robynmac

We beforehand lined Intel (NASDAQ:INTC) in April 2024, discussing its underwhelming Foundry prospects after the discharge of its new section reporting, as a result of the IDM 2.0 launched forth the uncertain cash burn and drag on its common profitability.

This was on prime of its delayed node roadmap compared with its foundry peer, signaling Intel Foundry’s uncertain prospects as a consequence of its nascency.

Whereas we had been optimistic regarding the stock’s US-made sentiments, it remained to be seen when its foundry section would have the flexibility to ship the important combination of node improvement, amount manufacturing, and profitability, resulting in our reiterated Keep rating.

Since then, INTC has already pulled once more tremendously by -44.4%, properly underperforming the broader market at +2.5%, triggered by the underwhelming FQ2’24 financial effectivity, dividend suspension, and drastic layoffs.

Blended with the continued market rotation from extreme progress semiconductor shares and the intensifying market pessimism surrounding generative AI, we take into account that there is also further ache all through its uncertain turnaround, resulting in our reiterated Keep rating.

We’ll speak about extra.

INTC’s Funding Thesis Has Turned Out Poorly Actually

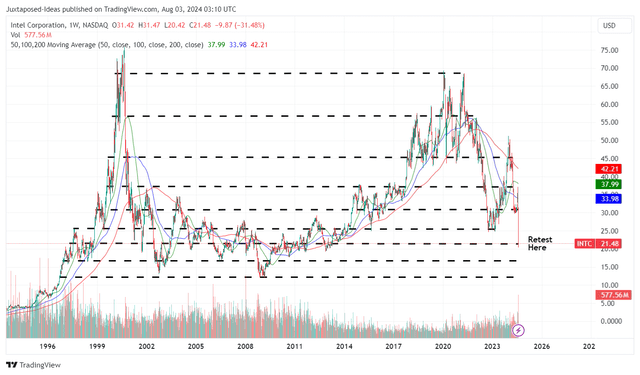

INTC 30Y Stock Worth

Shopping for and promoting View

Besides one had been residing beneath a rock, it went with out saying that INTC, as a legacy semiconductor agency, had didn’t capitalize on its earlier x86 market administration and the continued AI improve.

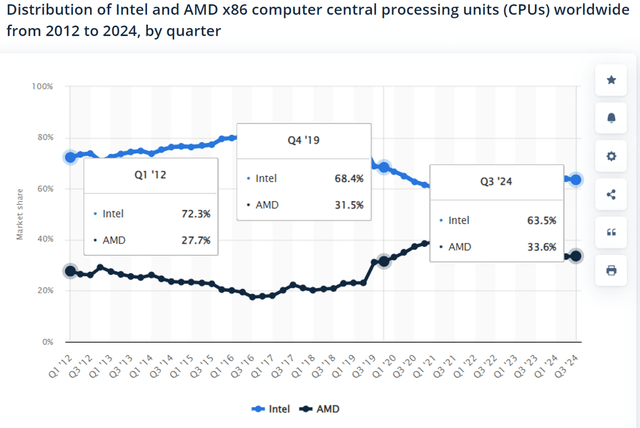

x86 Laptop computer Central Processing Objects Share

Statista

As an example, INTC has reported moderating x86 CPU market share of 63.5% by Q3’24 (-0.4 elements QoQ/ +0.9 YoY/ -13.4 from FQ2’19 ranges of 76.9%), as its direct competitor, Superior Micro Items (AMD) continues to develop to 33.6% (+0.2 elements QoQ/ -1.5 YoY/ +10.5 from F2’19 ranges of 23.1%).

On the an identical time, in an attempt to develop x86 market shares and Shopper Computing Group revenues to $7.41B in FQ2’24 (-1.5% QoQ/ +9.2% YoY), the administration has went on drastic worth cuts, naturally impacting the section’s working margins to 33.6% (-1.4 elements QoQ/ +4.4 YoY/ -7.3 from FY2019 ranges of 40.9%).

Furthermore, it goes with out saying that by way of the continued generative AI improve, Nvidia (NVDA) has already emerged as a result of the clear chief.

That’s due to Jensen Huang’s visionary current of a DGX-1 supercomputer to OpenAI once more in 2016 and the next nurturing of a “large group of AI programmers who continuously invent using the company’s know-how.”

This enchancment has triggered NVDA’s sturdy information coronary heart revenue progress to $22.6B (+23% QoQ/ +427% YoY) inside the latest quarter and the primary share of as a lot as 90% inside the AI GPU chip market/ 80% of the entire information coronary heart AI chip market.

How about INTC?

Properly, the Pat Gelsinger led agency reported solely $3.04B of Information Coronary heart/ AI related revenues in FQ2’24 (inline QoQ/ -3.4% YoY), whereas solely guiding FQ3’24 revenues of $3B (inline QoQ/ -3% YoY), exemplifying its incapacity to capitalize on the continued AI improve.

That’s whatever the Intel® Gaudi® 3 AI accelerator on monitor to launch in FQ3’24, with “roughly two-times the effectivity per buck on every inference and training versus the primary competitor,” implying that NVDA’s GPU/ AI accelerator decisions keep inherently further attractive to hyperscalers whatever the hefty price tag.

