Donny DBM/iStock by way of Getty Images

Anyone who’s study or listened to us recently-or any time thus far various years-pretty rather a lot is conscious of the throughline: an extended inflationary interval is legitimately inside the taking part in playing cards, borne on long-building pressures that aren’t going away. There isn’t any should stroll that fully plowed ground today-aside from noting that as we communicate is a bit fully totally different, because of some inflation components have begun to point themselves and catch at consumers’ consideration. So this may in all probability be about how our portfolios are positioned for that state of affairs.

For a number of years, the good river of funding funds flowed in a positive route, nevertheless not one we most popular, so we waited. Now we have been able to wait in companies with particular enterprise fashions that afforded wonderful financial compounding traits even inside the absence of favorable conditions. Lately, the river is flowing once more in our route. Intelligent inactivity is a strategic apply we wrote about early on, and is one factor we try to do as often as attainable – if that logic is possible.

And as diametrically unalike as our portfolios are to the stock market indexes and the acute Knowledge Know-how weightings, they nevertheless embody important and salubrious publicity to the the entire sudden rampant new experience funding cycle: the explosive spending by every important IT agency on data amenities amid the mass adoption of artificial intelligence. However, with none important changes on our half because of, in truth, we didn’t have to do rather a lot. Al’s pertinence to our portfolios bears some clarification, though, so this main half will try to explain a number of of the causes for the inevitability of the continued spending.

Half I: A.I. and Data Center Demand

Prefatory Remarks about AI and Data Amenities

One hears regarding the monumental sums being spent on data amenities. Meta currently talked about it may spend $60 to $65 billion on data coronary heart constructing this 12 months, larger than 50% above 2024. The Boston Consulting Group estimates that the principle data coronary heart companies will spend $1.8 trillion inside the U.S. between 2024 and 2030.1 An astounding decide, nonetheless it’s {powerful} to guage how large it actually is with out a reference degree.

The very best associated reference degree ought to completely be the nation’s spending for World Warfare II. For the human facet of its scope, the one best statistic could possibly be this: in 1945, 40% of the male inhabitants in America, from ages 18 to 45, was inside the military. An excellent bigger amount had served, nevertheless not all have been nonetheless serving by warfare’s end. Astounding, is it not?

In fiscal scope, between 1941 and 1945, the nation spent $296 billion in then-current {{dollars}} on the warfare effort.2 This amounted to 31% of 1940 GDP. Adjusted to reflect the impression of inflation since 1945, that’s $5.1 trillion of spending as we communicate. Which means that the aforementioned data coronary heart capital expenditure projection is of the an identical order of magnitude as the worth of World Warfare II, which involved a full, authorities mandated mobilization of the monetary system, private factories and all. Alternatively, in 2024, the entire U.S. safety funds was $842 billion. These are the magnitudes. The build-out of terribly large data amenities has the potential to be the very best deployment of non-public funding capital in historic previous.

First Question

To not ignore an obvious question, even when it seems self-evident, nevertheless what do the current expertise of knowledge amenities do and why do they value rather a lot? As monumental buildings that house giant numbers of laptop computer servers in large ranks of racks, their most observable bodily attribute is the ungodly portions of steel, concrete, copper, high-purity silicon and totally different belongings that go into them. As well as they devour ungodly portions {of electrical} vitality. The reality is, that’s their defining attribute, since data coronary heart measurement is quoted not in sq. toes or totally different precise property terminology, nevertheless in how rather a lot entire vitality their processors draw.

How rather a lot vitality? An anecdotal occasion, from Meta’s present announcement, is that by the highest of this 12 months it may private 1.3 million processing fashions. Each Nvidia-chip unit attracts 700 watts, which isn’t rather a lot decrease than the 1,200-watt electrical vitality utilization of a imply household.3 (Households moreover embody a 700-watt appliance-the microwave-but that runs for a minute or two at a time, not 24 hours a day. Nonetheless, one can see how giant a draw a microwave is on a home’s functionality.) At a 100% utilization cost, Meta’s 1.3 million chips would draw vitality on the cost of seven,972,000 megawatt-hours in a 12 months, in regards to the an identical as a result of the state of Rhode Island, a contact decrease than Hawaii.4

A nationwide scale picture is provided by the December 2024 report again to Congress by the Lawrence Berkeley Nationwide Laboratory, which estimates the enlargement in U.S. data coronary heart electrical vitality use from 2023 to 2028.5

Any number of funding companies and consultancies have made such projections, nevertheless Berkeley Lab has the property of not being a industrial entity, and of being staffed by scientists, with the entire attendant thoroughness one could anticipate. The analysis even incorporates a survey of various analysis, the aforementioned Boston Consulting Group paper amongst them.

Decide ES-1. Full U.S. data coronary heart electrical vitality use from 2014 through 2028.

All through the Berkeley Lab paper is a sub-review that sorts these totally different analysis by their methodologies: whether or not or not they make use of a bottom-up technique, top-down, or an extrapolation of present developments, and it evaluations the advantages and limitations of each methodology. Berkeley even evaluations the constraints of its private methodologies.

Berkeley Lab’s conclusory projections, confirmed inside the accompanying chart, makes allowances for each factor from the range of Nvidia chip fashions shipped per 12 months, to the server kinds and server utilization expenses. There could also be even consideration paid to the ability used for cooling the information amenities, with the latter being dependent upon the types of strategies employed, harking back to evaporative cooling, and the local weather conditions of areas with data coronary heart clusters. The aim is that-however reliable or invalid these projections flip into (the historic previous of new-technology improvement estimates is rife with miscalculation)-there is manner training-driven conservatism in these projections.

The low end of the range for data coronary heart electrical vitality needs-as a proportion of entire U.S. consumption, which in any case is already rising-is a 50% improve between 2023 and 2028, from 4.4% to 6.7%. The extreme end of the range is a near tripling, from 4.4% to 12.0% of U.S. demand. Provided that entire U.S. electrical vitality manufacturing has been primarily flat for a decade, and given the aged and undermaintained U.S. electrical grid, the question of how that could be achieved is one different dialogue.

Pre-First Question

The next question perhaps it should have been the first is why does Al require rather a lot vitality?

What we don’t discover out about experience fundamentals…

The Full Peanuts: 1957 to 1958 by Charles M. Schulz (Fantagraphics Books, 2005.) Initially revealed July 9, 1957.

| Ignorance Transparency Disclosure: The editor claims no coaching, teaching or expertise in laptop computer programming, computational biology, neurology, biochemistry or totally different science disciplines referred to herein, and considers this disclosure sufficient to exculpate any related misstatements or totally different reveals of ignorance. Editor merely endeavors, like many individuals, to read-perchance to grasp-some main guidelines as they might pertain to educated investing. |

The Electrical Vitality Needs of Huge Language Fashions – the Al we Know and Love

For a ChatGPT query, the power requirements are literally regarding the amount of knowledge that ought to sorted to supply a response-which is the quantity of knowledge that exists on the internet. It’s as if, for an open-book essay verify in a high-school Historic previous class, a particular pupil is unable to synthesize or draw a conclusion from the e e book assigned. As a substitute, the scholar has the weird capability to teleport to the library, then superfast study and verbatim-recall every phrase of every e e book and periodical in it, and from that select and piece collectively the 1,000-odd phrases for the standard five-paragraph essay.

Nonetheless even that’s additional high-functioning than ChatGPT. Because of piecing collectively to ChatGPT doesn’t counsel what it means to a person. ChatGPT can not understand context by itself: “The king was tyrannical and dominated the populace with an iron fist” isn’t any additional intrinsic a different than “The king was tyrannical and tickled the populace with ice cream.” ChatGPT makes use of statistical likelihood to estimate, from the entire instances inside the billions of listed internet web pages, that after the phrases “the king was,” which have been themselves pieced collectively this way, the phrase “tyrannical,” has a positive statistical likelihood of coming subsequent inside the sequence. Along with “benevolent,” “indifferent,” and a protracted document of various adjectives. This happens for each phrase and even part of a phrase.

There are ingenious ordering and selection methods to seek out out which subsequent phrase to utilize, impressed by the best way by which that neurons inside the thoughts promote or suppress electrical enter alerts that they might transfer on to totally different neurons. For each phrase chosen, numerous of billions of calculations occur. Full responses comprise trillions of calculations, and that’s largely what {the electrical} vitality is for.

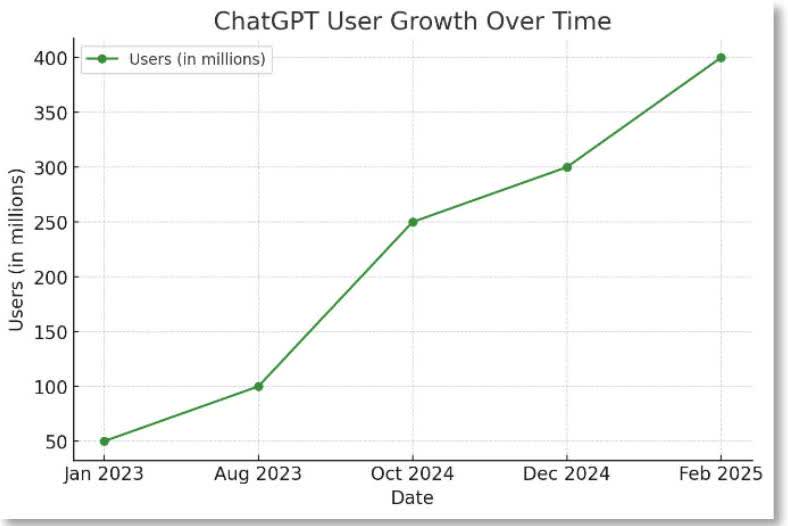

ChatGPT, which is one Huge Language Model amongst many, is reported to now course of over 1 billion queries every day, nonetheless solely a modest fraction of the number of every day Google queries. The number of ChatGPT queries will proceed to increase: inside the two months from yearend to February, the number of energetic weekly clients globally rose by one-third.6

