mack2happy

Investment Thesis

IIPR 5Y Stock Price

Seeking Alpha

The Innovative Industrial Properties, Inc (NYSE:IIPR) stock has been trading rangebound at these levels for the past three months, nearing the top of its previous FY2019 levels. Naturally, this was attributed to the default by one of its key tenants spooking investors in July 2022, leading to the tragic -20% decline in its stock prices then. That event has caused the stock to trade below its 50, 100, and 200-day moving average at the time of writing, indicating its normalized levels after pandemic hyper-inflation valuations.

Depending on the market condition ahead, we may see IIPR’s valuations further impacted, given the slight misses in the past two consecutive quarters. The delayed federal cannabis legalization is not helping market sentiments as well, as the Feds aggressively hike interest rates through 2023 and equity funding dries up for the industry.

Nonetheless, there might be a silver lining, given the relatively elevated September CPI with increased spending on smoking products by 0.2% sequentially and 8.2% YoY, indicating the robust US consumer consumption trend for now. Assuming that discretionary spending remains strong through the recession ahead, we expect to see IIPR valuation hold steady at these levels. In the meantime, we do not expect to see a meaningful recovery ahead, since cannabis margins remain tight ahead, due to the oversupply and intense pricing wars at state levels.

IIPR Impresses, Despite Normalized Growth Post Hyper-Pandemic Boom

S&P Capital IQ

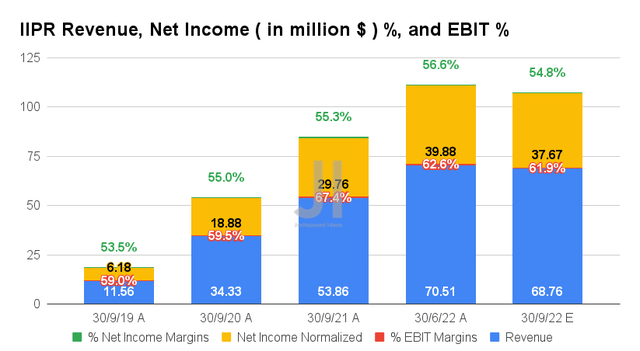

For its upcoming FQ3’22 earnings call, IIPR is expected to report revenues of $68.76M and EBIT margins of 61.9%, indicating a slight moderation of -2.48% and -0.7 percentage points QoQ, respectively. Otherwise, still an excellent YoY growth of 27.66% though a decline of -5.5 percentage points, respectively, attributed to rising inflationary pressures on the cannabis operators.

Naturally, this will impact IIPR’s profitability, with net incomes of $37.67M and net income margins of 54.8% for the next quarter. It will represent a QoQ decline of -5.54% though a 26.57% increase YoY.

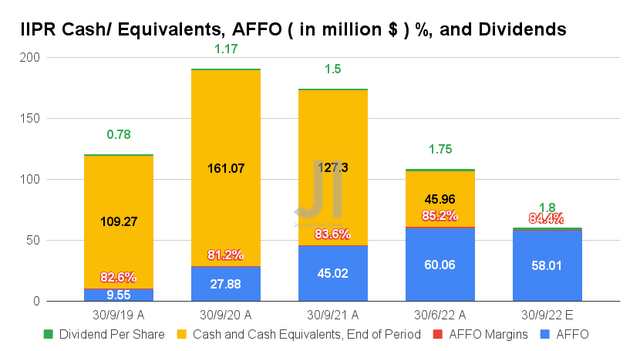

S&P Capital IQ

However, IIPR is expected to report an excellent AFFO of $58.01M and an AFFO margin of 84.8% in FQ3’22, indicating a minimal decline of -3.41% and -0.8 percentage points QoQ, respectively. Otherwise, still an impressive increase of 28.85% and 0.8 percentage points YoY, respectively. Given that the company has also committed to a lower acquisition plan of between $400M to $500M for the year, compared to the original guidance of up to $600M, we expect to see improved cash flow ahead. Thereby, temporarily boosting the liquidity on its balance sheet during the worsening macroeconomics in H2’22, leading to analysts’ inline projection of a $1.8 dividend for the next quarter.

