[ad_1]

The Federal Reserve System manages the US’s cash provide, rising or reducing financial institution credit score and different circulating media to succeed in a goal rate of interest often introduced at conferences of the Open Market Committee, which meets eight occasions a yr. They met this week, asserting the primary of a number of modest will increase within the federal funds fee. To satisfy this goal, the Fed will decrease provides of financial aggregates till the federal funds fee reaches the specified goal. It will primarily be achieved by open market gross sales of US Treasury bonds, payments, and notes by the Federal Reserve Financial institution of New York. With the intention to elevate the rate of interest, the New York Fed will promote Treasury securities to take away financial institution reserves from financial institution stability sheets, and it will have a leveraged impact as a result of any lending primarily based on these reserves may even be faraway from circulating as a part of the cash provide. The better shortage of loanable funds held by banks will elevate rates of interest.

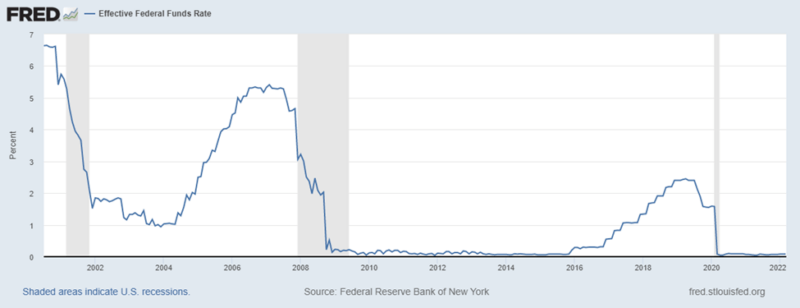

Determine 1: Efficient Federal Funds Price 2000-2022

Determine 1 reveals this goal rate of interest was stored beneath 2 p.c within the aftermath of the 2001 recession. This delicate recession resulted from the bursting of the late Nineteen Nineties expertise bubble. Low rates of interest within the 2000s triggered a brand new growth in actual property, development, finance, and investments, together with investments in highly-leveraged and non-transparent monetary derivatives. Building started to retrench as early as 2005, and the Fed realized the growth was not sustainable, so that they tried to chill it down by elevating rates of interest. Sadly the overheated actual property and monetary markets didn’t reply immediately, and after they lastly did, the consequence was the 2007 monetary disaster and the 2007-2009 Nice Recession.

The Fed responded by bloating its personal stability sheet by buying nugatory derivatives from distressed banks, paying inflated pre-crisis costs with a view to bail out distressed banks, insurance coverage corporations, and brokerage homes. Successive rounds of quantitative easing—finally the Treasury and the Fed both received uninterested in numbering them, or maybe have been embarrassed—stored rates of interest close to zero till 2017. Amongst different issues, this straightforward credit score coverage reinflated actual property markets. The federal funds fee was solely allowed to rise to 2.5 p.c in late 2018. This is able to have signaled some try at a return to normalcy, however then COVID-19 hit, and the Fed shortly flooded monetary markets with extra liquidity and financial institution reserves, conserving rates of interest again at close to zero ranges. Hire moratoria and near-absolute shutdowns of eating places, hospitality, journey, and manufacturing created a good better lack of jobs and output than we noticed throughout the Nice Recession.

For the previous few months the Fed has lastly been dealing with the prospect of inflation. After rising the cash provide dramatically for the reason that begin of the Nice Recession, we now have 7.5 p.c client worth index (CPI) inflation over 2021, accompanied by 24 p.c broad producer worth index (PPI) inflation—this means even greater CPI inflation in our future. Some industry-specific PPIs have elevated even sooner; for instance, the PPI for metals and metal-producing industries elevated an unimaginable 45 p.c over 2021. These relatively horrifying figures point out greater prices of manufacturing that can finally be handed on to shoppers.

Provide shocks just like the turmoil in world power markets as a result of Russian invasion of Ukraine aren’t the results of unfastened financial coverage we are able to blame on the Fed, so whereas rising gasoline costs clearly contribute to additional elevating the CPI and the inflation fee, they aren’t the results of an expansionary financial coverage. Nonetheless, the Fed has a lot to atone for.

