Revealed on October thirtieth, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which might be considerably larger than the market common. For instance, the S&P 500’s present yield is simply ~1.2%.

Excessive-yield shares may be significantly useful in supplementing earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Plains All American Pipeline, L.P. (PAA) is a part of our ‘Excessive Dividend 50’ collection, which covers the 50 highest-yielding shares within the Positive Evaluation Analysis Database.

We’ve got created a spreadsheet of shares (and intently associated REITs, MLPs, and many others.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full checklist of all securities with 5%+ yields (together with essential monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our checklist of high-dividend shares to evaluate is Plains All American Pipeline, L.P. (PAA).

Enterprise Overview

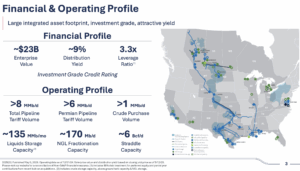

Supply: Investor Relations

Development Prospects

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

Plains All American Pipeline, L.P. (PAA) advantages from a extremely built-in and in depth midstream infrastructure community, together with over 18,000 miles of pipelines, storage, and gathering belongings throughout key U.S. and Canadian power hubs. This scale offers operational effectivity, robust market entry, and steady fee-based money flows, giving the corporate a aggressive edge in crude oil and NGL transportation. Strategic investments, similar to increasing its Permian Basin footprint by the BridgeTex Pipeline and optimizing core belongings, additional strengthen its market place.

PAA has additionally demonstrated resilience throughout financial downturns and power market volatility. Historic efficiency reveals that even after sharp declines in distributable money movement through the 2016–2017 oil droop and the COVID-19 pandemic, the corporate’s disciplined value administration, asset optimization, and robust stability sheet enabled a swift restoration. This observe document highlights PAA’s skill to keep up stability, generate money movement, and proceed distributions to unitholders throughout recessions or market stress.

- 2008 earnings-per-share: $1.48

- 2009 earnings-per-share: $1.57

- 2010 earnings-per-share: $1.52

Dividend Evaluation

The corporate’s annual dividend is $1.52 per share. At its current share value, the inventory has a excessive yield of 8.9%.

Given the corporate’s 2025 earnings outlook, EPS is predicted to be $2.65 per share. Because of this, the corporate is predicted to pay out roughly 57% of its EPS to shareholders in dividends.

Supply: Investor Relations

Closing Ideas

Lately, Plains All American has delivered robust returns, reflecting its disciplined operations and strategic asset administration. Trying forward, the corporate reveals potential for continued positive factors, with an 8.9% yield and doable valuation enhancements driving an estimated annual return of 16.2% over the medium time period. Whereas these prospects are engaging, we preserve a maintain ranking as a result of comparatively brief observe document of constant dividend development.

That stated, Plains’ stable infrastructure, resilient money movement, and give attention to capital self-discipline place it effectively to capitalize on development alternatives and navigate market volatility. Buyers searching for earnings mixed with reasonable development could discover it a compelling possibility, significantly if the corporate continues its strategic initiatives and strengthens its dividend consistency over time.

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].