m_a_n

Investment Thesis: Hyatt Hotels Corporation could see further upside due to rising RevPAR and earnings.

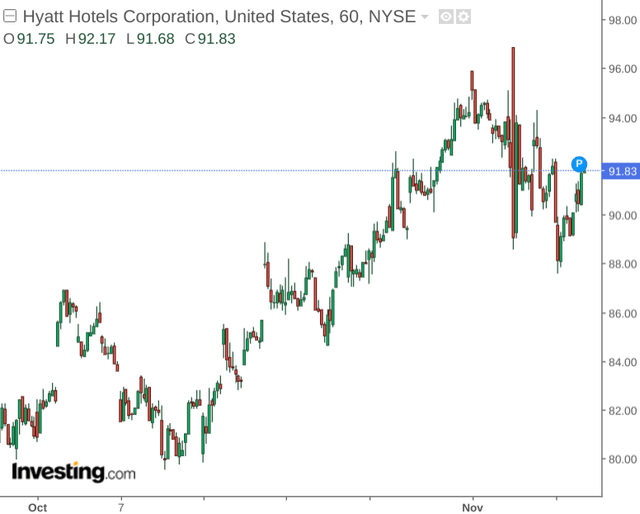

In an article last month, I made the argument that Hyatt Hotels Corporation (NYSE:H) could see further upside going forward – as a result of a strong financial position as well as a continuing rebound in luxury travel demand.

The stock has rallied since, up by nearly 10% since my last article:

investing.com

The purpose of this article is to evaluate whether further upside could exist for the stock, taking most recent financial results into consideration.

Performance

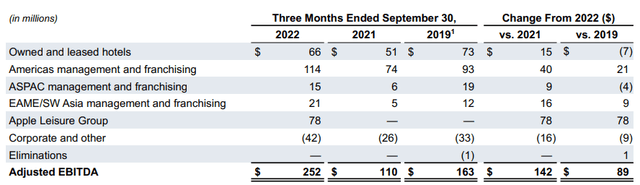

For Q3 2022, it is notable that Hyatt Hotels Corporation has seen its total fee revenue exceed 2019 levels by 50%, along with earnings across the Americas management and franchising having exceeded 2019 levels and owned and leased hotels nearing levels seen that year once again:

Hyatt Hotels Corporation: Third Quarter 2022 Results

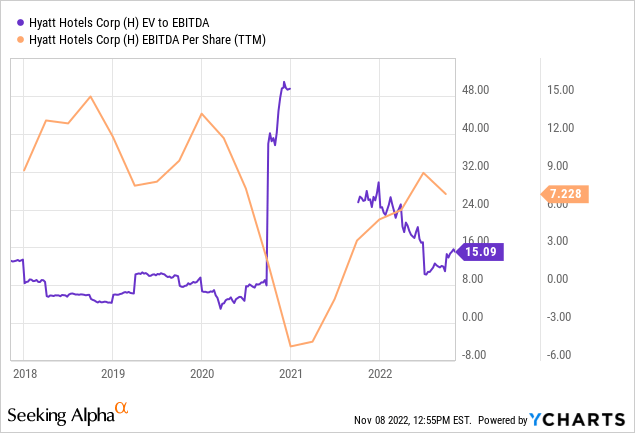

Moreover, net income per share was up to $1.46 on a nine-month basis for Q3 2022 as compared to 2021. While net income had decreased from $1.17 in Q3 2021 to $0.25 in Q3 2022, this was largely due to gains on sales of real estate accounting for the higher quarterly figure in 2021.

