onurdongel

Investment Thesis: Host Hotels & Resorts has seen an encouraging rebound in RevPAR. This has been driven significantly by a boost in revenue across the company’s Maui/Oahu portfolio. A continuation of this trend could lift the stock higher.

In a previous article back in July, I made the argument that Host Hotels & Resorts (NASDAQ:HST) would need to see a strong rebound in RevPAR as well as an improvement in the company’s cash position before we would see further upside.

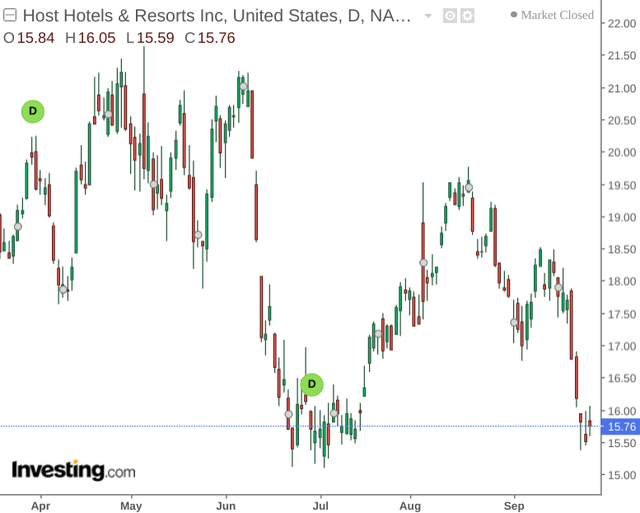

In the past three months, we can see that while the stock saw a rebound from July lows – Host Hotels & Resorts is still trading at the same level that we saw three months ago.

Investing.com

I previously mentioned that I would be paying particular attention to the company’s RevPAR growth in the next quarter, as well as analysing whether cash to total debt levels would see growth. The purpose of this article is to assess whether Host Hotels & Resorts could see upside on the basis of these metrics.

RevPAR

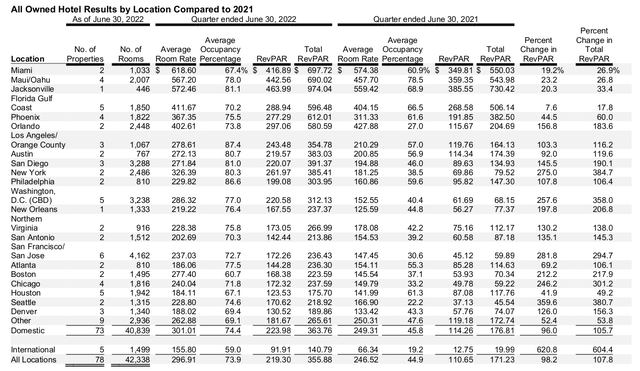

When looking at total RevPAR for the quarter ended June 2022 – we can see that RevPAR is up by over 100% across all locations as compared with June 2021.

Host Hotels & Resorts: Second Quarter 2022 Operating Results

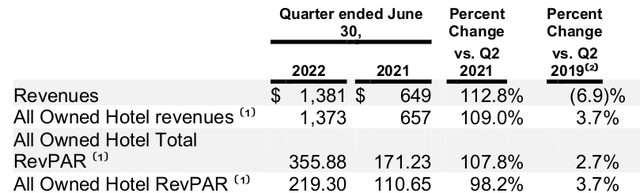

Moreover, we can also see that All Owned Hotel Total RevPAR is up on 2019 figures by nearly 3 percent:

Host Hotels & Resorts: Second Quarter 2022 Operating Results

Particularly, we note that across locations – Maui/Oahu showed the second-highest total RevPAR at $690.02 (but significantly more rooms than Jacksonville which had the highest RevPAR at $974.04), while Houston showed the lowest at $175.70.

To analyse the historical trends across these two locations further – I decided to gather Total RevPAR data for these two locations from Q2 2019 to the present and visualise total RevPAR by means of heatmaps.