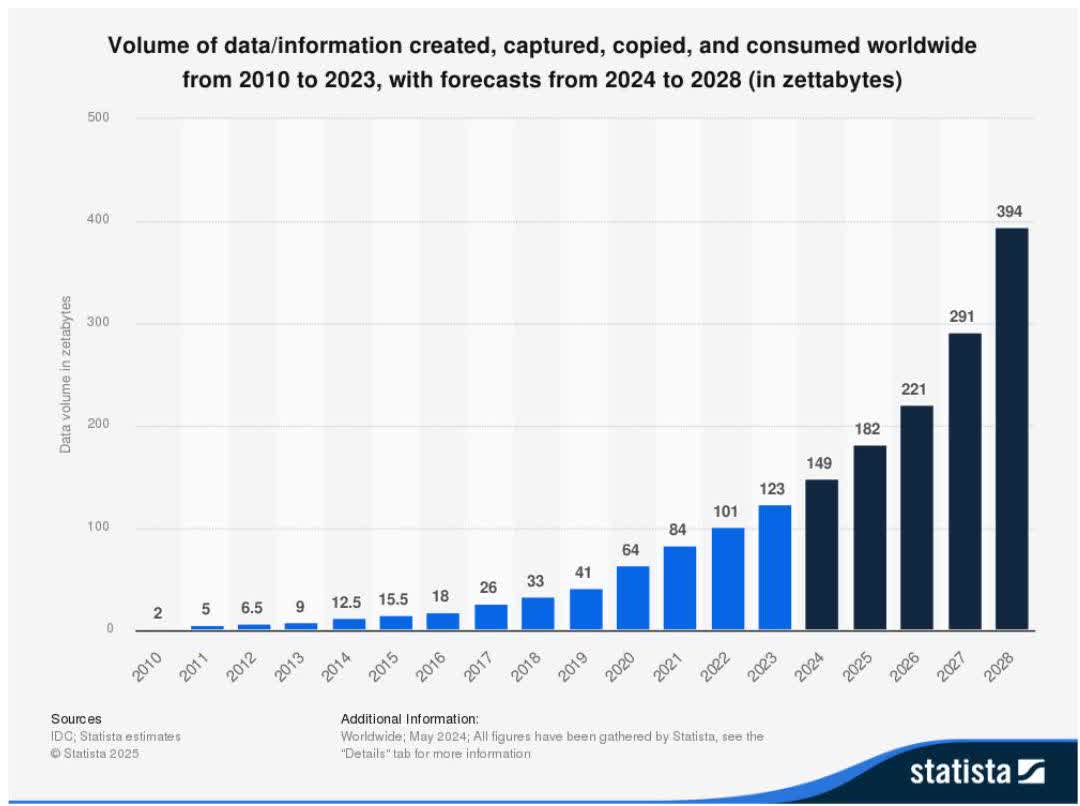

Vitality utilization generally is a function of the magnitude of knowledge on the market to sift through. The quantity of knowledge created, used or copied on the earth in 2025 is anticipated to exceed 180 zettabytes. What’s a zettabyte? As a amount, it’s a 1 adopted by 21 zeros. In seen media phrases, it has been cited as 250 quadrillion pictures or 20 billion years of streaming Netflix video. In journey phrases, it has been cited to be as many grains of sand as on the entire world’s seashores. That’s one zettabyte. The 180 zettabytes is form of triple the amount in 2020.

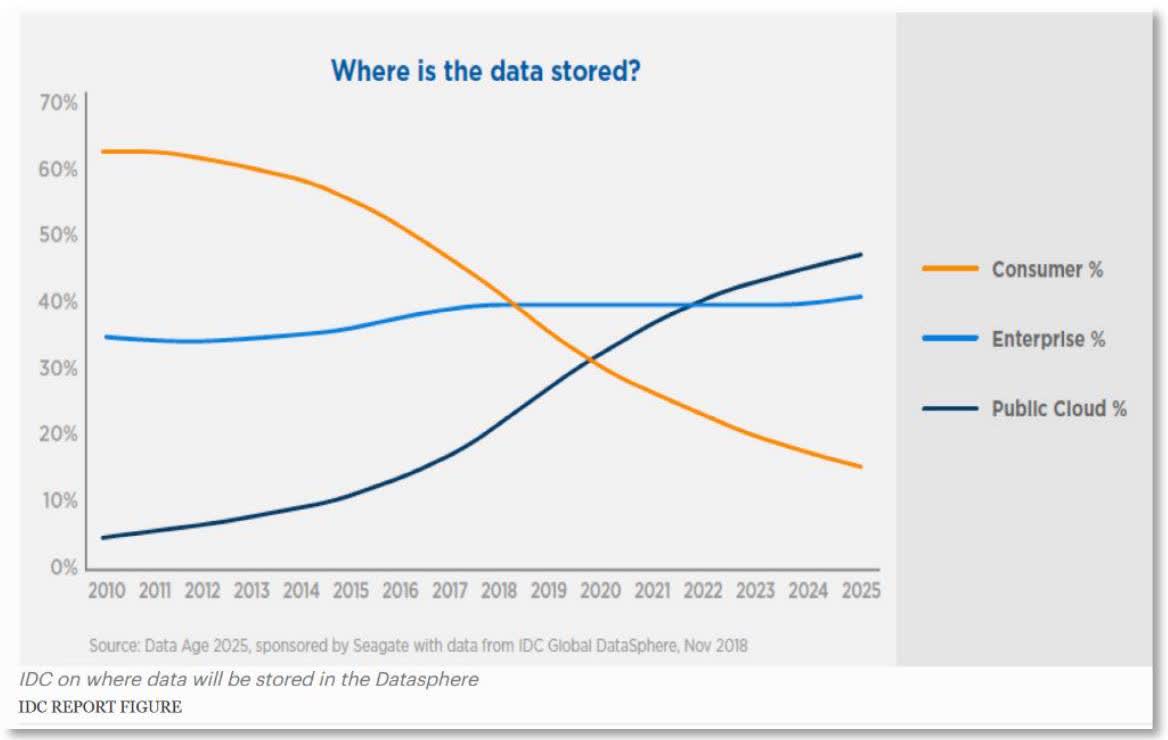

Solely a small proportion of that’s saved. In 2020, the put in base of storage functionality was 6.7 zettabytes, nevertheless was anticipated to increase at virtually a 20% annual cost for the 5 years as a lot as 2025.7 These statistics are from IDC and Statista. A definite company, Cybersecurity Ventures, estimates that storage will in all probability be a far, far bigger 100 zettabytes this 12 months.

The excellence between the two figures relies on a greater estimate for the proportion of latest data that’s fully saved, which the latter company now locations at 50%, up from 25% in 2015.8 As large as these variations seem, they’re trivial for our features, as will in all probability be confirmed shortly.

An vital degree is that the saved data moreover requires vitality: the servers ought to on a regular basis be on. The IDC/Statista decide for annual data creation and utilization is anticipated to larger than double between 2025 and 2028. A lot much less and fewer is being retained on dwelling or office laptop programs; even unusual smart-phone-carrying civilians have tens of 1000’s of pictures and flicks of their archives. That’s all emigrating to cloud storage, which suggests data amenities.

The explosion in energy consumption has each factor to do with AI, because of ChatGPT-type searches are variously estimated as requiring as a lot as 10x the ability of a Google search. Image expertise by way of AI has been estimated to require 5× additional electrical vitality than that. And video expertise by way of the SORA text-to-video AI model launched by OpenAI solely this earlier December has been calculated to utilize 1,000x additional energy than a ChatGPT search.

Pre-pre First Question

Even sooner than the question about why AI requires rather a lot electrical vitality, perhaps it should have been requested why the world even desires it? Or desires it to a degree that justifies numerous of billions of {{dollars}} of seemingly in a single day capital elevating and funding?

The one AI most people has interacted with is the Huge Language Model type, like ChatGPT. It’s easy to go looking out lists of very large markets for it.

Amongst them: voice search and faux evaluation detection (for e-commerce); proofreading and writing (for approved contracts, or for fake funding evaluation on financial data internet sites); data, intelligence, and cyber menace analysis and response (for industrial and armed forces clients); facial recognition, and gait and physique language analysis (for surveillance and laws enforcement); and back-office automation and portfolio analysis (for the banking sector). Completely different functions for AI embody image and video expertise, GPS navigation and autonomous driving, and robotics and industrial automation.

An entire document would clearly embody every sector and job description inside the monetary system that lends itself to algorithmic processing-and to transforming patterns and procedures that could be devoted to a database. Any a kind of functions is a candidate for saving manufacturing time, bettering success expenses, or one other attribute of monetary value to some entity. They’re clearly very large dollar-value numbers, nevertheless perhaps powerful to quantify, and completely not every member of the workforce is thrilled about an Al substitute for his or her job

The Completely different AI-Huge Math Fashions (or Huge Quant Fashions, which some select)

Nonetheless Huge Language Fashions are often not the one sort of AI. There’s one different, with which most people is form of wholly unfamiliar, Huge Math Fashions (or Huge Quant Fashions, which some select). LMMs use the an identical GPU chips as a result of the Huge Language Fashions, nevertheless in a very fully totally different technique.

Huge Language Fashions are educated on exterior data; they’ll sort and pattern and rearrange that data, nevertheless they cannot create their very personal neutral data. As a result of that, as rather a lot as they’ll do, there are vital classes of duties for which they aren’t environment friendly, nevertheless a Huge Math Fashions is. One such is new drug enchancment.

The Rising Disadvantage-and the Rising Reply-for New Drug Progress

Not solely is new drug discovery an infinite and rising market, it’s primed for big funding in LMM AI. To characterize the market different in main enterprise phrases, there’s intense inherent demand every from sellers (the drug companies) and from customers (everyone with a drug-treatable sickness) for faster-to-market and fewer egregiously expensive treatments. And perhaps significantly for the 1000’s of poorly treatable or as-yet untreatable conditions. And to make a additional {{powerful}} triad, even demand from a authorities social protection and monetary perspective.

New drug enchancment expense has prolonged been rising on the order of 13% yearly, multiples of the general value index.9 One concern behind that’s the tough course of to seek out novel molecules that will even have therapeutic outcomes.

A Sidebar on HI (Human Intelligence)Why is generative AI so energy costly? Because of it’s not actually intelligence. It doesn’t “know” points, nevertheless has to go open air itself to the entire library of human written and visual data to piece responses collectively through trillions of calculations. Whereas there are points it has already realized and would possibly re-access with a lot much less processing, world accrued data on a regular basis will enhance and will nonetheless be accessed. Human intelligence might be energy-intensive in a single very slim sense: the thoughts consists of solely about 2% of our physique weight, nevertheless consumes about 20% of our resting energy, so that’s 10x relative demand. Then once more, that 20% of a imply resting metabolic cost of 1,300 Vitality per day—sooner than bodily train—interprets to about 12 watts,. So nonetheless rather a lot memory the thoughts can keep and entry, whatever the quantity or prime quality of output it may produce, inclusive of the entire bodily capabilities that it regulates, it makes use of lot a lot much less energy than a fridge mild bulb. Which signifies that the 170 million minds inside the U.S. civilian workforce, irrespective of their mixture inventive and utilized psychological output could possibly be, devour about 2,040 megawatts in entire. That’s 0.3% of the mix vitality functionality of all electrical utilities inside the U.S. a It would rank underneath the fiftieth -largest vitality plant inside the U.S. b Curiously, intense pondering or studying-such as for a examination or perhaps a quarterly funding evaluation webinar-doesn’t appear to comprise any improve in thoughts energy consumption.a Electrical vitality – U.S. Energy Knowledge Administration (EIA) 04 02_a.htmlb Electrical vitality expertise, functionality, and product sales within the US – prime 10 – U.S. Energy Knowledge Administration (EIA) |

As quickly as a model new compound reaches the regulatory evaluation half, approval time is as a lot as 14 years.10 Most of the failures occur in remaining Half II and III medical trials, which can be designed to guage every efficacy and toxicity. These are the most expensive part of the strategy, because of that’s the place randomized double-blind testing takes place and, so, the place numerous the drug enchancment costs are misplaced.

Because of the third important issue of drug enchancment expense is that whilst quickly as a molecule is promising ample to reach Half I medical trials, the final failure cost for FDA approval is over 90%11 (this from a 2020 analysis all through 12,700 new compounds). For positive broad state of affairs items like oncology and neurology, the failure expenses are about 95%.