However, despite its moderated debt levels by -30.33% to $306.45M by FQ2’22, IIPR’s current long-term debt is still more than double from pre-pandemic levels, increasing its interest expenses by 245.90% thus far. Depending on its forward execution and the performance of the cannabis industry, the company may, unfortunately, need to rely on more debts ahead to fund its expansion in 2023. We shall see, since analysts are expecting another $400M expenditure then.

S&P Capital IQ

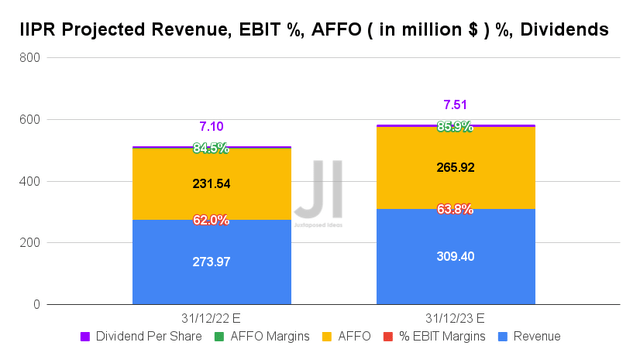

Over the next two years, IIPR is expected to report revenue and AFFO growth at a CAGR of 22.99% and 23.28%, respectively. These numbers evidently represent the deceleration in its top and bottom-line growth from the pre-pandemic levels of 418.75%/287.46% and the pandemic boom of 113.99%/123.91%, respectively. However, the improvement in its profitability is astounding, from an AFFO margin of 78.12% in FY2019, 85.54% in FY2021, and finally settling at a stellar 85.9% by FY2023.

In the meantime, IIPR is expected to report revenues of $273.97M and AFFO of $231.54M for FY2022, indicating an impressive YoY growth of 33.9% and 32.3%, respectively. With $7.1 of projected dividend payout for FY2022, we are looking at an excellent dividend yield of 7.69%, compared to its 4Y average yield of 3.07% and sector median of 4.3%. Furthermore, investors that load up at current levels would also see an 8.14% yield by FY2023, assuming a 5.77% YoY increase to $7.51. Impressive indeed, negating the extreme FUD levels in the stock market.

So, Is IIPR Stock A Buy, Sell, Or Hold?

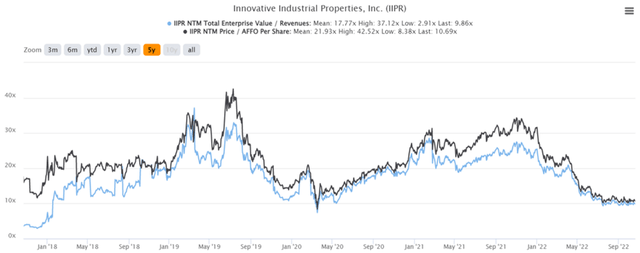

IIPR 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

IIPR is currently trading at an EV/NTM Revenue of 9.86x and NTM Price/FFO Per Share of 10.69x, lower than its 5Y mean of 17.77x and 21.93x, respectively. The stock is also trading at $92.26, down -67.96% from its 52 weeks high of $288.02, nearing its 52 weeks low of $87.47. Nonetheless, consensus estimates remain bullish about IIPR’s prospects, given their price target of $146 and a 58.25% upside from current prices.

For now, we expect IIPR to hold steady at these near-bottom levels, barring a catastrophic event ( similar to the King’s Garden episode ) plummeting the stock to $70s at its previous 2019 support levels. However, due to its improved profitability, Mr. Market may be a little more forgiving, despite certain experts expecting to see federal cannabis legalization from 2025 onwards. That is a real bummer for the stock and multiple MSOs, since many have been hoping for a sweeping legalization motion after Biden’s election in 2020.

Nonetheless, investors with higher risk tolerance and long-term trajectory may still nibble at current levels, due to the stock’s near-bottom valuations through the past five years. Cannabis is also slowly legalized at the state levels, with 46 states already allowing medical use and 32 states decriminalizing cannabis. With IIPR’s weighted-average remaining lease term of approximately 16.6 years and debts not due until 2026, we may see the stock outperform from these levels. Naturally, portfolios should be sized appropriately in the event of massive volatility, since we may be in for more pain with the Feds likely raising their terminal rates to over 5%, beyond the previous projection of 4.6%.