Published on January 5th, 2022, by Quinn Mohammed

Verizon pays a safe and reliable dividend. Even more, that dividend yields 6.5% and has increased for the last eighteen years. The company benefits from recession-resistant qualities and competitive advantages that we believe will allow them to continue raising the dividend for years to come.

Not all high-yielding businesses are as safe as we believe Verizon to be, so deep analysis should be completed to verify the safety of high-yield stocks.

We have created a spreadsheet of high dividend stocks with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

This article will analyze the telecom giant Verizon Communications (VZ).

Business Overview

Verizon is a leading provider of technology and communications services. The company we know today was formed due to a merger between Bell Atlantic Corp and GTE Corp in June 2000. The company reports in two segments: Verizon Consumer Group and Verizon Business Group.

In September 2021, the company sold what once was its third segment, Verizon Media Group. The company deemed Verizon Media to be a non-core asset.

The company’s wireless business makes up about three-quarters of total revenues, with broadband and cable services accounting for roughly one-quarter of sales.

Verizon recently lost its mega-cap stock status after dropping to a market capitalization below $200 billion. In the trailing twelve months, Verizon’s share price declined by 23%, and the company now has a market capitalization of $169 billion.

Verizon reported third-quarter results on October 21st, 2022. For the quarter, revenue grew 4% to $34.2 billion, beating estimates by $410 million. Adjusted earnings-per-share of $1.32 compared unfavorably to $1.41 in the prior year.

The company added 8,000 net new postpaid phone customers in the third quarter. Revenue for the consumer segment grew 10.8% for the quarter, driven by higher equipment sales and a 10% increase in wireless revenue growth. Consumer postpaid average revenue per account (ARPA) also increased by 3.8% year-over-year.

Business revenue rose 1.9% to $7.8 billion due to gains in wireless service revenue. This segment had 360K wireless retail postpaid net additions, including 197K postpaid phone net additions.

Verizon also announced a new cost savings program to remove $2 billion to $3 billion in annual costs by 2025.

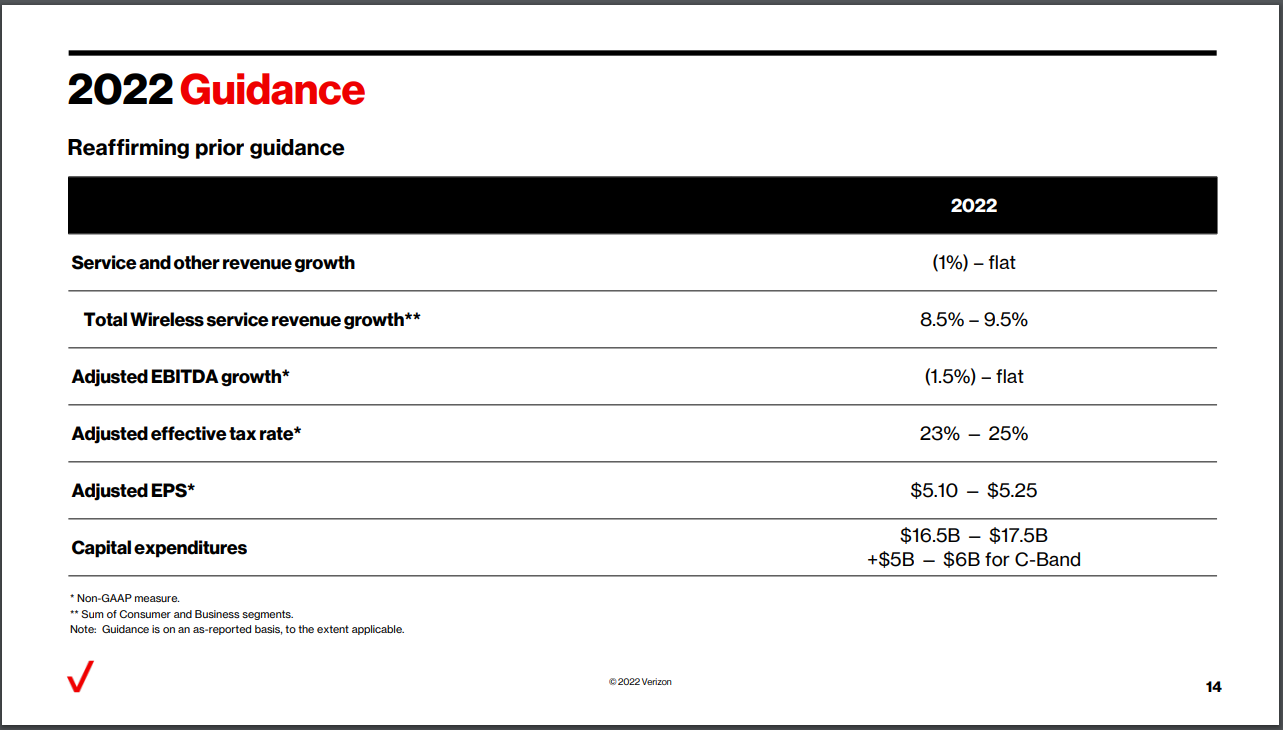

Source: Investor Presentation

Leadership reaffirmed its previous guidance for 2022. The company expects adjusted earnings-per-share of $5.10 to $5.25 for the year. Wireless revenue is projected to grow from 8.5% to 9.5%.

Growth Prospects

While telecommunications’ utility-like services are often trailed by slow growth, Verizon breaks the mold with an earnings-per-share growth rate of nearly 10% per year for the last decade.

However, going forward, Verizon itself anticipates much slower revenue growth. Over the next five years, we expect Verizon to grow earnings by about 4.0% annually.

