Published on January 17th, 2023 by Jonathan Weber

TC Energy Corporation (TRP) is a Canadian energy midstream company that offers a high dividend yield of more than 6% at current prices. Since shares have dropped by 15% over the last year, its shares are now trading at an attractive valuation.

It is one of the high-yield stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of TC Energy Corporation.

Business Overview

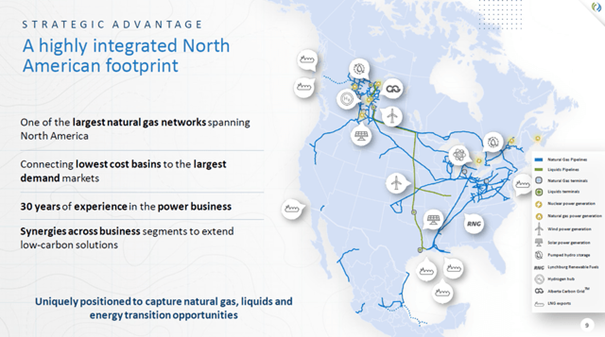

TC Energy Corporation, which was called TransCanada Corporation until 2019, was incorporated in 1951 and is headquartered in Calgary, Canada. The company is an energy infrastructure player that is active in North America. Its business is split into five segments: Canadian Natural Gas Pipelines, US Natural Gas Pipelines, Mexico Natural Gas Pipelines, Liquids Pipelines, and Power & Storage.

Overall, the company owns and operates more than 90,000 km of natural gas pipelines in Mexico, the US, and Canada, which connect production regions with end markets where natural gas is used for heating, cooking, and electricity generation. TC Energy also owns storage facilities that compliment its transportation assets.

Source: Investor Presentation

TC Energy’s oil pipeline footprint is significantly smaller, but totals around 5,000 km of pipes nevertheless, mainly connecting oil production areas in Alberta, Canada, with markets in the US, such as the Gulf Coast. Last but not least, TC Energy also owns stakes in several electricity-generating plants that are located in Alberta, Ontario, and Quebec.

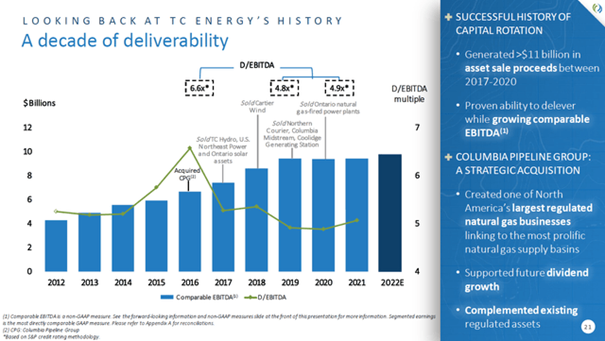

TC Energy has exhibited solid business growth in recent years. Its earnings-per-share have risen by a little more than 80% between 2012 and 2022, which makes for an annual growth rate of around 6%. Apart from two weak years in 2015 and 2016, when oil prices were low, TC Energy has delivered reliable business growth, showcasing earnings-per-share increases in 2017-2021.

Final results for 2022 are not released yet, but a small decline is forecasted when profits are denominated in US Dollars. In Canadian Dollars, 2022 likely was a year with positive growth as well, but due to a strengthening US Dollar, that’s not visible when results are converted to US Dollars.

TC Energy mostly uses fee-based contracts for its natural gas and oil transportation and storage businesses. That is why profits do not move a lot when the prices of these commodities move. During times when oil and natural gas prices decline, that’s good, as TC Energy generally can keep its cash flows stable or even grow them during these times. On the other hand, TC Energy does not benefit a lot when oil and natural gas prices climb, compared to other energy companies such as oil producers.

Source: Investor Presentation

TC Energy’s fee-based contracts allowed it to generate growing or stable EBITDA even during times when underlying oil and natural gas markets were weak, such as during 2020.

Growth Prospects

TC Energy’s industry isn’t a very fast-growing industry, but TC Energy should still be able to generate some profit and cash flow growth in the long run.

TC Energy can create cash flow growth in several ways. First, there is the possibility for business growth. While not a lot of new pipelines are being built, TC Energy can expand its existing pipelines via capacity expansion projects, which generally aren’t as burdensome when it comes to regulations compared to new greenfield projects. TC Energy also can invest in adjacent businesses such as LNG terminals, new storage facilities, and even electricity-generating capacity.

With its existing pipelines, TC Energy also can create some growth. Some of the company’s contracts are CPI-linked, thus revenues climb at unchanged volumes. Other contracts aren’t CPI-linked, but TC Energy can increase rates over time. Especially in the current environment, where its counterparties are very profitable, rate increases can be pushed through easily.

Last but not least, TC Energy can also utilize its cash flows for paying down debt, for acquiring assets via M&A, or for share repurchases. Each of these moves will increase cash flow-per-share over time, all else equal. We do not expect massive growth from TC Energy, but a mid-single digit annual growth rate seems quite achievable through these measures.

Competitive Advantages

The biggest advantage for energy midstream companies with a massive asset footprint is the very harsh regulatory environment today. Getting approvals for new pipelines is highly complicated and can take many years. Building out new pipelines is thus very complicated, costly, and risky. This means that the players with existing pipes in the ground benefit from high barriers to entry, as new market entrants can not reasonably take over their businesses.

TC Energy, with its large asset footprint across three countries, is one of the largest players in this field and thus also benefits from significant scale advantages versus smaller competitors, e.g. when it comes to accessing low-cost capital for expansion projects.

Dividend Analysis

TC Energy has been paying dividends for a long time, but it did not increase its payout during every one of those years. For the last seven years, TC Energy has been increasing its dividend annually. The dividend growth rate averaged 8% over that time frame, which is pretty attractive.

We believe that dividend growth will slow down in the future, as the recent dividend growth rate is higher than our earnings and cash flow growth rate estimate for the future. Eventually, dividend growth should fall more or less in line with profit anf cash flow growth, as the company can’t increase its payout ratio forever. Still, even a mid-single digit dividend growth rate, which seems more realistic going forward, would be very solid for TC Energy.

After all, shares offer a dividend yield of 6.4% at current prices. When a company offers a starting yield this high, not a lot of dividend growth is needed for the company to be an attractive investment in the long run. Annual dividend growth in the 3%-4% range could be sufficient for total returns to fall into the 10% range — which seems very much achievable for TC Energy based on its expected earnings and cash flow growth going forward.

Based on current estimates for this year, TC Energy will pay out around 80% of its net profits via dividends. The dividend payout ratio versus its funds from operations, which accounts for the high non-cash depreciation charges, is 52%, which is why we believe that a dividend cut is unlikely.

Final Thoughts

TC Energy is one of the largest North American energy midstream companies investors can choose from. This isn’t a high-growth industry, but some business growth will be achieved going forward. With low cyclicality thanks to a fee-based business model, TC Energy is not a high-risk stock.

The current dividend yield is pretty high and there should be some dividend growth going forward. When we add the fact that TC Energy is currently trading at just 8x this year’s expected funds from operations, and at 13x net profit, despite net profit being artificially low due to high non-cash depreciation expenses, TC Energy seems like an attractively priced investment following the share price pullback over the last six months.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].