Beautifulblossom/iStock through Getty Photographs

We discover it stunning that Informatica’s (NYSE:INFA) story remains to be not understood by the markets regardless of remaining a frontrunner in a number of data-management associated areas.

Firm filings

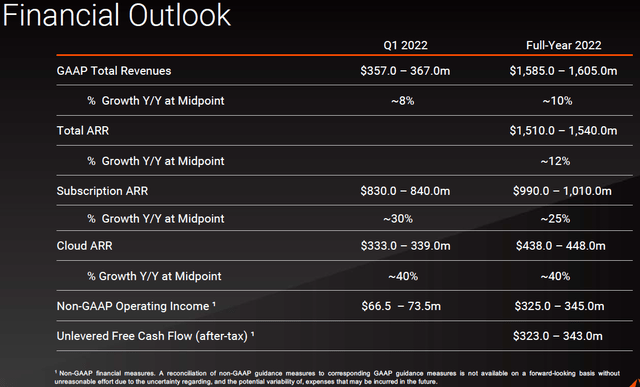

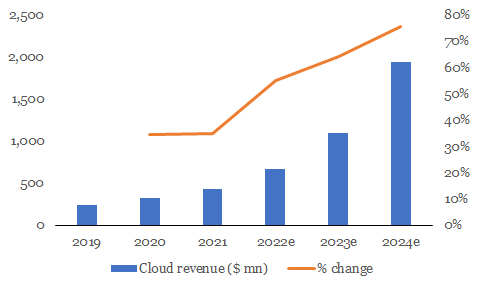

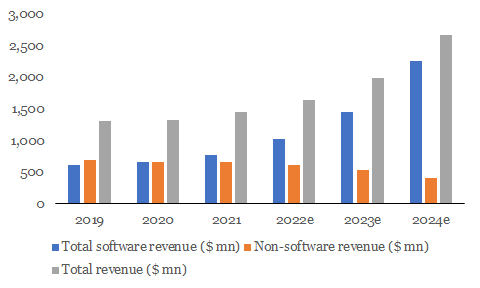

The one potential purpose for the inventory value to lag is the shortage of a giant subscription income base, which seems to be altering.

Firm filings

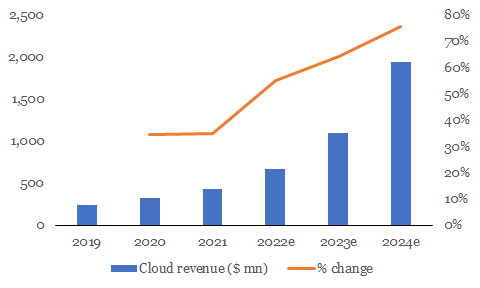

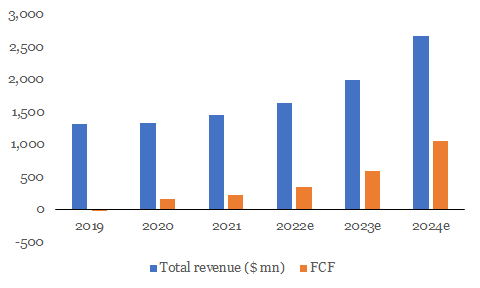

Together with the expansion in cloud income, we count on Informatica’s free money flows to considerably broaden (even forward of what the administration is projecting), making the inventory a multi-bagger.

A little bit of historical past

Informatica was a publicly-traded firm earlier than going non-public in 2015, with CPPIB as a big shareholder (who continues thus far). On the time, the ideas of cloud and subscription have been gaining traction amongst the investor group. Together with the Canadian Pension big (CPPIB), Microsoft and Salesforce had additionally invested in Informatica, presumably making an attempt to remain forward within the data-driven world.

The erstwhile board had backed the $5.3 billion deal, which was anticipated to permit Informatica to experiment with its expertise stack with out coming beneath the glare of the markets.

Informatica relisted on NYSE in October final 12 months, reaching a peak valuation of over $10.7 billion in December 2021 and presently is round $6 billion.

