Revealed on October twentieth, 2025 by Bob Ciura

Lengthy-term traders seeking to construct sustainable wealth over time, ought to contemplate dividend development shares.

Excessive-quality dividend development shares are likely to pay rising dividends year-after-year. This implies a increase for traders yearly. However the investor must do virtually nothing to get their annual increase.

The one “work” required is to carry your dividend development shares as long as they proceed to develop your revenue.

Annual dividend will increase compound over time. The longer the time horizon, the better your elevated revenue for purchasing and holding.

We view the Dividend Aristocrats as among the many finest dividend shares to buy-and-hold for the long term.

You possibly can obtain the total Dividend Aristocrats listing, together with necessary metrics like dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

Disclaimer: Certain Dividend just isn’t affiliated with S&P International in any means. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Certain Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the data on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official data.

The securities you choose in your purchase and maintain eternally dividend development portfolio matter.

Fortuitously, eye-popping return numbers aren’t wanted for long-term wealth creation. Persistently stable returns over longer durations of time can create very passable outcomes.

This text will focus on 10 of one of the best Dividend Aristocrats in the present day for long-term wealth creation.

Desk of Contents

The desk of contents beneath permits for simple navigation. The shares are listed by annual anticipated returns, in ascending order.

Wealth Creation Inventory #10: Coca-Cola Co. (KO)

- Annual Anticipated Returns: 9.7%

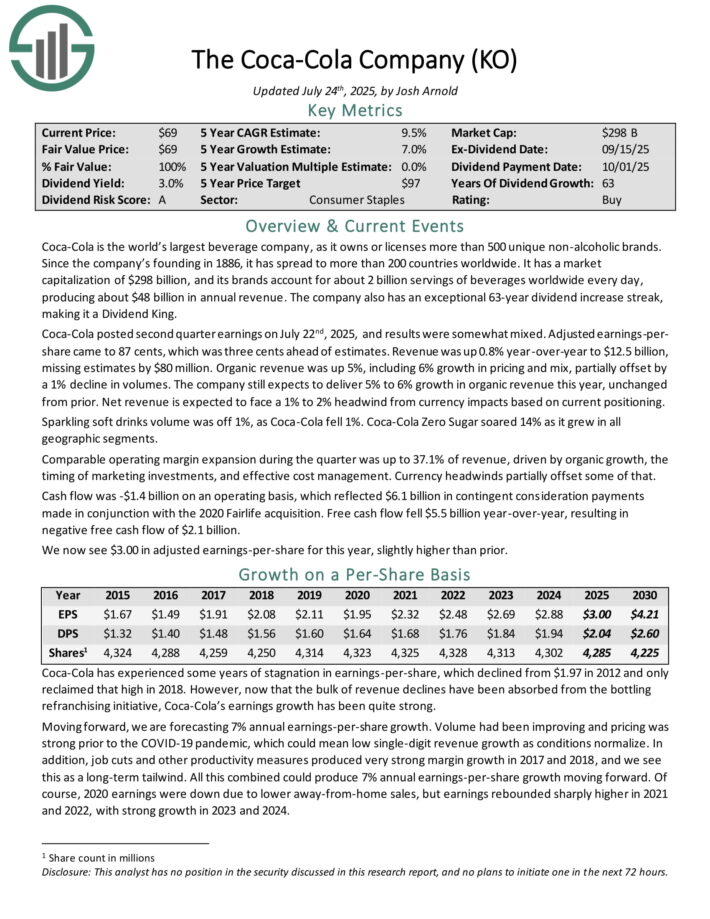

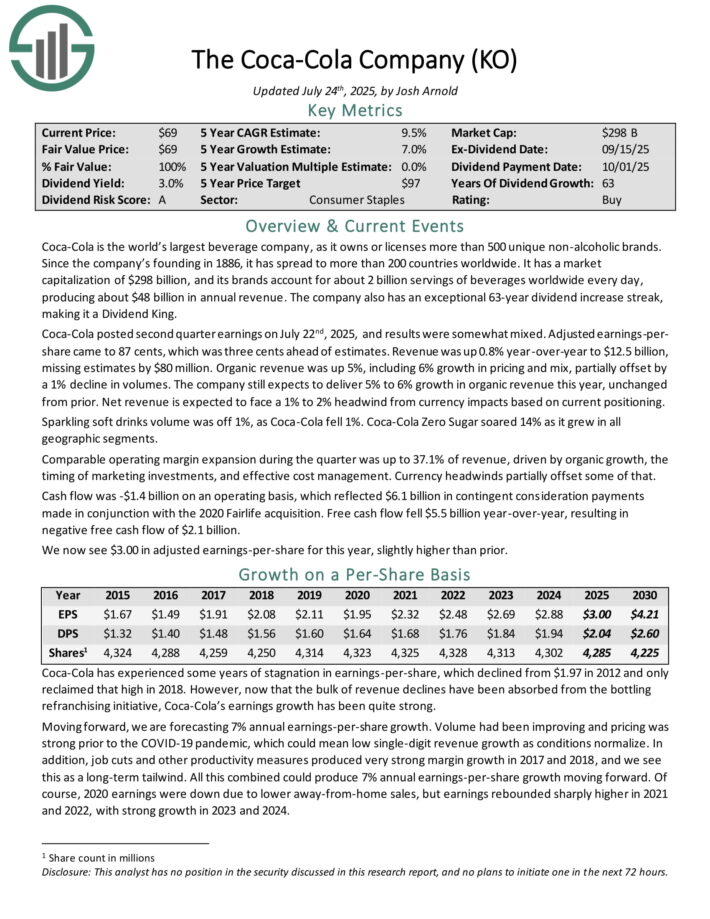

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 international locations worldwide.

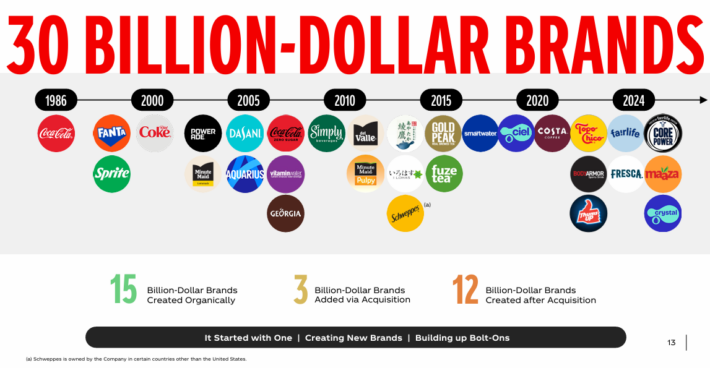

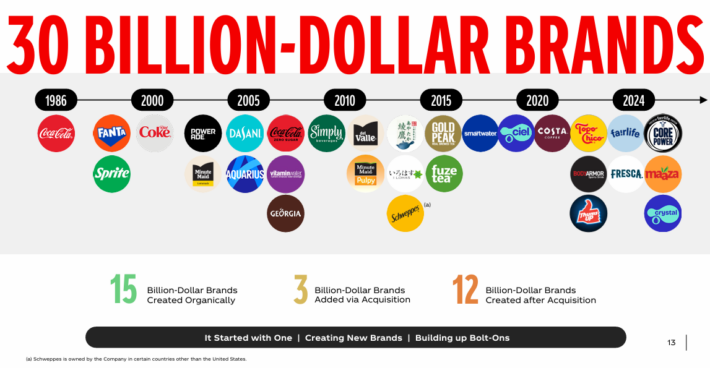

Coca-Cola now has 30 billion-dollar manufacturers in its portfolio, which every generate at the very least $1 billion in annual gross sales.

