winhorse/iStock Unreleased via Getty Images

HSBC logo (HSBC)

Investment thesis

Our long line of Buy stances on HSBC (HBSC) has paid off lately. The last buy call was in our article of 17th of November titled “ Benefits From Higher Interest Rates But The Share Price Stays Put”.

HSBC’s total return is up 40% since our last analysis (SA)

Although the stock had gone nowhere by November last year, it has certainly done well since. The share price is up 34% and the total return is 40%, which is not bad in half a year’s time.

Let us look at how HSBC did in Q1 this year and their prospects going forward.

Is it still a Buy, or do we need to revise our stance?

First Quarter 2023 Financial Results

On the top line, constant currency revenue increased by 36% from $14.8 billion to $20.2 billion on a Q-o-Q basis.

When we look at the reported net profit attributable to shareholders in Q1 it came in at $10.33 billion, This was 136% higher when compared against the $4.38 billion they posted in Q4 of last year.

The large difference mainly comes from a reversal of an earlier impairment of $2.1 billion related to the bank’s planned sale of the retail banking operations in France. It is now less certain if this transaction is going to take place. In addition, it also included a provisional gain of $1.5 billion from the acquisition of Silicon Valley Bank UK Limited in March 2023.

Net fees were stable, but net income from financial instruments held for trading, or managed on a fair value basis, saw a big jump of 52% from $2.7 billion to $4.1 billion.

The net income from interest rates was also stable Q-o-Q at $9 billion. The NIM was only 1 basis point higher at 1.69%. This is considerably lower than the smaller bank DBS Group (OTCPK:DBSDY) which had a NIM of 2.12% in Q1. We are of the opinion, that DBS’s NIM might not be sustainable, while HSBC’s NIM is more likely to stay close to the present level.

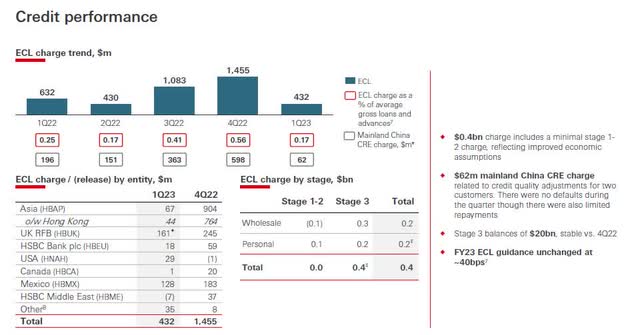

Whenever we face any economic setbacks like what we do see now, we are always concerned about the quality of the bank’s loan book. HSBC’s expected credit losses and other credit impairment charges were $0.4 billion in Q1, which reflects the bank’s view that they see a more favorable business environment and a change in the probability weightings of economic scenarios.

HSBC’s credit performance in Q1 of 2023 (HSBC 1st Quarter 2023 Financial Results Presentation)

To ensure that HSBC never faces the same fate as Silicon Valley Bank did, we want to see the bank have a high enough common equity tier 1 capital ratio.

As of the end of Q1, HSBC had a CET-1 ratio of 14.7%. That was 0.5% higher than the previous quarter, mostly driven by capital generation net of the dividend accrual, and included about 25bps impact from the reversal of the impairment on the planned sale of the retail banking operations in France.

The constant currency operating expenses in Q1 of 2023, excluding notable items, were $7.53 billion, which was slightly lower than the $7.80 billion from Q4 of last year. As such, the higher revenue and lower operating expenses bode well for reigning in costs to revenue.

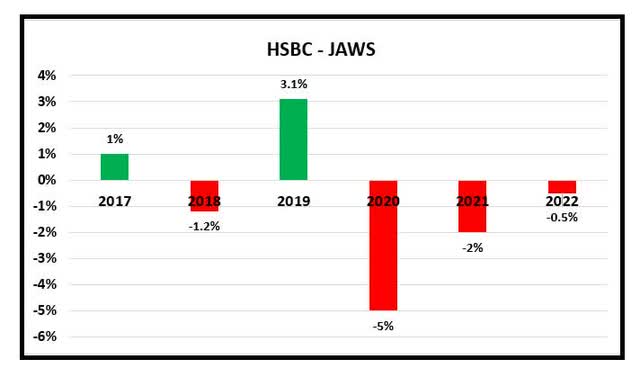

In the past, we have had some concerns regarding their ability to control costs. Previous management reported JAWS, which is the difference between the growth in revenue and the growth of costs. Ideally, you want to have an increase, but this has proven difficult.

We were pleased in November last year when we did see a positive trend moving in the right direction.

Since costs can be lumpy and vary from quarter to quarter, we need to look at JAWS on a Y-o-Y basis. Here is an update on HSBC’s JAWS;

HSBC – JAWS (Data from HSBC. Graph by TIH)

The trend is positive, but it is still negative JAWS. Ideally, we should see a positive JAWS, meaning that the growth in revenue is higher than the growth in costs.

Returning capital to shareholders

This has been a hot topic for the bank over the last few quarters.

It is well known that one of their largest shareholders, Ping An Insurance Group of China (OTCPK:PNGAY) has tried to get HSBC to separate their Asia business from the rest. The reason is simply that about 70% of the profit comes from Hong Kong, and it was the Bank of England that forced HSBC, headquartered there, to stop dividend payments during the pandemic.