Enterprise mannequin

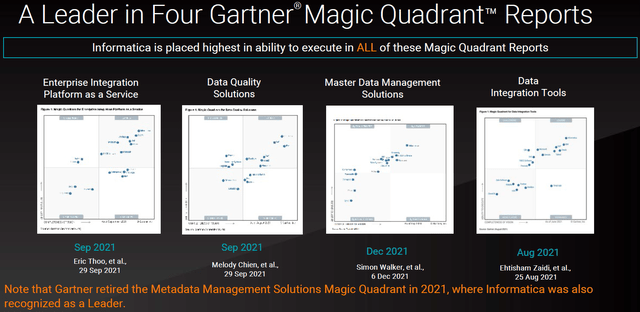

Informatica has been a long-standing chief within the enterprise information area.

Firm filings, Gartner

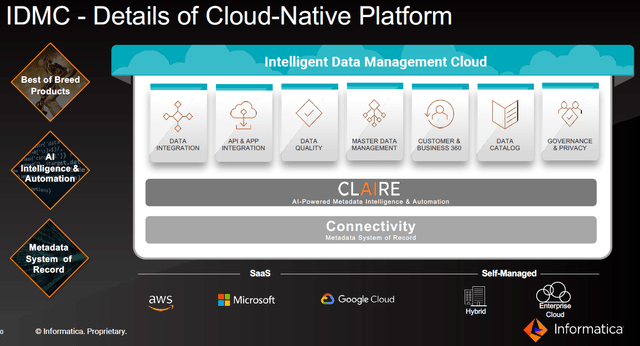

The corporate has been a pioneer in massive information and has tailored its applied sciences to create IDMC, or the Clever Information Administration Cloud.

Firm filings

IDMC helps collate, curate and correlate information throughout a corporation’s information belongings. This information and evaluation can then be used to handle person experiences, develop automation methods, and construct out analytics to deduce behavioural traits higher. This technique is much like that of Adobe’s:

Adobe was amassing person behaviour information of paying clients to grasp their wants and constructing an analytical engine on prime to assist serve extra, all with the information of employers and whereas complying with each information and privateness legislation there exists.

Supply: Adobe: Do Not Mistake This Money Move King To Be A Fallen Star

Notably, when Informatica had gone non-public, Bruce Chizen, former CEO of Adobe, had joined its board.

We additional notice, from Informatica’s filings:

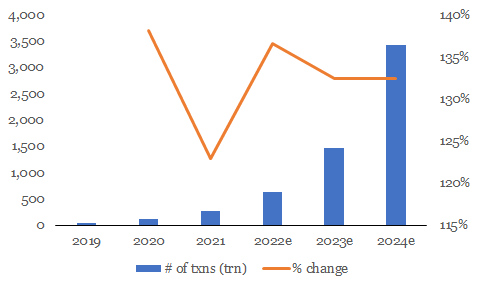

The expansion and adoption of our cloud platform has led to the variety of cloud transactions on our platform, which is a measure of knowledge processed, rising from 0.2 trillion monthly in 2015, to 16.9 trillion monthly in 2020 and to 27.8 trillion monthly as of December 31, 2021.

Supply: 10K

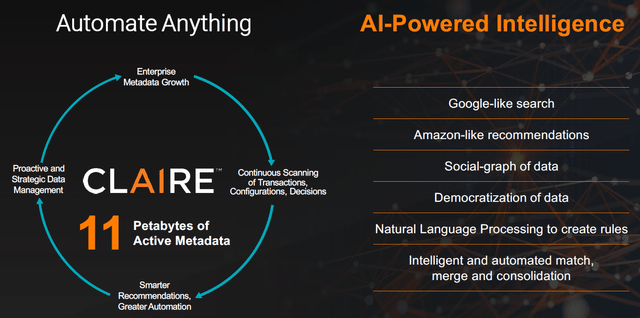

To leverage these transactions, on the coronary heart of the IDMC sits Claire or Informatica’s synthetic intelligence engine.