Source: Investor Presentation

The company expects for 5G Mobility to fuel the bulk of growth from 2022 to 2025. In fact, about half of the company’s growth is anticipated to come from 5G. Verizon anticipates a 2.0% annual revenue per account (ARPA) growth through 2025. Additionally, 5G adoption in the Business segment is set to grow to 80% by the end of the year 2025.

Another strong growth driver will be the company’s nationwide broadband growth. The company’s expanded footprint will cover 50 million households and 14 million businesses by the year-end of 2025. Fios also expects to reach 8 million internet subscribers by year-end 2025.

The MEC & B2B Solution business will continue growing Internet of Things (IoT) revenue as it anticipates annualized double-digit connections growth through 2025.

And lastly, Value Market and Network Monetization will make up the rest of the company’s expected growth in the years ahead.

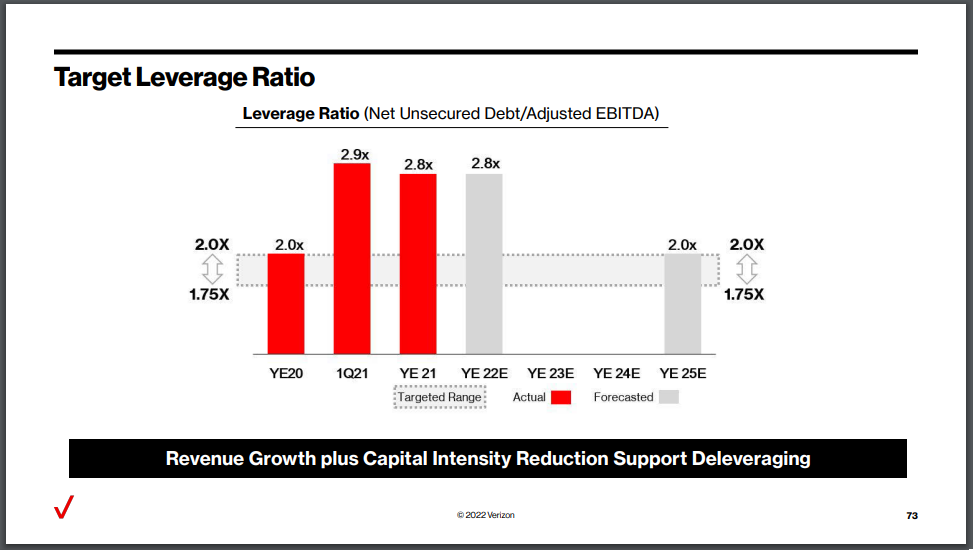

Source: Investor Presentation

Once the company has deleveraged to 2.25 times net unsecured debt to adjusted EBITDA, it will consider share repurchases, which could also produce a minor tailwind to earnings.

The company had a leverage ratio of 2.8x at year-end 2021 and expects to reach 2.0x by the end of 2025.

At the end of Q3 2022, Verizon’s net unsecured debt to adjusted EBITDA ratio was roughly 2.7x.

Competitive Advantages & Recession Performance

A key competitive advantage of Verizon is that it can often be considered the best wireless carrier in the U.S. This is clear when looking at the company’s wireless net additions and very low churn rate. The reliability of their service has led to a satisfied and intact customer base. This same customer base may then move to higher-priced plans.

The company also operates a business with recession-resistant qualities. Verizon customers will likely keep their wireless and broadband service, even during recessions.

Additionally, the divestiture of its non-core assets in Verizon Media will allow it to focus on maintaining its advantage in wireless service. And the massive infrastructure behind Verizon’s business would be difficult to replicate today, meaning the company has somewhat of a wide moat.

Dividend Analysis

Verizon paid dividends worth $2.57 in 2022. The company recently increased its dividend 2.0% and has an eighteen-year dividend increase streak. Following the increase, Verizon’s forward dividend per share is $2.61. At the current share price, Verizon is yielding 6.5%. The current yield is about 200 basis points higher than the trailing decade average of 4.5%.

According to Verizon’s 2022 outlook, the company is forecasted to earn $5.10 to $5.25 in adjusted EPS for the year. Therefore, the company is forecasted to pay out about 50% of adjusted EPS out in dividends. This is a healthy payout ratio for a telecom company. The security of the payout ratio and the solid expected growth rate of the company should lead to more dividend increases down the line.

In the last decade, Verizon has grown its average dividend by 2.6% per year. Given a forecasted earnings growth rate of 4.0%, the payout ratio will moderate in the future as earnings growth outpaces dividend growth.

Final Thoughts

In recent years, Verizon divested its non-core media segment as it aims to focus on its core competencies of telecommunications. The company has executed solidly in the last decade and should continue to do so going forward, albeit at a slower rate.

Verizon has increased its dividend for eighteen consecutive years. Not to mention, the payout ratio as a percent of adjusted earnings is only 50%. Given the company is still growing, the dividend is secure, and we expect it to continue growing.

The company’s 6.5% yield is attractive for income investors. Value investors may also like the company here as we believe it’s trading below fair value.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected]

rn

rn

Source link ","author":{"@type":"Person","name":"Index Investing News","url":"https://indexinvestingnews.com/author/projects666/","sameAs":["http://indexinvestingnews.com"]},"articleSection":["Investing"],"image":{"@type":"ImageObject","url":"https://www.suredividend.com/wp-content/uploads/2022/10/High-Dividend-Image.jpg","width":1920,"height":0},"publisher":{"@type":"Organization","name":"","url":"https://indexinvestingnews.com","logo":{"@type":"ImageObject","url":""},"sameAs":["https://www.facebook.com/Index-Investing-News-102075432474739","https://twitter.com/IndexInvesting_"]}}

Source link