Revealed on October 14, 2025, by Felix Martinez

Excessive-yield shares pay out dividends which can be considerably increased than the market common. For instance, the S&P 500’s present yield is simply ~1.1%, a product of file highs in inventory indices to this point in 2025.

Excessive-yield shares could be notably useful in shoring up revenue after retirement. A $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

We have now created a spreadsheet of shares (and carefully associated REITs and MLPs, and so forth.) with dividend yields of 5% or extra…

You possibly can obtain your free full listing of all excessive dividend shares with 5%+ yields (together with vital monetary metrics reminiscent of dividend yield and payout ratio) by clicking on the hyperlink under:

Subsequent on our listing of excessive dividend shares to evaluate is Horizon Bancorp, Inc. (HBNC).

Enterprise Overview

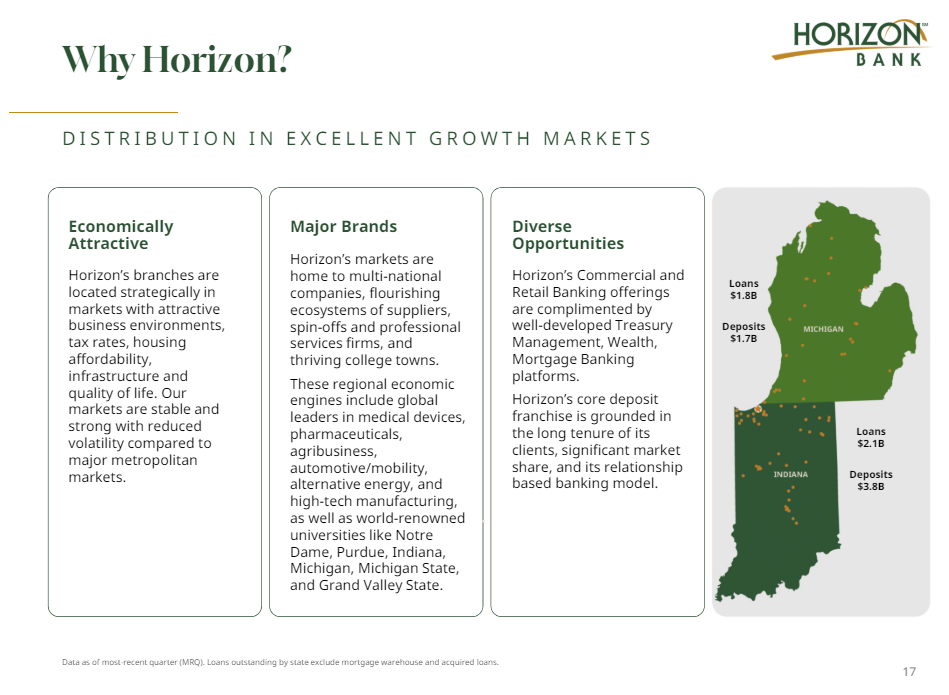

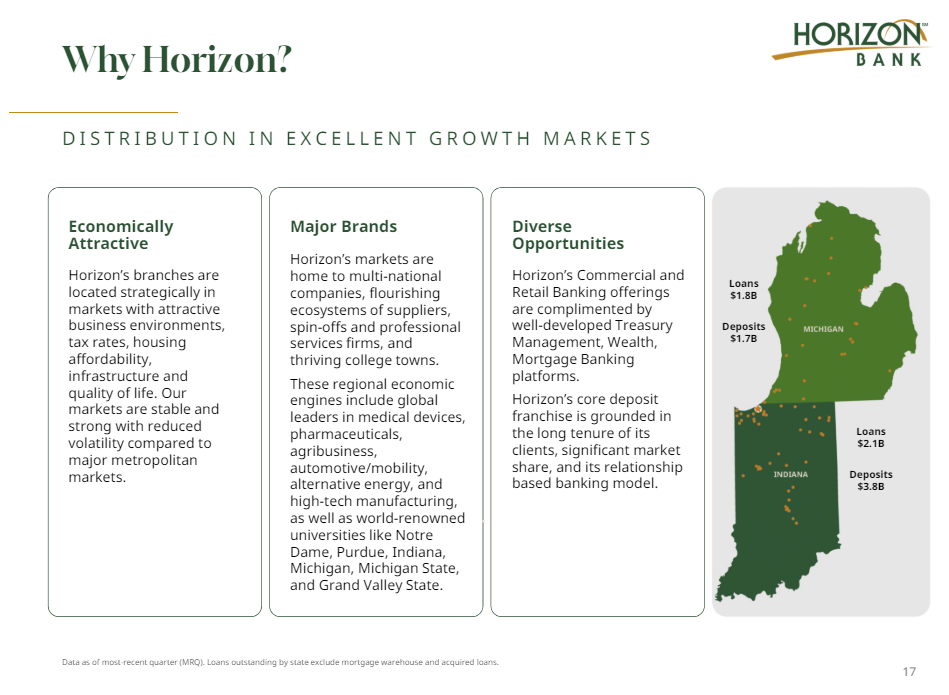

Horizon is a financial institution holding firm for Horizon Financial institution, which gives a various vary of economic and retail banking providers and merchandise.