Supply: Investor Presentation

Coca-Cola posted second quarter earnings on July twenty second, 2025, and outcomes have been considerably combined. Adjusted earnings-per-share got here to 87 cents, which was three cents forward of estimates. Income was up 0.8% year-over-year to $12.5 billion, lacking estimates by $80 million.

Natural income was up 5%, together with 6% development in pricing and blend, partially offset by a 1% decline in volumes. The corporate nonetheless expects to ship 5% to six% development in natural income this yr, unchanged from prior. Web income is anticipated to face a 1% to 2% headwind from foreign money impacts based mostly on present positioning.

Glowing smooth drinks quantity was off 1%, as Coca-Cola fell 1%. Coca-Cola Zero Sugar soared 14% because it grew in all geographic segments. Comparable working margin growth through the quarter was as much as 37.1% of income, pushed by natural development, the timing of promoting investments, and efficient value administration. Forex headwinds partially offset a few of that..

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

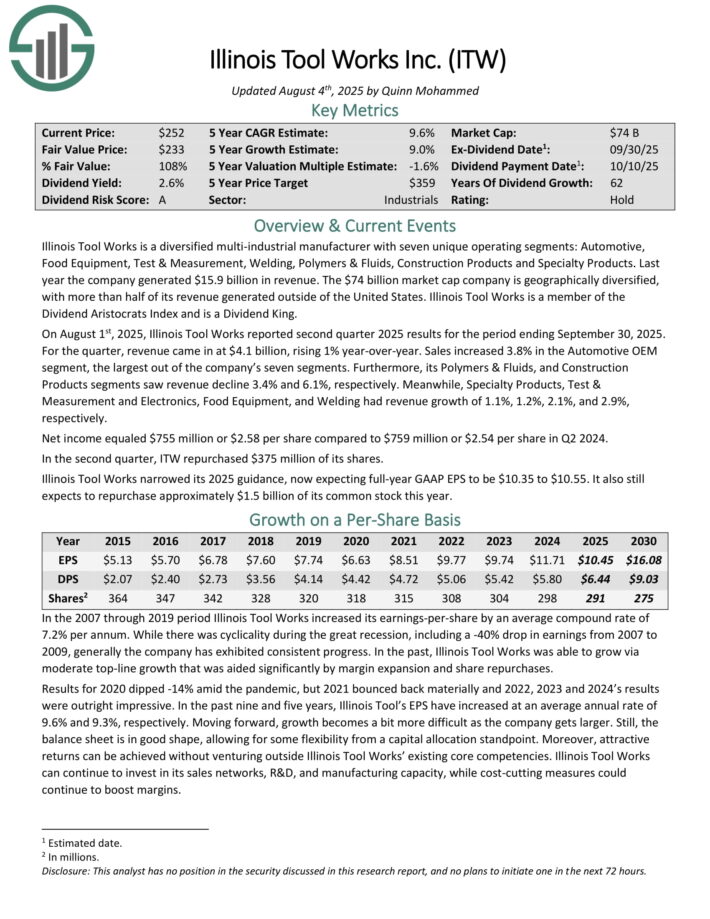

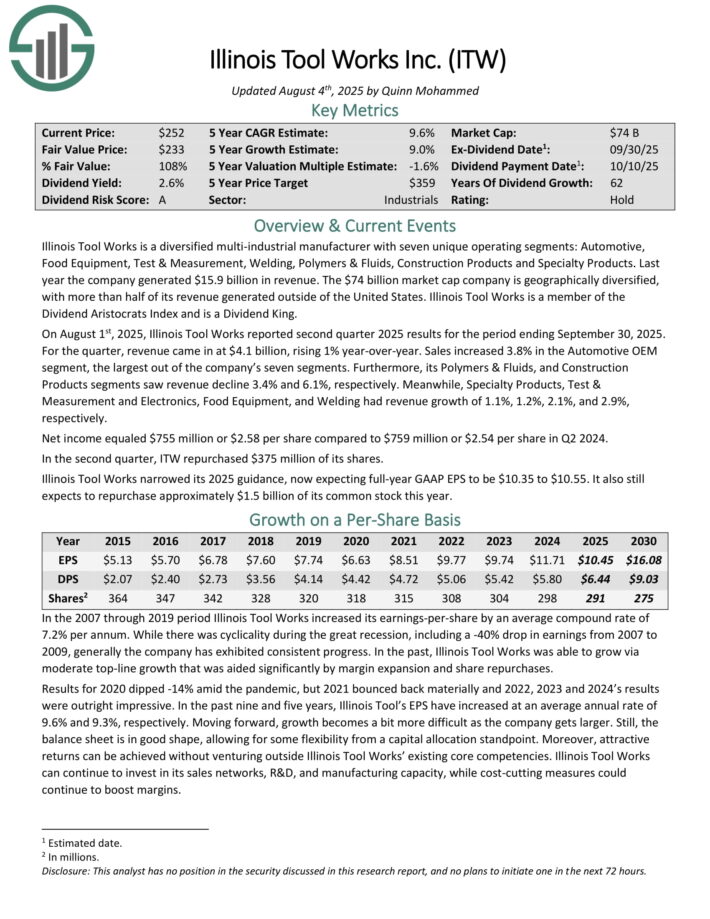

Wealth Creation Inventory #9: Illinois Instrument Works (ITW)

- Annual Anticipated Returns: 9.8%

Illinois Instrument Works is a diversified multi-industrial producer with seven distinctive working segments: Automotive, Meals Tools, Check & Measurement, Welding, Polymers & Fluids, Development Merchandise and Specialty Merchandise.

Final yr the corporate generated $15.9 billion in income. The corporate is geographically diversified, with greater than half of its income generated exterior of the USA.

On August 1st, 2025, Illinois Instrument Works reported second quarter 2025 outcomes. For the quarter, income got here in at $4.1 billion, rising 1% year-over-year. Gross sales elevated 3.8% within the Automotive OEM phase, the biggest out of the corporate’s seven segments.

Moreover, its Polymers & Fluids, and Development Merchandise segments noticed income decline 3.4% and 6.1%, respectively.

In the meantime, Specialty Merchandise, Check & Measurement and Electronics, Meals Tools, and Welding had income development of 1.1%, 1.2%, 2.1%, and a pair of.9%, respectively. Web revenue equaled $755 million or $2.58 per share in comparison with $759 million or $2.54 per share in Q2 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on ITW (preview of web page 1 of three proven beneath):

