gleitfrosch/iStock through Getty Pictures

Thesis

How low can a inventory go? How low cost can a valuation be? HUYA (NYSE:HUYA) inventory is down 41% YTD and 90% from February 2021 ranges. The corporate is now buying and selling at destructive $650 million enterprise worth. such a valuation, an investor wonders: What’s the market considering?

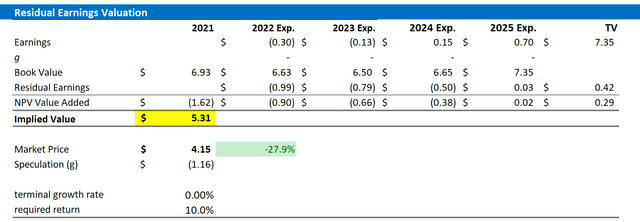

On this article I’ll have a look at HUYA’s fundamentals and construction a residual earnings framework to worth the company-based on analyst EPS consensus, no terminal worth development, and a ten% WACC. I conclude my valuation with a purchase advice and a $5.31/share goal value.

About HUYA

HUYA is without doubt one of the main reside streaming platforms in China. Because the No.1 streaming platform for gaming, HUYA usually hosts e-Sports activities occasion organizers and collaborates with main recreation builders and publishers. As well as, HUYA has additionally expanded streaming providers to different leisure genres, corresponding to expertise reveals, anime and out of doors actions. HUYA claims to have China’s largest, most energetic and most engaged online game live-streaming user-base with a MAU of 81.9 million and energetic paying customers of 5.9 million. Monetization of the platform relies on three primary drivers: promoting (1), fee charges from gifting/tipping (2), and paid subscription providers (3). HUYA was established 2014 as a spin-out from YY-live. Tencent is the corporate’s largest shareholder and holds majority of the voting rights.

Financials

Though HUYA is presently buying and selling like a no-growth worth firm, the corporate has loved sturdy development previously. Revenues grew from $705 million in 2018 to $1,760 million in 2021, representing a 3-year CAGR of 61%. Furthermore, HUYA has been worthwhile since 2019. In 2021, the corporate achieved net-income of $36 million. Buyers ought to observe, nonetheless, that HUYA recorded reducing profitability ever since 2019 (8% web revenue margin in 2019 vs 2% in 2021). Money supplied by operations was $50 million.

The primary argument for investing in HUYA is probably going based mostly on the corporate’s stability sheet. As of Q1 2022, the corporate is holding $1,652 million of money and money equivalents and solely $12 million of debt. Thus, referencing a market capitalization of 988 million, HUYA is buying and selling considerably beneath money. The query is: Will shareholders get one way or the other entry to the corporate’s the net-cash place, earlier than the treasure is consumed by losses?

HUYA’s Q1 was barely above analyst consensus, and in my view, extremely optimistic given the difficult macro-environment.

Listed below are the highlights as offered by the corporate

- Complete web revenues for the primary quarter of 2022 had been RMB2,464.6 million (US$388.8 million), in contrast with RMB2,604.8 million for a similar interval of 2021.

- Web loss attributable to HUYA Inc. was RMB3.3 million (US$0.5 million) for the primary quarter of 2022, in contrast with web revenue attributable to HUYA Inc. of RMB185.5 million for a similar interval of 2021.

- Non-GAAP web revenue attributable to HUYA Inc. was RMB46.6 million (US$7.4 million) for the primary quarter of 2022, in contrast with RMB265.9 million for a similar interval of 2021.

- Common cell MAUs of HUYA Reside within the first quarter of 2022 elevated by 8.5% to 81.9 million from 75.5 million in the identical interval of 2021.

- Complete variety of paying customers of HUYA Reside within the first quarter of 2022 was 5.9 million, in contrast with 5.9 million in the identical interval of 2021

Valuation

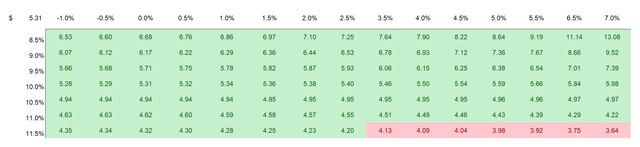

I imagine a reduced earnings framework is one of the best valuation methodology to problem the share value of a low/no development asset corresponding to HUYA. That mentioned, I’ve constructed a Residual Earnings framework based mostly on the EPS analyst consensus forecast till 2025, a conservative WACC of 10% and a TV development price equal to zero. I’ve additionally enclosed a sensitivity evaluation based mostly on various WACC and TV development mixture, so traders can worth HUYA based mostly on the state of affairs that greatest displays their basic view. For reference, pink cells indicate an overvaluation, whereas inexperienced cells indicate an undervaluation as in comparison with HUYA’s present valuation.

Primarily based on the above assumptions, my valuation estimates a fair proportion value of $5.31/share, implying that the inventory is roughly 30% undervalued. Furthermore, traders ought to observe that the majority of HUYA’s worth relies on the corporate’s present web cash-position. There’s nearly no added worth from future EPS. That mentioned, if the corporate had been capable of finding again to 2019 net-income profitability margins of 8%, the truthful valuation would leap simply to above $10/share.

Analyst Forecast, Writer’s Calculation Analyst Forecast, Writer’s Calculation

Draw back dangers

Though I discover HUYA inventory engaging at destructive enterprise worth, the funding is excessive danger, in my view. Particularly, traders ought to observe the next draw back dangers: First, a major financial slowdown in China, as a result of Covid-lockdowns, actual property disaster and inflation, may considerably influence HUYA customers’ willingness to tip. Secondly, the gaming trade in China is considerably uncovered to elevated regulatory danger. Within the firm’s Q1 report, HUYA famous:

On Could 7, 2022, the PRC authorities issued the Opinion on Reside Streaming Digital Gifting and Enhancing the Safety of Minors (the “Opinion”). The Opinion stipulates that web platforms shall, amongst different restrictions, (i) inside one month of the publication of the Opinion terminate all billboard capabilities that rank customers or broadcasters by the quantity of digital items that they ship or obtain, respectively, (ii) prohibit sure interplay and engagement capabilities between 8:00 p.m. and 10:00 p.m. day-after-day, and (iii) prohibit minors from buying digital items.

Third, HUYA’s enterprise operations presently don’t have any/nearly no profitability margin. If the pattern continues, HUYA will destroy firm and market worth. Forth, the live-streaming trade in China is extremely competitive-with DouYu (DOYU) and Bilibili (BILI) being main gamers. Fifth, a lot of HUYA’s share value is presently pushed by investor sentiment in direction of danger belongings, ADRs, and China equities. Thus, traders ought to intently monitor the market sentiment when taking shopping for/promoting choices for the inventory.

Conclusion

HUYA’s destructive 600 million destructive enterprise worth is simply too engaging to disregard. It’s true that the corporate is going through a number of challenges, together with financial slowdown in China, sturdy regulatory headwinds and lack of profitability. I do imagine, nonetheless, that HUYA will finally discover again to profitability and the corporate will thus not solely have the stability sheet worth, but in addition added NPV worth from earnings. That mentioned, I really feel HUYA’s present valuation is unnecessary and I give HUYA a Purchase/excessive danger advice with a base-case goal value of $5.31/share.