The R&D value of each of those failures, from a 2020 analysis, averaged over $2 billion and as extreme as $4.5 billion.12 They could possibly be larger by now. The worth of a model new drug ought to incorporate the mix value of the 9 out of 10 that failed. In some other case, the expense would overwhelm the earnings of the worthwhile ones and threaten the best way ahead for the entire pharmaceutical sector.

|

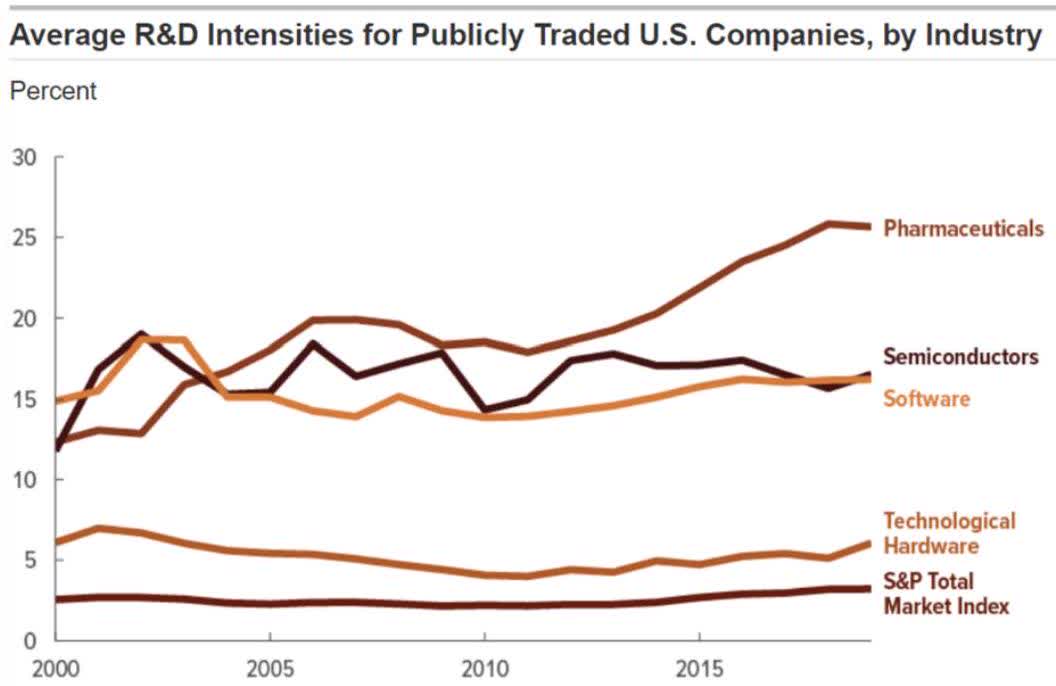

Data provide: Congressional Value vary Office, using data from Bloomberg, restricted to U.S. companies as acknowledged by Aswath Damodaran, “Data: Breakdown” (accessed January 13, 2020), Useful Data Models. See Evaluation and Progress inside the Pharmaceutical Enterprise. R&D depth is spending as a share of web revenues (product sales a lot much less payments and rebates). R&D = evaluation and enchancment; S&P = Customary and Poor’s. |

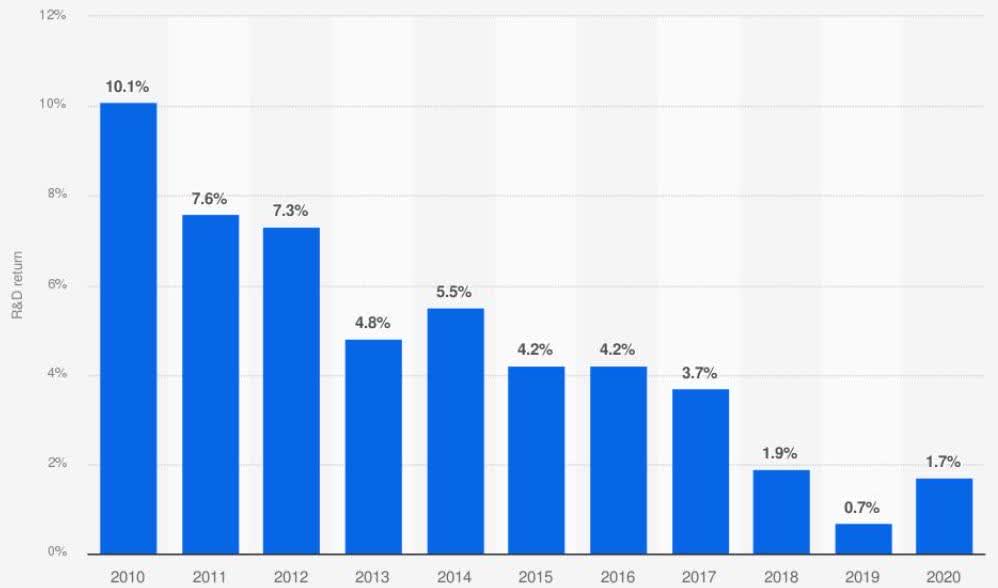

Share return on investments in evaluation and enchancment amongst large cap biopharmaceutical companies from 2010 to 2020

| SourceAdditional Knowledge:Deloitte© Statista 2024Worldwide; 2010 to 2020; 12 largest biopharma companies by R&Dspending |

The financial motive to chop again the payment and time to market will probably be measured. World pharmaceutical product sales in 2024 have been $1.5 trillion, over half of that coming from the U.S. To this point few a very long time, R&D spending, now at $306 billion, has claimed an ever bigger portion of drug agency product sales. It’s no coincidence that funding returns on R&D have been declining.

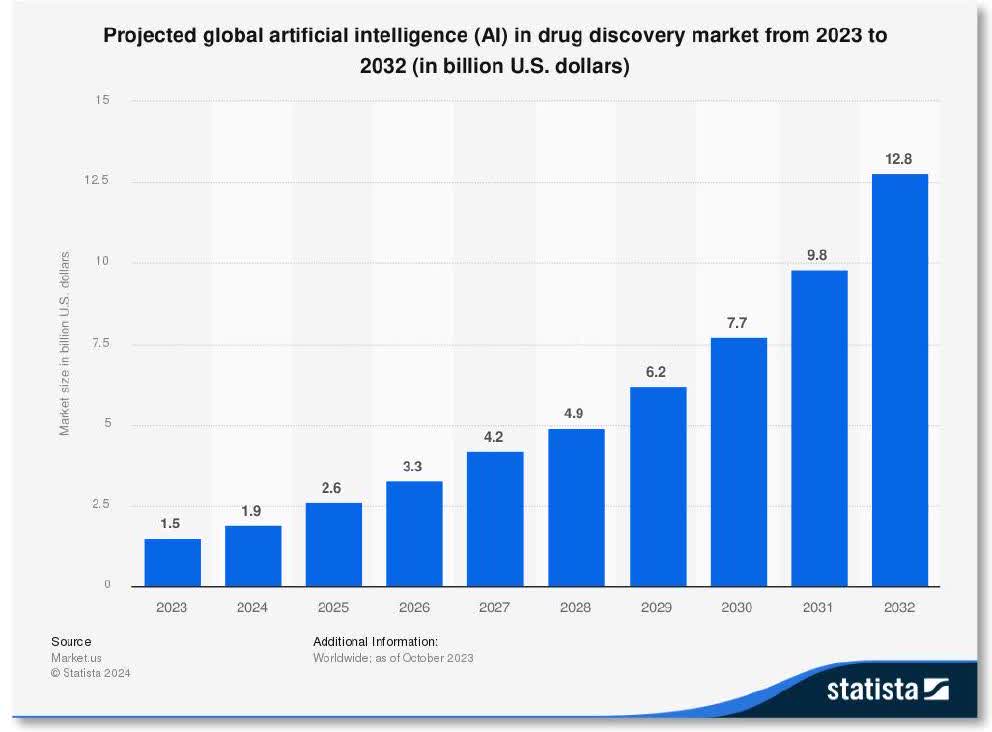

Drug discovery spending inside R&D is anticipated to be $71 billion this 12 months. In 2017, this was projected to develop at an 8.1% cost for the 9 years to 2025.13 As of October 2023, a nine-year projection for spending on AI all through the drug discovery part was for 27% annual improvement. One will recall that every Nvidia’s (NVDA) H100 chip and ChatGPT have been launched decrease than a 12 months earlier, in late 2022.

Huge Math Model Al for New Drug Progress, Additional Significantly

Al can save monumental portions of time and money for model new drug discovery. A great downside has been to ascertain and develop molecules or proteins that bind to or match into very explicit locations of a positive purpose protein or gene, often in very superior constructions, to activate or deactivate them. That’s what medication do.

This entails understanding how proteins change, or fold, their very elaborate shapes from an preliminary state into their remaining configuration. Almost every bodily function relies upon or regulated by proteins. Proteins can solely perform their natural capabilities as quickly as they’ve folded. Illnesses like Alzheimer’s and cystic fibrosis are related to mis-folding proteins, so that’s an house of intense analysis.

Folding, misfolding, and regulation of intracellular website guests of G protein-coupled receptors involved inside the hypothalamic-pituitary-gonadal axisAlfredo Ulloa-Aguirre Ross C. Anderson, Teresa Zariñán, Rubén Gutiérrez-Sagal, Eduardo Jardón-Valadez, Claire L. Newton First revealed: 07 March 2025 | https://doi.org/10.1111/andr. 70018 |

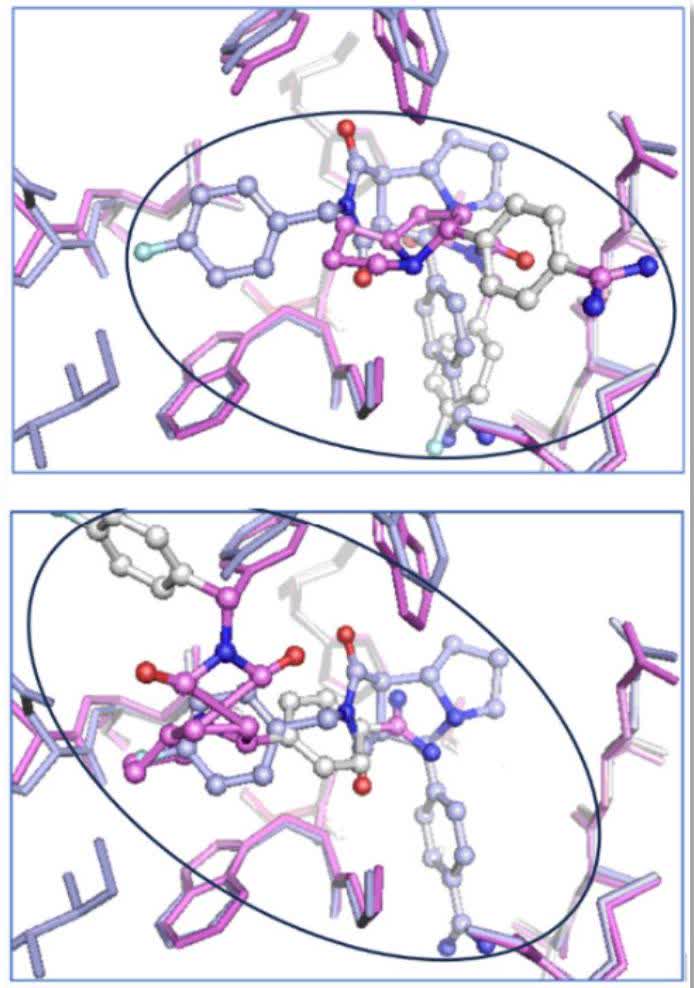

Merely determining a therapeutically applicable and significantly constructed protein, though, is hideously superior. As an illustration, the number of shapes that even a modest-sized protein can take, relative to others near it, actually exceeds the zetta diploma of 1021 that was talked about earlier regarding the zettabyte volumes of internet data.14 The underneath ball-and-stick graphics underneath current two of just about innumerable theoretical three-dimensional configurations a small molecule could take relative to its receptor protein.15 It’s seen as a result of the modified pattern of associated atoms relative to the fixed-background pattern of the purpose, solely a small portion of which is confirmed. The weather that impression how and why a selected protein folds with respect to a purpose occur on the quantum mechanical diploma, the place the outermost electron shell or wave function of atoms dictates how bonds could sort.