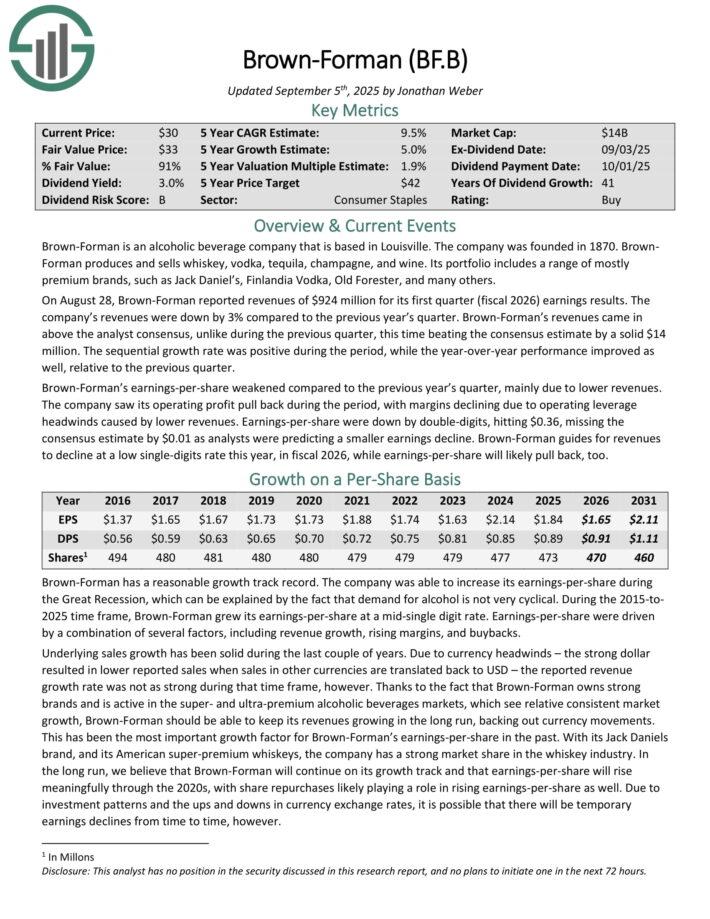

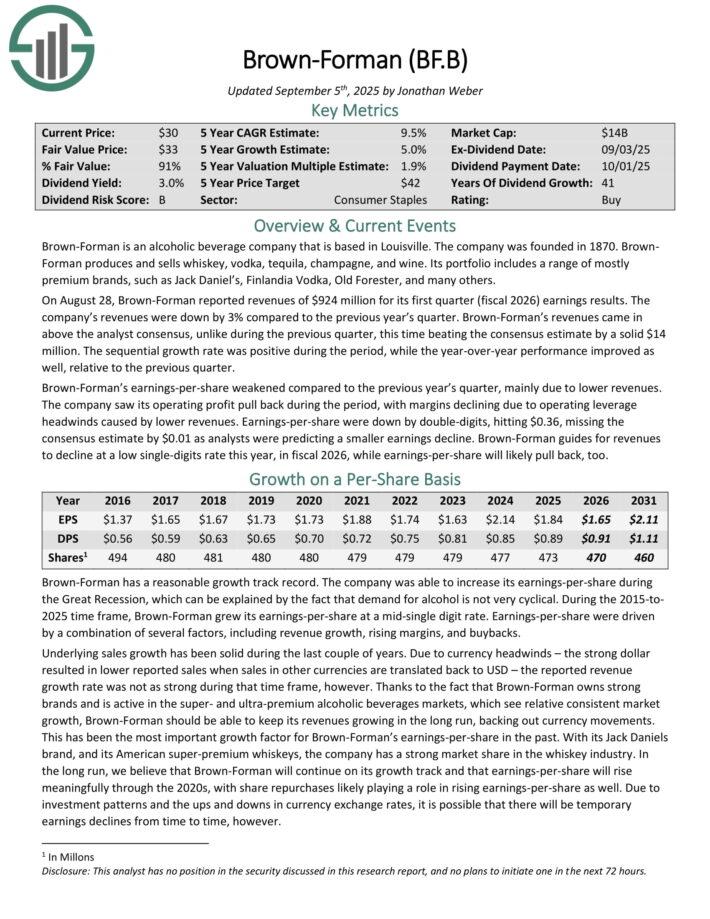

Wealth Creation Inventory #8: Brown-Forman Corp. (BF.B)

- Annual Anticipated Returns: 10.4%

Brown-Forman is an alcoholic beverage firm that’s based mostly in Louisville. The corporate was based in 1870. It produces and sells whiskey, vodka, tequila, champagne, and wine.

Its portfolio features a vary of largely premium manufacturers, comparable to Jack Daniel’s, Finlandia Vodka, Outdated Forester, and lots of others.

On August 28, Brown-Forman reported revenues of $924 million for its first quarter (fiscal 2026) earnings outcomes. The corporate’s revenues have been down by 3% in comparison with the earlier yr’s quarter.

Revenues got here in above the analyst consensus, not like through the earlier quarter, this time beating the consensus estimate by a stable $14 million. The sequential development fee was constructive through the interval, whereas the year-over-year efficiency improved as effectively, relative to the earlier quarter.

Brown-Forman’s earnings-per-share weakened in comparison with the earlier yr’s quarter, primarily as a result of decrease revenues. The corporate noticed its working revenue pull again through the interval, with margins declining as a result of working leverage headwinds attributable to decrease revenues.

Earnings-per-share have been down by double-digits, hitting $0.36, lacking the consensus estimate by $0.01 as analysts have been predicting a smaller earnings decline.

Brown-Forman guides for revenues to say no at a low single-digits fee this yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on BF.B (preview of web page 1 of three proven beneath):

