As charges of curiosity for rental properties lastly start to fall after a number of years of painful heights, many precise property patrons are renewing their curiosity in charges of curiosity as soon as extra. With lower expenses, significantly on the favored DSCR mortgage product that allows qualification based mostly on the DSCR ratio, a comparability of rents and payments (along with curiosity expense), in its place of the DTI ratio based totally on non-public earnings, rental property purchases financed by these loans are starting to look very attractive as soon as extra.

We’ve lined DSCR loans proper right here on BiggerPockets, along with a data on how charges of curiosity and prices are primarily determined by three key metrics: LTV ratio, DSCR ratio, and credit score rating score. We’ve moreover put out an superior approach data that displays how further secondary components moreover help determine your worth—equal to prepayment penalties, fixed vs. ARM development, and rent qualification type (i.e., LTR vs. STR, and so forth.).

Nonetheless, we’ll go extra and current you exactly how these components are utilized to get that exact price of curiosity amount you are quoted, pulling once more the curtain on how DSCR lenders and mortgage brokers calculate the pace and components you see in your DSCR quotes.

Cost Sheets and State of affairs Devices: The Calculator Constructed for Brokers and Lenders

No matter sometimes displaying sophisticated and customarily esoteric, the devices utilized to create your worth are not rather a lot fully totally different than a semi-basic calculator gadget and comprise pretty simple math. Lenders will often start each day with what’s known as a “worth sheet,” which displays an expansion of charges of curiosity from the lender’s minimal worth and most worth.

Each price of curiosity—often equipped in 12.5-basis degree increments, or an eighth of a p.c—has a corresponding “premium” amount, often spherical 100. These are known as the underside expenses and performance the place to start for calculating the speed of curiosity on a mortgage mortgage.

Together with these base expenses, the pace sheets will attribute what are known as loan-level worth adjustments (LLPAs) that switch the premium amount up and down based totally on within the occasion that they level out a higher-risk mortgage (strikes the premium down) or a lower-risk mortgage (strikes the premium up). The underside expenses are often based totally on prevailing market expenses, as described on this text (macro components), whereas LLPAs are based totally on the individual deal (for DSCR loans, primarily property components, however as well as based totally on the borrower’s credit score rating profile too), or micro components.

DSCR lenders will present lower expenses for loans which have the subsequent menace of default and are, subsequently, further harmful. These are sometimes intuitive—equal to loans with elevated LTVs (a lot much less distinction between the value of the mortgaged property and mortgage amount) and reduce DSCR ratios (a lot much less cash circulation earned from the property) assessed as elevated menace. Conversely, loans which have debtors with elevated credit score rating scores, as an example, are considered to have a lower menace of default, and debtors will benefit from lower charges of curiosity on account of their non-public creditworthiness.

Starting with a base price of curiosity and premium, DSCR lenders will often enter the entire associated pricing components of the mortgage with their associated adjustments (LLPAs) that add or subtract to the premium amount. Then, as quickly as the entire components have been enter, the lender will “treatment” for the pace that produces a premium number of 100 (or a purpose premium amount equal to 102 or 103). Thus, the pace is created.

Buckets

One observe sooner than diving in: DSCR lenders will often use mini-ranges for numerous metrics, usually known as buckets, when determining components in its place of explicit, exacting numbers. As an example, the pace sheets utilized by lenders will just about positively have LLPAs based totally on buckets for numerous inputs such as pricing for credit score rating scores between 700 and 719, scores between 720 and 739, and so forth., pretty than explicit individual adjustments for explicit scores.

So, as an example, a qualifying FICO score of 705 and 709 would have the equivalent adjustment, and the borrower could solely protected the subsequent worth by enhancing the score to 720 or above to attain the following bucket.

Predominant LLPAs—the Matrix

Whereas many patrons are seemingly accustomed to the “giant three” components for determining DSCR charges of curiosity (LTV, DSCR, and credit score rating score), with regards to calculating the pace, the overwhelming majority of DSCR direct lenders will use a matrix that features LTV and credit score rating score as the best most influential components (paradoxically, not that features the DSCR ratio, the namesake of the mortgage type).