Generative AI-based efforts, beginning a number of years sooner than the Nvidia H100 chip, have drastically aided evaluation by determining numerous of tens of thousands and thousands of potential protein constructions. That allowed researchers to model a compound “in silico,” as they’re saying, with out actually having to manually synthesize some restricted number of variations of it. Nonetheless, this hasn’t resulted in rather a lot progress in sickness remedy. Although many additional molecules are being delivered to, and succeeding at, the pre-clinical Half I diploma—the place testing is accomplished on a small group of healthful people to aim to resolve the utmost protected dose-the failure expenses at Phases II and III aren’t rather a lot fully totally different.

That’s because of the intrinsic limitation of the Huge Language Model: its pattern recognition capabilities are dependent upon on large volumes of present data.

Two configurations out of larger than billions?

Nonetheless what if there isn’t any such factor as a data? As in, how will a model new molecule work along with a selected pathogen or pancreatic most cancers cell protein? How will the immune system or essentially the most cancers cell reply? A Huge Language Model can’t be requested to create new data-or whether or not it’s requested, it could “hallucinate” it. Nonetheless that’s what Huge Math Fashions can do.

LMMs aren’t-as IT companies favor to debate with them-artificial “intelligence” any larger than Huge Language Fashions are. People in medical evaluation tend to make use of additional right descriptors: extreme effectivity computing, machine finding out, or computational biology. LMMs use the an identical Nvidia GPU chip as ChatGPT, nevertheless fairly than searching an exterior database, they create their very personal data through extraordinarily iterative modelling.

This can start by making a digital copy of an present molecule and a digital illustration of a particular receptor or tissue, and dealing simulations of their interactions. The LMM makes incremental changes in response to outcomes or non-results, then runs additional simulations, creating new data all alongside the best way by which. When a pharmaceutically promising development is acknowledged, biochemists can synthesize and verify it. Then it might be refined and re-modeled as soon as extra, and so forth.

The reality is, because of the information items generated are so giant, generative AI fashions are compulsory in order to discern patterns inside the data. They’re educated on the LMM-created data to hurry up the strategy and make larger inferences about toxicity or drug intervention outcomes. This appears to have the power to meaningfully improve success expenses on the Half II and III medical trial diploma.

For a manner of the massive computing vitality that should be delivered to bear, It should be understood merely how iterative and data-intensive that’s. As an illustration, the information to be simulated ought to incorporate 4 dimensions: not merely the three dimensional development of the entire proteins involved inside the interaction, however moreover their altering shapes over time as they fold. The shapes themselves will probably be terribly superior and would possibly embody 1000’s of atoms in quite a few groupings, each with their very personal constructions and folding dynamics.

As astounding as a result of it’d sound, the time it takes a protein to reach its distinctive folded state will probably be as little as 4 millionths of a second-a few hundred thousand cases per second. Enzymes, which catalyze reactions in several molecules, fold even faster. How rather a lot data is collected, nano-second by nano-second, if one particular person have been to be scanned for only some hours? Trillions upon trillions of simulations are made, and using large portions of knowledge.

The Eternal Data Storage Load: An Occasion

There is no such thing as a such factor as a doubt that the rising use cases for AI will set off storage should climb drastically. Staying with intelligence and neurology:

- Merely this month, a report was launched by The MICrONS Enterprise. This generally is a enterprise of IARPA, the Intelligence Superior Evaluation Duties Train program, of the Office of the Director of Nationwide Intelligence. IARPA has an curiosity in bettering pattern recognition strategies. One effort in direction of that’s reverse-engineering the best way by which the thoughts is able to be taught patterns from very modest portions of information, and to thereafter acknowledge them even when significantly distorted or degraded.

- MICrONS achieved an apparent first: the complete and completely detailed seen and digital reconstruction of merely decrease than a cubic millimeter of the seen cortex of a mouse’s thoughts. For reference, the thickness of a dime is 1.35 millimeters.

- That cubic millimeter included larger than 200,000 cells, 75,000 neurons, and 523 million synaptic connections amongst these neurons.

- There are numerous totally different fascinating points to say about this, nevertheless pertinent to this dialogue is that the raw dataset for this enterprise amounted to 2 petabytes. Numerically, that could be a 1 adopted by 15 zeros. In experiential phrases, it has been put, in ascending data density order, at 500 billion pages of abnormal printed textual content material, 2,000 years’ value of MP3 audio, or 13 years of high-definition video content material materials.

Just for this single, 1-cubic-millimeter analysis. Which isn’t, in any case, over; it’s merely the first step.

Summary

This high-performance computing half was all a technique of supporting, with additional accessible and relatable aspect, the idea that the enlargement in data amenities and their helpful useful resource requirements will proceed, because of it’s economically primarily based demand:

- The early proof is that high-performance computing utilized to drug discovery is about an 18month course of fairly than the norm of 5 to 10 years.

- It moreover appears to significantly “de-risk” new medication sooner than they get to the terribly high-failure-rate, high-expense medical trial stage, resulting in rather a lot larger FDA approval expenses. Every the invention and the testing half should experience dramatic benefits in terms of value and years-to-market.

- LMMs require gigawatt-scale data amenities, too. Will people want the information coronary heart monetary system and the implications of the entire energy consumption? Among the many features to which {the electrical} vitality for LLMs is put, say for surveillance or altering large swathes of white collar jobs, could be socially controversial. Nonetheless will people say no to a experience that ensures to vastly improve drug discovery and treatment beforehand untreated illnesses? No, they’re going to say positive.

- Moreover, fairly than costing more-which is the norm-high effectivity computing ensures to dramatically reduce the worth of billion-dollar-class medication. Correct there’s the {{powerful}} monetary dynamic of purchaser demand meeting vendor demand for the very same product.

- Moreover, drug discovery is only one software program of high-performance computing. The an identical iterative modelling methods for creating new compounds is getting used for chemical substances (harking back to for improved batteries) and provides science and engineering (lighter however stronger composites for, say, jet wings or wind turbine blades). The various varieties and functions appear to be transformative.

Half II: A Fork inside the Data Center Avenue-Two Antipodean Approaches to Portfolio Positioning

For example you may have concluded that prime effectivity computing and data coronary heart constructing of one-for-the-history-books scope are proper right here to stay and on the best way by which. It’s going to impression improvement, earnings, and valuations in of all types of industries.

How do you establish the place to take a position?

One Direct Technique-the GE Vernova Occasion

A direct technique could possibly be to buy a producer of gas mills for electrical vitality expertise, like GE Vernova. It already has a few four-year backlog. In 2022, it had orders for 30 of its 500-odd MW units-the world’s most powerful-and is rising functionality to ship as a lot as 80 subsequent 12 months. Solely a modest portion of the backlog is claimed to data coronary heart demand; that bounty is however to return again. It moreover has an order for considered one of many first small modular nuclear reactors inside the U.S. The company is amount 89 inside the S&P 500. An opportunity, nevertheless it’s a single-company hazard. (There’s a additional primary disadvantage, too. See the textual content material subject, underneath.)

|

A observe on GE Vernova: One should be just a bit cautious proper right here to not mistake a consumer of important belongings for a provider. Many would leap to the conclusion that GE Vernova is a provider. Reasonably, as a producer, the company can purchase steel and electrical power-and a great deal of it-in order, paradoxically, to supply mills and mills that produce electrical vitality. The Vernova 9Ha turbine weighs 9 tons. |

(The Paradox of) The Indexation Technique

The default different is the indexation technique. The logic in favor-aside from the assertions about its effectivity and safety versus explicit particular person security selection-is that it’s already chock-full of AI publicity. Nicely being Care, at 11%, is the third largest S&P 500 sector, and we already understand how pharmaceutical companies can revenue.

Financial Suppliers, the second largest S&P 500 sector, at 15%, is an obvious beneficiary of institutional-scale AI suppliers. Banks’ largest noninterest working expense is compensation. JPMorgan pays $51 billion to its 317,000 employees. AI could convey important efficiencies.

Stability sheet administration is rather more vital. With a $4 trillion stability sheet, JPMorgan has every sort of asset—from wholesale credit score rating, retail loans, financial institution playing cards and mortgages to precise property. They’re distributed all through industries, credit score rating prime quality and geographies. There’s foreign exchange and commodities shopping for and promoting; the associated hedges and derivatives; numerous debt leverage on all these asset groupings and naturally on the particular person loans and positions inside them; and on and on. Buried inside all this, aside from efficiencies that could possibly be realized, is a great deal of hazard. The problem for the monetary establishment is, “How rather a lot, and the place is it buried?”

Nonetheless many tens or numerous of 1000’s of positions it has, they’re too fairly a number of and complicated to be understood on a loan-by-loan or security-by-security basis. They’ll solely be assessed on a statistical basis-precisely what generative AI can do exceedingly correctly.

The default asset allocation selection is to participate by way of an important indexes. The IT companies are already there, and so are their main AI-beneficiary prospects.

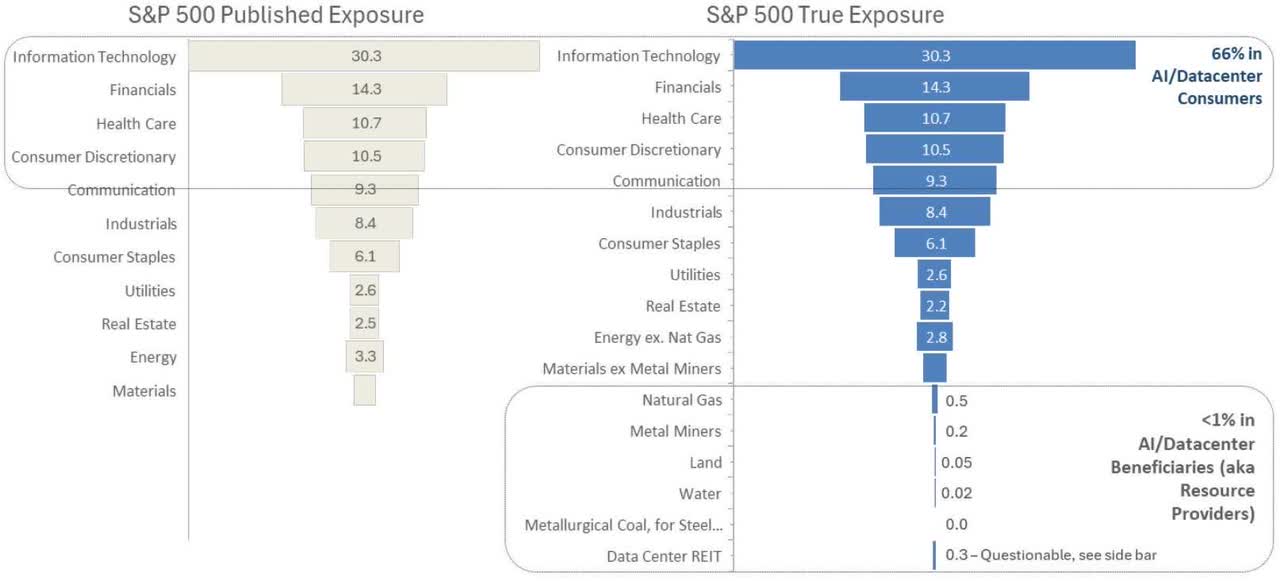

There’s a fully totally different technique to try this gameboard. The associations merely described suggest that the IT, Financial Suppliers, and Nicely being Care sectors share a sensible covariance. Collectively, they account for 66% of the S&P 500.16 Seen on this mild, the ascendance of AI suppliers concentrates rather more experience hazard inside the index.