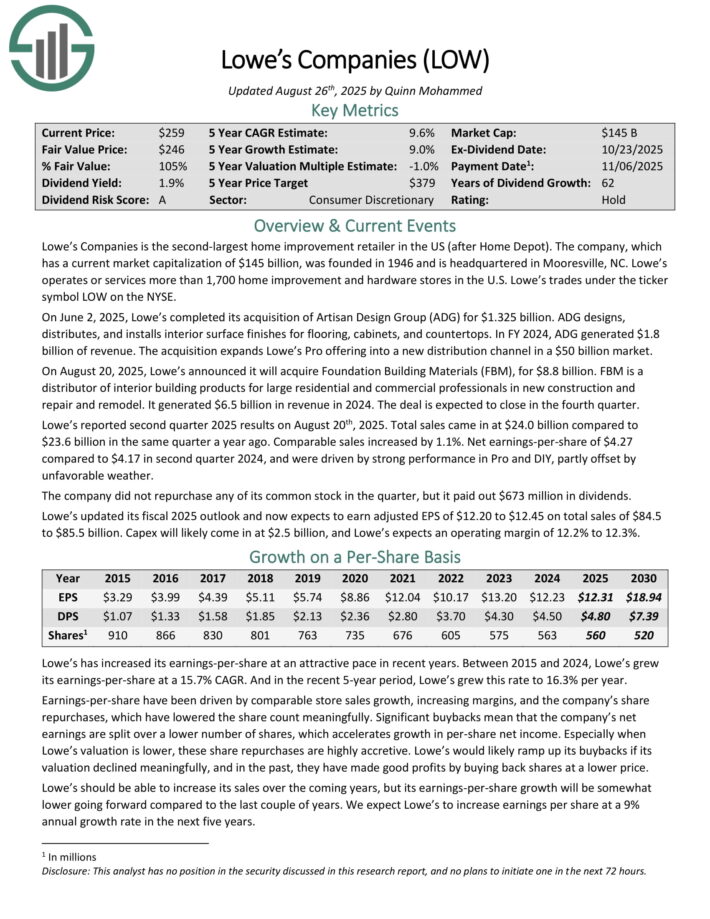

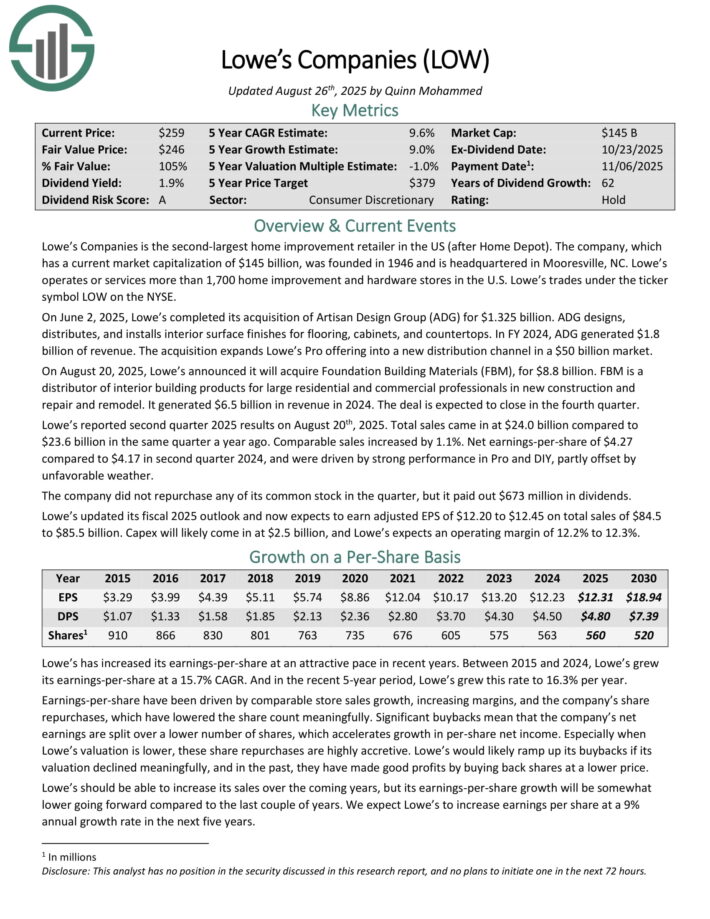

Wealth Creation Inventory #7: Lowe’s Cos., Inc. (LOW)

- Annual Anticipated Returns: 10.8%

Lowe’s Firms is the second-largest residence enchancment retailer within the US (after House Depot). The corporate was based in 1946 and is headquartered in Mooresville, NC. Lowe’s operates or companies greater than 1,700 residence enchancment and {hardware} shops within the U.S.

On August 20, 2025, Lowe’s introduced it would purchase Basis Constructing Supplies (FBM), for $8.8 billion. FBM is a distributor of inside constructing merchandise for giant residential and business professionals in new development and restore and rework. It generated $6.5 billion in income in 2024. The deal is anticipated to shut within the fourth quarter.

Lowe’s reported second quarter 2025 outcomes on August twentieth, 2025. Complete gross sales got here in at $24.0 billion in comparison with $23.6 billion in the identical quarter a yr in the past. Comparable gross sales elevated by 1.1%. Web earnings-per-share of $4.27 in comparison with $4.17 in second quarter 2024, and have been pushed by robust efficiency in Professional and DIY, partly offset by

unfavorable climate.

The corporate didn’t repurchase any of its widespread inventory within the quarter, but it surely paid out $673 million in dividends. Lowe’s up to date its fiscal 2025 outlook and now expects to earn adjusted EPS of $12.20 to $12.45 on complete gross sales of $84.5 to $85.5 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on LOW (preview of web page 1 of three proven beneath):

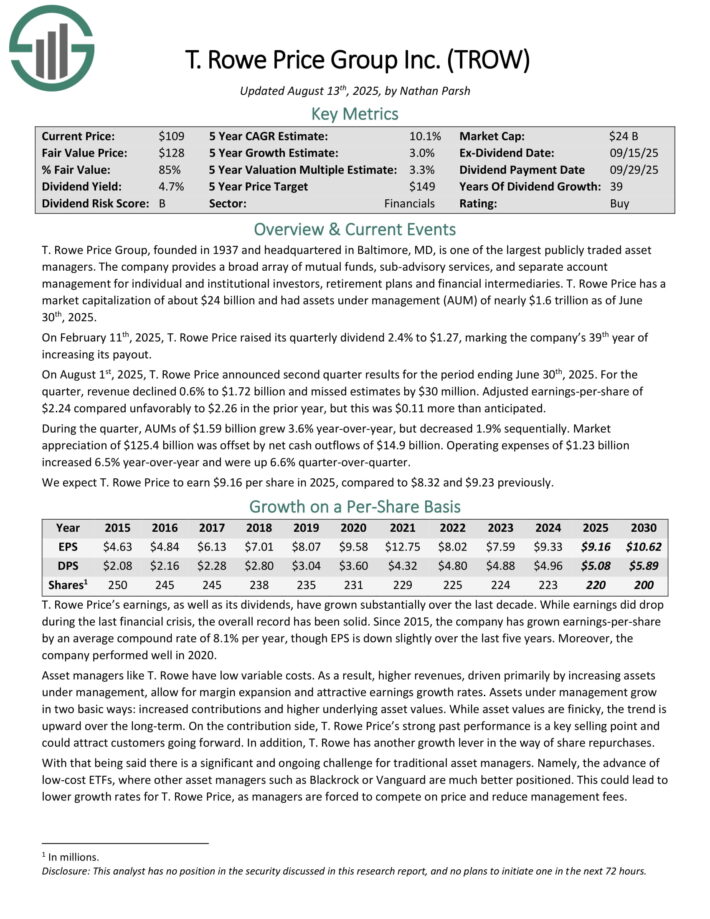

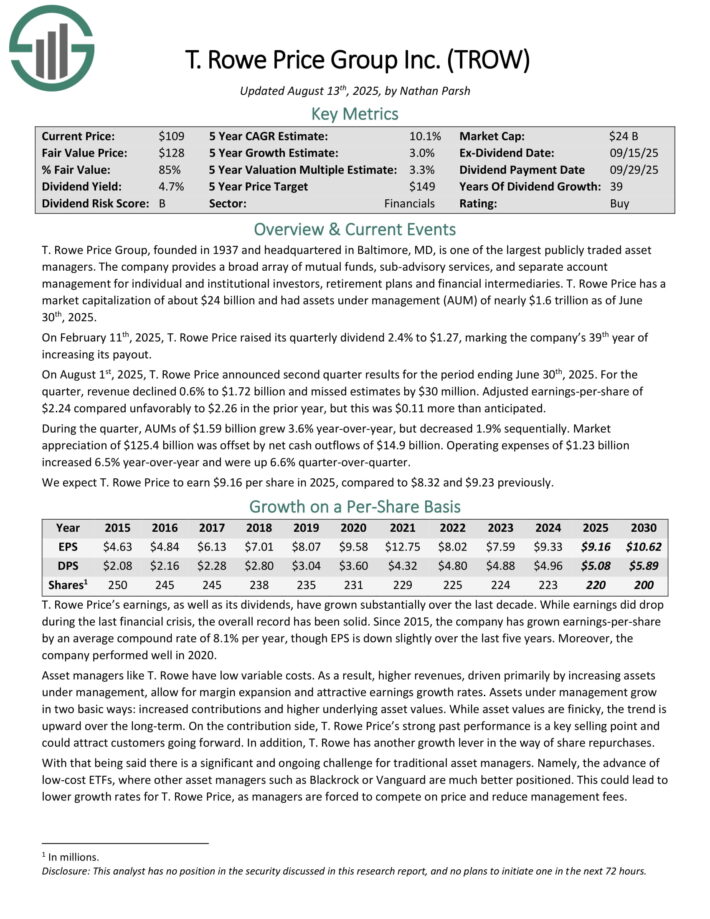

Wealth Creation Inventory #6: T. Rowe Value (TROW)

- Annual Anticipated Returns: 11.2%

T. Rowe Value Group is likely one of the largest publicly traded asset managers. The corporate supplies a broad array of mutual funds, sub-advisory companies, and separate account administration for particular person and institutional traders, retirement plans and monetary intermediaries.

