Isaiah 1:22—“Your silver has grow to be dross, Your drink diluted with water.”

Over 700 years earlier than Christ, we learn the above indictment of Israel’s southern kingdom of Judah from the prophet Isaiah. This precept—commanding simply weights and measures and condemning dishonest scales—is reaffirmed a number of occasions all through Scripture (Leviticus 19:35-36; Deuteronomy 25:13-16; Proverbs 11:1; 16:11; 20:10, 23; Hosea 12:7; Amos 8:5; Micah 6:10-11; Ezekiel 45:10). A part of the judgment concerned the pure financial penalties of dishonest cash by way of inflationary debasement and the ensuing debasement of products supplied on the market in change for cash, specifically, foods and drinks.

The context gives each cause to imagine that, not solely have been these practices society-wide, however have been allowed and even inspired by the civil rulers (Isaiah 1:23). At greatest, they benefitted from the corruption and did nothing to cease the fraud. These fraudulent and dishonest practices had penalties that pervaded their society, particularly harming the trustworthy, the harmless, and the susceptible.

Whereas financial inflation has numerous financial results—predictable and shocking, direct and oblique—this text seeks to discover the consequences of financial inflation on meals. Particularly, debased foreign money results in debased meals and warps the construction of manufacturing such that choices and behaviors are altered.

Others have famous this connection. Isaiah noticed the connection between fraudulent silver debasement and product debasement some 2,700 years in the past! Gary North, in his financial commentary, wrote regarding Isaiah 1:22,

Verse 22 factors to the “drossification” of silver. This might discuss with silver normally, or it might have been restricted to the financial unit. In both case, the authorized problem was fraud by deception. That which was debased was circulating as one thing precious. This produced analogous outcomes. The wine was combined with water. The debasement of silver, the metallic of honesty and commerce, had led to the debasement of a consultant shopper good. Why? As a result of financial inflation is predicated on deception. This deception then turns into common as costs rise. Producers lower corners. The phantasm of top quality merchandise is maintained, simply because the phantasm of top quality cash is maintained. Within the trendy phrase, “what you see is what you get,” not utilized. What males noticed was not what they received. They knew this, which was why Isaiah used the metaphor of dross. He knew they’d acknowledge the connection. (emphasis added)

The closeness of the outline signifies a single course of, however, “What has silver received to do with wine?” Since cash is economy-wide, financial inflation can be economy-wide, affecting all types of products, providers, and decisions. Saifedean Ammous, in his The Fiat Customary: The Debt Slavery Various to Human Civilization, writes (p. 111),

Cash, being part of each financial transaction, has a pervasive impact on most points of life…. [For example, take] two specific distortions: how fiat’s incentives for elevating time desire have an effect on farmland manufacturing and meals consumption decisions, and the way fiat authorities financing facilitates an activist authorities position within the meals market by way of interventionist farm rules, meals subsidies, and dietary tips.

Praxeologically, this is sensible. As debasement or financial inflation pervades the value and manufacturing construction, worth inflation happens—altering the financial scenario for human actors, benefitting some and disadvantaging others. Producers, particularly the trustworthy—who’re additionally customers, should take into account price-costs of inputs for what they produce, and can’t merely “go on prices to customers”—are compelled right into a trilemma.

The trustworthy producer, who acknowledges he’s getting much less with the devalued cash, can 1) promote on the identical costs for devalued foreign money, be defrauded, and take a loss; or, 2) enhance costs, presumably lose prospects and market share, and open himself as much as buyer displeasure and even attainable worth management laws. Tempting the trustworthy and benefitting the dishonest, a 3rd choice presents itself—debase the product in response to the debased cash however current it as the same amount and high quality as earlier than on the identical worth. (We may make this a quadrilemma if we add shutting down manufacturing). In reality, the trustworthy are deprived—presumably even berated—ought to they continue to be trustworthy, subsequently, there’s a tendency during which the trustworthy are pushed from the market. They both grow to be dishonest or depart the market.

Worth Inflation & Meals Decisions

From the patron aspect, if we merely take into account the obvious consequence of financial inflation—worth inflation—it’s not tough to additionally see how this impacts an financial system’s meals consumption. When meals costs enhance as a result of financial inflation, customers have a couple of choices—buy much less, buy the identical quantity and sacrifice elsewhere, search cheaper substitutes, wait to buy, search exterior help, shift to house manufacturing, go into debt or draw from financial savings, dietary compromise, and so on.—however their meals decisions can not stay unaffected.