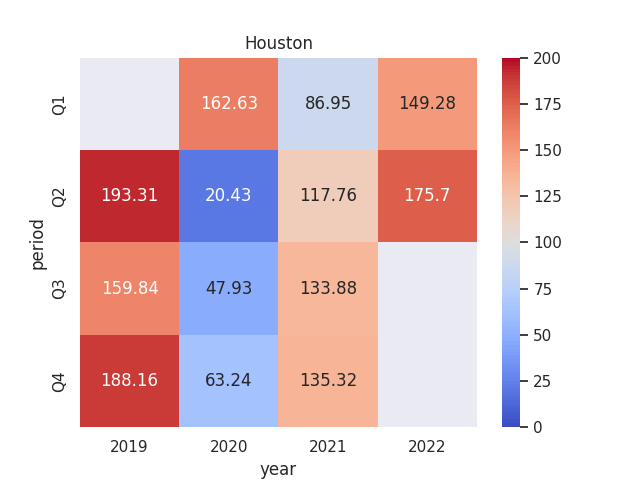

Houston: Total RevPAR

Figures sourced from historical Host Hotels & Resorts quarterly financial reports. Heatmap generated by author using Python’s seaborn library.

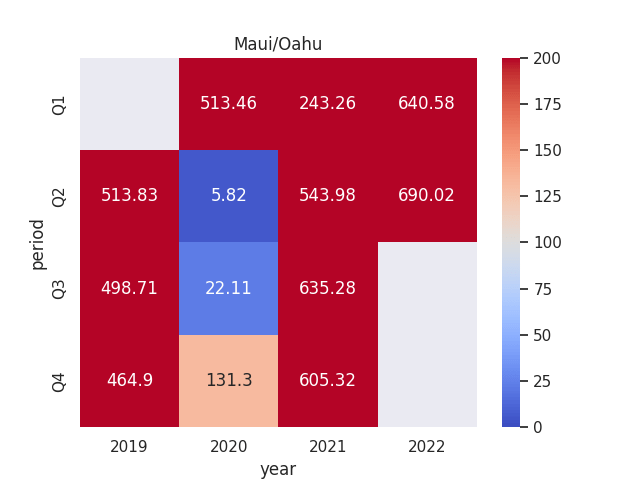

Maui/Oahu: Total RevPAR

Figures sourced from historical Host Hotels & Resorts quarterly financial reports. Heatmap generated by author using Python’s seaborn library.

In the case of Houston, we can see that total RevPAR has steadily rebounded to levels seen in 2019 across the first two quarters of this year.

However, we can see that total RevPAR for Maui/Oahu has significantly exceeded levels seen in 2019. With the Maui/Oahu portfolio, including chains such as the Andaz Maui at Wailea Resort, Fairmont Kea Lani, Maui, and the Hyatt Regency Maui Resort and Spa – these hotels cater to the luxury end of the market. Moreover, we can also see that for Q4 2021 and Q1 2022 (marking the autumn and winter seasons) – total RevPAR across the Maui/Oahu region continued to remain strong.

Financial Position

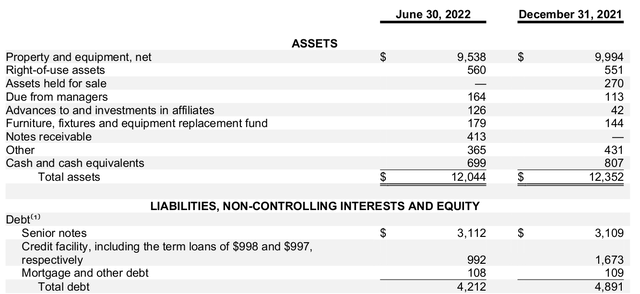

When looking at cash to total debt for both Q1 2019 and Q2 2022, we can see that cash levels have decreased while total debt has increased:

| March 2019 | June 2022 | |

| Cash and cash equivalents | 1082 | 699 |

| Total debt | 3862 | 4212 |

| Cash to total debt (%) | 28% | 16% |

Source: Figures sourced from Q1 2019 and Q2 2022 Host Hotels & Resorts Financial Results. Cash to total debt calculated by author.

With that being said, we can see that total debt levels have fallen since December 2021 – with the cash to total debt ratio remaining constant at 16%.

Host Hotels & Resorts Second Quarter 2022 Operating Results

On the whole – I take the view that for as long as the cash to total debt ratio does not fall significantly from here – investors would be willing to tolerate a lower ratio for as long as we continue to see strong RevPAR growth.

With Host Hotels & Resorts being the world’s largest lodging REIT, the company will invariably need to continue investing in its property portfolio – and as such investors are more likely to quantify meaningful revenue growth as being more important than bolstering cash reserves at the expense of losing revenue on a lack of investment in new properties.

Conclusion

To conclude, Host Hotels & Resorts has seen a strong rebound in RevPAR – particularly across the luxury Maui/Oahu segment.

In my view, should we see RevPAR across this segment continue over the winter months, then this could serve as quite an encouraging sign to investors. I take the view that the stock could see longer-term upside from here.