Until now, an important hazard was IT’s 40% weight. Put a lot much less dramatically, this covariance reduces the index’s diversification resilience.

Desirous about these interdependencies, the high-margin IT companies have begun to load their beforehand asset-light stability sheets with large portions of bodily belongings to assemble their cloud/data coronary heart suppliers. Their industrial prospects, like Financial and Pharmaceutical sector companies, will buy large parts of AI suppliers. In a manner, they’re all clients of AI related belongings. Shareholders, in flip, will in all probability be clients of those companies’ financial returns, which is ready to partly be a function of the supply and pricing of the bodily belongings. Everyone’s heading to the an identical sq. on the gameboard.

This raises a big-decision question: is it larger to spend cash on the information coronary heart companies, which devour the belongings required to assemble and performance them, and inside the clients of the information coronary heart Al suppliers? Or is greatest to spend cash on the suppliers of the belongings required to assemble and performance the information amenities?

This can be a check out the gameboard.

Comment: The additional electrical vitality needed for the information coronary heart buildout is startlingly large. Among the many many main commodity inputs with out which there won’t be electrical vitality, are these two of the three which were reviewed inside the 4th ― Quarter Commentary:

- Pure gas. Not solely will it’s the fuel of different, it already is. U.S. electrical vitality expertise in 2023 isn’t any larger than in 2005, nevertheless pure gas utilization for vitality expertise larger than doubled, whereas coal’s use declined two-thirds.

- Water. There is no such thing as a such factor as a special different. That’s for steam to maneuver the mills in thermal vitality vegetation (gas, coal and nuclear), and for cooling the information amenities and the power vegetation.

- Adopted by steel (which is 98% iron), copper, and totally different onerous commodities.

It’s previous question that data coronary heart development on the scale envisioned will impression commodity demand and pricing.

U.S. Electrical vitality Expertise by Provide

| Provide | ||

| (in bill. kWh) | 2005 | 2023 |

| Coal | 2,013 | 675 |

| Pure gas | 761 | 1,802 |

| Nuclear | 782 | 775 |

| Renewables | 358 | 894 |

| Petroleum & totally different | 142 | 32 |

| Full | 4,056 | 4,178 |

|

A brief aside on steel reveals a number of of the unavoidable options loops in an monetary system. Coal use for electrical vitality declined by two thirds thus far 20 years, and some of that was modified with wind mills; renewable electrical vitality manufacturing rose 150%. Nonetheless, a 5 MW offshore wind turbine requires as a lot as 900 tons of steel, which requires as a lot as 2,000MW {of electrical} vitality to offer,* along with metallurgical coal. Data amenities moreover use large parts of steel inside the constructing of the campus buildings, the server racks, security caging, airflow containment, and totally different infrastructure instruments. Last April, Nucor, the steel maker, purchased an data coronary heart infrastructure instruments producer, and has created a model new subsidiary typically often called Nucor Data Applications as an answer to participate in datacenter steel demand improvement.*https://ieefa.org/web sites/default/data/2022-06/steel-fact-sheet.pdf |

Comment: There are vastly additional funding {{dollars}} allotted to helpful useful resource consumers-the AI and data coronary heart companies and their prospects—than there are main helpful useful resource suppliers.

Whereas the AI/data-center clients are 66% of the S&P 500, the helpful useful resource suppliers comprise decrease than 4% of the index. Truly, hardly larger than 1%.

- Metals mining: 0.25%

- Energy: 3.3%. Nonetheless, that’s weighted in direction of oil. Primarily based totally on its contribution to energy agency manufacturing volumes, pure gas would have an index weight of 1%.

- Land: 0%. Till one applies the proportion of Texas Pacific Land Corp. market value that’s attributed to land, nevertheless that decide doesn’t completely exist on the steadiness sheet. In any case, it should be some fraction of TPL’s 0.05% index weight.

- Water: 0%. Till one applies the proportion of TPL revenues from water, by way of which case the water weight inside the index might be 0.02% (rounded up from 0.018%).

- Metallurgical coal, for steel manufacturing: 0%

- Data coronary heart REITs: a very iffy entry, solely because of it appears good to aim. REITs are an asset intensive and debt-leveraged enterprise development. Because of REITs ought to distribute 90% of web earnings, they generally resort to equity issuance to fund development, in order that they’re usually poor per-share earnings and e e book value compounders relative to their entire improvement expenses. For what it’s value, there are two data coronary heart REITs inside the S&P 500, and they also entire 0.27%.

| Realty Earnings Corp (0) | Annualized Change 25 Yrs. to 2025 |

| Earnings | 17.3% |

| Web earnings | 12.9% |

| Full dividends paid, {{dollars}} | 16.4% |

| Shares wonderful | 11.7% |

| Earnings/share | 5.0% |

| Web earnings/share | 1.0% |

| Dividends per share | 4.1% |

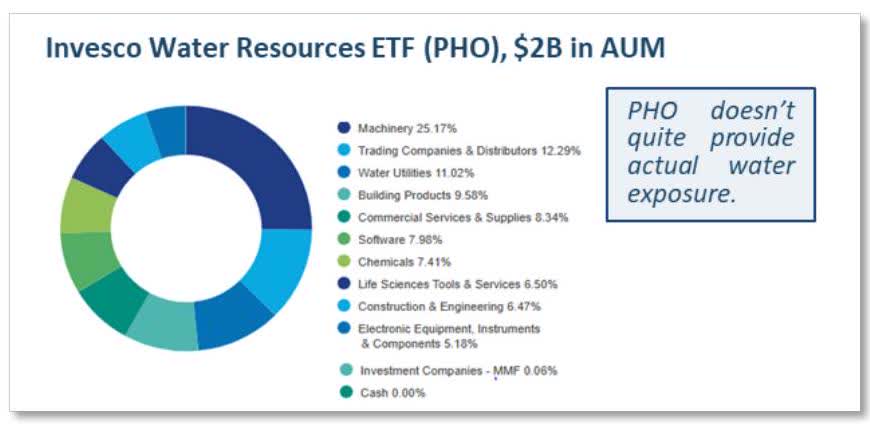

For a broader picture previous the S&P 500 Index, the complete market value of equity ETFs is 7.8 trillion,17 and they also amount 2,859. For these intrigued by additional bespoke decisions, etfdb.com lists 79 fully totally different industries. Of those, there are 12 industries, with 82 funds that sound as within the occasion that they could be supplier beneficiaries to AIdata coronary heart demand improvement. Their entire AUM is $98 billion17, which is a 1.3% mixture share of ETF {{dollars}}.

“Sound as if” because-well, because of we gained’t help ourselves-we do have to look beneath the hood. Two examples will illustrate the issue of getting helpful useful resource supplier publicity by way of indexation.

The largest of these sectors, Oil & Gas Exploration & Manufacturing, about 40% of the complete AUM, is just a bit problematic, since solely about one-third or a lot much less of oil agency manufacturing is pure gas. Little or no oil is utilized in electrical vitality manufacturing.

| # of ETFs | AUM ($MM) | |

| Broad Energy | 6 | $1,919 |

| Broad Provides | 14 | $10,012 |

| Commodity Producers | 1 | $0.001 |

| Copper Miners | 1 | $2,192 |

| Gold Miners | 14 | $23,982 |

| Laborious Property Producers | 1 | $146 |

| Metals & Mining | 4 | $2,415 |

| Pure Gas | 1 | $307 |

| Pure Sources | 7 | $8,968 |

| Oil & Gas Exploration & Manufacturing | 21 | $40,288 |

| Silver Miners | 5 | $2,926 |

| Water | 7 | $4,872 |

| Full Data Center Suppliers | 82 | $98,027 |

| Full Equity ETFs | 2,859 | $7,815,806 |

| % Market Share | 1.3% |

The largest of the Broad Provides ETFs (Provides Select Sector SPDR Fund, XLB, $5 billion of AUM) has solely two metals producers. They’re 10% of the fund’s value. The rest of the holdings are largely producers, harking back to of chemical substances, paints, packaging, paper, industrial gases and so forth. XLB’s security selection rule set is simply to repeat the S&P 500 provides sector.

The largest water sector fund, the Invesco Water Sources ETF (PHO), has $2 billion of AUM. Among the many many enterprise sector representations all through the fund are Gear, Setting up Merchandise, and Chemical substances. They each perhaps have one factor to do with water, nevertheless they aren’t exact water publicity.

Provides Select Sector SPDR Fund (XLB),$5 billion in AUM

| Picture | Agency Title | Weight | Prime Industries | Weight % |

| LIN | Linde plc | 18.63% | Chemical substances | 62.00 |

| SHW | Sherwin-Williams Co | 6.70% | Metals & Mining | 15.50 |

| Containers & Packaging | 14.65 | |||

| NEM | Newmont Corp | 5.70% | Growth Provides | 7.86 |

| ECL | Ecolab Inc | 5.24% | XLP has solely two metals producers, NEM and FCX, 10% of the fund’s value. The rest of the holdings are largely producers, harking back to of chemical substances, paints, packaging, paper, industrial gases and so forth. | |

| APD | Air Merchandise & Chemical substances Inc | 5.19% | ||

| CTVA | Corteva Inc. | 4.80% | ||

| FCX | Freeport-McMoRan Inc | 4.68% | ||

| VMC | Vulcan Provides Co | 4.43% | ||

| MLM | Martin Marietta Provides | 4.19% | ||

| DD | DuPont de Nemours Inc. | 3.73% | ||

The closest match is the 11% in Water Utilities. Water utilities are perhaps not getting you to the information center-growth promised land. They’re regulated and would possibly’t merely promote to the

highest bidder. These with in all probability essentially the most water amount are perhaps located in inhabitants amenities. The proof thus far is that municipalities just isn’t going to tolerate a large-scale data coronary heart claiming their water. Plus, the water should be proximate to plentiful pure gas present and suitably sizable acreage.

In any case, a regulated water utility is a definite enterprise than pure free-market water provision, harking back to by a land agency with subsurface water rights, like TPL. It would even be a water pipeline agency that immediately provides water provide and takeaway suppliers, like LandBridge affords, or Aris Water Choices.

A pending present/demand imbalance that extreme, significantly if not however manifest, is one factor consumers ought to really be aware of.

Turning Asset Allocation on its Head

Indexation and large-scale investing adjust to a logical technique: if an enterprise is an enormous part of the monetary system, it’s intelligent to non-public it in a proportionate pattern. You partake of the long-term monetary improvement, magnified through the working leverage and earnings of the guide companies. In some other case, you’re underrepresented inside the improvement of the monetary system. Contrarily, you wouldn’t make investments rather a lot or the least bit in marginal sectors, which couldn’t fare the least bit correctly even when the final monetary system is powerful.

Nonetheless can these dynamics work the other technique ‘spherical? Can one factor that isn’t wellrepresented inside the indexes or monetary statistics nevertheless be important to the monetary system and to those large sectors and companies? This can be a present relatable occasion.