Lately (February 21, 2024), one article, titled “It’s Been 30 Years Since Meals Ate Up This A lot of Your Revenue,” supplied the next graphic documenting percentages of shopper earnings devoted to meals:

Unsurprisingly, rising shopper costs, particularly on the grocery retailer, have been arguably a serious problem within the 2024 presidential election. On this direct manner, individuals skilled the results of inflationary financial coverage on their eating regimen.

Paradoxically, even whereas rising meals costs pressure household budgets, some official inflation metrics—just like the widely-cited Core CPI—exclude meals altogether, masking the impact of inflation. Rothbard referred to as this a trick of the “financial spin medical doctors.” He recounted how, in January 1990, the price of dwelling index reached over double-digit proportions—approaching the inflationary peaks of the Nineteen Seventies—public concern was largely muted. Why was this the case?

…the financial spin medical doctors have been fast to leap to their duties. You see, in the event you take out the quickest rising worth classes—meals and vitality—issues don’t look so dangerous. Meals went up by 1.8 % in January—an annual rise of just about 22 %; whereas vitality costs went up by a minimum of 5.1 %—an annual enhance of over 61 %.

If meals is excluded, the reported inflation quantity is decrease than what individuals expertise in meals purchases. Subsequently, it’s inescapable that inflation impacts eating regimen. Conversely, how may inflation not have an effect on eating regimen? What’s measured doesn’t change what individuals eat, however what individuals can afford will.

Layering irony upon irony, when the results of financial inflation grew to become manifest in worth inflation through the Nineteen Seventies, notably in meals, Richard Nixon appointed Earl L. Butz to function secretary of the US Division of Agriculture partially to handle meals worth will increase by way of central planning.

Growing meals costs—largely because of the unrestrained financial inflation that adopted 1971—have been changing into a political drawback. Making an attempt to convey down meals costs through extra inflation, subsidies, cronyism, and bureaucratic administration, Butz instructed farmers, “Get large or get out.” Artificially low rates of interest flooded farmers with capital to extend productiveness, successfully squeezing out smaller farmers and consolidating remaining farmers. Whereas this did lead to decrease meals costs, it was not the end result of a free market however of government-managed manufacturing and distortion. Saifedean Ammous, once more, explains (pp. 113, 114),

As costs of extremely nutritious meals rise, persons are inevitably compelled to exchange them with cheaper alternate options. Because the cheaper meals grow to be a extra prevalent a part of the basket of products [used in core CPI], the impact of inflation is discreet….

By subsidizing the manufacturing of the most affordable meals and recommending them to People because the optimum parts of their eating regimen, the extent of worth will increase and foreign money debasement is much less apparent.

By flooding the meals system with low cost, sponsored energy, the federal government masks actual inflation whereas shaping shopper habits. Artificially-subsidized meals—when included within the “basket of products” used within the principally meaningless Client Worth Index (CPI)—seems to scale back worth inflation. People, nevertheless, are successfully pushed away from and towards meals decisions they in any other case wouldn’t have made as a result of sure meals are taxed and others are sponsored.

“Worth rises don’t elicit equal will increase in shopper spending; they convey about reductions within the high quality of consumed items” (p. 113). Customers are pushed to artificially cheaper, sponsored, and fewer nutritious meals alternate options. Wealth appears to be rising—and there have been historic wealth will increase due to real manufacturing alongside synthetic development—however it’s largely farcical. Whereas weight problems was seen as a sign of wealth, now it’s arguably the other: “weight problems is definitely an indication of malnutrition.” Simply as fiat inflation impoverishes whereas giving the impression of elevated wealth, weight problems appears to symbolize abundance when it’s truly a type of malnutrition. In different phrases, “your wine has grow to be water” (Isaiah 1:22).

Shrinkflation & Skimpflation

On the producer aspect, many have observed—whether or not anecdotally or in any other case—the phenomenon generally known as “shrinkflation.” In explaining financial principle and inflation to highschool seniors, I requested for a pupil to provide a bag of chips and maintain it up (there was by no means a category that didn’t have one). I might instruct the scholar to make use of two fingers to pinch close to the highest of the bag and run them down—exhibiting all of the air—till they lastly hit the chips. This was one illustration of how inflation impacts merchandise, particularly meals. Some vigilant observers have chronicled examples.

