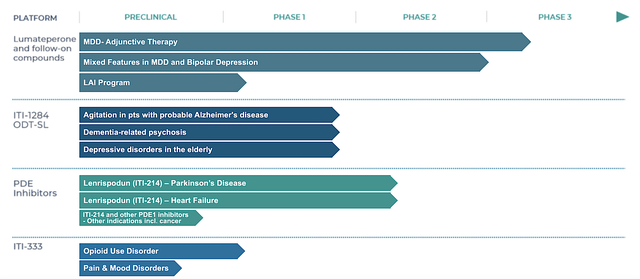

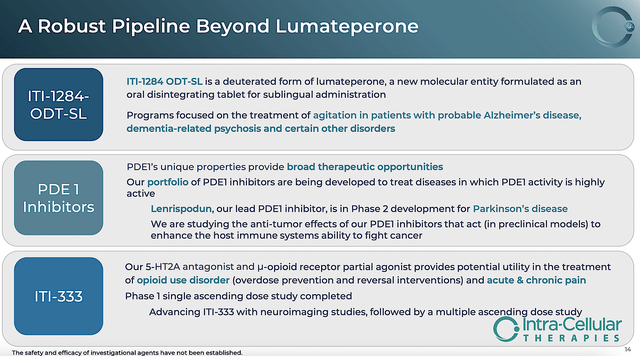

Operating out of New York, Intra-Cellular is focused on the innovation and commercialization of stellar therapeutics to fill the unmet needs in psychiatric medicines. As shown in the pipeline, the company is rapidly advancing an interesting portfolio of powerful drugs. They include ITI007 (i.e., lumateperone, aka Caplyta), ITI214 (a PDE1 inhibitor), ITI1284 (a deuterated form of Caplyta), and ITI333.

Intra-Cellular

Figure 2: Therapeutic pipeline

Strong Caplyta Commercialization Progress

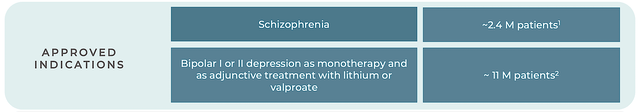

Shifting gears, let us analyze Caplyta’s commercialization progress. In late 2019, Caplyta is approved and launched initially as a neuroleptic for schizophrenia. The said drug is unique because it has stellar efficacy and an excellent safety profile.

In other words, Caplyta is a rare medicine that can superbly manage both positive and negative symptoms of schizophrenia. Contrary to conventional drugs, Caplyta is not subjected to tremendous side effects (i.e., adverse outcomes) like weight gain, muscle contortion, and extrapyramidal symptoms. As such, you’d expect extremely strong sales growth early in the launch.

Intra-Cellular

Figure 3: Caplyta’s approved indications

Nevertheless, early sales results have been a gradual increase. As you can imagine, the gradual ramp-up is due to the fact that there are only 2.4M Americans afflicted by the dreaded condition. Moreover, the company is commercializing Caplyta without a large pharmaceutical partner.

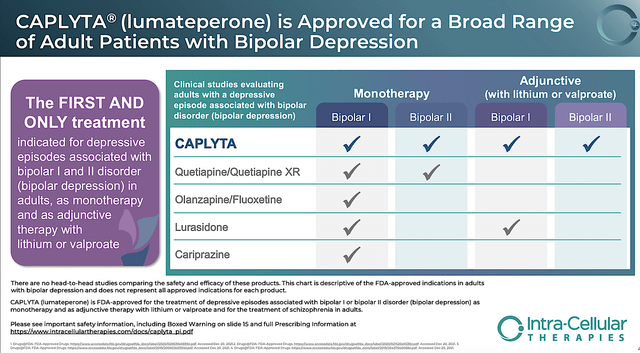

In unlocking Caplyta’s value, Intra-Cellular successfully obtained the label expansion for bipolar depression (i.e., BPD) in late 2021. From the figure below, you can appreciate that the BPD regulatory win is special. After all, Caplyta is the “first and only” drug that can manage both Type 1/2 bipolar as either a monotherapy (i.e., stand-alone treatment) or an adjunctive treatment (with lithium or valproate).

Intra-Cellular

Figure 4: Unique therapeutic profiles

Due to its unique therapeutic profile and now targeting a much larger patient population (i.e., 21M Americans), Caplyta prescription/sales picked up substantially. That is to say, sales growth hit another spurt earlier this year. Viewing the figure below, you can see that the TRx growth rate hit a steep incline back in January.

Intra-Cellular

Figure 5: Strong prescription uptake following BPD launch

Riding aggressive growth, the total sales for the latest quarter came in at $71.9M. On a year-over-year (i.e., YOY) basis, Caplyta sales are 223% higher than the $22.2M for the same period in the year prior. On a sequential basis, Caplyta sales improved by 30% going from Q2 to Q3. As such, you can appreciate that Intra-Cellular is operating at an inflection point in growth.