T. Rowe Value had property beneath administration (AUM) of almost $1.6 trillion as of June thirtieth, 2025.

On February eleventh, 2025, T. Rowe Value raised its quarterly dividend 2.4% to $1.27, marking the corporate’s thirty ninth yr of accelerating its payout.

On August 1st, 2025, T. Rowe Value introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income declined 0.6% to $1.72 billion and missed estimates by $30 million. Adjusted earnings-per-share of $2.24 in contrast unfavorably to $2.26 within the prior yr, however this was $0.11 greater than anticipated.

Through the quarter, AUMs of $1.59 billion grew 3.6% year-over-year, however decreased 1.9% sequentially. Market appreciation of $125.4 billion was offset by internet money outflows of $14.9 billion. Working bills of $1.23 billion elevated 6.5% year-over-year and have been up 6.6% quarter-over-quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on TROW (preview of web page 1 of three proven beneath):

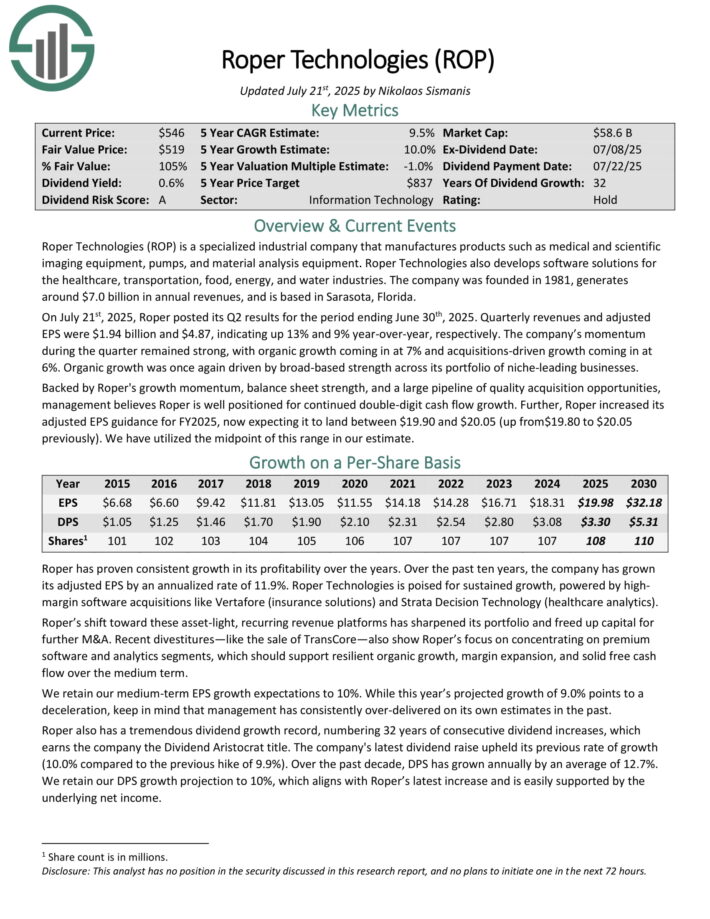

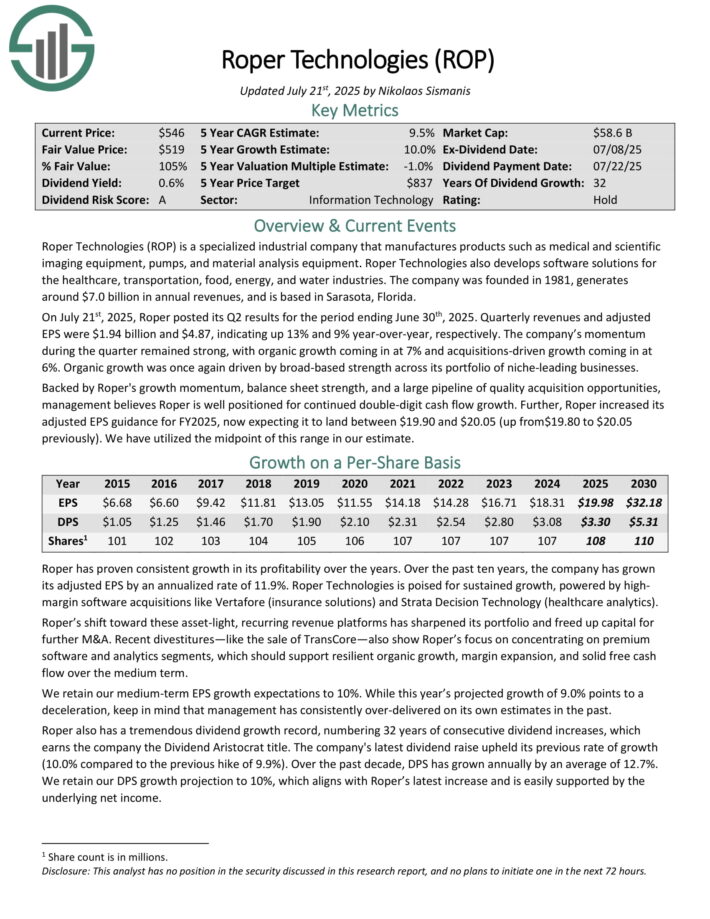

Wealth Creation Inventory #5: Roper Applied sciences (ROP)

- Annual Anticipated Returns: 11.2%

Roper Applied sciences is a specialised industrial firm that manufactures merchandise comparable to medical and scientific imaging tools, pumps, and materials evaluation tools.

Roper Applied sciences additionally develops software program options for the healthcare, transportation, meals, vitality, and water industries. The corporate was based in 1981, generates round $7.0 billion in annual revenues, and is predicated in Sarasota, Florida.

On July twenty first, 2025, Roper posted its Q2 outcomes for the interval ending June thirtieth, 2025. Quarterly revenues and adjusted EPS have been $1.94 billion and $4.87, indicating up 13% and 9% year-over-year, respectively.

The corporate’s momentum through the quarter remained robust, with natural development coming in at 7% and acquisitions-driven development coming in at 6%. Natural development was as soon as once more pushed by broad-based power throughout its portfolio of niche-leading companies.

Backed by Roper’s development momentum, stability sheet power, and a big pipeline of high quality acquisition alternatives, administration believes Roper is effectively positioned for continued double-digit money circulate development.

Additional, Roper elevated its adjusted EPS steering for FY2025, now anticipating it to land between $19.90 and $20.05.

