Revealed on April 6, 2022, by Felix Martinez

There are a whole lot of client defensive firms within the inventory market. Nevertheless, few of them pay a excessive dividend yield. This text will cowl a excessive dividend yield client defensive firm in The Kraft Heinz Firm (KHC).

We additionally cowl a whole lot of different completely different high-yield shares in our database.

Now we have created a spreadsheet of shares (and carefully associated REITs and MLPs, and many others.) with dividend yields of 5% or extra…

You’ll be able to obtain your free full listing of all securities with 5%+ yields (together with necessary monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink under:

This text analyzes the high-yield inventory Kraft Heinz Firm intimately. Whereas it doesn’t have a 5.0%+ yield at the moment, its dividend yield of 4.1% continues to be excessive in comparison with the low-interest-rate atmosphere and the broader Market.

Enterprise Overview

Kraft-Heinz is a processed meals and drinks firm that owns a product portfolio that features meals merchandise corresponding to condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler eating regimen & vitamin. The corporate was created in 2015 in a merger between Kraft Meals Group and H. J. Heinz Firm, orchestrated by Warren Buffett’s Berkshire Hathaway and 3G Capital. Kraft-Heinz is headquartered in Chicago, IL.

The corporate leverages its scale and agility to develop throughout a portfolio of six consumer-driven product platforms. Among the firm’s well-known manufacturers are Heinz ketchup, Mayo, Lunchable, Oscar Mayer, Jell-o, and Kool-Assist. The corporate has a complete internet gross sales of $26 billion for Fiscal 12 months (FY)2021, with a market capitalization of $48.9 billion.

Supply: Firm Factsheet

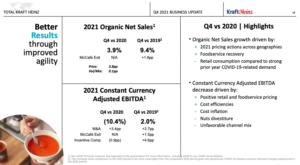

On February 16, 2022, the corporate reported fourth-quarter and full-year outcomes for FY2021. For the fourth quarter, complete gross sales had been down 3.3% in comparison with the fourth quarter of 2020. Whole gross sales had been $6,709 million in comparison with 4Q2020 of $6,939 million. America area noticed a big lower of 6.8% in gross sales, whereas the worldwide and Canada area noticed gross sales will increase of 6.5% and 5.2%, respectively. Nevertheless, year-over-year natural internet gross sales progress was 3.9% for the quarter versus the fourth quarter of 2020.

Web revenue for the quarter was down considerably. The corporate reported a lack of $257 million in comparison with a revenue of $1,032 million in 4Q2020, largely as a result of impairment of the Kraft model following the closing of the Cheese Transaction. Thus, diluted Incomes Per Share (EPS) was detrimental $0.21 in comparison with $0.84 per share prior yr identical quarter. Nevertheless, Adjusted EPS was barely down for the quarter by 1.3%, from $0.80 per share in 4Q2020 to a reported $0.79 per share, primarily pushed by decrease Adjusted EBITDA that greater than offset decrease taxes on adjusted earnings and decrease curiosity expense.

Supply: Investor Presentation

For the fiscal yr, complete gross sales had been barely flat in comparison with FY2020. Whole gross sales had been $26,042 million in FY2021 in comparison with $26,185 million in FY2020, a lower of 0.5%. The regional segments noticed the identical type of outcomes because the fourth quarter. For the yr, america area noticed gross sales lower by 3.1%, from $19,204 million in 2020 to $18,604 million final yr. Nevertheless, the Worldwide and Canada area noticed gross sales enhance by 6.5% and 6.5%, respectively.

Gross revenue for the yr was down 5.4%, however working revenue noticed a big enhance of 62.6% year-over-year. Revenue additionally noticed a big enhance of 184.5% for 2021 in comparison with 2020. Thus, diluted EPS was $0.82 in comparison with $0.29 per share prior yr identical quarter, or a 182.8% enhance. Moreover, Adjusted EPS was barely up for the yr by 1.7%, from $2.88 per share in FY2020 to a reported $293 per share in FY2021.