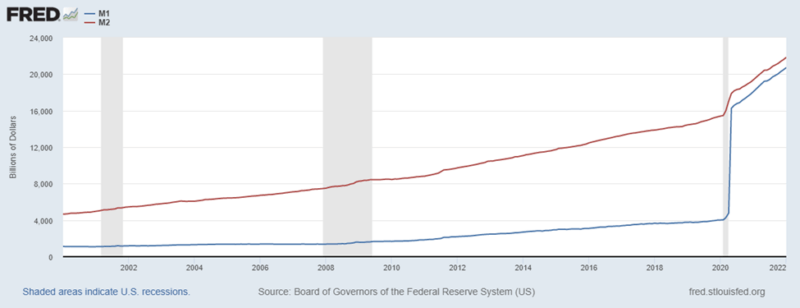

Determine 2: M1 and M2, 2000-2022

M1, or transactions cash, consists of foreign money and cash in circulation, plus unusual checkable deposits. These earn little or no curiosity, and may be spent at once. M2, or financial savings cash, is a broader measure of the cash provide, and Determine 2 reveals that till 2020, M2 was roughly 4 occasions the scale of M1. M2 contains M1 however provides quite a few interest-earning belongings folks usually use as financial savings belongings. These belongings are much less liquid as a result of they typically should be transformed to an M1 asset earlier than they are often spent—transferred to money or checking. Each M1 and M2 had been rising steadily, and even at a reasonably accelerating fee previous to the pandemic. This is able to have brought on issues in some unspecified time in the future, each by way of inflation, and creating an unsustainable growth in funding that will finally trigger a recession.

Then the Fed responded to COVID-19 by additional rising M1 and M2. Though M2 solely rose reasonably, that sharp uptick in 2020 remains to be alarming and fairly unprecedented in its personal proper. This isn’t a cash provide that’s being managed responsibly. The actually outstanding occasion proven in Determine 2 is the digital removing of conventional saving belongings from the economic system. These have been issues like financial savings account balances, cash market mutual fund shares, certificates of deposit (CDs), and so on. These have been the variations between M1 and M2 and so they used to account for as much as 80 p.c of M2. Because the pandemic, they solely account for about 5 p.c.

Why this occurred is straightforward to know in mild of the near-zero rates of interest these financial savings belongings are at the moment paying. So long as financial savings accounts or CDs pay zero curiosity, there may be little incentive to not hold that cash in money or checking. Because the Fed begins elevating rates of interest, incentives will change, financial savings belongings will turn out to be extra engaging, and M1 ought to begin to turn out to be a smaller fraction of M2. Nevertheless, the Fed has managed to engineer a state of affairs the place costs are actually skyrocketing, whereas concurrently provide constraints hobble any financial exercise that hasn’t already been crippled by regulatory constraints.

It’s by no means straightforward for coverage makers to boost rates of interest, however it’s a lot simpler for them to do this when the economic system is overheating, costs are rising, and unemployment is low. Proper now, we’ve a moribund economic system with really unspectacular financial progress. That will be dangerous sufficient, nevertheless it stays unclear how sustainable even this weak progress will transform with out severe structural reform. The one saving grace of our present state of affairs is that unemployment stays low, however that fails to inform the entire story as a result of our present low unemployment is due partly to unprecedented numbers of potential staff who’re simply not making themselves accessible in labor markets—the labor drive participation fee has not been this low since 1977—although it’s at the moment headed in the precise path. Low GDP progress and low unemployment hardly ever occur on the similar time.

Every time the Fed raises rates of interest, funding spending and funding borrowing will take a success, and this may occasionally contribute to greater unemployment and decrease labor drive participation. These outcomes will put strain on the Fed to decrease charges, or not less than both delay elevating them additional, or elevate them in smaller increments. If the Fed places off elevating charges to the place they have to be for a wholesome economic system, inflation will get additional uncontrolled. With rates of interest as little as they’ve been for a lot of the interval following the Nice Recession, the Fed actually can’t squeeze out a lot short-run stimulus by decreasing them additional.

Over the months and years to come back, will probably be very fascinating to see how faithfully the Fed pursues its coverage of returning rates of interest to regular and sustainable ranges—roughly 3-4 p.c for the federal funds fee. Each time the Open Market Committee meets for the following a number of years, they may face simultaneous strain to decrease rates of interest to stimulate the economic system and counteract greater borrowing prices, and strain from different quarters to boost rates of interest to struggle inflation.

[ad_2]

Source link