Click on right here to obtain our most up-to-date Certain Evaluation report on ROP (preview of web page 1 of three proven beneath):

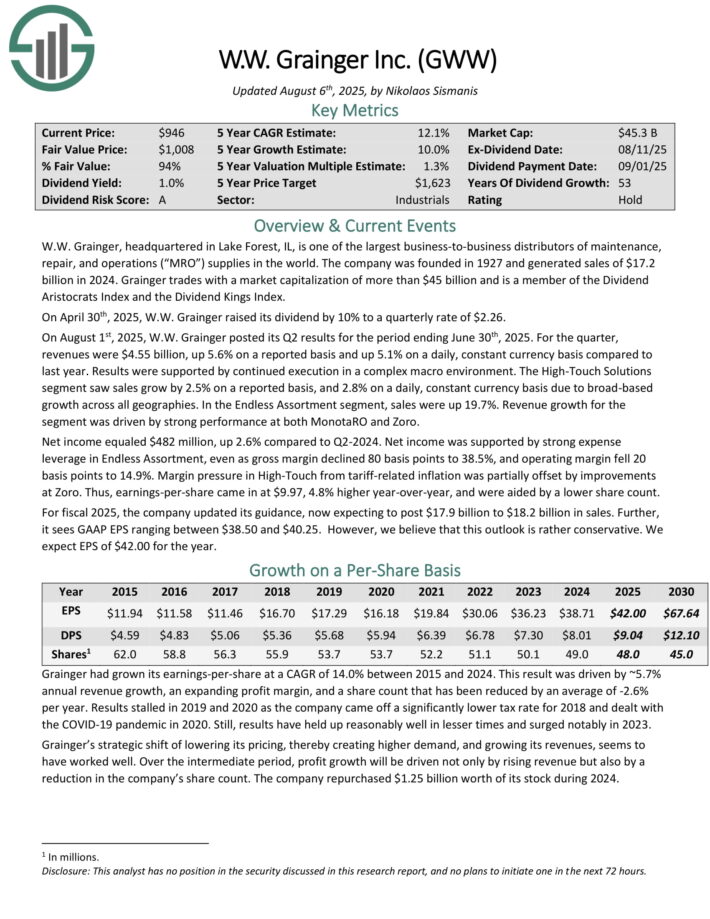

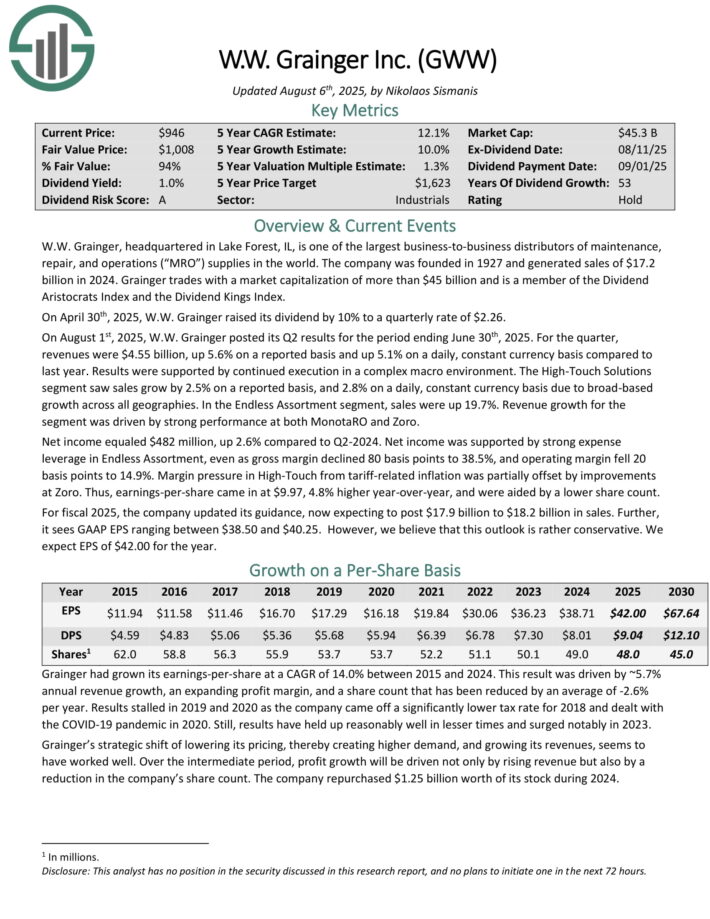

Wealth Creation Inventory #4: W.W. Grainger (GWW)

- Annual Anticipated Returns: 11.9%

W.W. Grainger, headquartered in Lake Forest, IL, is likely one of the largest business-to-business distributors of upkeep, restore, and operations (“MRO”) provides on the planet. The corporate was based in 1927 and generated gross sales of $17.2 billion in 2024.

On August 1st, 2025, W.W. Grainger posted its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, revenues have been $4.55 billion, up 5.6% on a reported foundation and up 5.1% on a each day, fixed foreign money foundation in comparison with final yr.

The Excessive-Contact Options phase noticed gross sales develop by 2.5% on a reported foundation, and a pair of.8% on a each day, fixed foreign money foundation as a result of broad-based development throughout all geographies.

Within the Limitless Assortment phase, gross sales have been up 19.7%. Income development for the phase was pushed by robust efficiency at each MonotaRO and Zoro.

Web revenue equaled $482 million, up 2.6% in comparison with Q2-2024. Web revenue was supported by robust expense leverage in Limitless Assortment, at the same time as gross margin declined 80 foundation factors to 38.5%, and working margin fell 20 foundation factors to 14.9%.

Margin stress in Excessive-Contact from tariff-related inflation was partially offset by enhancements at Zoro. Earnings-per-share got here in at $9.97, 4.8% larger year-over-year, and have been aided by a decrease share depend.

Click on right here to obtain our most up-to-date Certain Evaluation report on GWW (preview of web page 1 of three proven beneath):