It gives checking, financial savings, cash market accounts, certificates of deposit, retirement accounts, varied sorts of client and industrial loans, insurance coverage, and extra.

Horizon operates in Indiana and Michigan and was based in 1873.

Supply: Investor presentation

The financial institution reported its second-quarter earnings on July 23, 2025, and the outcomes had been considerably improved from the prior quarter.

Supply: Investor presentation

The corporate reported robust second-quarter 2025 outcomes, with web revenue of $20.6 million, or $0.47 per diluted share, up 26% year-over-year and $0.03 above estimates. Income rose 26% to $70.3 million, pushed by higher-yielding loans and efficient deposit price administration. The online curiosity margin expanded to three.23%, marking the seventh straight quarterly improve, whereas mortgage progress rose 6.2% annualized, led by industrial lending. Credit score high quality remained wonderful with minimal charge-offs at 0.02%, and the effectivity ratio held regular at 59.5%. Deposits declined 1.1% because the financial institution continued to handle out higher-cost time deposits.

As of June 30, 2025, Horizon’s whole property stood at $7.7 billion, with tangible guide worth per share climbing to $14.32. Capital ranges remained robust, with a Tier 1 ratio of 12.52% and whole capital ratio of 14.48%. CEO Thomas Prame highlighted continued operational energy and margin enlargement, noting a 58% year-over-year improve in EPS for the primary half of 2025. Trying forward, Horizon expects sustained earnings progress supported by prudent expense management, regular mortgage demand, and improved funding prices, positioning the financial institution to ship constant shareholder returns by the rest of 2025.

Development Prospects

Horizon’s earnings progress has been uneven to say the least. The financial institution has managed to spice up its earnings over time; nevertheless, previously decade, there have been three years of declining earnings, together with final yr.

We count on to see 8% progress from this yr’s base of $1.42.

Supply: Investor presentation

If that is to occur, Horizon is prone to depend on mortgage progress, which it has been concentrating on in latest quarters.

In Q2, the financial institution expanded its mortgage portfolio by $76 million, pushed by progress in industrial actual property and industrial and industrial (C&I) loans.

Aggressive Benefits & Recession Efficiency

Like different banks, Horizon actually doesn’t have any aggressive benefits. We word that every one banks typically provide the identical set of services, so small banks like Horizon depend on model loyalty and workplace location comfort for buyer retention. Nonetheless, we word that these are free benefits at finest, much like these of different banks.

Moreover, like different banks, Horizon is prone to recessionary intervals, and we anticipate that Horizon’s earnings will seemingly endure in the course of the subsequent interval of financial weak point.

To its credit score, the corporate carried out comparatively strongly in the course of the earlier main financial downturn, the Nice Recession of 2008-2009:

- 2008 earnings-per-share: $0.54

- 2009 earnings-per-share: $0.47

- 2010 earnings-per-share: $0.54

Horizon’s wonderful credit score high quality will serve it nicely in the course of the subsequent recession, however the reality stays that no financial institution has management over mortgage demand throughout recessions, or certainly debtors which can be unable to pay.

With Horizon struggling lately to develop earnings throughout a interval of robust financial progress, we’re cautious in regards to the financial institution in the course of the subsequent recession.

Dividend Evaluation

Horizon has managed to spice up its dividend by a mean of virtually 11% yearly previously decade, which is extraordinarily robust by the requirements of the banking group. Nonetheless, it has not elevated its dividend over the previous two years. We aren’t anticipating a dividend improve this yr both. Though the corporate has a low payout ratio of 34%,

The present dividend of 64 cents per share yearly is lower than half of earnings, so we imagine it’s protected for the foreseeable future. We imagine that Horizon’s potential to boost the dividend is considerably restricted, however we additionally suppose that small will increase are seemingly within the playing cards for the approaching years.

The yield could be very robust at greater than 4%, a results of the robust dividend progress, but in addition a comparatively stagnant share value. Total, we recognize the yield and the relative security of the payout, however we see the probability of huge will increase being muted.

Last Ideas

We view Horizon as a robust revenue inventory, providing a comparatively protected dividend and room for small will increase going ahead. We word the dearth of aggressive benefits and susceptibility to recession, however the latter will not be presently a difficulty.

We encourage traders to observe the online curiosity margin, because it’s a weak level for Horizon in the mean time by way of earnings, which has a direct affect on its potential to boost the dividend.

If you’re focused on discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Certain Dividend assets might be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

:max_bytes(150000):strip_icc()/Health-GettyImages-HydrationDrinksForAthletes-d59cb0e245b34ebe8a86bba45e88c70d.jpg)