As a result of avian flu, egg prices almost doubled between year-end and March. Nonetheless since they’ve solely a 0.17% weight inside the CPI, their impression on the revealed inflation figures was negligible. Other than, the 100% egg value improve was significantly offset by the roughly 30% value decline of potatoes and pasta, which collectively have a 40% bigger weight. The Shopper Value Index registered pretty low inflation: inside the three months from December to March, it rose by a pleasing, common 0.63%, or 2.6% if annualized. Nonetheless, egg customers did in fact experience important—identify it “localized”—inflation.

If apple prices had doubled, clients could readily have substituted them with pears, oranges or grapes. Eggs, though, are often not merely substituted, and egg prices turned a cause for nationwide political concern. However the availability declined by solely 10% all through these few months.18 That’s what happens when there’s a present constraint for a commodity with fairly inelastic demand; it may happen with any commodity.

A Phrase on Historic S&P 500 Sector NormsThe absence of commodity and inflation-beneficiary companies inside the S&P 500 simply isn’t the norm, solely a present and non-permanent norm. That absence is the outcomes of a very long time of accelerating financialization of the securities markets all through a protracted interval of artificially low charges of curiosity. These expenses have been enabled by a protracted disinflationary interval, that disinflation being partly enabled by a sustained present surge of onerous commodities from China and the Soviet Union. These exports accompanied reversals, inside the Nineteen Eighties, of the then extant restrictions on worldwide capital flows, which relaxation in flip allowed the occasion of novel financial gadgets to hedge such flows and commerce, and which in flip engendered bigger and bigger volumes. Quite a few long term geopolitical, regulatory and monetary protection assist went into the current historically extreme market development. It isn’t an inherent norm; it solely exists all through the context of forces that assist it. Consumers have been as quickly as predominantly hard-asset oriented; future circumstances could dictate they as soon as extra flip their consideration there. |

A lesson for anyone wishing to hedge in direction of or income from inflation-they’re truly the an identical thing-is to deal with belongings and commodities for which there isn’t any such factor as a immediately on the market substitute, most significantly in a interval of accelerating demand. That could be a circumstance tailored for localized inflation.

As such, there’s perhaps regular agreement-humorous asides aside-that pure gas and electrical vitality are far more essential to the monetary system than espresso and eggs; espresso prices moreover doubled this earlier 12 months. And, like eggs, we already seen the negligible weightings of such onerous commodities inside the equity indexes. They don’t even approximate their GDP weightings. Energy is reported as 8% of GDP.19 Water just isn’t reported in GDP and it’s not inside the CPI, each. Nonetheless pure gas and water are rather more essential to the AI/data coronary heart enterprise than even espresso and eggs are to us breakfast eaters, even once we do take into consideration espresso to be a important asset.

That’s an object lesson-in diametric opposition to as we communicate’s market development orthodoxy and bought knowledge-that the extreme effectivity profit can now reside not inside the large-scale investing model, which is accomplished on the $100-billion-plus scale,20 nevertheless in small-scope investing. And for the Al/data-center interval, in limiting-factor belongings.

“Cornering” the Market with Small-Scope Investing

Attempting to nook the market in a security or commodity, by securing administration of a large portion of the supply, is prohibited and intently monitored by regulators. The idea is to drive the worth up by artificially limiting the supply. An artificially boosted value could create a situation with pressured customers who had provided fast, typically on a leveraged basis, harking back to inside the commodities futures markets. The short-sellers wanted to purchase the merchandise in question to close out their place. That was the “fast squeeze.”

Nonetheless what if cornering a market could someway be replicated legally and naturally? If it involved no market manipulation inside the approved sense of the time interval? Weirdly, large-scale index investing has itself constructed the conditions for numerous cornered markets, and which can be open to most individuals to utilize.

It could possibly be described this way. Listed Equity ETFs and mutual funds amount to about $14 trillion.21 This doesn’t embody in-house indexing by large institutions like endowments and outlined revenue pension plans. If none of those pension fund belongings are inside the publicly traded ETF and mutual figures, they could be one different $12 trillion,22 and even bigger by some calculations, nevertheless not wanting to double rely, the decide will in all probability be used provisionally.

As ETF promoters search strategies to supply publicity to the data-center-growth phenomenon, their consideration will in some unspecified time sooner or later flip to the enabling commodities, and to companies which might be associated to those commodities. If asset allocators’ consideration interprets, even when solely to the marginal diploma of a single share degree of portfolio allocation, utilized to this powerful estimate of listed equities of someplace between $14 trillion and $26 trillion, that could be $140 billion to $260 billion of buying curiosity. Moreover, for this state of affairs, there isn’t any need to restrict the potential curiosity to listed equity assets-actively managed portfolios should lastly have a keen curiosity on this theme as correctly. In any case, there merely simply isn’t ample market capitalization of this relative handful of companies to go spherical. These equities would, in that sense, be overwhelmed, which could be expressed of their share prices.

Being pre-positioned in such companies could be very very like collaborating in a cornered market, albeit of indexation’s making.

Half III: Portfolio Insights—The Use of Predictive (versus descriptive) Attributes, and A Few Data-Center-Progress Beneficiaries

Predictive Attributes and Time Arbitrage (AKA Equity Yield Curve)

Indexes, and index and stock screeners, are primarily based upon descriptive attributes. These are statistical measures, starting with the GICS sector and enterprise codes23 into which companies are categorized, adopted by their stock market capitalizations, and shopping for and promoting liquidity. There could also be moreover dividend yield, value volatility, whether or not or not companies have expert quick earnings improvement, have extreme or low valuations, and so forth. The statistics can describe how a constituent agency has carried out, and there are revealed earnings estimates. Nonetheless none of these inform how correctly a corporation could do in the end. They don’t appear to be predictive.

We used to jot down down reasonably rather a lot about predictive attributes-if you contemplate in that sort of thing-which are choices that predispose a enterprise or security to do correctly in the end. Most likely essentially the most straightforward occasion could be the dormant asset. A company could private an asset that produces no earnings or earnings. The company in all equity priced relative to its reported earnings, which suggests the share value consists of no value for this asset. It could possibly be a piece of land acquired so manner again at so low a price that it doesn’t even qualify as a line merchandise on the steadiness sheet. It’s invisible.

| Horizon Kinetics Predictive Attribute Sequence | |

| Phrase: The underneath alternate options symbolize sample evaluation research as of the listed publication dates. Taere bave been so edits made to these evaluation research since they’ve been revealed. As such, the information berein shouldn’t be relied upon with out first reviewing additional receat figures. | |

| Desk of Contents | |

| Topics | Internet web page # |

| The Equity Yield Curve | 2 |

| Proprietor-Operators | 18 |

| Spin-Offs 1 | 36 |

| Dormant Property | 42 |

| Bits & Objects | 46 |

| Scalability | 52 |

| Prolonged Product Lifecycle | 59 |

| Liquidations | 65 |

Nonetheless, the land could be located on a block of a metropolis enterprise district that’s current course of a redevelopment. That lot could possibly be value an vital deal, probably as rather a lot as the company’s operations, nevertheless its potential earnings or sale value won’t be seen until the company takes some movement. This isn’t a madeup occasion. A dormant asset will probably be predictive of a superior return. It is usually, truly, a function of 1 different predictive attribute.

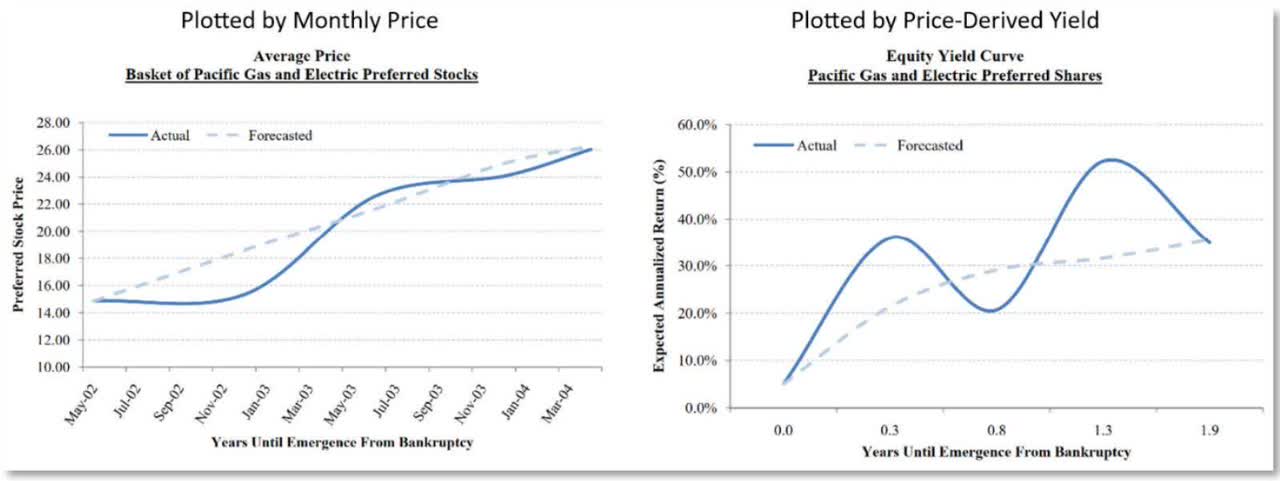

This totally different predictive attribute simply isn’t as discrete or just demonstrated, nevertheless is widespread in that it may apply to easily about any security. That’s the Equity Yield Curve. A number of of our analysts, reflecting a more moderen expertise of schooling, select the time interval Time Arbitrage. It’s associated to the three comparatively present additions to some of our strategies that may in all probability be reviewed shortly.

Briefly, the equity yield curve is a technique of displaying merely how rather a lot return consumers require from a stock relative to how prolonged they contemplate they should stay up for that return. It’s upward sloping, merely the best way by which a bond yield curve typically is: The farther the maturity date to recoup the principal, the higher the yield that consumers want in return. Beneath is a twentieth Anniversary depiction of a additional conventional yield curve than has been at present extant.24

The equity yield curve is technique, technique steeper, though. Sadly, it is extremely unusual you may actually plot one. The problem is you may’t have low cost confidence in what the worth of a stock should be one 12 months, two years, three years in the end; valuation is extraordinarily subjective. You say Nvidia will develop at 40% for 10 years and protect a P/E of 40. One other particular person could say 20% and a remaining P/E of 12. Chances are you’ll every have cogent arguments, and low cost minds may differ.

As quickly as in a protracted whereas, though, an odd security reveals up that does current an excellent diploma of confidence about its future value on or a few positive date. It could be a pre-existing contract for a future buyout or a put attribute that has a date and value or valuation methodology attached; it could be some sort of arrearage or approved declare with sufficient enforceability to depend upon. With these two pretty purpose data components, an equity yield curve may be plotted.

Do that every time you discover such a security—even all through fully totally different monetary and yield environments, and vastly fully totally different firms and asset kinds—and their yield curves are remarkably associated. In apply, while you technique the three-year range, the provided annualized return will probably be 35%.

This occasion from a earlier portfolio holding and associated evaluation report is a reasonably good one. It was for all or any the 9 assortment of hottest shares of Pacific Gas & Electrical, which filed for chapter in April 2001, due to the spreading financial catastrophe catalyzed by the Enron debacle. The company stopped paying the favored dividends, and the preferreds fell to two-thirds of face value.