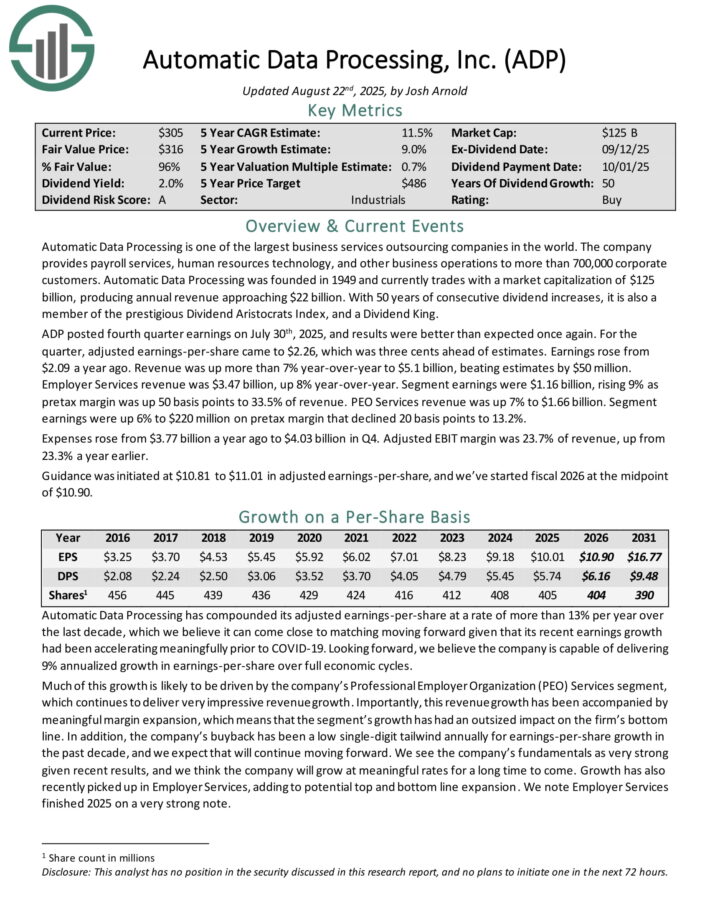

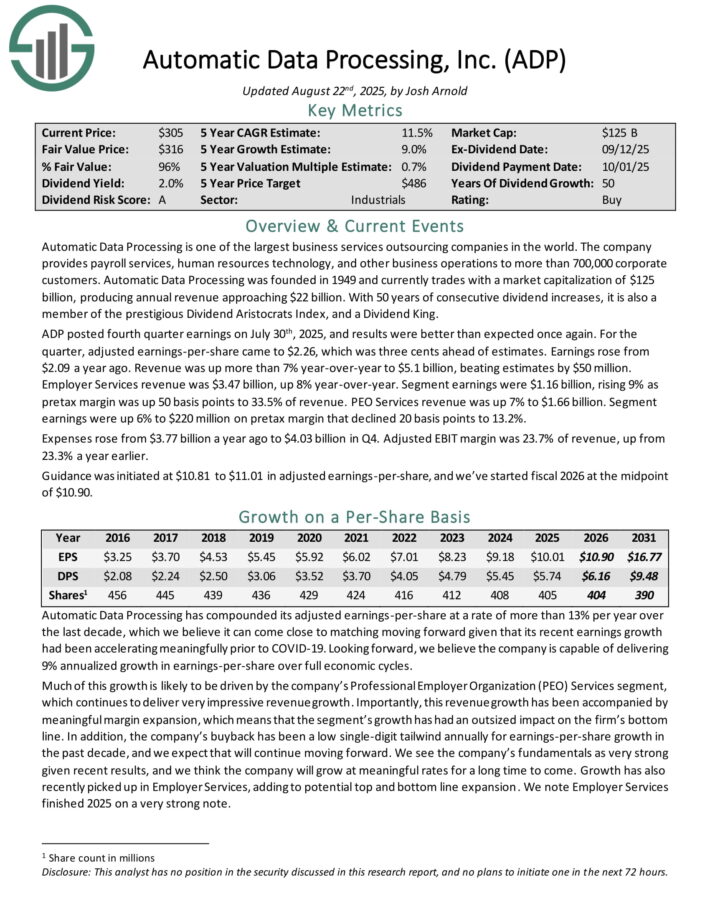

Wealth Creation Inventory #3: Computerized Knowledge Processing (ADP)

- Annual Anticipated Returns: 13.4%

Computerized Knowledge Processing is likely one of the largest enterprise companies outsourcing corporations on the planet. The corporate supplies payroll companies, human assets expertise, and different enterprise operations to greater than 700,000 company clients.

Computerized Knowledge Processing produces annual income of about $20 billion.

ADP posted fourth quarter earnings on July thirtieth, 2025, and outcomes have been higher than anticipated as soon as once more. For the quarter, adjusted earnings-per-share got here to $2.26, which was three cents forward of estimates.

Earnings rose from $2.09 a yr in the past. Income was up greater than 7% year-over-year to $5.1 billion, beating estimates by $50 million.

Employer Providers income was $3.47 billion, up 8% year-over-year. Phase earnings have been $1.16 billion, rising 9% as pretax margin was up 50 foundation factors to 33.5% of income.

PEO Providers income was up 7% to $1.66 billion. Phase earnings have been up 6% to $220 million on pretax margin that declined 20 foundation factors to 13.2%.

Bills rose from $3.77 billion a yr in the past to $4.03 billion in This fall. Adjusted EBIT margin was 23.7% of income, up from 23.3% a yr earlier. Steerage was initiated at $10.81 to $11.01 in adjusted earnings-per-share.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADP (preview of web page 1 of three proven beneath):

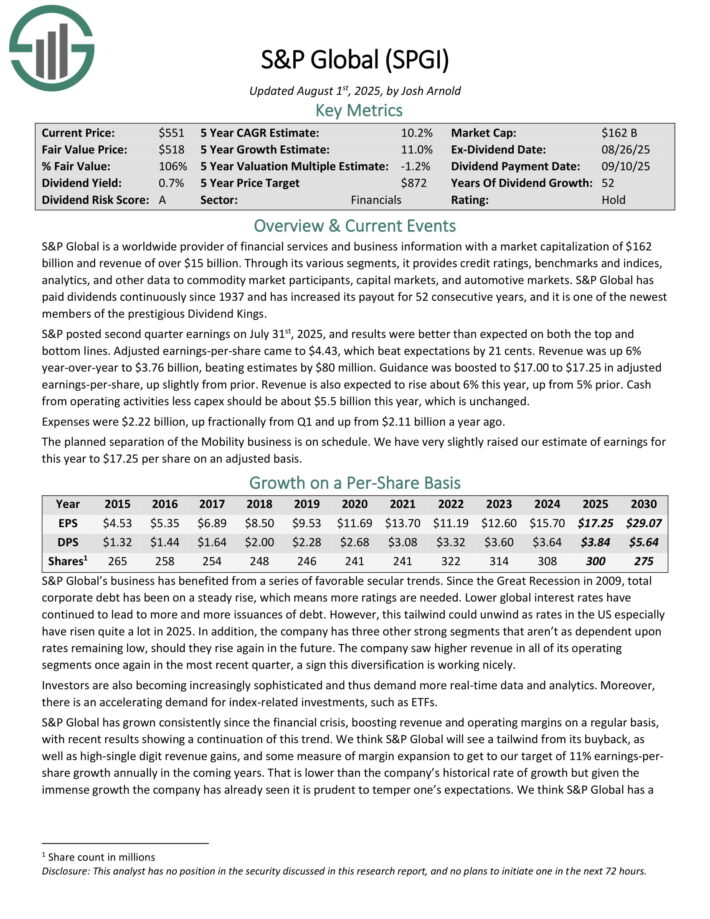

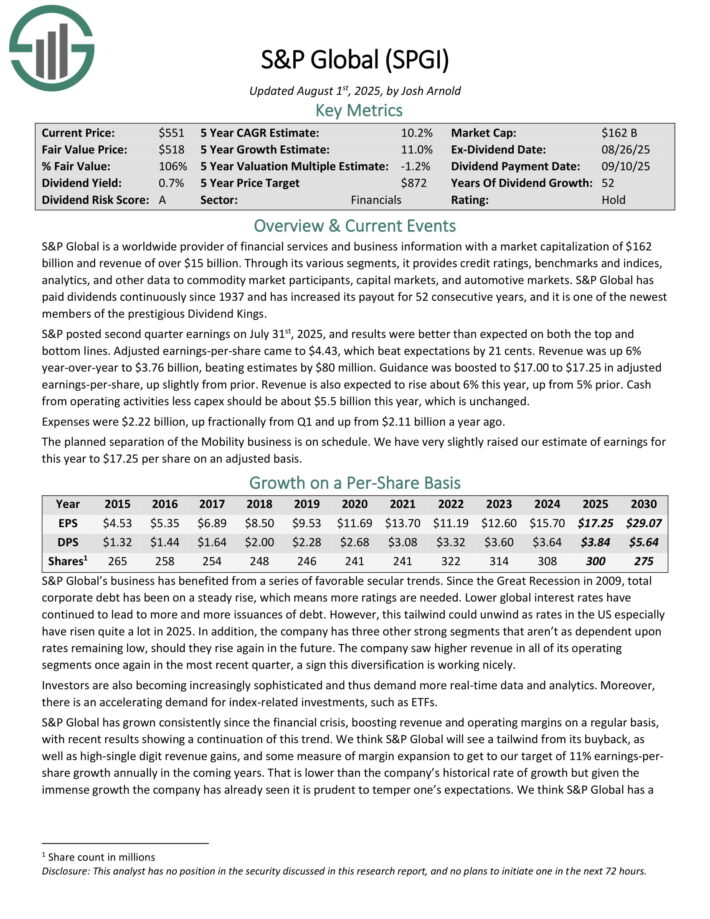

Wealth Creation Inventory #2: S&P International (SPGI)

- Annual Anticipated Returns: 13.6%

S&P International is a worldwide supplier of monetary companies and enterprise data with income of over $15 billion. By means of its numerous segments, it supplies credit score scores, benchmarks and indices, analytics, and different information to commodity market contributors, capital markets, and automotive markets.