Jeff Degner in his Inflation and the Household—the place he traces the impacts of financial inflation’s impression on marriage and the household—develops this level a bit additional in a footnote (p. 81, n12),

There may be proof that the ancients additionally acknowledged a connection between debasement, inflation and meals high quality. The Jewish prophet Isaiah (1:22, King James Model) declared, “Thy silver is grow to be dross, thy wine combined with water.” If taken actually, the prophet appears to establish what trendy economists have referred to as “shrinkfation” or a decreasing of the standard of meals in response to a lowered high quality of cash that’s related to debasement and inflation together with declining well being outcomes and life expectancy. Certainly, the US has not stored tempo with the remainder of the OECD nations with respect to life expectancy will increase, and has even begun to say no in recent times, a scenario that many blame on low high quality meals merchandise. See Avenado and Kawachi (2014) for believable meals high quality hyperlinks together with different options of the inflation tradition and their impression on mortality and morbidity outcomes within the US…

Shrinkflation is maybe the only and most literal type of this course of—smaller portions are supplied for a similar or elevated costs. Not solely do costs have a tendency to extend, however the financial unit actually purchases much less. The producers, in response to the financial debasement and elevated worth inflation, discover intelligent methods to scale back the product—presenting it as the identical quantity—lest they merely settle for being defrauded.

When it comes to meals high quality and vitamin, Degner, once more, highlights a attainable connection between financial coverage and reproductive well being,

As for any connection between organic actuality and expansionary cash provides, this may at first look appear to be a tenuous connection. Nonetheless, it has just lately been steered that inflationary financial coverage degrades the standard of meals and vitamin (Ammous 2021), which can in flip impression reproductive well being. Certainly, eating regimen, vitamin, and meals safety are among the many elements that healthcare specialists name the “social determinants of well being.” These have been proven to impression fertility, maternal morbidity, and mortality, all of which counsel that the position of worth will increase in issues of eating regimen, well being, and dwell births shouldn’t be dismissed out of hand as irrelevant or trivial (Kozhimannil et al. 2019). (p. 81)

Mental Debasement and the Interventionist Paradigm

Many have famous the consequences of meals worth inflation on well being and well-being, particularly amongst essentially the most susceptible. Nonetheless, misunderstanding the causal chain between financial coverage and worth inflation, and never understanding the causal penalties of a long time of presidency interventions, the issue is normally misdiagnosed and the would-be options are counterproductive. Even recognizing the failure of previous and present authorities interventions, many function inside a paradigm the place the one reply is to name for extra authorities intervention.

For instance, in “How inflation is hurting the diets of low-income People” we learn, “Regardless of authorities packages encouraging and subsidizing wholesome meals, the issue is barely rising.” The interventionist mindset will even acknowledge authorities failures—whereas “encouraging and subsidizing wholesome meals,” they admit “the issue is barely rising”—however will nearly inevitably name for extra intense authorities intervention to handle the issue. The identical article continues, “As a lot as these advocacy and subsidy packages assist, the downward development in wholesome consuming is pervasive. Inflation makes purchasing for wholesome meals tougher however not unattainable. It’s about habits as a lot as worth tags.” In different phrases, the federal government interventions assist and the issue is worsening concurrently.

One other examine, “Meals inflation and youngster undernutrition in low and center earnings nations” argues, “This proof gives a robust rationale for interventions to forestall meals inflation and mitigate its impacts on susceptible kids and their moms.” To be truthful, the authors may imply healthcare “interventions” somewhat than authorities interventions, however it’s uncommon to learn any articles that don’t name for an rising position of the state.

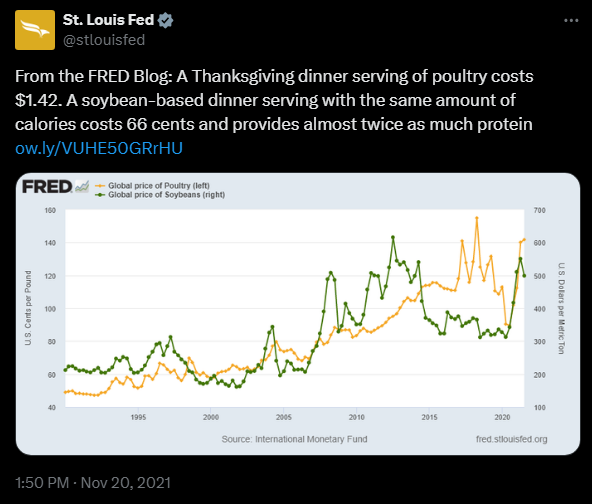

Sound economics is important to appropriately diagnose the issue and to acknowledge and keep away from false options primarily based on misdiagnoses. And, if the reader just isn’t but satisfied that the Fed—as a central banking establishment—has any curiosity in intervening in your eating regimen, see the next pre-Thanksgiving tweet from the St. Louis Fed (for which I’m indebted to a earlier Mises article):