By May 2002, every the company and the California Public Utility Price itself had put forth competing plans of reorganization. Although they differed in numerous respects, they’ve been agreed on two factors: They’ve been structured to comprehend an funding grade rating for the company, and to result in no impairment to the favored shareholders, along with dividend arrearages. Accordingly, the substantive financial hazard was

erased and a post-recovery value could be estimated with some confidence, whether or not or not it was to the face value of the preferreds or to the dividend yields at which non-troubled utility preferreds then traded.

From the May 2002 purchase, allowing two years for emergence from chapter and the amount of arrearages that could be payable in May 2004, the last word value might be, together with the par value and accrued dividend arrearages, over 80% larger than the then current share value. Prospectively, in May 2002, the two-year annualized return was, roughly 35%:

| Sequence | Arrearages | |||

| 6.0% PCGpfA | $18.00 | $29.73 | $4.875 | 30.8% |

| 5.5% PCGpfB | $16.00 | $28.26 | $4.688 | 35.6% |

| 5.0% PCGpfC | $14.50 | $25.51 | $4.0625 | 35.3% |

| Provide: Bloomberg, Agency research |

With every passing month after May 2002, one could confirm the shopping for and promoting value of the favored, and calculate the annualized return to May 2004, to see what annualized return consumers did in fact require for, first, a 23-month value realization, then a 22-month yield, a 21-month yield, and so forth.

That is the issue, as a result of the yield curve underneath will current. As uncommon as a result of it sounds, the size of that improbable potential return-like a bull market in a bottleis not that essential to a time-constrained and relative-return-judged fund supervisor. What’s vital is WHEN? How shortly can I’ve it?

“The stock market is a software for transferring money from the impatient to the affected particular person.” – Warren Buffett, quoted in The New Zevaland Herald

The longer it may take to earn that return, If correctly previous the standard institutional 12-month time horizon, the a lot much less and fewer value or utility that return has for them. Notably if the timing is uncertain-in this case, it might want been as shortly as 8 months, it might want been 21/2 years. The institutional disinterest interprets to a decrease value/larger yield. Nonetheless it pursuits us. Along with the extreme low value cost or yield, we’ll take the interim time and effectivity hazard.

Half IV: Case Analysis-Some Data Center Progress and Equity Yield Curve Portfolio Companies25

The subsequent agency synopses have been written, on fast uncover (see sidebar), by two of our evaluation analyst/fund managers. Amongst their totally different benefits, each of these three companies is priced someplace deep inside the equity yield curve.

Two of them have constructive publicity to limiting-factor belongings important to the massive data-center-buildout requires.

It was Carl Reiner, commenting about deliberately throwing an sudden question at Mel Brooks all through their 2,000 Yr Earlier Man comedy sketches, that (paraphrasing intently), it was a good looking issue to nook a gifted ideas proper right into a panic and see what emerges. |

Two of them-still solely three companies-share very recognizable valuation and value pattern profiles with securities we have now written about and owned sooner than.

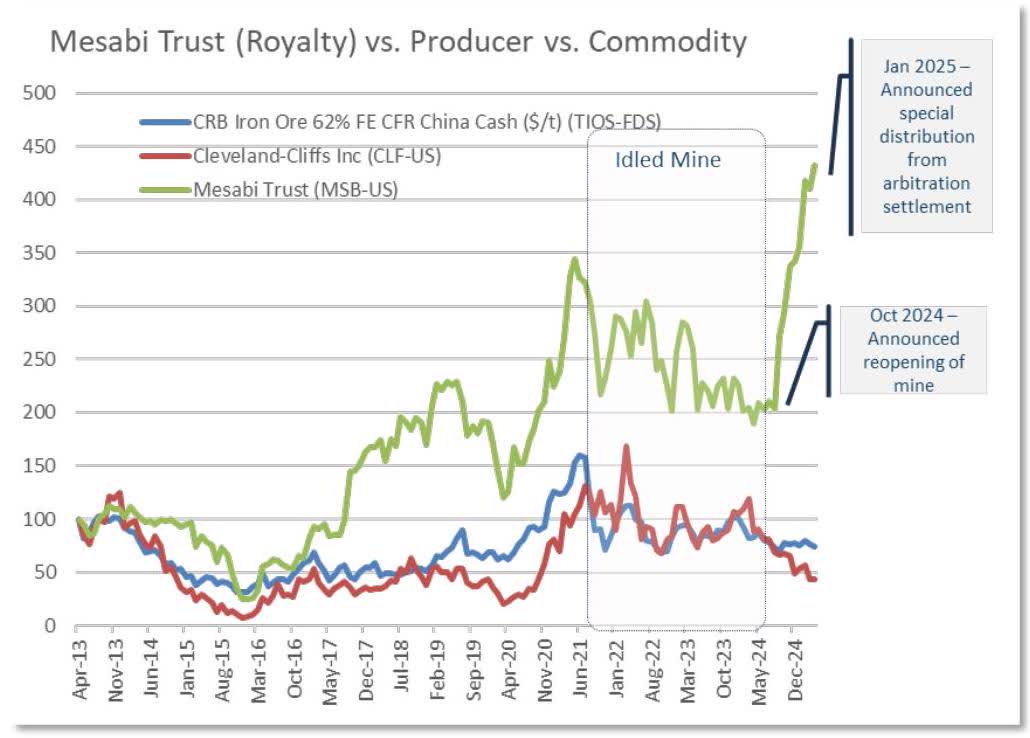

San Juan Basin Royalty Perception, like Mesabi Perception, is an entity with no employees. Reasonably, it has a trustee with a contractually circumscribed compensation affiliation. Every Trusts merely transfer their royalty earnings on to their unitholders as direct earnings from the underlying onerous belongings: pure gas and iron ore. Moreover, as with San Juan, Mesabi had launched a dividend suspension and solely within the close to previous reinstated it, with the logical consequence inside the fully-recovered share value. It was almost a two-year journey. They further have in frequent that the dividend suspension was (and is) confidently recognized to be a quick state of affairs with a reasonably predictable time horizon. A pleasing time arbitrage occasion, although we’ve not plotted Mesabi’s time arbitrage chart.

Hawaiian Electrical Industries, as a utility that wanted to droop its dividend inside the face of bankruptcy-level liabilities, could also be very rather a lot inside the mould of earlier utilities in associated circumstances as or shortly after their existential hazard was erased by a regulatory and judicially approved restoration plan. The post-recovery value is shortly estimated, as is the timeframe, so it is just a matter of prepared. An fascinating question about such a deeply discounted utility is whether or not or not, in a pure funding sense, it’s a utility stock or one factor else totally. Should developments unfold as anticipated, its extraordinarily uneven return profile from this degree forward, along with its financial progress, will look nothing like a utility stock.

Aris Water Choices (ARIS)

A standard technique to sourcing investments: Determining favorable conditions for capital appreciation. Low cost as this technique may be, favorable conditions are typically accompanied by sturdy valuations. There could also be little use in determining favorable conditions if the market has completely priced in these fundamentals (and perhaps reasonably extra).

If we invert this technique and take into consideration pervasive unfavorable conditions that will obscure an in some other case wonderful value proposition, we’re left with reasonably extra fascinating different items for undervaluation. And we’re in a position to have a look at Aris Water Choices as a really properly timed security to debate. There is no such thing as a such factor as a shortage of unfavorable conditions impeding the market from recognizing its value. Nonetheless, we appear to be at an inflection degree the place the longer-term improvement and profitability potential of the company is shortly apparent.

Customary funding approaches overlook Aris for various causes. It’s technically an oilfield service agency (strike one), and it obtained right here public in 2021 as a small capitalization issuer (strike two) by way of various private equity market sponsors (strike three). It was an inauspicious IPO setup for the company, as a result of the world was nonetheless grappling with energy demand points related to the pandemic, ESG considerations-dominated committee conferences, and profitless experience agency valuations hovering with ample capital flowing. It’s a marvel that the funding bankers have been even able to place Aris shares out there available in the market.

We adopted the preliminary offering from the sidelines, cautious of the leverage ratio, and had associated energy water infrastructure publicity through our hottest capital-light land holdings. Aris predictably traded in a dangerous nevertheless largely flat range for the next three years. Aris piqued our curiosity after we participated inside the LandBridge IPO in 2024, andcame to larger acknowledge the big value of water infrastructure all through our enterprise evaluation.

Our company isn’t any stranger to the Permian Basin water enterprise, by benefit of our longstanding funding in TPL. Water is every an important enter for fracking shale and a substantial correctly byproduct output. The enter, or injected “provide water,” could also be very fully totally different from the formation “produced water” that comes out of the wells. The earlier is often sourced from aquifers and injected into wells to stimulate oil manufacturing. This water ought to meet positive purity necessities so it doesn’t damage drilling casing and instruments or disrupt the pure stream of the hydrocarbon mixture.

The produced water is a high-saline brine with quite a few toxic compounds and extreme entire dissolved steady content material materials. Suffice it to say, this water is often neither applicable for reinjection into wells, nor irrigation. The reality is, it presents a severe environmental obligation, and should be transported from the correctly site-either to be cleaned for reuse in fracking, or disposed of by way of injection into saltwater disposal wells.

Throughout the Delaware Basin, there are roughly 4 barrels of produced water generated for every barrel of oil equal. This “water scale back” solely will enhance as deeper shale formations are centered and present wells age. Thus, the basin requires a minimal of 4 cases the amount of infrastructure for water as for hydrocarbons. This generally is a large and rising busi-ness-but many oil and gas companies want nothing to do with it. Let’s uncover why.

Water administration is an expense to grease and gas producers-the largest and fastest-growing part of lease working payments inside the Delaware Basindirectly elevating drilling break-even prices. The producers are focused on producing and, to a lesser extent, transporting their hydrocarbons, not managing the related bonded hydrogen and oxygen molecules. These companies usually don’t want such actions on their stability sheets, as a result of it wouldtake capital away from drilling-and from shareholder returns. Firms increasingly acknowledge that water is a extraordinarily specialised and technical enterprise often larger outsourced. In response, a concentrated group of specialty water infrastructure companies has emerged.

Aris was constructed from the underside up by Solaris Energy Capital to deal with wastewater from Permian oil and gas wells. This usually involved eternal and semi-permanent pipelines to maneuver water from the wellhead to a disposal correctly. Most pipelines and “coping with providers” are operated by way of land leases, rights of technique, and/or royalty injection agreements with the landowners. To produce context, TPL and LandBridge are amongst the largest landowner lessors of land to third-party water administration companies.

Most likely essentially the most prolific portion of the Delaware Basin spans the border between Texas and New Mexico. This generally is a important aspect of water administration on account of differing legal guidelines all through state strains and ranging private/state/federal lands. Consequently, lots of the Aris neighborhood is in New Mexico, and much of the economics are predicated on getting additional water into Texas, the place it might be additional merely disposed of. This setup presents an infinite aggressive profit to every the landowners (recipients of land lease and injection royalty revenues), however moreover incumbent operators with established infrastructure (harking back to Aris).

Aris is paid to take barrels of water away from the correctly head, nonetheless it doesn’t have to simply remove it as waste. Consequently, the company has developed a complementary recycling enterprise that filters the water to necessities acceptable for reuse in fracking. To the extent that this can be carried out economically, the company can earn a second earnings stream on the an identical barrel of water that will in some other case be disposed of.

Aris handled roughly 1.142 million barrels of water per day inside the first quarter of 2022, at anaverage value of $0.68/barrel and an adjusted margin (on a cash working basis) of $0.42/barrel, or 61.7%. The quantity mix was roughly 70% produced water ($0.78/barrel) and 30% recycled water ($0.45/barrel).