This split is not going to happen anytime soon. Ping An Insurance also wanted HSBC to distribute more dividends, and they were not alone in requesting this.

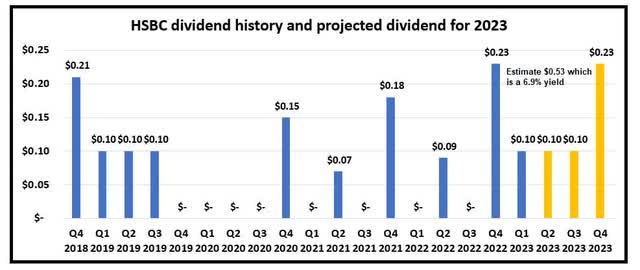

Under this pressure, the board of HSBC agreed to restart the quarterly dividend payments from 2023 and do have plans to increase the payout ratio from 40% to 50% in 2023 and 2024. A special dividend will also most likely be paid out once the sale of the consumer banking unit in Canada is complete, which now is expected to be completed in Q1 of 2024.

Here is the dividend history and our projection for the balance of the year.

HSBC’s dividend history and our projection for 2023 (Data from HSBC, graph by TIH)

Bear in mind that the ADR trading on NYSE consists of 5 ordinary shares.

The bump in dividends, which based on our projection will yield almost 7%, and based on our average price will give us a yield of 7.7% in 2023.

On top of this, the board has authorized the management to buy back shares of up to $2 billion.

What we do not understand is their timing on these buybacks. During last year, the stock was trading between HKD 40 and the low HKD 50’s, but management did not at that time want to do any share buybacks.

Let us see if the share price can get back up to its glory days, pre-GFC of 2008:

HSBC – share price since 2000 (Yahoo Finance)

Business Prospects and Risk to the Thesis

HSBC is now more focused than it was in the past and executing the various moves that should improve its ROE and profitability in general.

As usual, we like to look at a company’s ROE as a proxy for how profitable it is and how well they allocate its capital. We have earlier pointed out that their ROE, which was 9.9% in 2022 was on the low side.

With ROE being as high as 19.3% in Q1, their target of at least 12% for 2023 should be well within reach.

As with other business ventures, as long as they deliver excellent services and a good value proposition to their customers, more business will come their way. In the past, they do not have a particularly good reputation as being the best bank relating to customer service and delivering value.

According to an article in March last year in Retail Banker International, HSBC only came in as the 11th best bank in terms of being a bank that a customer would recommend to their friends.

In Hong Kong, they may have a better standing, although we do not see any similar research being done on customer satisfaction. A recent study by Statrys, which is an Asia-based payment platform, puts HSBC on the top of their list of banks in Hong Kong. There are pros and cons, as with most companies. The cons were HSBC’s higher fees and difficulties for customers to solve issues they had with the bank.

There is a lot of room for improvement here.

One main risk for the bank is to find a balance between two powers. They get pulled by the U.K. and by China.

Geopolitical tension between China and the West does not seem to be getting much better. We do see improvements in China’s relationship between Australia and some European countries, but there could be events taking place, such as a peaceful, or not, resolution with Taiwan, that could be problematic for HSBC.

Valuation

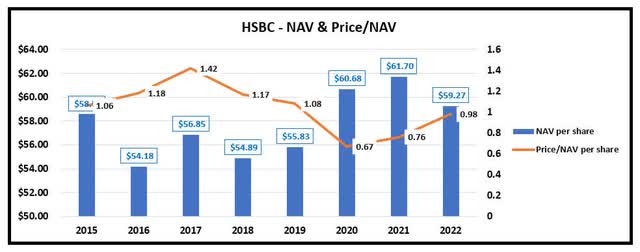

For us, one way to look at the company as a value stock is to see if the company’s stock is trading at an attractive, or at least a fair, price in relation to its net asset value.

HSBC’s NAV and price to NAV per share (Data from HSBC. Graph by TIH)

In the five years directly preceding the pandemic, HSBC was trading with a price/NAV in the range of 1 to 1.5 which we think is fair value but not particularly attractive.

However, as we can see, the bank has been able to bring the NAV per share up over the last few years. This has made the price to NAV more attractive.

We use this also to assist us in looking for an opportune time to buy into the company. The year 2020 was a good year, not only for entering HSBC but many other companies. Our point is that when we are not sure what action we want to take, we can often find the answer from the data points. This can make decision-making easier.

Conclusion

In our earlier analyses of HSBC, we stated that “another potential catalyst for a higher share price will be a more shareholder-friendly dividend policy”.

It seems that the market has responded by pushing up HSBC’s share price, as we earlier stated.

It is our opinion, that providing they are able to execute on some of their goals, and at the same time hold the three interim dividends at $0.10 per quarter with slowly growing Q4 dividends, more investors will want to get in on what is an attractive dividend yield.

If there is such a thing as a “fair price” we would say that HSBC should be worth HKD 75 per share which would still yield 5.5% based on the HKD 4.15 we estimate they will distribute for this year. That is competitive with all other large banks.

As such, we maintain our Buy stance.