Hyatt Hotels Corporation: Third Quarter 2022 Results

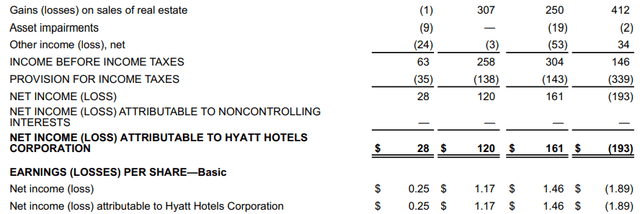

When looking at the company’s historical EV/EBITDA – we can see that earnings have just about rebounded to levels seen pre-2020, while the EV to EBITDA ratio is slightly higher than pre-2020 levels.

ycharts.com

In this regard, while the stock may be slightly more expensive than pre-2020 levels, there is a possibility that we could see Hyatt Hotels start to trade at an attractive value if earnings growth continues going forward.

In terms of the company’s balance sheet, I had previously pointed out in my previous article that Hyatt’s quick ratio (calculated as current assets less inventories all over current liabilities) had risen significantly over the past six months, indicating that the company was in a better position to service its current liabilities:

| Dec 2021 | Jun 2022 | |

| Current assets | 2062 | 2892 |

| Inventories | 10 | 8 |

| Current liabilities | 2232 | 2411 |

| Quick ratio | 0.92 | 1.20 |

Source: Figures sourced from Hyatt Hotels Corporation Quarterly Report For The Year Ended June 30, 2022. Figures provided in millions of dollars, except the quick ratio. Quick ratio calculated by author.

For the most recent quarter, we can see that the quick ratio is back down to 0.89, which is just slightly below the level seen last December:

| Dec 2021 | Sep 2022 | |

| Current assets | 2062 | 2634 |

| Inventories | 10 | 9 |

| Current liabilities | 2232 | 2957 |

| Quick ratio | 0.92 | 0.89 |

Source: Figures sourced from Hyatt Hotels Corporation Quarterly Report For The Year Ended September 30, 2022. Figures provided in millions of dollars, except the quick ratio. Quick ratio calculated by author.

While investors would ideally like to see the quick ratio rise above 1 once again – I take the view that a quick ratio at the current level will remain appropriate so long as Hyatt Hotels is showing strong growth in revenues and earnings.

Additionally, long-term debt to total assets has decreased over the same period, which is encouraging:

| Dec 2021 | Sep 2022 | |

| Long-term debt | 3968 | 3150 |

| Total assets | 12603 | 12402 |

| Long-term debt to total assets ratio | 0.31 | 0.25 |

Source: Figures sourced from Hyatt Hotels Corporation Quarterly Report For The Year Ended September 30, 2022. Figures provided in millions of dollars, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

Looking Forward

Going forward, I take the view that Hyatt Hotels Corporation continues to be in a good position to capitalise on a rebound in luxury travel, with demand remaining strong in spite of inflationary pressures.

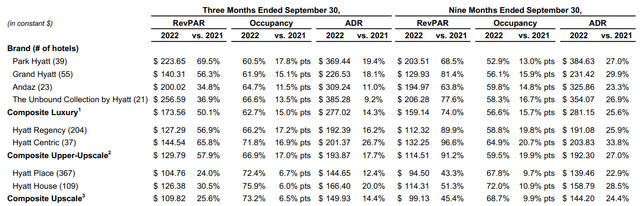

Additionally, when analysing the hotel’s ADR (average daily rate) and RevPAR (revenue per available room) by brand, it is notable that both the Park Hyatt and The Unbound Collection by Hyatt, both with the highest ADR or $369.44 and $385.28 respectively for 2022, also showed the highest RevPAR of $223.65 and $256.59.

Hyatt Hotels Corporation: Third Quarter 2022 Results

This indicates that Hyatt’s luxury brands have been able to increase prices across their luxury room offerings while continuing to see revenue growth. Should this trend continue, then I take the view that the company is well poised to thrive in an inflationary environment. While inflation and a temporary decline in demand due to seasonal factors remain a risk, I take the view that the stock should continue to have longer-term upside overall.

Conclusion

To conclude, Hyatt Hotels Corporation has seen strong growth in RevPAR and earnings. While inflation and a potential slowdown in macroeconomic activity remain risk factors, I take the view that the stock could have further long-term upside from here.