Housing gridlock continues with remarkably low transaction quantity. Would-be sellers wish to grasp on to their low-cost current mortgages, so only a few persons are promoting.

Realtors are dropping enterprise and homebuyers are pissed off by the shortage of appropriate houses in the marketplace.

The gridlock isn’t enjoyable for a lot of individuals within the housing market, but it surely advantages Two Harbors Funding Corp. (NYSE:TWO). With the elevated stability from longer length property, we imagine the preferreds are opportunistic sources of excessive yield.

The Purchase Thesis

Two Harbors has a collection of fixed-to-floating preferreds which upon conversion to floating would yield between 9.6% and 10.5% utilizing present SOFR. These well-above market yields are, in idea, justified by TWO being a extremely leveraged mREIT, which might indicate an above-average degree of threat. Nevertheless, with the freshly prolonged length of TWO’s property, there’s a good quantity of visibility into its future money flows, which have ample room to cowl the popular dividends.

As such, I believe TWO preferreds are extra secure than would sometimes be obtainable at that degree of yield, making them probably opportunistic as a high-yield play. For the reason that preferreds commerce at reductions to par, there’s room for a little bit of capital appreciation on prime of the yield.

Lengthened Period and Extra Stability

Two Harbors has two major strains of enterprise: Company RMBS and mortgage servicing rights (MSRs). These asset lessons make up the overwhelming majority of its steadiness sheet.

TWO

MSRs and company RMBS are a pure pairing as a result of they’ve inverse sensitivity to rates of interest. MSRs acquire in worth as rates of interest rise, and RMBS loses worth as charges rise.

With this offsetting facet, Two Harbors is essentially proof against modest adjustments to rates of interest in both course. This minimized the injury to TWO as mortgage charges shot as much as 7%.

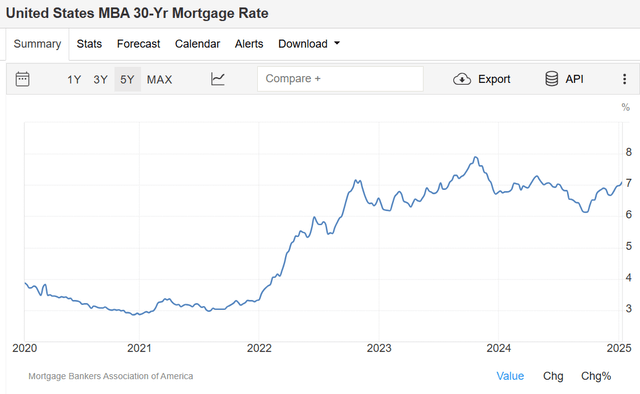

TradingEconomics

Nevertheless, as mortgage charges rose to 7% after which hovered round 7% for the final couple of years, it ushered in an fascinating change to TWO’s outlook: considerably longer asset length.

There’s nothing distinctive in regards to the 7% degree of mortgage charges. Mortgage charges have been round 7% many occasions traditionally. What makes this example totally different is that charges have been so low beforehand that current mortgages are overwhelming at very low charges (2%-5%).

Folks would usually both refinance or pay down mortgages, such that the length of a 30-year mortgage is commonly someplace nearer to 10 years. Given the extraordinarily enticing charges of current mortgages, debtors will attempt to lengthen them to as near 30 years as they’ll.

There are 3 principal sources of prepayment:

- Voluntary early cost

- Refinancing

- Default

All 3 sources are abnormally low proper now.

Folks don’t wish to pay down principal on a 3% mortgage as a result of they might be higher served getting a 5% certificates of deposit (CD) and taking advantage of the unfold.

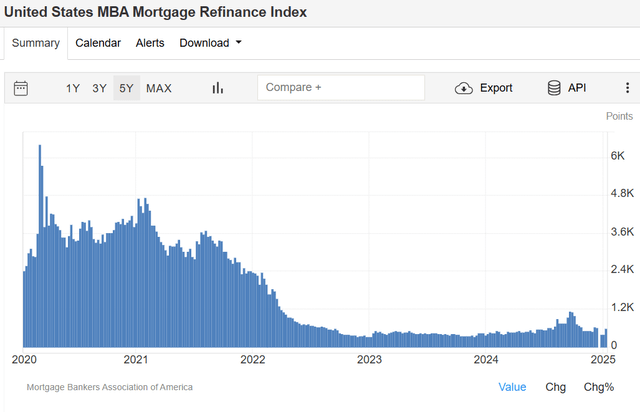

They’re additionally reluctant to refinance, with present mortgage charges nicely above the extent of current mortgages. There is no such thing as a monetary incentive to refinance and persons are even delaying shifting in order to maintain their mortgages.

