ronstik/iStock through Getty Pictures

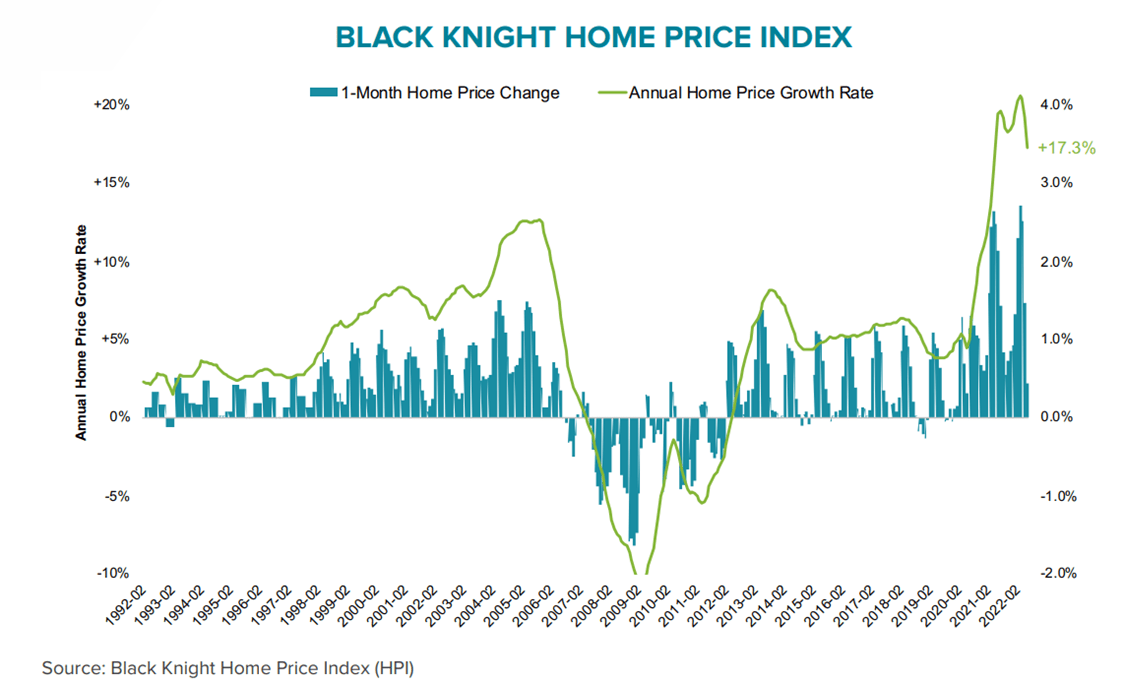

U.S. annual residence value appreciation slowed in June to 17.3% in June from 19.3% in Might, representing the most important slowdown since no less than the early Seventies, Black Knight stated in its June Mortgage Monitor. That represents the third straight month of decelerating residence value development.

Earlier than the June cool-down in residence value development, the most important single-month discount in development was 1.2 proportion factors within the housing downturn of 2006.

The worth development is more likely to cool even additional. “Whereas this was the sharpest cooling on report nationally, we’d want six extra months of this type of deceleration for value development to return to long-run averages,” stated Ben Graboske, president of Black Knight Information & Analytics. “Given it takes about 5 months for rate of interest impacts to be totally mirrored in conventional residence value indexes we’re possible not but seeing the complete impact of current charge spikes, with the potential for even stronger slowing in coming months.”

The mortgage report additionally exhibits that housing provide is growing. Black Knight’s Collateral Analytics knowledge confirmed seasonally adjusted 22% improve within the variety of properties listed on the market over the previous two months. Nonetheless, the market is at a 54% itemizing deficit in contrast with 2017-2019 ranges, Graboske stated.

“With a nationwide scarcity of greater than 700,000 listings, it will take greater than a yr of such report will increase for stock ranges to totally normalize,” he stated.

Every week in the past, U.S. housing affordability poised to fall to lowest since GFC on hovering costs, charges, S&P International Scores stated.