As Bitcoin solidifies its presence within the monetary panorama, a noticeable pattern emerges: establishments are closely invested in Bitcoin, usually controlling market dynamics, whereas retail buyers stay on the sidelines. This text unpacks the institutional affect on Bitcoin’s worth and highlights why retail buyers have but to reach in pressure, pointing to the potential for a major worth surge as broader adoption takes place.

Institutional Curiosity: The Driving Power Behind Bitcoin Worth Actions

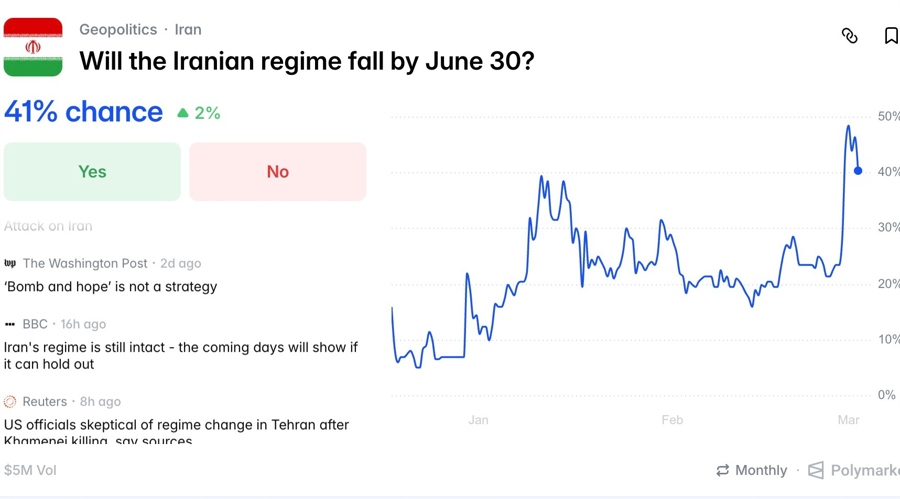

Institutional buyers are amassing Bitcoin by means of numerous channels, notably by means of Bitcoin exchange-traded funds (ETFs) and direct acquisitions. Information from 2024 exhibits a marked enhance in institutional funding, with a 14% rise in Bitcoin ETF participation, bringing the whole variety of establishments concerned to over 1,100. These establishments now maintain 21.15% of complete property beneath administration (AUM) inside Bitcoin ETFs. Heavyweights like Millennium Administration, Schonfeld Strategic Advisors, Morgan Stanley, and Aristeia Capital are on the forefront of this motion, underscoring a major institutional dedication.

Direct acquisitions have additionally gained momentum, with public corporations proudly owning over 335,777 Bitcoin, amounting to 1.60% of the whole Bitcoin provide. Main Bitcoin holders reminiscent of MicroStrategy, Tesla, and Block Inc. are testomony to the rising adoption amongst main firms, securing their stake in Bitcoin’s long-term worth.

The Information: Retail Traders Haven’t Arrived But

Regardless of Bitcoin’s reputation, retail investor participation stays comparatively low. For now, the market is primarily influenced by massive establishments aiming to build up Bitcoin on the most advantageous costs doable. Their technique is obvious: push down Bitcoin’s worth by means of market maneuvers to accumulate it cheaply, anticipating substantial returns because the market matures. This absence of retail exercise means that Bitcoin’s worth stays largely undervalued, with retail-driven momentum but to floor.

Bitcoin’s basis, as defined in Satoshi Nakamoto’s seminal whitepaper, emphasizes a decentralized, peer-to-peer digital forex meant to sidestep conventional monetary establishments. Nevertheless, in observe, massive monetary gamers exert appreciable management over Bitcoin’s provide and demand, influencing worth actions that might in any other case happen organically. For example, a survey of over 250 establishments revealed that 93% consider within the longevity and worth of digital property and blockchain, with 35% of respondents allocating between 1–5% of their portfolios to digital property, signaling additional growth of their stakes as confidence grows.

Bitcoin ETFs, Direct Purchases, and Future Outlook

The introduction of Bitcoin ETFs and the rise in institutional purchases point out a monetary atmosphere more and more designed to cater to massive gamers. This dynamic has but to incorporate vital retail participation, which generally arrives throughout phases of elevated worth momentum, probably setting the stage for a future surge.

Information from MacroMicro additional means that an inflow of institutional buyers reduces the ratio of retail to institutional possession, which traditionally correlates with rising Bitcoin costs. This pattern is anticipated to persist as extra establishments enter the market, positioning Bitcoin for substantial appreciation as soon as retail buyers be a part of.

Maintain, Don’t Promote: The Technique Amid Institutional Shopping for Frenzy

Given the present institutional accumulation part, holding Bitcoin seems to be a prudent technique. Promoting now, notably when retail funding stays low, might imply lacking out on future worth appreciations pushed by each institutional and eventual retail participation. Establishments are shopping for with long-term aims in thoughts, and as soon as retail buyers begin buying in vital numbers, a worth rally might be inevitable.

The information paints a transparent image: institutional curiosity is driving Bitcoin’s present worth trajectory. Retail buyers haven’t but made a major impression, leaving ample room for progress in Bitcoin’s valuation. For now, holding onto Bitcoin aligns with the data-backed technique, as retail entry into the market is more likely to push costs even increased. This market part just isn’t about promoting Bitcoin; it’s about securing a stake in an asset class that establishments are quickly adopting, setting the stage for substantial future good points.

Sources — Google