Firm presentation

Our cloud-native platform leverages over 50,000 metadata-aware connections that repeatedly scan our clients’ information to create wealthy and extremely contextualized metadata to create and handle a metadata system of document that acts as a single supply of reality about their information. This permits our AI engine, CLAIRE, to assist clients entry higher information quicker, make contextual suggestions about information relationships, uncover novel insights about their enterprise and automate beforehand handbook duties. As extra clients undertake our platform, CLAIRE repeatedly analyzes new transactions, configurations, guidelines, and selections and makes use of this elevated intelligence to drive additional automation and ship higher insights to our clients, which in flip we consider will proceed to speed up the adoption of our platform.

Supply: 10K

The IDMC results in a easy bifurcation of revenues: subscription (cloud), non-subscription (software program, however non-cloud) and assist.

The Firm derives its income from gross sales of 1) cloud subscriptions, representing entry to the Firm’s software program through Firm hosted cloud purposes, 2) on-premises subscription licenses, representing a time period license to on-premises software program, 3) subscription assist, representing assist for on-premises subscription licenses, 4) perpetual software program licenses, and 5) upkeep {and professional} providers, consisting of upkeep on perpetual software program licenses, {and professional} providers, consisting of consulting and schooling providers.

Supply: 10K

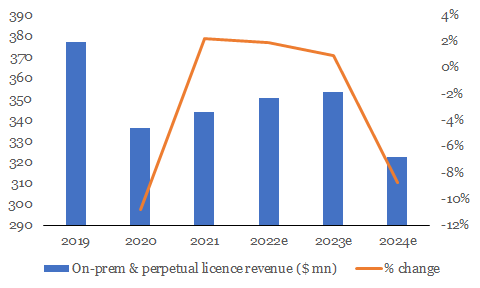

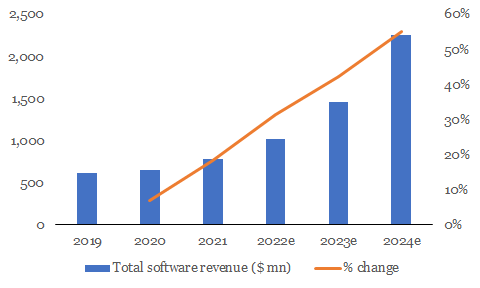

Firm filings, Creator’s evaluation Firm filings, Creator’s evaluation Firm filings, Creator’s evaluation

Whereas cloud software program ought to proceed to develop on rising transactions, non-cloud (on-prem) revenues will quickly be subsumed within the subscription enterprise mannequin.

Firm filings, Creator’s evaluation

Non-software income has been on a downward trajectory and is anticipated to say no additional. The autumn in skilled and providers income is a deliberate transfer, occurring attributable to Informatica’s rising cloud focus (and thus ARR).

Financials

We deal with the transaction volumes information supplied by the corporate and, primarily based on non-linear regression, have triangulated how the transaction volumes would have roughly grown over the previous few years. Then, we use this pattern to challenge the expansion sooner or later (we may very well be considerably conservative right here, provided that the transaction volumes ought to develop even quicker given the big quantity of knowledge the corporate manages).

Firm filings, Creator’s evaluation

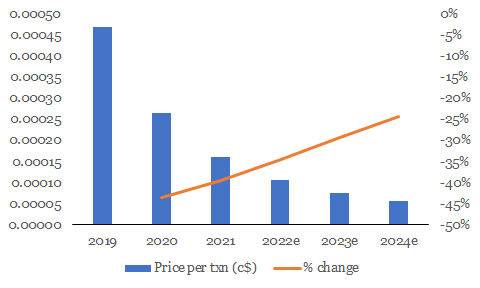

Utilizing this information, we arrive on the anticipated pricing per transaction of cloud income.

Firm filings, Creator’s evaluation

Regardless of expectations of pricing persevering with to stay weak, the quantity development ought to give a big impetus to cloud revenues.