DSCR lenders will take advantage of what’s also known as a pricing matrix as the first LLPA that adjusts the underside worth and premium. It’s a simple two-way matrix plotting rows and columns, the place each combination of credit score rating score bucket and LTV bucket creates the first LLPA, which is often fairly important.

Furthermore, some mixtures of credit score rating score and LTV received’t be eligible due to the perceived menace. As an example, as confirmed in an occasion FICO/LTV matrix, a lender would possibly lend as a lot as 80% LTVs, nevertheless solely debtors with a 720 or elevated qualifying credit score rating score might be eligible.

As you’ll be capable to see inside the sample matrix, maximizing leverage, significantly maximizing leverage with less-than-perfect credit score rating, will finish in significantly unfavourable LLPAs, which may have the impression in the calculations of requiring a rather a lot elevated worth. It’s additionally attainable to see how (and why) low LTV gives, significantly combined with a strong credit score rating profile, could find yourself in terribly favorable charges of curiosity.

It’s vital to note that this kind of pricing is rarely linear, which means every enhance in LTV bucket doesn’t consequence inside the comparable change in LLPA—as a soar from the 50.1%-55% LTV bucket to the 55.1%-60% LTV bucket is barely a 12.5 bps unfavourable change, whereas an equal 5% bucket enhance from 70.1%-75% LTV to 75.01%-80% LTV results in a 62.5 bps unfavourable change!

When optimizing your price of curiosity on a DSCR mortgage, the additional conservative you’re leverage-wise and the upper you keep your credit score rating, the happier you’re likelier to be when you get your price of curiosity.

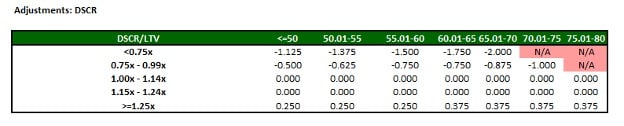

DSCR LLPAs

No matter not being inside the primary “matrix” of most DSCR lenders, the DSCR ratio will often have a huge impact on your worth calculation as properly. Like credit score rating score and LTV, DSCR ratios will possible be in buckets, along with for DSCR ratios underneath 1.00x!

Most DSCR lenders can have minimums of 1.00x and surprisingly cope with properties not too in any other case with regards to constructive DSCRs, i.e., less-than-expected variations between a property with a 1.45x DSCR ratio and a 1.15x DSCR ratio, as an example. Some DSCR lenders will even lend on properties with DSCR ratios under 1.00x, or even under 0.75x (usually known as no ratio DSCR loans).

At first look, it will possible seem shocking. Nonetheless, there are some conditions the place DSCR loans on properties with decrease than 1.00x DSCR ratios make sense. Nonetheless whatever the gorgeous no ratio DSCR mortgage chance, LLPAs for these situations are pretty harsh, and often restricted to the lower LTV buckets. A sample DSCR LLPA matrix illustrates how these can impact pricing calculations.

Mortgage Dimension LLPAs

After the LTV, credit score rating score (FICO) and DSCR ratio are enter, and the following predominant adjustments are computed. The DSCR lender will then start inputting secondary LLPAs that, whereas often not as important as the first three pricing drivers, will extra alter the associated premium favorably (addition) or negatively (subtraction).

Mortgage measurement is generally an LLPA for DSCR loans. Identical to the well-known Goldilocks and the Three Bears fable, the proper mortgage measurement for DSCR lenders is commonly between the extremes—not too giant and by no means too small.

Why? Mortgage sizes too large, often if you get to the $1.5 million or above fluctuate, level out very high-value properties and should fluctuate in price further dramatically (and thus characterize elevated menace), primarily on account of {the marketplace} for the associated high-end properties is in fact smaller (fewer people can afford them if delivered to market, and fewer to rent them at eye-watering rents if used as a long-term rental). As such, many DSCR lenders will assess some minor unfavourable LLPAs for loans properly into the seven figures to account for elevated menace.

