Revealed on March 18th, 2022 by Aristofanis Papadatos

Inflation has surged to a 40-year excessive this yr because of the immense fiscal stimulus packages supplied by the federal government in response to the pandemic and the invasion of Russia in Ukraine, which has led commodity costs to skyrocket.

Excessive inflation exerts nice strain on income-oriented buyers, because it erodes the actual worth of their portfolios. In consequence, many income-oriented buyers will select to resort to high-yield shares, with a purpose to preserve constructive precise returns.

We have now created a spreadsheet of shares (and carefully associated REITs and MLPs, and so forth.) with dividend yields of 5% or extra…

You may obtain your free full record of all securities with 5%+ yields (together with necessary monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink beneath:

On this article, we are going to analyze the prospects of M.D.C. Holdings (MDC), which is providing a 4.9% dividend yield with a payout ratio of solely 21%.

Enterprise Overview

M.D.C. Holdings has two main operations, house constructing and monetary companies. Its house constructing operation purchases completed tons or develops tons to the extent needed for the development and sale of single-family indifferent properties to house patrons below the title “Richmond American Properties.” Its monetary companies operation points mortgage loans primarily for the house patrons of the corporate whereas it additionally sells insurance coverage protection.

As a result of nature of its enterprise, M.D.C. Holdings has at all times been extremely susceptible to recessions, as demand for brand new properties plunges throughout tough financial intervals. Within the Nice Recession, the quarterly gross sales of M.D.C. Holdings plunged 99% inside just some quarters and the corporate incurred hefty losses.

Nevertheless, M.D.C. Holdings has proved markedly resilient all through the coronavirus disaster. Regardless of the fierce recession brought on by the unprecedented lockdowns imposed in 2020, the house builder grew its earnings per share 50% in that yr, from $3.56 to $5.33.

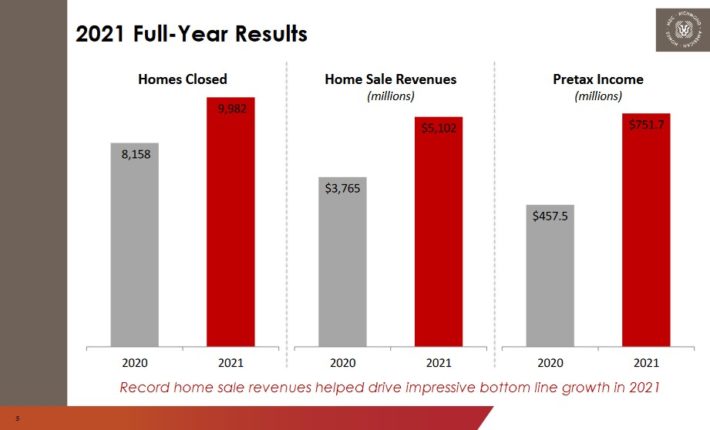

Even higher, due to the extreme fiscal stimulus packages supplied by the federal government and robust pent-up demand, M.D.C. Holdings posted blowout leads to 2021.

Supply: Investor Presentation

The corporate grew its house sale models by 22%, from 8,158 to a file 9,982, and its earnings per share by 53%, from $5.33 to a brand new all-time excessive of $8.13.

Even higher, the enterprise momentum stays sturdy. Within the fourth quarter, the corporate grew its house sale revenues 22% over the prior yr’s quarter due to a 4% improve in new models and a 17% improve in common promoting costs. In consequence, it grew its earnings per share 10%.

Because of lack of present house provide and pent-up demand, M.D.C. Holdings is more likely to proceed to take pleasure in sturdy pricing energy for the foreseeable future. It additionally has a file backlog of $4.3 billion.

Administration expects 10,500-11,000 house deliveries in 2022, which correspond to five%-10% development vs. 2021, and a gross margin round 25%, a major enchancment from 20.8% in 2020 and 23.1% in 2021.

Given the spectacular enterprise momentum of M.D.C. Holdings and its brilliant outlook, we anticipate it to develop its earnings per share at a double-digit fee this yr, to a brand new file stage.

Progress Prospects

As a result of nature of its enterprise, M.D.C. Holdings has exhibited a unstable efficiency file, with dramatic swings. Nevertheless, the corporate has grown its earnings per share for seven consecutive years, at a 35.3% common annual fee.

In fact, buyers mustn’t anticipate M.D.C. Holdings to take care of such a excessive development fee within the upcoming years. The tailwinds from the sturdy restoration from the pandemic and the large fiscal stimulus packages, which have significantly elevated the discretionary earnings of shoppers, are more likely to fade going ahead.

As well as, the Fed has simply begun to boost rates of interest aggressively in an effort to place inflation below management. Greater charges are more likely to take their toll on the demand for brand new properties in some unspecified time in the future sooner or later.

Then again, the perfect enterprise circumstances prevailing proper now shouldn’t be underestimated. In the newest quarter, M.D.C. Holdings loved 9% development in new orders and thus its backlog rose to a file stage of $4.3 billion. This bodes properly for the long run development prospects of the corporate.

General, we anticipate M.D.C. Holdings to develop its earnings per share at an 8.0% common annual fee over the subsequent 5 years.

Aggressive Benefits

M.D.C. Holdings provides inexpensive costs and a built-to-order mannequin, which resonates properly with the need of shoppers for brand new house customization. It is a important aggressive benefit. As well as, the corporate has proved extraordinarily resilient all through the coronavirus disaster.

Nevertheless, buyers mustn’t leap to the conclusion that M.D.C. Holdings is proof against recessions. As evidenced by the Nice Recession, the house builder is extremely susceptible to recessions. It proved resilient in the course of the pandemic due to the quick length of the recession and the unprecedented fiscal stimulus packages, which led to a pointy restoration of the financial system.

Quite the opposite, the Nice Recession was the worst monetary disaster of the final 80 years and included a collapse of the house market as properly. In different phrases, it was the worst doable enterprise setting for M.D.C. Holdings.

So long as the financial system stays wholesome, M.D.C. Holdings is more likely to preserve thriving, however the firm can be affected every time the subsequent recession exhibits up.

Dividend Evaluation

As a consequence of its cyclical enterprise efficiency, M.D.C. Holdings has a poor dividend file. The corporate has grown its dividend for under seven consecutive years and thus it passes below the radar of most income-oriented buyers.

Nevertheless, M.D.C. Holdings is at present providing a sexy 4.9% dividend yield. Even higher, due to its blowout earnings, the inventory has a payout ratio of solely 21%. We additionally reward administration for sustaining a wholesome steadiness sheet, which is paramount on this extremely cyclical enterprise.

The corporate pays negligible curiosity expense and its web debt of $1.8 billion is barely 60% of the market capitalization of the inventory and solely 3 occasions the annual earnings of the corporate. Subsequently, though M.D.C. Holdings is susceptible to financial downturns, its 4.9% dividend has a large margin of security.

Remaining Ideas

M.D.C. Holdings is on monitor to publish file earnings for a 3rd consecutive yr in 2022 due to favorable enterprise circumstances, together with pent-up demand and tight house provide. Additionally it is providing a 4.9% dividend, which has a large margin of security. Then again, this enterprise is infamous for its cyclicality and the profit from the accommodative fiscal coverage will fade in some unspecified time in the future sooner or later.

That is the explanation behind the extraordinarily low ahead price-to-earnings ratio of 4.1 of the inventory. General, the inventory is attractively valued from a long-term perspective proper now however it’s appropriate just for the buyers who can abdomen excessive inventory worth volatility and prolonged intervals of potential paper losses.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].