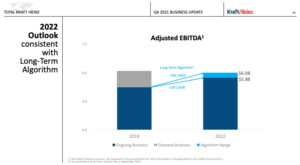

The corporate expects a low-single-digit proportion enhance in 2022 Natural Web Gross sales versus the prior-year interval, reflecting continued stronger consumption versus pre-pandemic ranges. They anticipate adjusted EBITDA to be within the vary of $5.8 billion to $6.0 billion.

Nevertheless, We anticipate the corporate to earn $2.62 per share for FY2022. This might characterize a lower of 11% year-over-year in comparison with FY2021.

Development Prospects

Development drivers for the corporate will come from devasting on low-performing manufacturers and buying manufacturers that flatter the corporate present manufacturers. Rising markets are additionally a supply of progress for the corporate. Organi internet gross sales grew by 17% for the yr in comparison with 2019. Additionally, specializing in model enlargement like plant-based gadgets and Heinz model extension ought to assist the corporate with future progress.

Supply: Investor Presentation

As you see within the image under, the corporate divested a few of its enterprise in 2019. It has been a superb transfer by the administration workforce as the corporate was in a position to develop with a 2% Compound Annual Development Price (CAGR).

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

The aggressive benefit for the corporate is its model consciousness. The corporate has manufacturers that most individuals, if not all, in America have heard of. Thus, we predict sustaining or growing model spending can be necessary in sustaining model consciousness and assuring a aggressive benefit. The spending on promoting is important for the corporate since most prospects at the moment are on the lookout for more healthy choices.

Because the firm was not round throughout the Nice Recession of 2008-2009, we are going to take a look at how the corporate carried out throughout the COVID-19 pandemic.

KHC’s earnings-per-share earlier than and after the COVID-19 pendmic:

- 2018 earnings-per-share of $3.53

- 2019 earnings-per-share of $2.85 (19% lower)

- 2020 earnings-per-share of $2.88 (1% enhance)

- 2021 earnings-per-share of $2.93 (2% enhance)

Earnings declined earlier than the COVID-19 pandemic, as the corporate earnings dropped by 19% in 2019. However the firm did recuperate modestly by 1% in 2020 and a pair of% in 2021.

Dividend Evaluation

In 2019, the corporate needed to lower its dividend by 36%, from $2.50 per share to $1.60 per share a yr. The dividend lower was as a result of incomes strain and the corporate specializing in paying down its debt. Since 2019, the corporate has been paying the identical dividend.

To find out the protection of the dividend, we are going to take a look at two metrics. We’ll take a look at adjusted Earnings Per Share (EPS) and Free Money Stream (FCF). For FY2021, the corporate EPS was $2.93 per share. This might give us a dividend payout ratio of 54.6%. This covers the dividend properly. In that very same yr, FCF was $3.61 per share. FCF offered a dividend payout ratio of 44.4%. Thus the dividend is secure based mostly on FY2021 earnings and FCF.

Nevertheless, since we make investments sooner or later, we are going to take a look at the dividend payout ratio based mostly on EPS and FCF for FY2022. We anticipate the corporate to earn $2.62. We don’t anticipate a dividend enhance, so it will give us a dividend payout ratio of 61.1%. In 2022, we anticipate the corporate will make $2.62 per share in FCF. This can even cowl the dividend by 61.2%. Due to this fact, the dividend is secure for the foreseeable future.

The corporate additionally has a good steadiness sheet. The corporate has a 0.4 debt-to-equity ratio, which has been enhancing over the previous few years. The corporate’s curiosity protection ratio is 1.8, a good degree. Moreover, Kraft Heinz has an S&P Credit score Ranking of “BBB-.” This credit standing is an investment-grade ranking from S&P.

Thus, the steadiness sheet is in good situation, and traders can belief that the corporate is working properly.

Last Ideas

The Kraft Heinz Firm is an organization that’s attempting to alter issues round. The corporate owns a number of the well-known manufacturers within the USA. . Due to worldwide progress, the corporate ought to have the ability to generate some earnings progress in the long term, however Kraft-Heinz won’t ever flip right into a high-growth firm. Total, the corporate dividend is secure and properly suited to traders on the lookout for a secure, excessive yield firm.

This inventory just isn’t for dividend progress traders who’re on the lookout for years of dividend will increase from the businesses of their portfolios.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].