Furthermore, when the mortgage measurement is just too small, often inside the low-$100,000 fluctuate and even 5 figures, there could also be not solely a lot much less margin for error (misreading the value by only some thousand has a rather a lot larger impression), however it absolutely hurts the lender’s economics. The amount of labor (and associated working costs) to originate a $100,000 DSCR mortgage and a $1 million DSCR mortgage are typically often the equivalent, nevertheless the lender will often make rather a lot a lot much less money on the mortgage (lender economics are often based totally on a proportion of the mortgage amount). Thus, to make smaller loans worth it economically, many DSCR lenders will assess the subsequent LLPA penalty for smaller loans.

The sweet-spot mortgage amount for a lot of DSCR lenders is thus not too giant, not too small, often all by the six-figure fluctuate in 2024 (~$250,000 to $1 million). These will often not have any unfavourable pricing adjustments and finish in the most effective expenses.

Property Kind LLPAs

One different vital LLPA for DSCR loans is the property type. At a extreme stage, the prospect (and thus LLPA) is derived by the liquidity and salability of the underlying property. DSCR lenders mitigate their menace primarily by the secured collateral—and the pliability to foreclose and promote the property in case of default in order to be made complete or lower losses on loans that go unhealthy.

Very similar to the occasion on mortgage measurement, the place there could also be a lot much less menace for loans spherical $350,000 versus $3.5 million, primarily on account of there are so many further eager and ready patrons of properties inside the $500,000 price fluctuate than the $5 million fluctuate, there’ll possible be unfavourable pricing adjustments for property types which have a smaller market of potential patrons.

As such, {the marketplace} for single-family residences (SFRs) is very large (along with the overwhelming majority of owner-occupants), and vanilla single-family leases will often not have a unfavourable LLPA. Nonetheless, for various property types, unfavourable pricing adjustments (and reduce LTV most eligibility) will possible be typical. Since there are fewer potential patrons for condos, duplexes, or totally different multiunit properties, these are riskier for the lender (extra sturdy to advertise in case of a foreclosures), and thus there will often be subtractions to the pricing inside the kind of unfavourable pricing LLPAs.

Mortgage Perform LLPAs

Mortgage goal is commonly outlined as each an acquisition (self-explanatory, using a DSCR mortgage to buy a property), rate-term refinance (a refinance transaction, the place cash-out proceeds are decrease than $2,000 or the borrower has to hold “money to the desk”), or cash-out refinances (a refinance, the place the proceeds put cash in pocket, when the excellence between mortgage amount and prior mortgage being paid off plus closing costs/escrows is higher than $2,000, or when the property was beforehand owned free and clear).

Sometimes, there’ll possible be unfavourable LLPA adjustments for refinances and by no means acquisitions, primarily resulting from a lot much less certainty over price. Whereas DSCR lenders should always be utilizing an neutral third-party appraisal, a market price is further certain in an acquisition transaction (by definition, the property was merely listed and purchased out there available on the market) versus a refinance transaction (appraiser estimate solely). The unfavourable LLPA will thus be assessed on refinances to account for this elevated menace (a lot much less certainty on price).

Furthermore, cash-out refinances often have harsher refinances for quite a lot of causes. Lenders have found that psychologically, patrons with a lot much less “pores and pores and skin inside the sport” after having cashed out equity often are inclined to default. Furthermore, precise property fraud schemes that target lenders are most positively to be by cash-out refinance transactions, so mitigation of this elevated menace is funneled to a unfavourable LLPA inside the worth computation.

Mortgage Building LLPAs

DSCR worth sheets might also often attribute quite a lot of LLPAs based totally on the provisions inside the mortgage mortgage paperwork. Typical mortgage development adjustments that may decrease premium (and enhance required worth) embody choosing an “interest-only” chance (really solely partially interest-only for DSCR loans, with principal funds required for the ultimate 20 years of the time interval) versus a completely amortizing development.