TradingEconomics

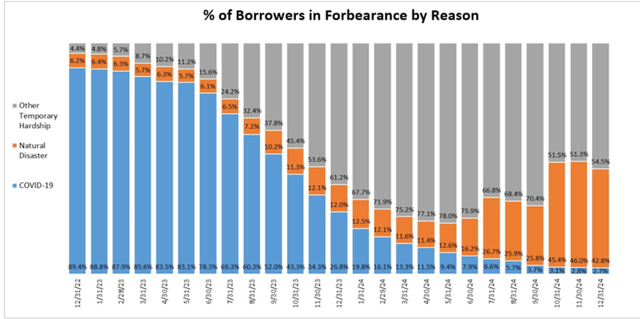

Lastly, default can also be fairly low in the intervening time. In accordance with Mortgage Bankers Affiliation:

Complete loans in forbearance decreased by 3 foundation factors in December 2024 relative to November 2024: from 0.50% to 0.47%.

Among the many small proportion of defaults, a higher-than-normal portion is said to pure disasters, probably the hurricanes and wildfires of latest months.

MBA

With all 3 sources of prepayment at lowered ranges, the length of 30-year mortgages is considerably prolonged.

MSRs significantly profit from longer length because the right-to-service mortgages are bought upfront, after which TWO collects a price in the course of the mortgage. TWO now has extra price earnings for longer.

This offers higher visibility into TWO’s future earnings. Charge earnings from MSRs together with the stream of coupon funds from its company RMBS offers comfy protection for TWO’s most well-liked dividends.

The Preferreds

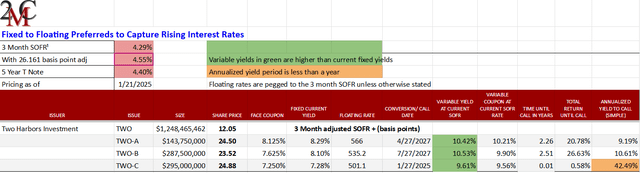

On Portfolio Earnings Options, we regularly observe the universe of mortgage and fairness REIT preferreds. Many preferreds are correctly priced such that they supply a good yield relative to the extent of threat. A choose few are mispriced, and we imagine the TWO preferreds (TWO.PR.A) (TWO.PR.B) (TWO.PR.C) are cheaper than they need to be. Listed below are the vitals:

Portfolio Earnings Options

As a fast reminder, the best way a fixed-to-floating most well-liked works is that it pays the face coupon up till the day of conversion to floating, after which level its coupon turns into the floating fee SOFR plus an adjustment.

For instance, TWO-A pays its 8.125% face coupon till conversion to floating on 4/27/27 at which level it is going to pay SOFR plus a 26 foundation adjustment plus 566 foundation factors. At as we speak’s SOFR, that might be a ten.21% coupon.

Coupons confer with the payout towards the $25 par worth. Given the low cost at which it trades, the yields are barely larger at 8.31% present yield after which 10.45% yield upon conversion to floating (assuming SOFR stays the identical).

All 3 of the TWO preferreds are opportunistic for my part.

TWO-A has the most important adjustment over SOFR at 566 foundation factors, which makes it the one TWO is most incentivized to redeem. As it’s buying and selling at a reduction to par, redemption is a good final result for buyers who would accumulate the distinction in addition to the partial interval dividend accrued.

TWO-B trades on the largest low cost to par which offers about 6% capital appreciation potential to par. These coupons are excessive sufficient that even when rates of interest stay the place they’re the market may simply commerce it at par.

TWO-C has the benefit of an earlier conversion date. On 1/27/25 it is going to start paying its floating coupon of 9.56% which interprets to a yield of 9.61%. Given how shut this date is, that’s functionally its present yield. With a 501 foundation level unfold over SOFR it isn’t fairly as massive of a floating coupon as both the B or the A, however the conversion date is greater than 2 years sooner making the dividends probably bigger for the subsequent couple of years.

Over time, I think all 3 will commerce round $25 par.

We’ve been buying and selling varied mounted to floating preferreds for years and fairly constantly noticed them buying and selling as much as par as their conversion dates method. The principle necessities to commerce at par appear to be sufficiently massive changes over SOFR and a secure underlying firm. For my part, Two Harbors preferreds to test each of these packing containers.