Roberto Galan

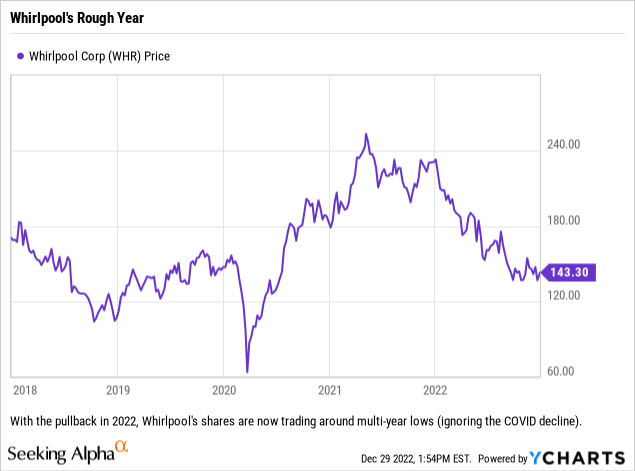

Whirlpool (NYSE:WHR) has been a name that we have liked for years, and for those who have held it for a few years (prior to the current year) then you know all about the good times with this name. When the housing market is decently strong and the economy is moving forward with little to no headwinds, Whirlpool is a stock that can, at times, provide some decent outperformance for one’s portfolio. Add in the fact that the company has a strong dividend history and a very favorable total return picture begins to emerge.

It is no secret that we like Whirlpool for a long-term hold, as we have covered it twice this year already. In the first article, we discussed why it made sense for Warren Buffett to purchase the company, and in the second, we discussed the bolt-on acquisition of Emerson Electric’s (EMR) InSinkErator business. Long-term this company is built to survive, but right now it is painful to own and a total drag on performance. No need to worry, though, because we have a trade for the new year that we think makes Whirlpool a compelling component for both growth and income portfolios.

So What Is The Trade?

Whether one already owns Whirlpool or wants to add exposure to the name, we think that looking to the options market makes sense here. As many of our readers know, we are not extremely optimistic about 2023 and see a number of headwinds, but we do think that most of the pain of this pullback has already been experienced in 2022. This is why we think that the January 19, 2024 maturity date makes sense for selling covered calls.

Specifically, we like the January 19, 2024 Calls with a strike price of $180/share. By selling a covered call here, with the stock at $142.88/share, you leave yourself $37.12/share of upside, or nearly 26% upside, while also locking in an option premium of around $8.40/share, or 4.67%.

Why Do We Like The Trade?

We like this trade for a few reasons. First, this strike price provides a decent amount of ceiling for us to profit (basically 26%) off the shares if we are incorrect in what we expect to be at best a sideways year for the market. The argument can be made that you could utilize a lower strike price, and for some investors that might work, but we like the idea of keeping most of the potential gains we believe a stock to have for ourselves.

The option premium is also key here. It provides a 4.67% yield at these prices, which is pretty close to Whirlpool’s dividend yield. The roughly $8.40/share in cash received, or $840 total per contract, covers some of the potential downside on the stock, which is also a bonus.

Lastly, the stock pays a dividend of $7.00/share per year. The sale of this specific option could result in an investor being able to collect the entirety of the annual dividends due to the timing of Whirlpool’s last quarterly dividend ex-date (historically around the middle of November), which this year was November 17, 2022. Even if the call is trading a bit above the strike price around this date, unless it is worth exercising the option at that time (two months early) then you will get to claim that dividend too. Having an option worked out before maturity happens, usually with about a month to go from experience, but the option would have to be in the money a decent amount and the dividend worth claiming.

In total, the trade can potentially deliver a total return for investors of roughly 35.55%, when combining the potential capital gain, the option premium, and the dividends (assuming all are collected before a potential call). If the shares are not called, then the investor gets the dividends and option premium and would have 4.67% of outperformance on the position.

Final Thoughts

This all boils down to where one thinks that Whirlpool trades in 2023 and the first few days of 2024. We believe this option premium does the job in paying us to stick around and cuts what we see as the potential downside in the stock in half.

There is the argument to be made that if one is not extremely bullish on the next 13 months or so, then why not grab more premium and give up more upside, and we cannot argue with that logic. We actually did look at the January 19, 2024 Calls with a strike price of $170, which has you give up about 600 basis points of capital gains upside (potential) to get an extra almost 200 basis points of option premium. Not horrible, but you only get about 19% of potential upside from current prices and as we said before, we like to attempt to set up a trade such as this to capture most of any potential gain and treat the option premium as a bonus. Still, giving up 600 basis points of potential gains, which are only given up if the stock rises more than ~19%, to pocket 200 basis points of return today is compelling.

With the volatility in the market over the last few weeks, investors might do well to look at their portfolio to see if trades such as this make sense.