Loads of lenders might also often present what are known as hybrid ARM decisions, the place the speed of curiosity can alter after a certain initially fixed-rate interval, equal to after 5 or seven years, in its place of choosing a 30-year fixed worth development. Choosing a hybrid ARM is commonly a constructive LLPA since DSCR loans which might be hybrid ARMs will often have a price floor that restricts the speed of curiosity on the mortgage to always float underneath the preliminary worth, even when market expenses improve over the lifetime of the mortgage.

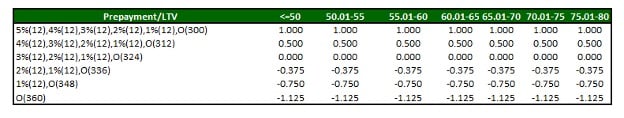

Many patrons who’ve utilized DSCR loans or explored the DSCR mortgage chance versus totally different funding property mortgage types (along with typical and totally different non-QM mortgage types) have seemingly discovered that prepayment penalty provisions, or a proportion fee that is assessed if the borrower prepays early, are a key LLPA attribute of DSCR loans. These prepayment LLPAs are constructive LLPAs, whereby together with a prepayment penalty that’s extreme in every dimension (what variety of months the penalty interval is in impression) and severity (how extreme the fee is, expressed as a proportion of wonderful mortgage stability) can add significantly to the computed premium, and thus generate a lower worth.

DSCR loans with prepayment penalties extreme in proportion fee and dimension (although often certainly not higher than 5% and 5 years of the 30-year time interval) are typically the most effective match for patrons with a really very long time horizon and no plans to advertise inside the near time interval, as these DSCR expenses could possibly be equal and even lower than numerous typical mortgage decisions.

See the occasion prepayment penalty LLPA matrix displaying the quite a few constructive outcomes of prepayment penalties on the computation of DSCR mortgage charges of curiosity.

Completely different LLPAs

These LLPAs are often regular all through just about all DSCR lenders. Whereas adjustments and minimums and maximums will vary, often, all DSCR lenders will attribute them on their pricing calculators. DSCR lenders, not like typical lenders, do have differentiated pointers and mortgage purposes, nonetheless, and these are examples of LLPA adjustments it’s attainable you’ll encounter when getting a DSCR mortgage, nevertheless vary from lender to lender, or be absent on some DSCR worth sheets.

Lease qualification

DSCR lenders can fluctuate from not lending on properties utilized as short-term leases to short-term rental-friendly lenders that use aggressive underwriting pointers equal to qualifying with devices equal to AirDNA. For lenders that do lend on STRs, some will view long-term leases as a lot much less harmful and thus have constructive LLPAs for LTRs and unfavourable adjustments if the property ought to qualify as a short-term rental.

Investor experience

DSCR lenders will often vary in how they cope with debtors who’re searching for their first funding property. Lenders that do current DSCR loans to first-time patrons will usually have unfavourable LLPA adjustments to account for this menace, nevertheless it’s further frequent for these lenders to have lower LTV or mortgage amount maximums than charging first timers elevated expenses.

Poor credit score rating historic previous

Vital unfavourable events in your credit score rating historic previous spherical precise property, equal to present 30+-day delinquencies on mortgage loans, or a extreme “credit score rating event” in present historic previous such as a chapter, foreclosures, temporary sale, or deed-in-lieu, improve giant crimson flags amongst DSCR lenders. Newest credit score rating points spherical precise property debt clearly level out a most likely elevated likelihood of future points.

Many DSCR lenders will nonetheless lend to debtors with these warts on their credit score rating historic previous, nevertheless the LLPAs are often very unfavourable and important, resulting in rather a lot elevated charges of curiosity to account for this menace. If you see a DSCR mortgage with an price of curiosity that seems properly above market expenses, it’s seemingly on account of the borrower seemingly has had present points on their credit score rating report related to precise property loans.