Firm filings, Creator’s evaluation

Because the high-margin cloud income begins to dictate the trajectory of the general revenues, we expect FCF also needs to see an analogous development pattern.

Firm filings, Creator’s evaluation

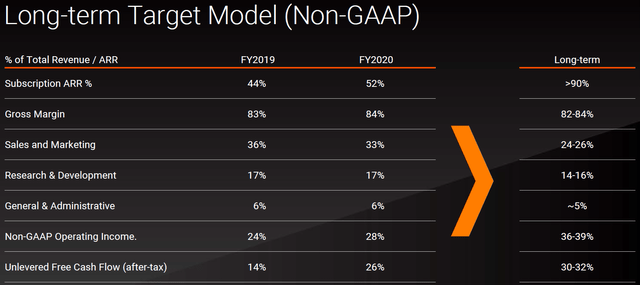

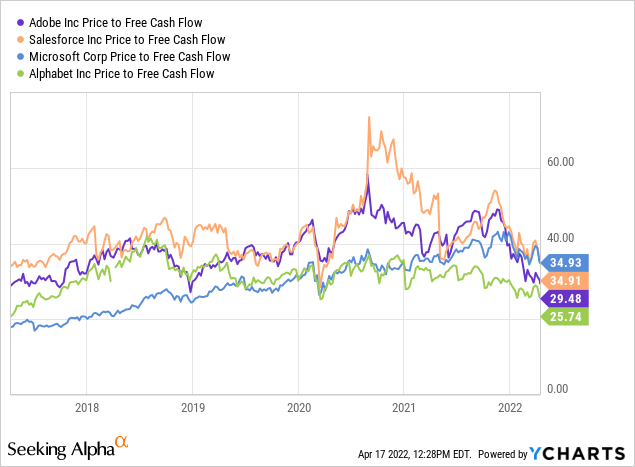

Informatica’s 2022 free money flows make it comparatively low-cost at 18x. Searching to 2023, the corporate trades at a cheap P/FCF of 10x.

Dangers

Informatica’s enterprise will be thought-about a ‘utility-type’ enterprise within the tech area, given the data-centricity within the enterprise mannequin. Whereas many of the cloud performs are on the software layer and the hyperscalers, Informatica is likely one of the few on the information layer.

The most important dangers that we envisage are:

- Challenges in execution: The transition to a subscription mannequin requires important effort, though a lot decrease than what was wanted a decade again. Nonetheless, since it’s a crucial part of our thesis, it’s value highlighting as a possible threat.

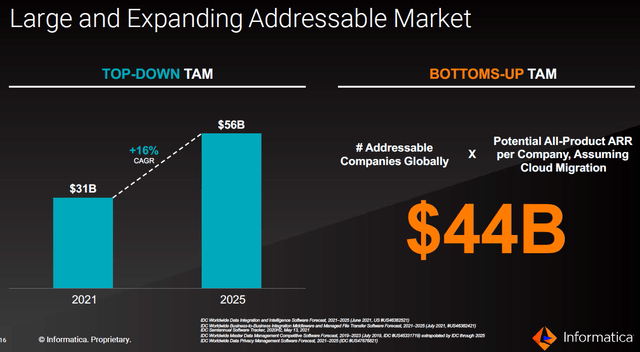

- Competitors: Along with specialised distributors, most of Informatica’s companions additionally compete with the corporate. Whereas the marketplace for Informatica is comparatively massive, a few of the hyperscalers are recognized to be a bit overzealous.

Firm presentation

- Native information laws: The pressure driving Informatica’s engine is information, which may probably scale back the effectiveness of the corporate’s AI choices if restricted by geography.

Conclusion

Contemplating Informatica’s integrations with the hyperscalers, we expect a re-rating within the firm’s valuation is imminent. As well as, Informatica’s business management in deep information administration capabilities and powerful institutional backing (CPPIB nonetheless holds c.30%) will additional assist maintain and construct upon the valuation re-rating. Because of this, we expect the inventory is considerably undervalued and may change into among the best picks for 2022.