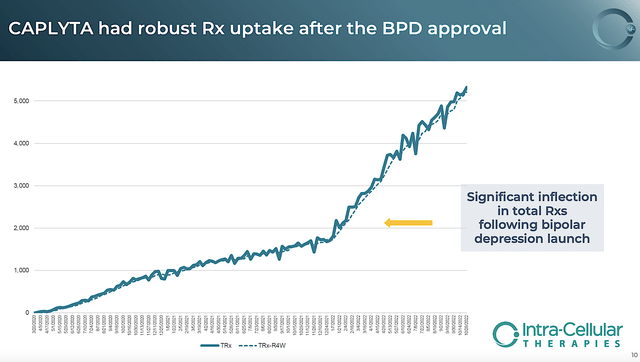

Expectations for Caplyta

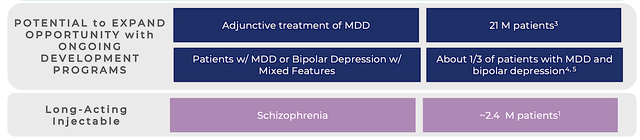

To turn what is good into great, Intra-Cellular continues to expand Caplyta’s label for three additional indications. They include adjunctive treatment for major depressive disorder (i.e., MDD), mixed features, and a long-acting injectable version of Caplyta. As a ramification, Caplyta can correspondingly boost its addressable US market to 21M, 10.5M, and 2.4M. As such, the total number of patients for Caplyta’s new label expansions is tallied to 33.9M.

Intra-Cellular

Figure 6: Much larger future label expansions

Assuming no growth, the current total market that Caplyta is servicing is already 13.4M patients (i.e., 2.4M patients with schizophrenia plus 11M patients having BPD). By that number of patients alone, Caplyta has already garnered $71.9M in revenue.

Due to the upcoming label expansions which increased the servicing patients to 33.9M, you’re looking at a minimum of $181.8M in future quarterly sales. However, that’s a highly conservative estimate. My expectation is that Caplyta would become a blockbuster in the next five to seven years.

Younger Assets

While it’s still quite early to size up the younger assets, the PDE1 inhibitor (lenrispodun) is already advancing in a Phase 2 trial for Parkinson’s disease. As a condition that is in dire need of novel medication, fruitful development in this area can deliver more long-term upsides. Nevertheless, the company can still do well with Caplyta as the sole blockbuster.

Intra-Cellular

Figure 7: Younger assets beyond Caplyta

Financials Assessment

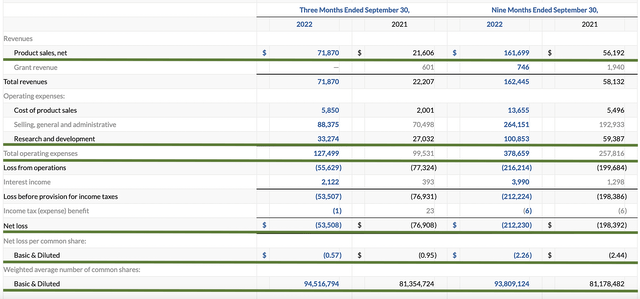

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, you should analyze the 3Q2022 earnings report for the period that ended on September 31.

As follows, Intra-Cellular procured $71.8M compared to only $21.6M for the same period a year prior which entails a 223% YOY increase. That aside, the research and development (R&D) for the respective periods registered at $33.1M and $27.0M. I viewed the 22.5% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $53.5M ($0.57 per share) net losses versus $76.9M ($0.95 per share) net declines for the same comparison. On a per-share basis, the bottom line is improved by 40%. It’s great to see that Intra-Cellular is starting to improve its bottom line while continuing to ramp up top line growth.

Intra-Cellular

Figure 8: Key financial metrics

About the balance sheet, there were $630.5M in cash, equivalents, and investments. As you can see, the public offering back in January substantially strengthened the balance sheet. On top of the $71.8M quarterly revenue and against the $127.4M quarterly OpEx, there should be adequate capital to fund operations into 2Q2025. Simply put, the cash position is robust relative to the burn rate and the revenue.

While on the balance sheet, you should check to see if Intra-Cellular is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 81.3M to 94.5M, my math reveals a 16.2% annual dilution. At this rate, Intra-Cellular cleared my 30% cut-off for a profitable investment.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the most immediate concern for Intra-Cellular is whether Caplyta can generate positive Study 403 data several months from now. If positive, you are likely going to see a 30% upside and vice versa.

That aside, Intra-Cellular may ramp up Caplyta sales too aggressively and thereby overspends its cash on sales/marketing. As such, it can create a cash flow constraint. Notwithstanding, that’s just a small chance.

Final Remarks

In all, I upgraded my recommendation on Intra-Cellular Therapies from buy to a strong buy with a 5/5 star rating. Around this time of the year in 2019, I was covering Caplyta’s regulatory binary event. And, it was quite nerve-wracking. Nevertheless, Intra-Cellular eventually enjoyed the FDA’s early Christmas present in the form of approval for schizophrenia. Almost two years later, Caplyta also enjoyed another victory with the label expansion for BPD. Since early 2022, sales growth has picked up aggressively due to the larger patient BPD population.

As a company that is operating at an inflection point in growth, you can expect annual sales to reach blockbuster five years from now. By then, the share price should at least double. In Q1 next year, you also have the Study 403 catalyst that can power further upsides.