Whereas NVDA’s Blackwell launch is also fairly delayed, it’s apparent that numerous hyperscalers have positioned extra perception in its superior AI accelerator decisions, primarily based totally on GOOG’s (GOOG) order worth $10B, Meta (META) at $10B, and Microsoft (MSFT) at $1.62B.

These developments are moreover why INTC has reported underwhelming FQ2’24 revenues of $12.8B (+0.7% QoQ/ -0.7% YoY) and adj EPS of $0.02 (-88.8% QoQ/ -84.6% YoY).

Blended with the hefty FY2024 capital expenditure steering of $26B (+1% YoY/ +60.3% from FY2019 ranges) and FY2025 at $21.5B (-17.3% YoY), attributed to its Foundry targets, it’s unsurprising that the company has reported opposed Free Cash Circulation of -$12.58B over the past twelve months (+24.8% sequentially/ -174.3% from FY2019 ranges of $16.93B).

That’s the reason we take into account that the administration’s option to droop dividends from This fall’24 onwards has been prudent, setting up upon the sooner cut back launched in early 2023 – one which we take into account should have occurred earlier, with the administration “seemingly financing its dividend payouts with debt.”

That’s significantly since INTC’s stability sheet has been continuously deteriorating, with rising (current and long-term) cash owed of $53.02B (+1.1% QoQ/ +7.6% YoY/ +82.8% from FY2019 ranges of $28.99B).

Shifting forward, with a variety of the unhealthy info already baked in and the peak capex depth behind us, we take into account that the administration is also increased positioned to slowly flip the legacy ship spherical.

That’s partly aided by the projected low cost of -$1.6B in Working Payments in 2024 and -$4.1B by 2025, down from the $21.6B reported in FY2023, and the capex low cost – ensuing inside the supposed $10B in worth monetary financial savings.

Even so, if we is also painfully reliable, it’s uncertain how worthwhile their eventual turnaround is also, since INTC’s legacy firms have didn’t innovate and hold ahead of the shortly altering semiconductor panorama.

With totally different players already gaining giant headways inside the x86, information coronary heart, and CPU/ GPU end markets, amongst others, the administration should miraculously “pull a rabbit out of the hat” to not solely survive the extraordinarily aggressive enterprise, nevertheless to in the end thrive and regain the market’s/ shareholders’ perception.

For now, solely time might inform.

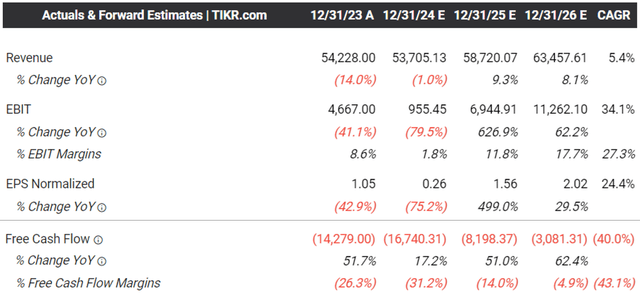

The Consensus Forward Estimates

Tikr Terminal

For now, a quiet optimism is already seen inside the promising consensus forward estimates, with INTC anticipated to report trough FY2024/ FY2025 years and FY2026 extra more likely to convey forth drastically improved numbers.

Even so, with bloated stability sheet and opposed Free Cash Flows, we take into account the administration is unlikely to reinstate dividends inside the intermediate time interval, efficiently putting an end to the 31 years of consecutive dividend payouts.

So, Is INTC Stock A Buy, Promote, or Keep?

INTC 30Y Stock Worth

Shopping for and promoting View

Due to these pessimistic developments, it’s unsurprising that the market has opted to punish INTC first, as seen inside the drastic two day pullback by -30.1%, or the equal -$39B in market capitalization.

For context, we had supplied an excellent value estimate of $30.10 in our last article, primarily based totally on the annualized FQ4’23 adj EPS of $1.36 (after adjusting for the $1.2B litigation revenue for improved accuracy, versus the reported sum of $2.52) and the 5Y P/E suggest valuations of twenty-two.15x.

Whereas INTC is lastly cheaper, we’re uncertain whether or not it’s sensible to counsel a Buy rating proper right here, since there is also six further quarters of uncertainty until its headcount reductions are completed.

On the an identical time, whereas the administration has highlighted a sturdy common AI PC market share progress from decrease than 10% in 2024 to over 50% by 2026, it stays to be seen how quite a bit helpful properties the legacy semiconductor agency might report, with the CPU market an increasing number of aggressive as QUALCOMM (QCOM) enters the picture with ARM-based processor.

Blended with the uncertain monetization of its foundry ambitions, as talked about in our earlier article proper right here, and totally different further expert foundry leaders establishing geopolitically secure operations in Japan/ the US, we take into account that it is likely to be further prudent to maintain up our earlier Keep rating proper right here.

Lastly, with Pat Gelsinger failing to ship (in hindsight) the overly formidable turnaround story, we take into account that there is also further uncertainty ahead, significantly since INTC no longer pays out dividends whereas boasting minimal near-term progress prospects.

Endurance is also further prudent proper right here.