Throughout the subsequent three years (through the fourth quarter of 2024), the company’s entire volumes rose by 14% per 12 months and earnings per barrel rose to $0.75. Aris has maintained an adjusted margin of $0.44/ barrel . This improvement has been a product of every pure volumes inside its present pipeline neighborhood along with capital funding.

Whereas the company operated at virtually a 60% adjusted margin per barrel inside the fourth quarter of 2024, it’s value noting this was based mostly totally on roughly 60% and 30% functionality utilization for, respectively, the produced water and recycled water strategies. It may not be unreasonable to anticipate further margin development from larger functionality utilization. Nonetheless that’s solely half the story.

The Permian Basin doesn’t have infinite space for wastewater to be injected, and many essentially the most cost-effective areas near important oil and gas train are shortly approaching functionality. This generally is a function of pressure and porosity, the place there was seismic train related to water injection, along with interference with drilling train.

Consequently, regulators are limiting new injection permits, and water companies are creating longhaul pipes to remove water from the congested areas. This comes with a price, and pricing leverage will belong to the landowners and incumbent infrastructure operators.

If we revisit the unfavorable conditions beforehand confronted by Aris, which have been plainly seen inside the second, we’re in a position to present the longer-term, additional economically important conditions which were creating: secular water amount improvement, value inflation, and bounds to aggressive entry.

There could also be moreover nascent electrical vitality and data coronary heart enchancment inside the Permian Basinnotably, being pursued by LandBridge. Thermal vitality expertise (gas combined cycle) and data coronary heart liquid cooling are immensely waterintensive, and lots of the Permian is a desert.

It stays to be seen what, if any, earnings publicity the incumbent companies like Aris ought to this water market. Clearly, though, this “selection” simply isn’t priced into the stock, which trades at roughly 8.5x estimated pre-tax cash stream for subsequent 12 months.

-James Davolos

San Juan Basin Royalty Perception (SJT)

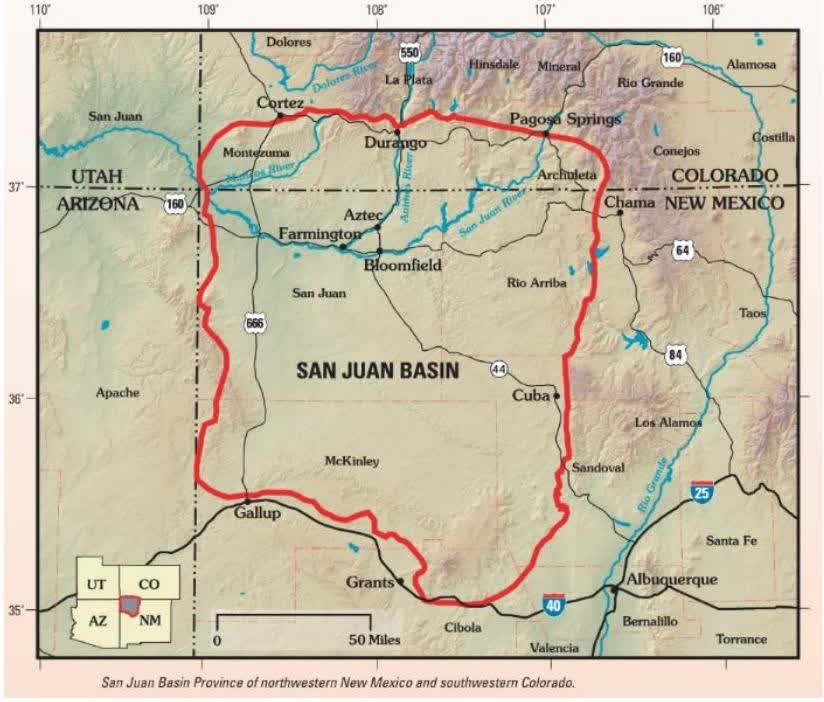

An informal energy market observer could be forgiven for not understanding the water dynamics in energy manufacturing, or the prevalence of oil and gas produced in New Mexico. Whatever the frequent coupling of Texas with the prolific Permian Basin, the formation stretches correctly into Lea and Eddy counties inside the southeast nook of New Mexico. And, between 400 and 500 miles northwest of these counties—largely in New Mexico and alongside the borders of Colorado, Utah, and Arizona-lies the San Juan Basin. This generally is a largely forgotten gas space with methane primarily produced from a coalbed formation.

Speaking of unfavorable present and observable conditions for a stock, we present San Juan Basin Royalty Perception. As a result of the title implies, the “agency” is certainly a perception that distributes a web income curiosity (NPI) from positive properties inside the house. It has no debt and no employees. It has an organization Trustee, the compensation for which is proscribed by a schedule inside the Perception Indenture. It begins at 1/twentieth of 1% of the first $100 million of annual gross revenues of the Perception, permits for hourly expenses in additional of 300 hours a 12 months, and establishes a minimal cost of $36,000 per 12 months. In 2024, the Trustee expenses totaled $120,108, although entire regular and administrative payments have been $2.1 million.

Pure gas may be appreciated by a rising minority as a cleaner fuel provide as compared with coal, nevertheless it’s extensively loathed by consumers on account of per- ceived oversupply (and attendant value volatility) within the US.

The U.S. has an abundance of high-quality, low-cost pure gas reserves. This dynamic is exacerbated by a extraordinarily seasonal gas consumption pattern and restricted storage/export potential relative to manufacturing ranges. Consequently, U.S. pure gas is a extraordinarily dangerous market that has been answerable for a lot of fortunes made and misplaced.

This dynamic, nonetheless, is shortly altering on account of monumental incremental gas vitality demand (data amenities, reshoring of enterprise, and lots of others.) and a doubling of LNG export functionality inside the subsequent 18 months.

Whereas this could promote drilling on the margin, there are logistical pipeline constraints that make the market far a lot much less fluid than reserves data advocate.

These parts could quickly shift the market from structural surplus to deficit.

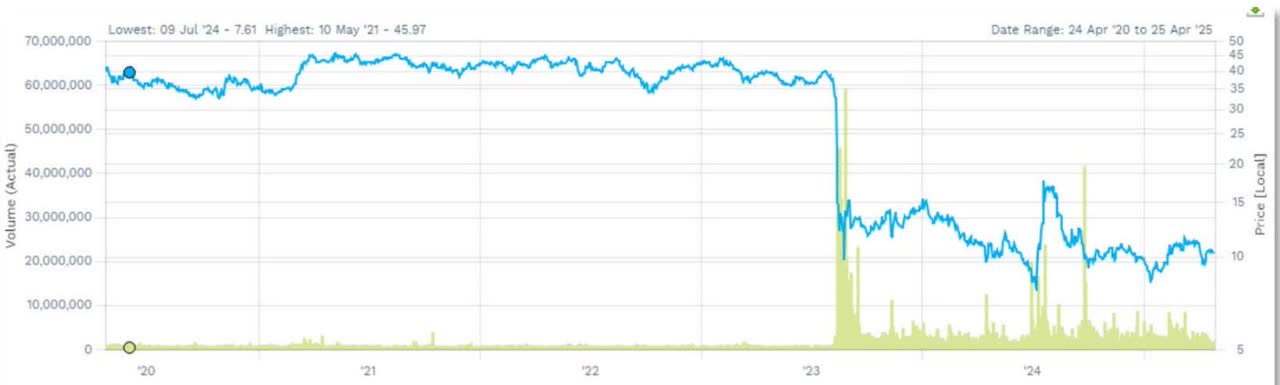

The thesis simply isn’t about gas pricing, nevertheless that contributes to unwarranted pessimism for the San Juan Basin Royalty Perception. The bigger headwind is that it for the time being distributes nothing to shareholders. This should be taken inside the context of the Perception making a $0.41 month-to-month distribution per share in March of 2023. This annualized to roughly $4.10 per share, larger than the stock value on the end of 2024 ($3.83). Welcome to the world of pure gas investing!

Nonetheless, that’s no unusual dividend scale back. It’s the outcomes of the operator (Hilcorp) rising capital expenditures in 2024 to $36 million, up from the 2023 diploma of $4.4 million. This eightfold improve in spending will result in considerable manufacturing improvement, nevertheless given the phrases of the NPI, the funding should be recouped by way of earnings earlier to perception holder distributions being made. Thus, there have been no distributions since April of 2024.

Hilcorp is privately held, so we must always make educated estimates on the manufacturing profile going forward. Nonetheless, based mostly totally on disclosures from the Perception, we estimate close to a 70% manufacturing improve from the highest of 2024 on account of capital spending and elevated drilling. Furthermore, it’s low cost to contemplate that the 2025 spending steering of roughly $9 million can keep this diploma of producing.

Lastly, if we assume comparable lease working payments and severance tax costs26 going forward, we’re in a position to estimate the date and amount of the distribution reinstatement (based mostly totally on prevailing gas prices). As an illustration, if we assume that benchmark pure gas averages $3/mcf and apply a ten% low value to the native “basis,” the run-rate manufacturing will result in a full paydown of the proportionate capital expenditure deficit in May/June of this 12 months. Critically, this may in all probability be based mostly totally on a month-to-month NPI to the Perception of roughly $3.6 million/month or $43 million/12 months, which equates to nearly a 17% yield based mostly totally on the quarter-end share value.

This prepare delivers a dynamic emergent return state of affairs, considerably with incrementally larger gas prices, nevertheless pretty favorable even at $3 gas prices. Actually, these hypothetically larger gas prices could speedy Hilcorp in order so as to add rather more drilling, due to this fact rising the net asset value further.

The Perception started the 12 months with barely a $200 million market value, so we doubt many others are even working these figures. If by chance one other particular person is, few consumers have the endurance to attend for the inevitable resumption of the dividend.

Whereas the underside case state of affairs (conservative gas pricing and low value cost/distribution yield assumptions) delivers a return state of affairs which is able to rival something out there available in the market as we communicate, there’s moreover the “selection” value of gas value related to data coronary heart and industrial demand.

Lastly, it should be well-known that the San Juan Basin is amongst the one areas with gas pipeline entry to the Southern California market, which is prone to episodic disruptions to fuel present, thus resulting in premium pricing for piped gas.

-James Davolos

Hawaiian Electrical Industries, Inc. (HE)

A direct occasion of the equity-yield curve in movement is the utility agency Hawaiian Electrical. In a standard setting, the outcomes of the enterprise are comparatively predictable. That’s partly on account of surrounding regulation, given the regional monopoly standing utilities protect. Every earnings and earnings are dominated by a performance-based regulation framework dominated by the native public utility payment. This incorporates an annual earnings adjustment, and an earningssharing mechanism based mostly totally on a longtime return on widespread frequent equity from regulatory capital. Any earnings that fall open air this range are shared between prospects and utilities, so that every additional constructive points and diminished earnings are restricted.

In numerous phrases, improvement is proscribed, nevertheless so is hazard (absent extraordinary circumstances), so consumers cope with utilities additional like yield alternate choices. A majority of the earnings are paid out by way of dividends—though in comparison with bond yields, they supply potential for some annual improvement; related goes for e e book value. Hawaiian Electrical simply isn’t distinctive on this regard. The reality is, as a utility, perhaps its most unique attribute was its possession of the American Monetary financial savings Monetary establishment, through a 90.1% stake was provided on the ultimate day of 2024 in a cash transaction, so HE just isn’t matter to capital regulation as a monetary establishment. Now HE is a pure utility additional consistent with buddies, with the added complexity of securing energy for a distant island.