S&P International has paid dividends repeatedly since 1937 and has elevated its payout for 52 consecutive years.

S&P posted second quarter earnings on July thirty first, 2025, and outcomes have been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to $4.43, which beat expectations by 21 cents. Income was up 6% year-over-year to $3.76 billion, beating estimates by $80 million.

Steerage was boosted to $17.00 to $17.25 in adjusted earnings-per-share, up barely from prior. Income can be anticipated to rise about 6% this yr, up from 5% prior.

Money from working actions much less capex must be about $5.5 billion this yr, which is unchanged. Bills have been $2.22 billion, up fractionally from Q1 and up from $2.11 billion a yr in the past.

Click on right here to obtain our most up-to-date Certain Evaluation report on SPGI (preview of web page 1 of three proven beneath):

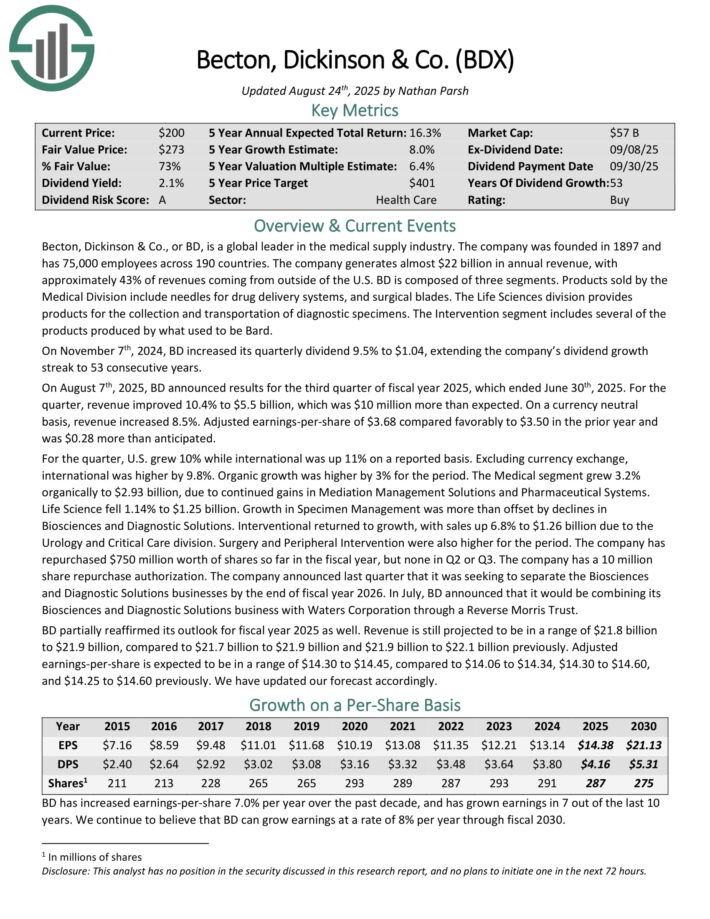

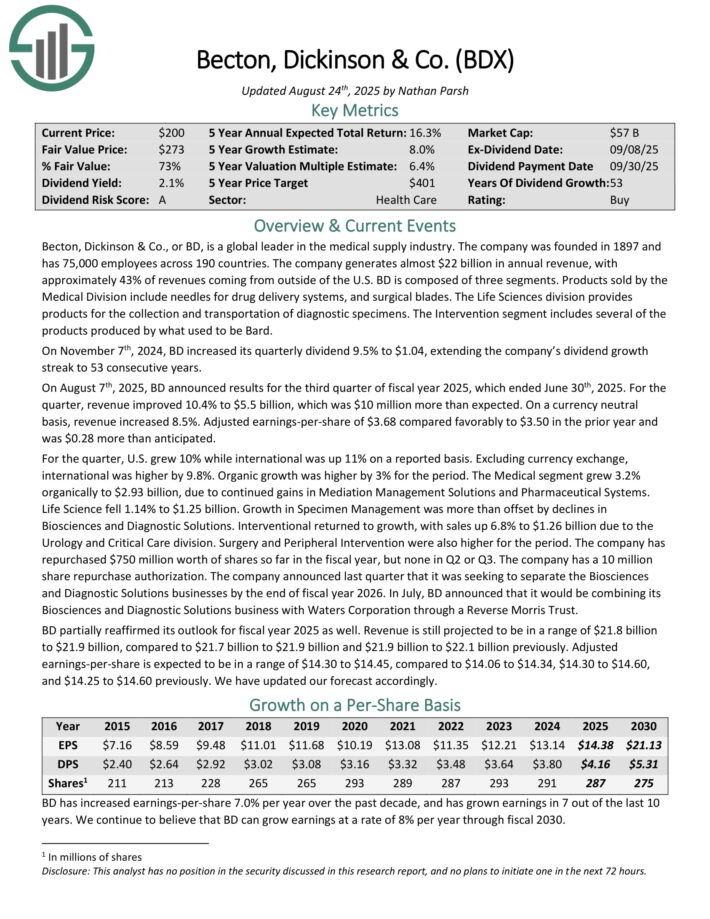

Wealth Creation Inventory #1: Becton Dickinson & Co. (BDX)

- Annual Anticipated Returns: 17.6%

Becton, Dickinson & Co. is a world chief within the medical provide business. The corporate was based in 1897 and has 75,000 workers throughout 190 international locations.

The corporate generates about $20 billion in annual income, with roughly 43% of revenues coming from exterior of the U.S.

Becton, Dickinson & Co., or BD, is a world chief within the medical provide business. The corporate generates virtually $22 billion in annual income, with roughly 43% of revenues coming from exterior of the U.S.

On August seventh, 2025, BD introduced outcomes for the third quarter of fiscal yr 2025, which ended June thirtieth, 2025. For the quarter, income improved 10.4% to $5.5 billion, which was $10 million greater than anticipated.

On a foreign money impartial foundation, income elevated 8.5%. Adjusted earnings-per-share of $3.68 in contrast favorably to $3.50 within the prior yr and was $0.28 greater than anticipated.

For the quarter, U.S. grew 10% whereas worldwide was up 11% on a reported foundation. Excluding foreign money trade, worldwide was larger by 9.8%. Natural development was larger by 3% for the interval.

BD partially reaffirmed its outlook for fiscal yr 2025 as effectively. Income remains to be projected to be in a spread of $21.8 billion to $21.9 billion, in comparison with $21.7 billion to $21.9 billion beforehand. Adjusted earnings-per-share is anticipated to be in a spread of $14.30 to $14.45.

Click on right here to obtain our most up-to-date Certain Evaluation report on BDX (preview of web page 1 of three proven beneath):

Extra Studying

The next Certain Dividend databases include essentially the most dependable dividend growers in our funding universe:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].