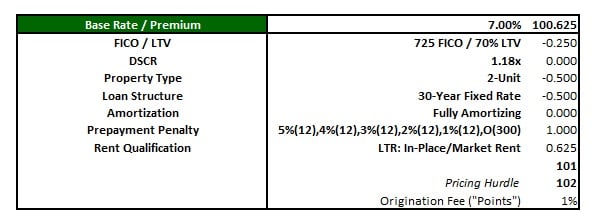

Pricing Occasion

The chart displays a typical occasion of how this all flows collectively and a DSCR worth quote is computed. On this case, the DSCR lender has a pricing hurdle of 102—which means they need to earn 2% on the transaction to cowl costs and performance the enterprise.

As is illustrated, a base worth and premium of seven% and 100.625, respectively, is the place to start (these are based totally on regular market components), and there are a sequence of unfavourable LLPA adjustments (the combo of a 725 qualifying credit score rating score and 70% LTV ratio), constructive LLPA adjustments (a 5/4/3/2/1 prepayment penalty and qualifying as a long-term rental), and neutral LLPA adjustments (no adjustment constructive or unfavourable for a 1.18x DSCR inside the 1.15x-1.24x DSCR bucket and utilizing a completely amortizing development in its place of any interest-only decisions).

As illustrated, together with and subtracting the entire LLPAs from the 100.625 place to start will get to a sum of 101, which requires a 1-point origination fee to make up the excellence between the worth of the mortgage and the required pricing premium hurdle. Resulting from this reality, for this state of affairs, the borrower can protected a DSCR mortgage with an price of curiosity of seven% and a 1% degree paid for a closing fee.

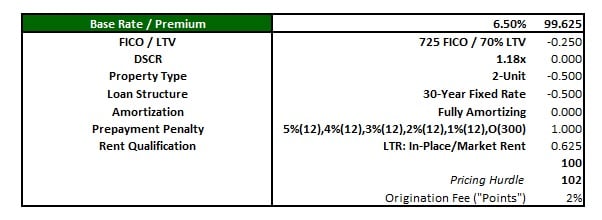

Cost Buy-Downs

Typically, mortgage lenders will allow debtors to buy down an price of curiosity, an chance by which the borrower can protected a lower price of curiosity by paying further origination expenses at closing. This is what it means to “buy down an price of curiosity.”

The occasion will current what it could seem like when a borrower needs to buy down their worth. Taking the equivalent sample state of affairs, on this computation, an price of curiosity of 6.5% is quoted, which has a corresponding base premium of 99.625 in its place of 100.625. With all of the equivalent LLPAs, the sum now includes 100, requiring a 2% origination fee in its place of 1%. On this occasion, the borrower buys down the pace 0.5% (from 7% to 6.5%) for the worth of 1% of the mortgage amount inside the kind of an additional 1% closing fee.

Final Concepts

Hopefully this helps illuminate the computation course of for charges of curiosity and shutting expenses for mortgage loans, considerably DSCR loans. Many rental property investments are carefully affected by the numbers—considerably the mortgage payment and price of curiosity—and utilizing this data to tailor your funding expectations could help make the excellence between profitable leases and draw back properties.

Adjust to the creator of this textual content, Easy Highway Capital companion Robin Simon, on quite a lot of social platforms, along with X and BiggerPockets, for further insights into expenses and developments out there out there for DSCR loans and to stay up to date on all the current pricing of loans for rental properties.

This textual content is obtainable by Easy Highway Capital

Easy Highway Capital is a private precise property lender headquartered in Austin, Texas, serving precise property patrons throughout the nation. Outlined by an expert workforce and progressive mortgage purposes, Easy Highway Capital is the proper financing companion for precise property patrons of all experience ranges and specialties. Whether or not or not an investor is fixing and flipping, financing a cash-flowing rental, or developing ground-up, we have now now a solution to go well with these needs.

Discover By BiggerPockets: These are opinions written by the creator and don’t basically characterize the opinions of BiggerPockets.